In late September I outlined my credit card strategy, and how October was a month of credit card applications for me. Well, I just picked up my second card, and wanted to share my experience with that.

In this post:

Recapping My First Card Application For October

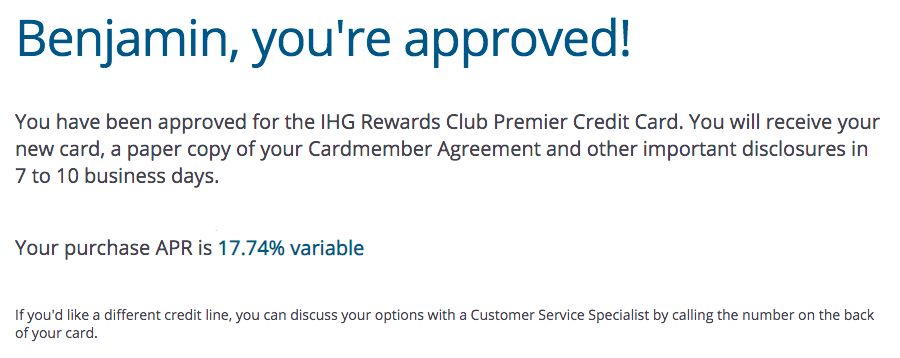

On October 1 I applied for the IHG One Rewards Premier Credit Card (review), which is the card I’ve wanted most. Much to my surprise, I got instantly approved (which is rare for me with Chase cards).

My Second Credit Card Application

The Citi Double Cash® Card (review) will be my new credit card for everyday spending. As of recently, rewards earned on this card can be converted into ThankYou points. Going forward this no annual fee card will earn 2x ThankYou points per dollar spent (1 when I purchase and 1 when I pay), so this for me will replace the Chase Freedom Unlimited® (review) for everyday spending.

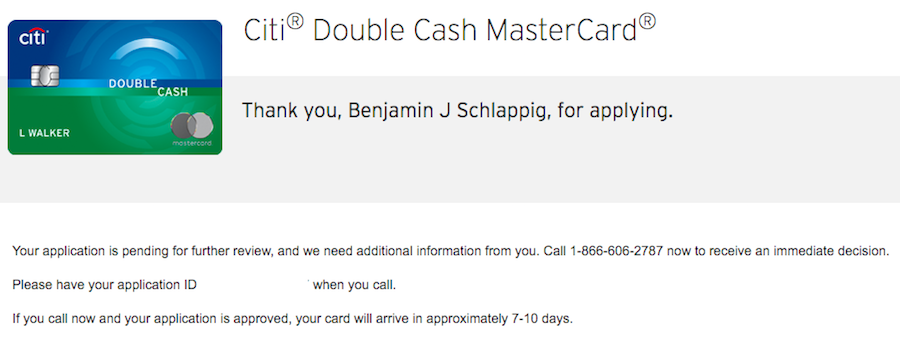

I applied for this card on October 2, and initially got a message saying my application was under review and that they needed further information. They gave me an application ID and a number to call.

I called the number, and they told me that I had to move around some of my credit line from other cards. That’s fair enough, since I have some Citi cards with outrageously high credit limits.

I was conditionally approved, though I was told a more senior person would still have to sign off on the application, and that could take several days. I just checked the status again and it still shows as being under review, though I trust that will come through.

This Card Will Be A Game Changer For Me

I value Membership Rewards, Ultimate Rewards, and ThankYou points roughly equally, at about 1.7 cents each. So to me, this is the best personal credit card for everyday spending. In addition to using this card for my “normal” spending:

- I’ll be paying my taxes with this card at a fee of 1.87%, which is like acquiring ThankYou points for ~0.94 cents each

- I’ll even likely use Plastiq for many of my bills at a maximum fee of 2.5% (though they often have promotions that lower the rate); even so, I think it’s worth acquiring ThankYou points at ~1.25 cents each

What’s Next?

I have two trains of thought here.

I’d really like to still get the Southwest® Rapid Rewards® Performance Business Credit Card (review), which has an incredible welcome bonus and valuable long term perks when flying Southwest:

- Initially, I was going to apply for the Southwest Card and then the IHG Card, but then I learned the IHG offer ends October 9, so I decided to apply for that first

- I was at 4/24 when I applied for the IHG Card so I should be at 5/24 now (this is in reference to the “5/24 limit”)

- However, my credit report doesn’t show that latest inquiry, and I think often there is a delay there of a few weeks

Does anyone know if there’s still a chance I’d be approved for the Southwest Card under those circumstances?

If that’s not happening then the next step is to apply for the Virgin Atlantic World Elite Mastercard® (review), which is also a card that can be worth putting spending on thanks to some rewarding bonus categories and benefits.

Bottom Line

I’m thrilled to have been approved for the IHG One Rewards Premier Credit Card, and to more or less have been approved for the Citi Double Cash® Card. The IHG offer ends soon and has been on my radar for a long time, while the recent changes to the Citi Double Cash make it a no brainer for me.

I hope to be approved for the Southwest® Rapid Rewards® Performance Business Credit Card and/or Virgin Atlantic World Elite Mastercard® next, but even if that doesn’t happen I’d still be happy.

Not sure why you are considering the IHG card when it earns hotel points and loyalty status at IHG is nothing special. Not all hotel Platinum statuses are alike. Some give better benefits than others. Also, could you explain your logic to incur an expense for using Plastiq? The taxes, if you earn more than 1.87% in the rewards you obtain, that is understandable, but it does not seem you will breakeven or earn a positive result with Plastiq.

Wht about N26 bank and MasterCard ?

You should NOT have applied for Citi DC. You should have product changed from another card.

You should definitely had applied for the SW business card first. Then a SW personal card within the same year to get the companion pass. Now, you're locked out of both.

@AZrunnr - Thank you for the response. Net rate of return from travel rewards credit cards is making no annual fee cash back cards much more attractive. I use three travel rewards credit cards (not Citi) but the next year will tell whether I keep them with point devaluations and ongoing loyalty program erosion. Have a nice day.

@Sean I don't think that's correct. Per TPG and other sites Prestige kept extended warranty.

I successfully product changed from a Citi AAdvantage Platinum Select World Elite Mastercard (a card I never use anymore) to this card. Took about 10 minutes on the phone. Saves me a credit inquiry (trying to minimize hard pulls these days as I am in the market for a mortgage) and a $95 annual fee, and I now have a card that will create a lot more value.

@Darlene..I know that they absolutely will not change the Simplicity card to the double cash. Not sure about others..

I used TY points to pay for non chain hotels along with the 4th night free from the Prestige card. It got me free nights at the Grand Hotel Stockholm recently which was awesome.

Can I product change from a Citi Preferred TY card to the Double Cash Card or must it be a downgrade from the Premier card? Thanks.

The card I use most for non-bonus spend in US Bank Altitude Reserve. I use it with SamsungPay and get 3% rebate. I then use the rebate to fund travel expenses which gives me a 50% bonus or 4.5% total rebate. I use this a lot.

My credit card strategy:

1. Travel and Car Rentals: Sapphire Reserve

2. Anywhere that I can use SamsungPay: Altitude Reserve

3. Restaurants: Uber Visa 4% cash...

The card I use most for non-bonus spend in US Bank Altitude Reserve. I use it with SamsungPay and get 3% rebate. I then use the rebate to fund travel expenses which gives me a 50% bonus or 4.5% total rebate. I use this a lot.

My credit card strategy:

1. Travel and Car Rentals: Sapphire Reserve

2. Anywhere that I can use SamsungPay: Altitude Reserve

3. Restaurants: Uber Visa 4% cash back

4. Everything Else: Fidelity 2% Cash Back (except overseas where I use Spark Business Card 2% cash back).

@Steve Altschuler — With the Barclays Arrival you are getting 1% back per point, so 2 points per dollar spent with the 5% rebate gets you 2.1% back. Because Lucky values ThankYou points at $0.017/pt, he's theoretically getting 2 X 0.017= 3.4% back... Note that you are getting a guaranteed return of 2.1%; 3.4% is based on the assumption that Lucky will get $0.017/pt in redemption (could be more, could be less).

@JimT — On the whole, I agree. For me, Price Rewind alone with my Premier card was worth the card AF (I reaped hundreds in statement credits from this). With regards to travel coverages, Citi’s benefits have always been inferior to Chase, so I’ve never put travel on the Premier (thankfully, as I’ve successfully filed roughly $1500 in claims with Chase in the past 3 years).

However, TYPs do have some valuable redemptions, e.g., Avianca...

@JimT — On the whole, I agree. For me, Price Rewind alone with my Premier card was worth the card AF (I reaped hundreds in statement credits from this). With regards to travel coverages, Citi’s benefits have always been inferior to Chase, so I’ve never put travel on the Premier (thankfully, as I’ve successfully filed roughly $1500 in claims with Chase in the past 3 years).

However, TYPs do have some valuable redemptions, e.g., Avianca Lifemiles can be used to book tickets on United for a fewer miles, and they don’t charge the $75 close-in fee that United hits you with. And Citi, historically, has had decent 25% transfer bonuses to Avianca (bettering Amex’s 15%). I’ve also got good value in transfer bonuses to FlyingBlue… So there are some valid reasons to maintain TYPs.

Also, it’s worth noting that all World Elite MCs will be adding cell phone damage/theft coverage by the end of the year, which is a plus that Chase Freedom Ultd, for example, doesn’t have.

For me, with the Premier card relegated to gas earn, I really can’t accrue a meaningful amount of points anymore to justify the AF. And the Prestige isn’t good value for my travel profile; however, if you are a loyal Prestige holder and are consistently accruing miles, I don’t think the Double Cash back card is a bad deal for miscellaneous spend... But again, I agree that there are card combinations with the other programs that are far better than the Citi offerings after their recent gut of benefits.

Had been thinking the same, but I don't have any Citi Cards yet (did Chase and Amex first). Questions are: Does Citi not allow Visa Gift Card Purchases? (like Amex) I would envision using Double Cash through gift cards/debit cards to then be able to pay a lot of bills that are usually not payable by credit card (or to reduce fees). I would also be concerned if they give low credit limits as it...

Had been thinking the same, but I don't have any Citi Cards yet (did Chase and Amex first). Questions are: Does Citi not allow Visa Gift Card Purchases? (like Amex) I would envision using Double Cash through gift cards/debit cards to then be able to pay a lot of bills that are usually not payable by credit card (or to reduce fees). I would also be concerned if they give low credit limits as it may restrict paying taxes with the cards. Would of course have to decide on a second card in order to transfer the miles, but the United domestic redemptions, even if Turkish/Hawaii is rescinded, would be fantastic.

@mike22

Turkish. Many awards on Turkish can only be booked with Turkish miles. You won't see them if you search united.com. A very convenient airline to fly to Eastern/Central Europe or Middle East.

@Steve

The Prestige extended warranty was removed on 9/22 (along with many other benefits that make the Prestige no longer worth the annual fee).

I’m only excited by the possible redemption opportunities a card gives me. What do you have as your best use of TY OTA?

Don't dismiss the 2 year warranty Prestige tacks on to pretty most everything you buy. If you have a couple of smartphones and computers that's worth the annual fee right there.

Not what it used to be but what it used to be was downright stupid, at least for Citibank and it's good to keep Citi in the market or Chase has no reason to stay competitive.

I understand you wanting the 2x points benefit, but could you compare it to the 2x points I get with the Barclay Arrival Plus World Elite MC, which then also gets you extra rebated points when you do a statement redemption? I usually use that for any non-bonus category spend. Am I missing something here?

Lucky, what am I missing here? Is it really worth the extra 1/2 percent from the nominal 2% Citibank Double Cash World Elite MasterCard compared to a myriad of 1.5% no annual fee cash back credit card alternatives to have a Double Cash World Elite card with the higher swipe fee but with no added benefits as of September 2019; hard to understand, scripted, and generally ineffective overseas customer service; a foreign transaction fee; and...

Lucky, what am I missing here? Is it really worth the extra 1/2 percent from the nominal 2% Citibank Double Cash World Elite MasterCard compared to a myriad of 1.5% no annual fee cash back credit card alternatives to have a Double Cash World Elite card with the higher swipe fee but with no added benefits as of September 2019; hard to understand, scripted, and generally ineffective overseas customer service; a foreign transaction fee; and now with the dubious option of converting cash to points with many redemption options worth less than one cent per point and limited transfer partners? Seriously?

It is a no brainer to cancel this card and every other Citi card except perhaps the Costco card. Why would one keep the Citi Premier or Prestige when AMEX and Chase are still offering travel insurance benefits? Why deal with poor customer service when relying on a premium travel rewards credit card?

The Citibank Double Cash was the best cash back card when it was released. No more. I was one of the earliest to acquire the card and used it frequently top of wallet. It has since been cancelled due to the September 2019 changes and erratic Citi credit card changes and customer service. Count me deeply disappointed.

@Kevin That makes sense. Forgot that some people spend > $50k/yr non-bonus spend. Most of my large purchases are travel and dining related so they go Ink Preferred and AMEX Gold. Groceries also on the latter.

@Jules I have Amex bbp. But it’s only 2x per dollar up to $50k a year and I spend more than $50k a year on none bonus categories so Citi Double cash is perfect for my spending pattern.

Citi had awful transfer partners and long delays for the same partners that transfer instantly via Amex or Chase. Citi also devalues their benefits often. I gave up on them. Amex everyday preferred at 1.5x plus bonus categories on gas and supermarkets. Pair with a gold or platinum card for other benefits and category bonuses

Nobody applies citi dc directly. Always downgrade from other premium card.

I don't get the excitement of getting the Citi Double Cash if you already have AMEX BBP. Maybe collecting Turkish miles for United flights to Hawaii but that's a pretty niche redemption opportunity which probably won't last long.

@Ben - Thanks! I'll take a look for that or give them a call. Time to dust off the DC and put it back into main rotation for all non-travel spending.

While this is a good card for non-bonus categories and grocery, it really shouldn't be the go-to card given the drop in benefits. It no longer has extended warranty (important for electronics & appliances) or price rewind (also important for electronics & appliances). It also lost basic checked baggage & rental car insurance so a NEVER USE card for travel purchases.

@ Sean -- All fair. I'd never use the card for travel due to the points I'd be giving up. Furthermore, I've never taken advantage of a price rewind or extended warranty benefit, though perhaps I've been missing out there. That being said, I'm not sure I value that protection at ~0.85% of the purchase price (since that's how much I value 0.5 TYP).

@Ben - Have you figured out how to get the Double Cash Thank You points into/combined/transferred into a TY Account that can transfer to airline partners?

So for my DC goes into a separate TY account than my Premiere. (I had both before the switch) Obviously, I want them all in the Premiere account. I suspect I might need to talk to CS about mapping my DC into my Premiere account but haven't figured anything out yet.

@ Chris -- You just need to link the two accounts. If you have the same user ID for both then you should see that option in your account. Otherwise you can call and they should be able to help you with it.

@ Ben -- How likely do you think it is that Citi will offer some sort of sign up bonus for this card?

@ Gene -- Anything is possible, but I don't think the card has ever had a sign-up bonus, and I think it's less likely (rather than more likely) to get a bonus now that the value proposition has been improved. So as much as it kills me to get a card without a bonus, I 100% thought it was the right move here.

I have had my Citi DoubleCash card for a long time now. My rule is all dining and travel goes on my Chase Sapphire Reserve, while everything else goes on the DoubleCash card. The cash back is very easy to redeem. My only gripe is Citi extends much lower credit lines to me than Chase does.

So at this point, are you mostly a Citi guy given your use of the Prestige for dining and airfare?