The Platinum Card® from American Express (review) is one of the most perks-rich premium rewards cards out there. While the card has a steep $695 annual fee (Rates & Fees), it offers benefits that will more than help offset it for many.

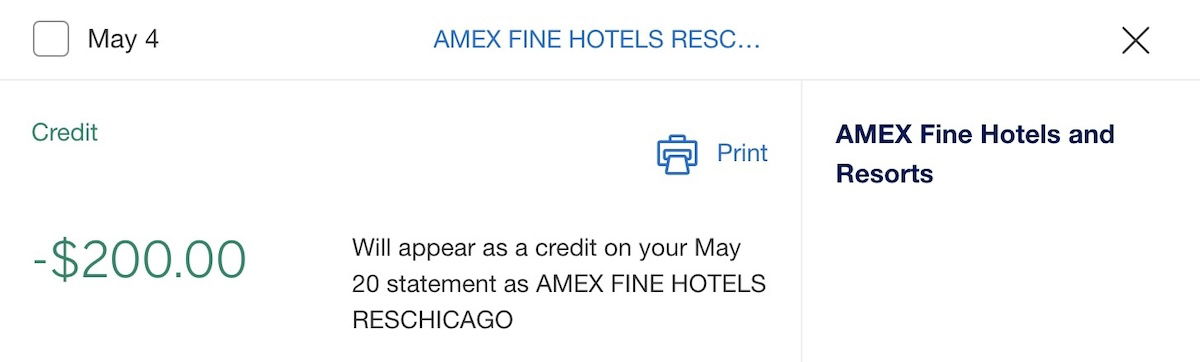

Several of the card’s perks are credits, which come with all kinds of terms. In this post I wanted to take a look at one of my favorite credits offered by the card, which is an annual $200 hotel credit.

In this post:

Details of the Amex Platinum $200 hotel credit

The Amex Platinum Card offers up to $200 per year in hotel credits. To take advantage of this, you just have to book a prepaid hotel through Amex Fine Hotels + Resorts® (no minimum stay) or The Hotel Collection (two-night minimum stay) through American Express Travel®. As you’d expect, there are some terms to be aware of:

- This is available to the primary cardmember on the personal version of the U.S. card, so this doesn’t apply to the business version of the card, or to cards issued in foreign countries

- There’s no registration required to take advantage of this, as long as you have a card in good standing

- A hotel stay can be booked through the Amex Travel website, Amex app, or by calling the number on the back of your eligible card

- The benefit is once per calendar year, so the benefit isn’t related to when your card’s anniversary is; however, the calendar year requirement is based on when you book, and not based on when you stay

- Only prepaid bookings qualify for this perk (referred to as “Pay Now” bookings)

- Statement credits will typically post within a few days, though it can take up to 90 days after an eligible prepaid hotel is booked for it to be charged to the card account (so keep that in mind if making a booking toward the end of the year)

Amex Fine Hotels + Resorts® and The Hotel Collection basics

For those not familiar with Amex Fine Hotels + Resorts® or The Hotel Collection, which are programs that those with the Amex Platinum Card have access to, and it’s also where you can use the $200 credit.

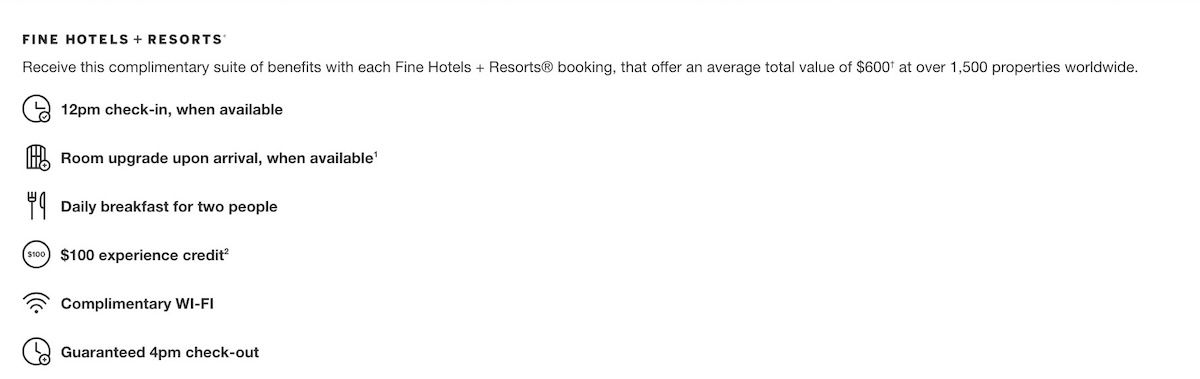

Amex Fine Hotels + Resorts® is a program that gives you access to a selection of 1,500+ luxury hotels around the globe. You’ll typically pay the same as the flexible rate charged directly by the hotel, and will receive extra perks, including complimentary breakfast, a room upgrade subject to availability, a hotel credit, guaranteed 4PM check-out, and more.

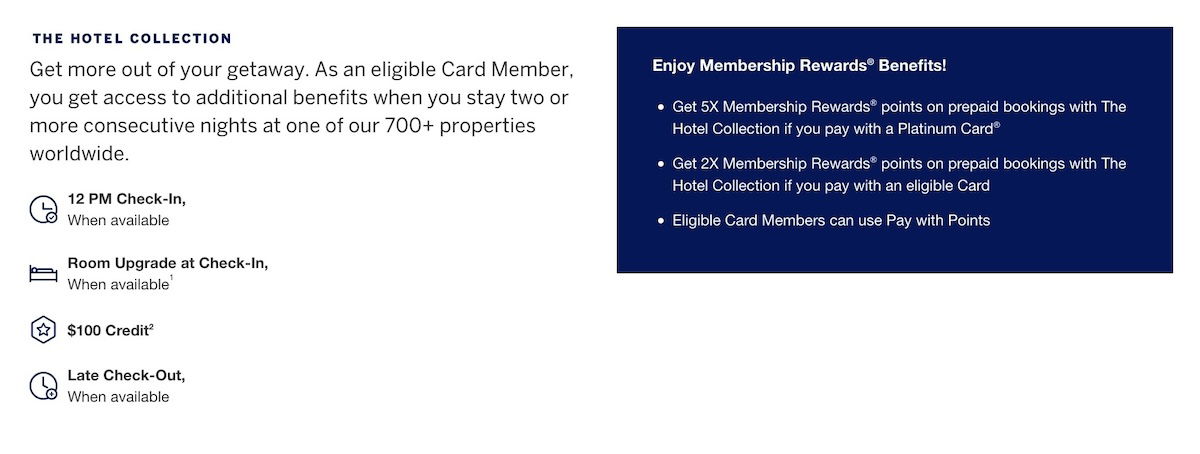

The Hotel Collection is another program by Amex, giving access to a selection of 700+ hotels around the globe. These are also typically luxury properties, but a tier down from Fine Hotels + Resorts®. You’ll typically pay the same as the flexible rate charged directly by the hotel, and will receive extra perks, including a room upgrade subject to availability, a hotel credit, and more.

There are two other points worth clarifying:

- While you need to book a prepaid reservation to take advantage of the $200 hotel credit, that doesn’t mean the stay is non-refundable; instead, it just means you’re paying upfront, but it’s often possible to still cancel for a full refund (you’ll want to check the terms when you book)

- You can usually still earn points and receive perks with your preferred hotel loyalty program if booking stays through these programs, as they’re usually considered “qualifying” stays for those purposes

Why I value the Amex Platinum $200 hotel credit

While the Amex Platinum Card offers lots of perks, the truth is that there are hurdles to using many of the credits. Often the credits are issued monthly, registration is required, etc. Personally, I find the $200 hotel credit to be one of the card’s easiest to use perks.

That’s because this isn’t a benefit that you need to use monthly (like some other Amex credits), but rather you can extract big value from it once per year.

My strategy is to use the $200 hotel credit for Amex Fine Hotels + Resorts®, since there’s no minimum stay, and there’s a great collection of hotels. Yes, there are lots of Amex Fine Hotels + Resorts® properties that cost thousands of dollars per night, but there are also some reasonably priced ones.

There are plenty of eligible properties that cost in the $200-300 range, and sometimes even less. The value here is simply excellent. Not only can you get the $200 statement credit applied to such a stay, but you can also take advantage of the Amex Fine Hotels + Resorts® perks.

For example, you can’t beat booking a one-night stay at a reasonably priced property, and then getting a $200 statement credit, plus perks like a $100 property credit.

Each year I use this perk for a one-night stay. For example, last year I used it at the Raffles Europejski Warsaw, while this year I used it at the Waldorf Astoria Kuwait. Both hotels were phenomenal, and I got an amazing deal thanks to a combination of the credit plus the perks.

The Amex Fine Hotels + Resorts® program can be valuable in general, but the $200 hotel credit makes it an absolute no-brainer for at least one annual booking per year.

Bottom line

The Amex Platinum Card offers lots of perks, and one benefit that I get value from annually is the $200 hotel credit. While there are some important details to be aware of, I find this to be one of the easier to use benefits. Hopefully the above is a useful rundown of how it works.

What has your experience been with the Amex Platinum $200 hotel credit?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Platinum Card® from American Express (Rates & Fees).

I booked a 2 night stay at Ritz Carlton Ft Lauderdale for Feb 24. I clicked through the AMEX APP to FHR and booked. Unfortunately when I checked in the reservation was not made at the FHR but the “Lowest Rate” and I did not receive my FHR benefits. Since I had booked a club level room the hotel went out of their way to comp similar benefits like write off my breakfast charges but...

I booked a 2 night stay at Ritz Carlton Ft Lauderdale for Feb 24. I clicked through the AMEX APP to FHR and booked. Unfortunately when I checked in the reservation was not made at the FHR but the “Lowest Rate” and I did not receive my FHR benefits. Since I had booked a club level room the hotel went out of their way to comp similar benefits like write off my breakfast charges but the problem was with the AMEX booking system. I also did not receive Marriott points because of the booked rate. So check your invoice when booking on line to make sure the FHR rate was booked. It took several calls and arguments with AMEX for them to acknowledge the problem. There only solution was next time call or make sure I check my invoice after booking on line.

used amex website, booked a night the last day in Dec 2023 for feb 2024 at a NYC hotel listed on their website and after i checked out i learnt this hotel did not qualify.

this is how they treat a customer after eight years of paying fees and this was the first time i tried to use the $200 hotel credit.

fuck that shit

While I've used it for trips before, we have most often used it for staycations, to checkout local nice hotels we'd otherwise have no reason to visit. We stay in the off season, pick a weekend where it mostly covers the entire cost, and then enjoy an upgraded room (hopefully) and room service with the food credit.

Timely, I’m using my $200 credit in a week at The Charles in Munich Softens the blow. Already been upgraded to Panoramic view room.

Now is Sakes would get my Safar fluffy blue towel in stock don’t need the larger bath sheet nor its higher price ;-)

Not guarantee to work. We booked hotel in Sydney for 1 night. When we arrived, the front desk agent said we booked it via Expedia and therefore no benefits at all. Called Amex. They could not understand how this happened, but after all, not benefits. Amex got back to us in a couple of weeks and said that we booked ineligible rate. That's simply impossible to do on their website as there is only 1...

Not guarantee to work. We booked hotel in Sydney for 1 night. When we arrived, the front desk agent said we booked it via Expedia and therefore no benefits at all. Called Amex. They could not understand how this happened, but after all, not benefits. Amex got back to us in a couple of weeks and said that we booked ineligible rate. That's simply impossible to do on their website as there is only 1 rate and if you pay it now then you are eligible.

We had other reservations done the same way at the same hotel and no issues.

Had to almost go to court to get Amex to reimburse all the money we spend to cover benefits Amex promised to deliver.

Love the examples. Could you post more US and Europe examples? It maybe only $200-$300 certain times of year, but that’s ok. For example the Palace in SF has rooms under $300 in December. The Roosevelt in New Orleans used to, not sure if they do anymore.

I don’t like one night stays but a hybrid of FHR and points booking works.

We just used this benefit at the Chateau Frontenac in Quebec City. It was seamless - the hotel had a letter prepared with all of the benefits detailed. We used them all - early check in, late check out, $100 food and beverage credit, room upgrade, and the $200 back from AMEX. Nice program that we’ll use again

I used the benefit at the same location - in the winter it was $225 with fees, so a really good value.