Link: Learn more about the Sapphire Reserve for Business℠, Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, or Ink Business Unlimited® Credit Card

Chase is known for its excellent business cards, which are among the most lucrative credit cards out there, in terms of their overall value proposition. The cards have excellent welcome bonuses, a great return on spending, and give you access to the Ultimate Rewards ecosystem.

When you apply for a business credit card, you typically don’t need a corporation, as you can also apply as a sole proprietorship. In this post, I’d like to talk about that in a bit more detail, and share the best way to go about this. This is something that confuses many people, and you might be surprised by the success you have.

In this post:

Basics of Chase Sapphire & Ink business cards

For a bit of background, let me briefly cover the details of the four most popular Chase business cards that earn Ultimate Rewards points:

- The Sapphire Reserve for Business℠ (review) has a $795 annual fee, but offers lots of great perks, including a massive welcome bonus, compelling rewards structure, Chase Sapphire Lounge access, and much more

- The Ink Business Preferred® Credit Card (review) has a $95 annual fee, and is one of the most well-rounded business cards, with a huge welcome bonus, generous rewards structure, cell phone protection, rental car coverage, and much more

- The Ink Business Cash® Credit Card (review) has no annual fee, and offers 5x points bonus categories, making points rack up quickly, especially with the welcome bonus

- The Ink Business Unlimited® Credit Card (review) has no annual fee, and is one of the best Chase business cards for everyday spending, and also has a great welcome offer

Chase Sapphire and Ink business cards aren’t mutually exclusive. You can apply for all the cards and earn the bonuses (you can even get the same card for multiple businesses, if you have more than one business), and they make excellent complements as well.

Now, while I’m focusing primarily on the Chase Sapphire and Ink business card portfolio, the same general principles of applying for a card as a sole proprietorship apply on other cards, like the Southwest® Rapid Rewards® Performance Business Credit Card, World of Hyatt Business Credit Card, IHG One Rewards Premier Business Credit Card (review), etc.

Chase business card sole proprietorship application

You don’t need to have a corporation to pick up a business credit card, but rather, a sole proprietorship would generally qualify as well. So let’s talk about that in a bit more detail — what is a sole proprietorship, what do you need to qualify for one, and how should you apply for a business credit card using this method?

What is a sole proprietorship, and who is eligible?

A sole proprietorship is the most basic form of a business, where it’s owned and run by one person, and isn’t incorporated. The owner has unlimited liability, and the business has no legal existence, separate from the owner. The owner reports the business’ income on their personal tax return, and pays federal and state income tax on profits.

Now, I’m obviously not here to advise as to what kind of a business someone should set up (you should talk to a tax professional about that), but in most places there’s literally no barrier to having a sole proprietorship, as it doesn’t even require registering in any official capacity.

For many people, a side hustle could very well be considered a sole proprietorship, whether you have a property you rent out, you do consulting, you’re a freelance writer, or whatever. There’s value to being able to separate your business expenses from your personal expenses, and of course the very lucrative business cards that we see don’t hurt either. 😉

How should you fill out an application with a sole proprietorship?

When you’re filling out a business card application as a sole proprietorship, how should you go about doing so? For example, I recently applied for the Ink Business Preferred® Credit Card as a sole proprietorship, as I already have the card for my corporation.

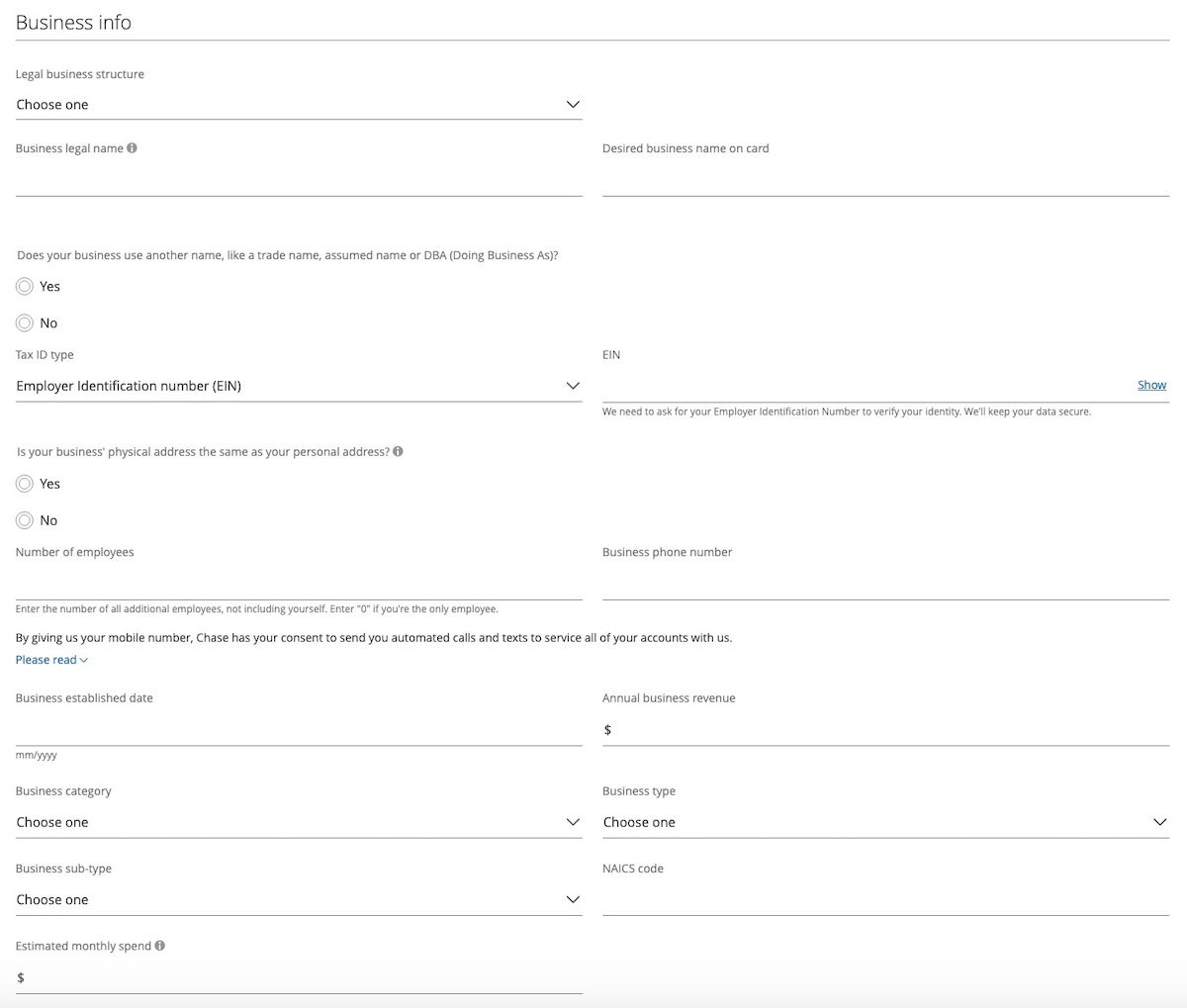

While Chase card applications always require providing basic personal information, let’s talk a bit about the section that asks for business information, and how to go about filling this out for a sole proprietorship:

- For legal business structure, you can select “sole proprietorship”

- For the legal business name, you can just use your name

- For the tax ID type, you can select “social security number,” and then enter your personal one

- For the number of employees you can select “one,” and your business phone number can be your personal number, if that’s what you use

- For the business establishment date and business revenue, just provide that information as asked

- For the business category, select whatever best matches what your sole proprietorship does

For more details, I recently wrote about Chase Ink business card eligibility requirements, and my experience getting approved with a sole proprietorship. Also remember that due to the Chase 5/24 rule, there’s generally merit to applying for business cards before personal cards, though that’s no longer consistently enforced.

What are your odds of being approved with a sole proprietorship?

You should always fill out credit card applications truthfully. To be approved for a business credit card, you don’t need a business with a million dollars in revenue annually, and with a dozen employees. Plenty of people get approved for business cards as a sole proprietorship, with one employee, with limited business revenue, and with limited history.

Now, are you likely to be approved if you say you have zero revenue, and the business is brand new? Well, it’s possible, but odds probably aren’t amazing. The more history and the more revenue you have, the more likely you are to be approved. That’s especially true if you have a great credit score.

Everyone should use their own judgment when applying for credit cards based on their own situation. Assuming you have an excellent credit score, there’s huge upside to applying, while there’s limited downside.

Typically your score gets dinged a few points temporarily for the credit inquiry, but there aren’t any major implications in the event you get denied. Business credit cards generally also have a limited impact on your personal credit score.

Bottom line

Chase has an excellent portfolio of business cards, in particular the Sapphire Reserve for Business℠, Ink Business Preferred® Credit Card, Ink Business Cash® Credit Card, and Ink Business Unlimited® Credit Card. While it’s often people with corporations who apply for business cards, you don’t actually need one to be approved.

You can also apply as a sole proprietorship, and hopefully the above provides a basic rundown on how to do so. I know applying for business cards can be intimidating, but many people are also pleasantly surprised by the results.

If you’ve applied for a business card as a sole proprietorship, what was your experience like?

The credit of the individual is an important factor here.

I've been on a bit of a binge getting cards this past year (particularly the past 4-6 months), and wanted a Chase Ink Preferred (90k bonus) to go along with my Chase Ink Unlimited that I got last year. (Preferred is a good business travel card -- no FTF, rental car protection, yada, yada.)

My credit score had already dropped from 820-850 to 770-790 due to so many cards (and high monthly spend, tho I...

I've been on a bit of a binge getting cards this past year (particularly the past 4-6 months), and wanted a Chase Ink Preferred (90k bonus) to go along with my Chase Ink Unlimited that I got last year. (Preferred is a good business travel card -- no FTF, rental car protection, yada, yada.)

My credit score had already dropped from 820-850 to 770-790 due to so many cards (and high monthly spend, tho I do pay everything off every month).

I coincidentally needed a backup business bank account (I'm a sole proprietor), and Chase was offering a bonus on that as well ($750 I think).

The opening process was painful -- it should not take 2+ hours filling in info with a banker to apply for a bank account and a credit card, Chase -- but having my own banker has proved beneficial.

Preferred card was initially denied due to too many new accounts. My banker called some of his colleagues, and the denial was reversed.

I applied for the CIBP last year when the offer was 120K points. I don't have a business per say, but I do sell an occasional item on Facebook. At the time, I had plans to find things at a thrift store, spruce them up, and resell them. I made a mistake on the application (typed in 1 wrong number in my SS#). When 2 weeks went by and I didn't hear anything, I nervously...

I applied for the CIBP last year when the offer was 120K points. I don't have a business per say, but I do sell an occasional item on Facebook. At the time, I had plans to find things at a thrift store, spruce them up, and resell them. I made a mistake on the application (typed in 1 wrong number in my SS#). When 2 weeks went by and I didn't hear anything, I nervously called and The representative was very kind to me. I said I was just starting this little business and after fixing my error, was approved with a $5000 credit limit.

I would love to apply for another Ink but I just feel weird applying for another card. Life has gotten in the way and I never have time to do projects like I want to.