I love the Amex Membership Rewards program, which has 20 transfer partners, including 17 airline partners and three hotel partners. Personally, my favorite transfer partners are Aeroplan, Air France/KLM FlyingBlue, Etihad Guest, and Singapore KrisFlyer. Meanwhile, I don’t find Amex’s three hotel transfer partners — Choice Privileges, Hilton Honors, and Starwood Preferred Guest — to be especially valuable. Up until now the transfer ratios for those three partners have been as follows:

- Membership Rewards to Choice Privileges at 1,000:1,000

- Membership Rewards to Hilton Honors at 1,000:1,500

- Membership Rewards to Starwood Preferred Guest at 1,000:333

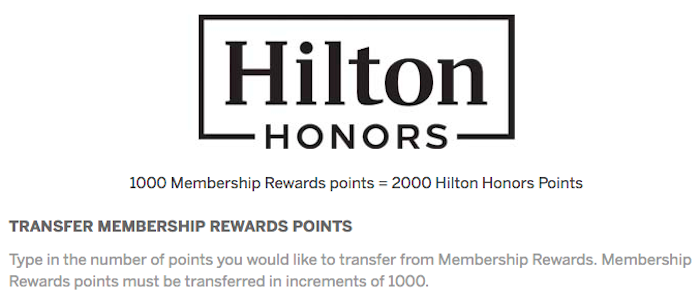

There’s some good news when it comes to Hilton Honors transfers. Effectively immediately, Amex Membership Rewards points transfer to Hilton Honors at a 1:2 ratio, meaning that 1,000 Membership Rewards points can be converted into 2,000 Hilton Honors points.

This isn’t a promotional transfer bonus, but rather is the new fixed transfer cost. I suspect this change is partly related to American Express and Hilton getting even closer than in the past. Up until last year Hilton had credit cards issued by both American Express and Citi, while in 2018 Amex got an exclusive contract, and we should see a new portfolio of cards introduced this year. Just last month, Hilton Honors was dropped as a transfer partner for the Citi ThankYou program.

However, even with this improved transfer bonus, this still isn’t how I’d use my Amex Membership Rewards points. I value Membership Rewards points at ~1.7 cents each, while I think Hilton Honors points are worth under 0.5 cents each. So using my valuation, you’re still getting less than penny of a value per point by transferring Amex points to Hilton.

If you’re interested in this transfer option, points can be earned via cards such as:

- 4x points at restaurants, on up to $50,000 in purchases annually

- 4x points at U.S. supermarkets, on up to $25,000 in purchases annually

- 3x points on flights booked directly with airlines or through amextravel.com

- $325

- Access to Amex Offers

- Redeem Amex Points Towards Airfare

- $375

- Earn 5x points on flights purchased directly from airlines or through Amex Travel (up to $500k/year)

- $200 Annual Uber Credit

- Amex Centurion Lounge Access

- $695

- Earn 1.5x on purchases of $5,000 or more in a single transaction on up to $2MM per calendar year

- Redeem Points For Over 1.5 Cents Each Towards Airfare

- Amex Centurion Lounge Access

- $695

- 2x points on purchases up to $50k then 1x

- Access to Amex Offers

- No annual fee

The only transferable points currency where I think transfers to hotel programs is worthwhile is the relationship between Chase Ultimate Rewards and World of Hyatt. Transferring points at a 1:1 ratio between those programs is a solid deal, in my opinion.

I do not earn significant AMEX MR points. The limited MR points that I earn, mostly through automated monthly bill payments (magazine, newspaper subscriptions) that I'd set up to keep my AMEX Biz Plat account active, I transfer to my SQ Krisflyer account.

With HH points being so easy to earn, it makes little sense to transfer MR points to HH points. The just announced change in MR-to-HH transfer ratio happened simply because AMEX...

I do not earn significant AMEX MR points. The limited MR points that I earn, mostly through automated monthly bill payments (magazine, newspaper subscriptions) that I'd set up to keep my AMEX Biz Plat account active, I transfer to my SQ Krisflyer account.

With HH points being so easy to earn, it makes little sense to transfer MR points to HH points. The just announced change in MR-to-HH transfer ratio happened simply because AMEX and HH want to get their ducks in a row ahead of the start of their new partnership that starts later this month with the introduction of a whole bunch of new HH AMEX co-brand cards...

With airfare being so cheap these days, I now try focusing point-redemptions on hotels. However, it seems like the only efficient option is Chase -> Hyatt transfers. While the new Amex-> Hilton transfer ratio isn't great, I welcome it as a new, "not awful" option.

That being said, my general strategy remains: Amex for airfare, Chase for hotels

Thanks for the post Ben.

Now if only AMEX would actually improve the rate for ALL MR users around the world and not just the US. It's always so annoying to see them make things that little bit sweeter for their US customers but then just not bother to make it equally available in other regions. Like the fact that MR points here in France still for whatever reason don't transfer to airlines at...

Thanks for the post Ben.

Now if only AMEX would actually improve the rate for ALL MR users around the world and not just the US. It's always so annoying to see them make things that little bit sweeter for their US customers but then just not bother to make it equally available in other regions. Like the fact that MR points here in France still for whatever reason don't transfer to airlines at a 1:1 ratio (all of them are 5:4 or worse) and this new Hilton bump didn't get pushed over.

Anyways rant over :-)

Happy New Year Ben.

@DCS,

Thanks for the post - I have the exact thought in mind when I read about the new conversion ratio.

Still it is much easier to earn HH pts than SPG pts in many cases. SPG pts got the boost of the 1 to 3 conversion to Marriott, making the top level Marriott redemption an outsize value but that would go away once the 2 programs finally merge into 1 come 2019.

Before this change, transferring MR to HH points got one 4.5x relative TO startpoint transfers, rather THAN 6x that it should have been! Now they have fixed it.

Everyone got it completely wrong again, but you get a pass this time because it is really not easy to understand...

The prior MR-to-HH transfer ratio of 1:1.5 MR:HH was actually wrong...in AMEX's favor!

What AMEX and Hilton have now done is to fix the error by bringing the value of the HH point and AMEX MR point in line with what they award for the co-brand cards.

What does that means?

For on-property...

Everyone got it completely wrong again, but you get a pass this time because it is really not easy to understand...

The prior MR-to-HH transfer ratio of 1:1.5 MR:HH was actually wrong...in AMEX's favor!

What AMEX and Hilton have now done is to fix the error by bringing the value of the HH point and AMEX MR point in line with what they award for the co-brand cards.

What does that means?

For on-property spend, AMEX awards 2 starpoints/$ on the SPG AMEX, but 12 HH points/$ on the AMEX Surpass. That is a 6:1 HH-to-starpoint ratio.

What were the MR-to-HH transfer ratio, and MR-to-starpoint transfer before?

1:1.5 MR:HH

1:0.333 MR:starpoints

1.5: 0.333 = 4.5

MR points were transferring to HH points at a lower rate than startpoints (should've been 6 and not 4.5!)

Now what we will have will be:

1:2 MR:HH

1:0.333 MR: starpoint

2/0.333 = 6

MR will now be transferring correctly to HH points relative starpoints!

What AMEX is telling you is that one should earn 6x more HH than starpoints for the same spend. Before this change, transferring MR to HH points got one 4.5x relative startpoint transfers, rather 6x that it should have been! Now they have fixed it.

AmEx Surpass gives you 3-6 points per $ , not a bad Hilton deal

HiltonDishonors puts Delta skypesos to shame when it comes to massive devaluation and introducing new tiers. Watch out for new higher end categories from 9 to 12 this year..

A 1:4 ratio from MR is more in line.

Hilton Venice hotel premium room may go from 3 million points to 6 million hilton points..

Brace yourself.

More Hilton point devaluations are coming

Should be entitled “still a huge ripoff” or less PC “lipstick on a pig” but that would not earn you any love from your affiliates at AmEx and Hilton. Hilton points are not worthless but close

Could be an ok deal depending on the redemption. It might make sense at a higher end Hilton Property like Grand Wailea or Conrad Maldives.

still only worth 0.8 cents per membership point - should be 4,000 HIlton, but at least an improvement