For several weeks there has been speculation of Virgin America looking to be taken over. On Saturday it was reported that a merger between Alaska and Virgin America would be announced shortly, a deal which was expected to be worth $2 billion. Then on Sunday we learned that the deal was expected to close on Monday, with a purchase price of roughly $2.5 billion.

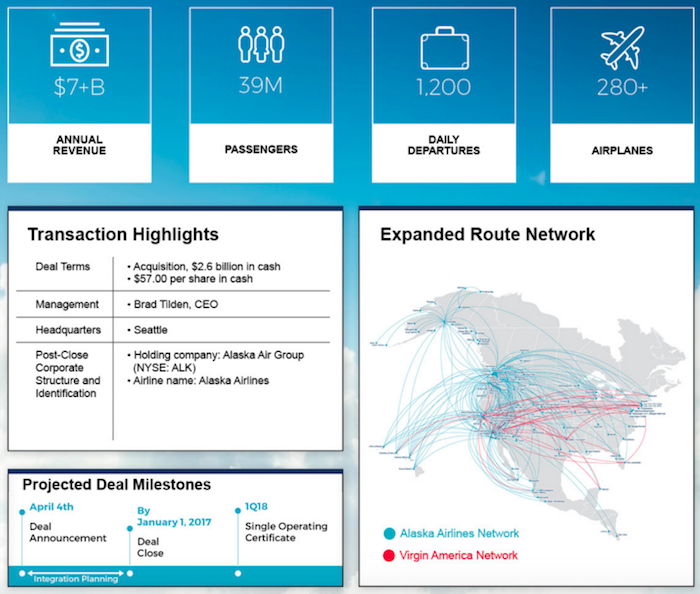

Well, the merger between Alaska and Virgin America is now official, and the purchase price is even higher than expected — Alaska is purchasing Virgin America at a cost of $57 per share in cash. That represents a total equity value of $2.6 billion, with an aggregate transaction value of $4 billion.

The merger between the two airlines is expected to close by January 1, 2017, and they’re hoping to be on a single operating certificate by the first quarter of 2018.

You can find the full press release here, and the website dedicated to the merger here.

The combined airline’s headquarters will remain in Seattle, Alaska Mileage Plan will be the surviving frequent flyer program, and Alaska’s CEO (Brad Tilden) will be the head of the combined company.

Here are the highlights that Alaska is advertising about the merger:

- Deal combines two leading airlines known for outstanding customer service and low fares.

- Alaska Airlines expands its California presence, while creating new opportunities for growth and competition.

- Expanded route network benefits customers, with 1,200 daily departures.

- Transaction is expected to be accretive to adjusted earnings per share in first full year, increases annual revenues 27 percent to more than $7 billion and offers $225 million total net synergies annually at full integration.

- Alaska Airlines Mileage Plan™ to welcome Virgin America Elevate® members.

- Company headquarters to remain in Seattle.

In terms of loyalty programs, Alaska Mileage Plan will be the surviving program, though up until the transaction closes the two airlines’ loyalty programs will remain distinct:

Following closing, Alaska Airlines will welcome Virgin America Elevate loyalty program members into its Mileage Plan, ranked #1 by U.S. News and World Report. With Alaska Airlines Mileage Plan, members are able to redeem award miles for travel to more than 900 destinations worldwide, rivaling global alliances. Until the transaction closes, both loyalty programs will remain distinct – with no short-term impact on members. Upon closing, the programs will be merged. Alaska Airlines is committed to ensuring that loyalty members of both airlines maintain the same high-value rewards they’ve come to enjoy in both programs – with access to an even larger network.

Alaska indicates that they’re looking for ways the “Virgin America brand could continue to serve as a role in driving customer acquisition and loyalty,” so I’ll be curious to see what elements of the Virgin America experience they incorporate into the combined airline. The airlines couldn’t be much more different in terms of their approaches to the onboard product. Alaska just recently installed power ports on their planes, while Virgin America has TVs at every seat.

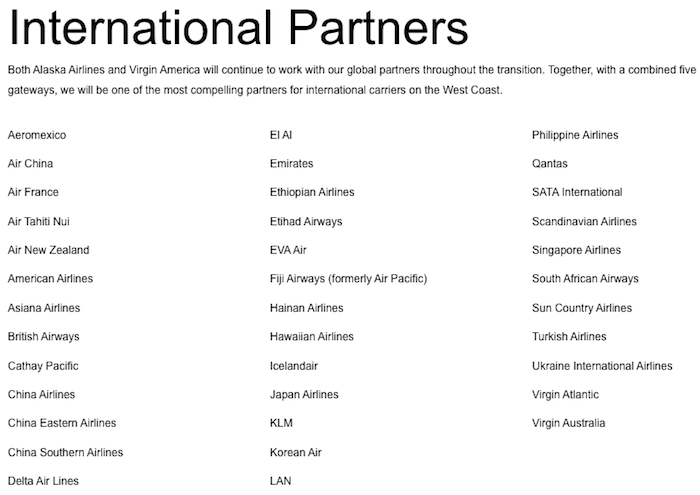

As part of the merger, the two airlines are emphasizing their international partners, and how they plan on being the premier airline for connecting west coast travelers to international gateways. I am curious to see if they can really combine the partner airlines from both Alaska and Virgin America, as in some instances I imagine this would represent a conflict of interest. It would be awesome, given that Alaska and Virgin America are already both unique in terms of their airline partners.

It’s also interesting to note what Alaska sees as the big picture upside of this merger:

The combination expands Alaska Airlines’ existing footprint in California, bolsters its platform for growth and strengthens the company as a competitor to the four largest U.S. airlines. Combining Alaska Airlines’ well-established core markets in the Pacific Northwest and the state of Alaska with Virgin America’s strong foundation in California will make Alaska Airlines the go-to airline for the more than 175,000 daily fliers in and out of Golden State airports, including San Francisco and Los Angeles.

For Virgin America customers, service will expand in the thriving technology markets in Silicon Valley and Seattle. The combined airline will also offer more frequent connections to international airline partners departing Seattle, San Francisco and Los Angeles. In addition, this transaction will open up growth opportunities in important East Coast business markets by increasing Alaska Airlines’ access to slot-controlled airports like Ronald Reagan Washington National Airport and the two primary New York City-area airports, John F. Kennedy International Airport and LaGuardia Airport.

Bottom line

I’ve shared why I think Alaska and Virgin America aren’t a good fit (especially at the price Alaska is paying), so I won’t beat a dead horse. All I’ll say is that consolidation isn’t good for consumers, especially when both airlines are strong in similar regions of the country.

I wish the airlines the best with this merger. As someone most interested in miles & points, I’m hoping for two things. First of all, I hope that Mileage Plan doesn’t go revenue based, and maintains what makes it unique. I’m also hoping that Alaska’s partner airlines are expanded, with full reciprocity for both earning and redeeming miles.

Alaska Airlines Mileage Plan airline partners

What are your thoughts on the Alaska & Virgin America merger, now that the details have been unveiled?

Same here with LLP. I love Virgin's style. So original. I will miss that... I don't hate Alaska, but I wanted Virgin to be independent and unique...sigh

Hate this merger. I've always loved the service and amenities on Virgin above all other airlines. Alaska has never been an airline that I would chose so I'm pessimistic at best that they will keep any of the things that made Virgin the best.

More I think about this, more it makes sense for Alaska. It gives them California capabilities, which Alaska can easily feed due to their close partnership with AA since AA is pretty weak out of bay area. Also, it makes Alaska's relationship more valuable with their partnership with Emirates, BA, and Cathay, (to lesser degree Hainan and Icelandair) to just the name few. All these partners have multiple flights per day to LAX/SFO (up to...

More I think about this, more it makes sense for Alaska. It gives them California capabilities, which Alaska can easily feed due to their close partnership with AA since AA is pretty weak out of bay area. Also, it makes Alaska's relationship more valuable with their partnership with Emirates, BA, and Cathay, (to lesser degree Hainan and Icelandair) to just the name few. All these partners have multiple flights per day to LAX/SFO (up to 7 flights per day per airline) and now Alaska can leverage their partnership to connect those passengers throughout US. There's rumors of BA and Alaska strengthening their relationship and I am sure this helps. Plus, most of VA's A320 fleet is leased so they can transition them out and replace with 737.

The price might be high, but that's what happens with if they were in bidding war with JB. All in all, I think this makes more sense than meets the eye due to Alaska's ability to fill VA routes with international connections.

I just think the fact that they actually mentioned Virgin branding in their release (actually an entire paragraph) is notable. If they had no interest in pursuing the Virgin brand, they likely wouldn'tve mentioned it.

A good friend of mine works on the team that was responsible for Alaska's recent refresh. Alaska is VERY interested in shedding their stodgy image. And one thing that's become painfully clear: they aren't that loved outside of the...

I just think the fact that they actually mentioned Virgin branding in their release (actually an entire paragraph) is notable. If they had no interest in pursuing the Virgin brand, they likely wouldn'tve mentioned it.

A good friend of mine works on the team that was responsible for Alaska's recent refresh. Alaska is VERY interested in shedding their stodgy image. And one thing that's become painfully clear: they aren't that loved outside of the NW. Outside of trips to the NW (and maybe holidaymakers to Hawaii) they haven't had much luck down there. Sure, It'd be suicide to ditch the Alaska name now (I live in Seattle and know just how much people love the brand here), but I can see a slow move towards reducing the Eskimo's prominence.

According to the email Alaska just sent me, flights on their new network will be free. They will be "complimentary". Isn't that great news!

Wow.....Made my day, even though I only have a small amount my VA stock made me a nice penny today

I'm excited! But I'm a longtime Alaska elite, so, of course. I'll be curious to see which international partners AS gets to inherit. But mostly I'm excited for the DCA-SFO nonstop that Virgin has and Alaska currently doesn't. It completes the DCA-to-west-coast quartet, since AS already has the nonstops to SEA, PDX, and LAX.

I'm curious what Lucky would value an Alaskan mile at after the devaluation

@Dan

Really don't see the Virgin brand sticking around and I think that's a main reason why Richard Branson hates the deal. Don't forget VX pays Virgin Group a licensing fee for the name. I can't imagine Alaska is not only going to walk away from their name as the acquiring party, but also pay a royalty for the name in perpetuity to do so. Alaska actually has a pretty good brand appeal in California, especially LA and San Diego.

A) Lucky needs to calm down. While I'm not convinced this is the best move by AS, there's plenty of potential upside here. Further, JetBlue isn't 'clearly' better partner he keeps saying they are. Their finances are a bit dodgy, unlike AS. The fleet commonality thing also isn't that big a deal. Leases can be easily retired, plus this gives AS an opportunity to evaluate the competition (which they will use to extract a killer...

A) Lucky needs to calm down. While I'm not convinced this is the best move by AS, there's plenty of potential upside here. Further, JetBlue isn't 'clearly' better partner he keeps saying they are. Their finances are a bit dodgy, unlike AS. The fleet commonality thing also isn't that big a deal. Leases can be easily retired, plus this gives AS an opportunity to evaluate the competition (which they will use to extract a killer deal from either Airbus or Boeing once they consolidate).

B) At first, I was confused as to why AS was forking over so much money as well. If it's just expanding network capacity, that doesn't make sense. They could probably do the same thing organically for half the price and risk. But if they get rights to the Virgin brand, that could explain things. They might be loved in the NW, but in California brand acceptance has been a huge issue for Alaska. I'm going way out on a limb here, but I'm guessing there's a decent chance they might ultimately ditch the Alaska name with this move.

Beyond being both West-coast based, these 2 airlines have little in common. I thought a merger Jet Blue would have made more sense.

As a Virgin America fan and loyalist, I'm mildly bummed, with some hope flight options will increase as a silver lining.

IMHO, Virgin American customers should be glad the airline was purchased by Alaska, rather than gobbled up by one of the Big 3.

The fact is that Alaska, while strong in its area, is facing a significant threat from Delta in its home base of Seattle. Delta is using it's muscle and size to try beat Alaska down and eat it's lunch. Like any small guy in a fight with a big guy, Alaska...

IMHO, Virgin American customers should be glad the airline was purchased by Alaska, rather than gobbled up by one of the Big 3.

The fact is that Alaska, while strong in its area, is facing a significant threat from Delta in its home base of Seattle. Delta is using it's muscle and size to try beat Alaska down and eat it's lunch. Like any small guy in a fight with a big guy, Alaska needs to not only defend itself but also draw some blood. It has to make the big guy pay a price that is just a little to high to make sense. I think that is Alaska's goal.

Alaska's reward plan is still a far better one than Delta's, IMHO, despite not being able to book Emirates 1st class for 100,000 points. The number of people who did that is minuscule compared to those who routinely fly Alaska inside the USA. If Alaska has any sense at all they will keep the plan the way it is until Delta's nose is red and sore.

Interesting wording on their website: "Loyalty points accrued in Elevate® during the transition period will be transferred and honored." This wording "during the transition" would seem to infer that points accumulated in my elevate account prior to April 4 will not be transferred to Mileage Plan. Very unfortunate, if true. Hopefully, this is just poor wording and all points will be merged.

It does create a great non-alliance connecting partner on the U.S. west coast for international carriers.

The bottom line here is that his acquisition makes Alaska too big a fish to swallow by a major airline. This should finally put to rest the persistent rumors that either Delta or AA will make a hostile takeover bid. At least this is a combining of two airlines with a customer-first focus. An acquisition by a major of either of these two would be a disaster.

What are the potential impacts on AS's current partnership with AA? With the slots of VX's in DAL JFK/EWR, is newAS likely to go head-to-head against AA?

Look at the stock increase. Crazy. Only if I were not a grad student and had money....

This deal was about growing to make money now while fuel is cheap and airlines can print money. That takes planes and pilots, both of which are hard to acquire in a short time period. You can't just go out and acquire 55 frames and the crew to support them overnight without M&A.

I don't get the problem with a mixed fleet. Southwest is the only large carrier domestically that has a single fleet type....

This deal was about growing to make money now while fuel is cheap and airlines can print money. That takes planes and pilots, both of which are hard to acquire in a short time period. You can't just go out and acquire 55 frames and the crew to support them overnight without M&A.

I don't get the problem with a mixed fleet. Southwest is the only large carrier domestically that has a single fleet type. I think Delta has shown that fleet commonality can be overblown. The thing to remember is all those pilots they just acquired are Airbus drivers. The A320s aren't going anywhere. Alaska may try to keep the Airbuses out of SEA, but they're not walking away from 20% of their fleet.

Virgin has solid market share in the California to East Coast transcon market. Alaska now gets access to that. When LGA inevitably lifts its distance restriction, Alaska will be able to fly LGA to LAX, SFO and Seattle, which is valuable.

I fly transcon a few times a year - when I can fly business, I fly American, but when I fly coach for personal travel I look at Delta or Virgin. The ability...

Virgin has solid market share in the California to East Coast transcon market. Alaska now gets access to that. When LGA inevitably lifts its distance restriction, Alaska will be able to fly LGA to LAX, SFO and Seattle, which is valuable.

I fly transcon a few times a year - when I can fly business, I fly American, but when I fly coach for personal travel I look at Delta or Virgin. The ability to credit the Virgin flights to Alaska will make me more I inclined to fly them now.

I like this merger. I also like the Marriott / Starwood merger as I tend to stay at Marriott hotels and look forward to redeeming at Starwood in the future, so I may be in the minority when it comes to these deals

Ultimately I don't really care because they're not airlines I use, but...

What does Alaska really, truly get out of this? Planes they may or may not keep, a few new routes they may or may not keep, and slots at a few slot-restricted airports that they may or may not want. (For all we know, Alaska has Boeing agreed to take the A320s off their hands for the promise of more 737 MAX orders.)

...Ultimately I don't really care because they're not airlines I use, but...

What does Alaska really, truly get out of this? Planes they may or may not keep, a few new routes they may or may not keep, and slots at a few slot-restricted airports that they may or may not want. (For all we know, Alaska has Boeing agreed to take the A320s off their hands for the promise of more 737 MAX orders.)

Almost $4B to keep B6 from getting planes and routes they might not have wanted?

Keeping emotions aside, why did Alaska choose to assume all this risk and work?

This seems to be one of the fastest announced mergers in history- why the rush?!!