Delta Air Lines has just become the first major airline to report its third quarter results, and as you’d expect, they aren’t pretty…

In this post:

How big was Delta’s third quarter loss?

Delta has reported:

- A GAAP pre-tax loss of $6.9 billion (or $8.47 per share) on a total of $3.1 billion in revenue

- An adjusted pre-tax loss of $2.6 billion (or $3.30 per share) on a total of $2.6 billion in revenue

Just for some context on that, here’s a reminder of Delta’s second quarter losses:

- A GAAP pre-tax loss of $7.0 billion (or $9.01 per share) on a total of $1.5 billion in revenue

- An adjusted pre-tax loss of $3.9 billion (or $4.43 per share) on a total of $1.2 billion in revenue

As you can see, things are moving in the right direction, though Delta still has a really long road to profitability.

As Delta CEO Ed Bastian describes these results:

“While our September quarter results demonstrate the magnitude of the pandemic on our business, we have been encouraged as more customers travel and we are seeing a path of progressive improvement in our revenues, financial results and daily cash burn. The actions we are taking now to take care of our people, simplify our fleet, improve the customer experience, and strengthen our brand will allow Delta to accelerate into a post-COVID recovery.”

Highlights from Delta’s earnings report

Rather than rehashing the entire earnings results, I figured I’d share some of the numbers and statements I find to be most interesting:

- Delta’s daily cash burn continues to decrease; in the third quarter it averaged $24 million per day, and for the month of September it averaged $18 million per day (that’s $750,000 per hour); as a point of comparison, in the second quarter Delta averaged $43 million per day in cash burn

- $4 billion of Delta’s losses include special charges due to coronavirus, including fleet-related restructuring, charges for voluntary separation and early retirement packages (partly offset by the CARES Act), and more

- Operating expenses in the third quarter decreased by $5.5 billion (or about 52%) compared to the same period last year

- At the end of the third quarter, Delta had $21.6 billion in liquidity

- Delta has managed to “restructure” its Airbus and CRJ aircraft order books, reducing aircraft purchase commitments by more than $2 billion in 2020, and by more than $5 billion through 2022

- Delta leadership believes it may be two years until there’s a “normalized revenue environment”

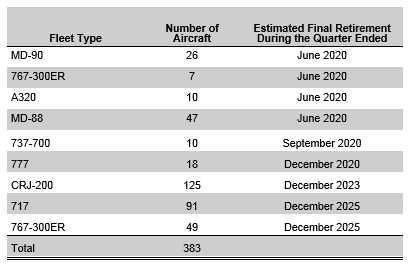

- Delta will retire 383 aircraft between now and December 2025 (shown below in a chart)

Bottom line

The third quarter was yet another very rough quarter for Delta. On the plus side, most metrics improved compared to the previous quarter, including reductions in operating costs and cash burn.

Many of Delta’s one-time charges this quarter should lead to improved results in the future, including paying for early retirement and voluntary separation packages (then again, CARES Act funding helped offset that).

While things are moving in the right direction, it’s pretty clear that we’re still a very long way from a recovery. Even the world’s most profitable airline (historically) is far from safe here…

What do you make of Delta’s Q3 results?

Only reason they’re not losing more money is they cut all non union salaries by 25% even with cares act funding paying for 100% of them.

Pretty shameful of delta to take government money paying 100% of salary then cut salaries 25%. Legal, but shameful.

@ Jkjkjk, point missed, which was that no matter what the content of a OMAAT post on Delta it will be followed by an obligatory stream of generic complimentary comments.

Thank you for not disappointing me.

Reaper,

So is Ed bastian a bad CEO?

Most employees recommended him on glassdoor.

Too late to join before the obligatory comments fawning over Delta had already begun.

Brian & Jkjkjk were too fast for me!

According to the NYT article today, DL has scaled back its $5 Billion in aircraft purchases today probably pending the outcome of the EU proposed tariffs on aircraft buys in retaliation to those imposed for Airbus subsidies.

Ed Bastian is one of the best CEO out there. I trust he will do what’s best for employees and the shareholders. Delta FTW

Maybe stock buy-backs and a LATAM acquisition weren't the best long term moves

Really curious to see how this compares with the airlines who aren't reliant on the middle-seat-blocked marketing strategy

product over profit. cost cutting is not necessary.

These results contain one time items but 2 things that struck out at me. DL continued to burn through $18 million in cash a day in September. I remember in the early 2000s right before the UA bankruptcy how the airline was lamenting that it was losing a $1 million a day (not actual cash burn). That was quaint compared to today.

Second, is the sheer number of a/c the airline plans on retiring over...

These results contain one time items but 2 things that struck out at me. DL continued to burn through $18 million in cash a day in September. I remember in the early 2000s right before the UA bankruptcy how the airline was lamenting that it was losing a $1 million a day (not actual cash burn). That was quaint compared to today.

Second, is the sheer number of a/c the airline plans on retiring over the next few years. To me DL has read the writing on the wall and realizes that some business travel isn't coming back anytime soon and they can't make a future on replacing all of that capacity with deep discounted leisure fares.