One of the best ways to rack up rewards points is with credit cards. The problem for many of us is that there are only so many things we can pay by credit card. That’s where Plastiq comes into play.

This is a service that I’ve used for years, and have also reviewed in the past. However, I think my time using this service has come to an end. I’ll share more details below, but to summarize the changes:

- Plastiq is increasing fees as of today, from 2.5% to 2.85%

- Plastiq is increasing wire fees

- Plastiq has over the past few months made their referral program much worse

- Over the past week I’ve interacted with Plastiq customer service for the first time, and it was underwhelming, to put it mildly

- Plastiq used to offer all kinds of promotions back in the day, but those are now exceedingly rare

Let’s get into a bit more detail on this…

In this post:

Plastiq Bill Pay Basics

Plastiq is a bill pay service that lets you pay virtually any expense by credit card. There are two common reasons people may want to use this:

- Because they value the rewards offered by credit cards

- For cash flow reasons (maybe someone has a 0% intro APR offer on a credit card, and sees this as a good opportunity to pay a bill)

I’m focusing on this entirely in terms of the rewards aspect, since in general I recommend doing everything you can to avoid credit card financing, given how high the fees can be. At the same time, I understand that some people like a 0% intro APR offer on a credit card, so no judgment.

Which Credit Cards Can You Use With Plastiq?

Plastiq allows you to pay with most major credit cards, including those issued by American Express, Mastercard, Visa, Discover, Diners Club, JCB, and Capital One (though Capital One is limited to business cards).

There are restrictions with some issuers regarding what kind of payments can be made, and you can read more about that here.

How Much Does Plastiq Charge?

Plastiq has increased fees as of July 1, 2020 — Plastiq used to charge 2.5% for payments made by credit card, but now charges 2.85%. Plastiq justifies the fee increase by explaining that several major credit card companies have announced upcoming interchange price increases, which directly impacts their costs.

Not only is Plastiq increasing the fee for every dollar processed, but they’re also increasing fees for those who need to send wires:

- Domestic wire fees are $40 (they used to be $30)

- International wire fees are $60 (they used to be $50)

It’s disappointing to see Plastiq not only raise the fee per dollar processed, but to also increase wire fees.

I’ll get into more detail on this below, but I’d say ~2.5% was right around the cusp of what I considered to be worthwhile, while I have a hard time getting excited about ~2.85%.

Does Plastiq Have A Referral Program?

Plastiq used to have a great referral program, with a rewards currency of “Fee Free Dollars” (FFDs). Each FFD is good for one dollar of bill pay without any sort of fees.

Unfortunately this has been scaled back significantly:

- Until a few months ago this offered 1,000 FFDs both to the person referring and the person being referred

- Now the referral program offers 100 FFDs to the person referring, and nothing to the person being referred

That’s not exactly particularly compelling…

What Payments Can You Make With Plastiq?

Plastiq allows you to pay for all kinds of things, including (but not limited to) auto leases, auto purchases, business services, club fees, mortgages, contractors, employees, insurance, legal services, rent, tuition, taxes, utilities, and more.

How Does The Process Of Paying With Plastiq Work?

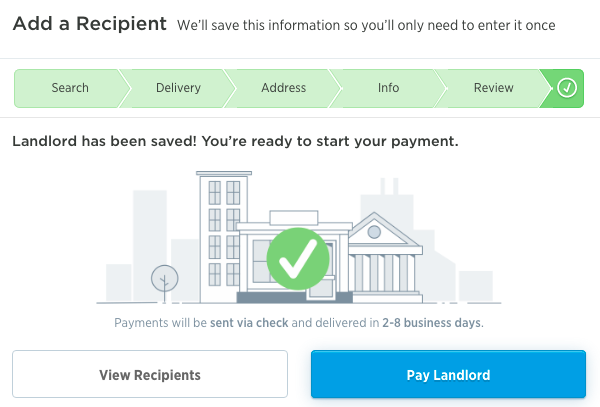

The process of making a payment with Plastiq is fairly easy.

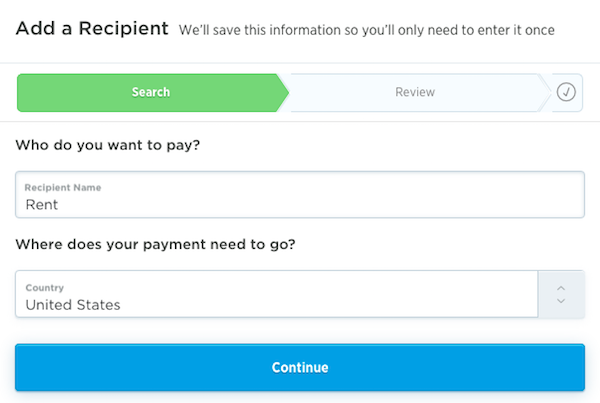

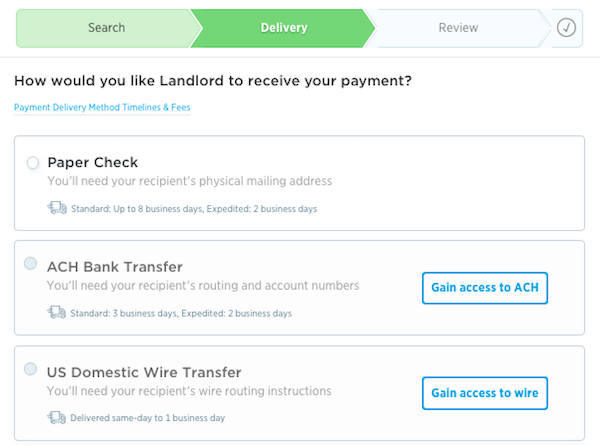

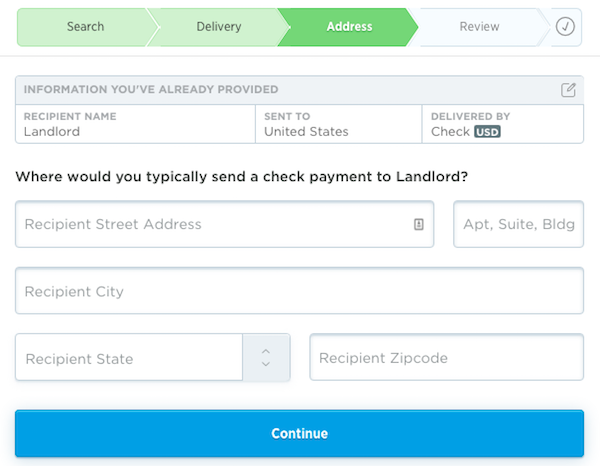

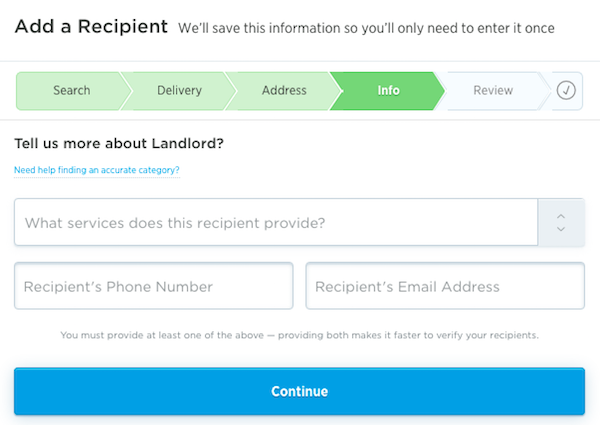

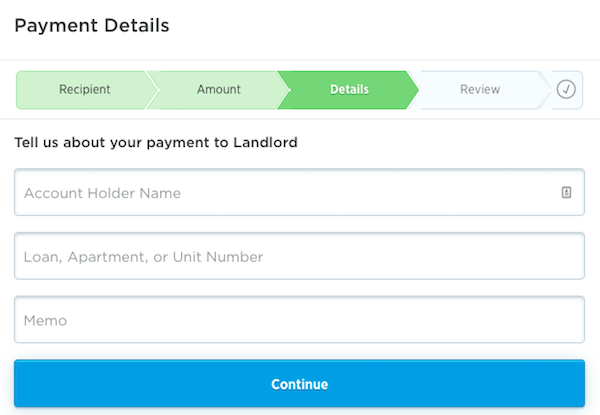

The first step is that you have to add the recipient to your Plastiq account, which includes adding their name, address, preferred payment type (check, wire, or ACH), and some basic details about the type of payment you’re making.

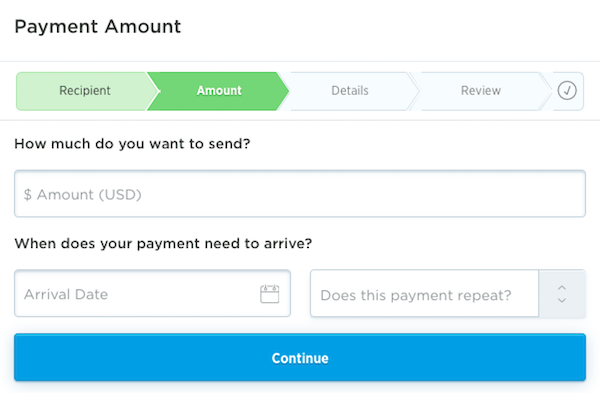

Then you have to enter your payment amount, which includes entering all your credit card details (if they’re not already saved to your account).

You can save credit card details as well as information about the people you’re paying on your account, and you can even set up a recurring payment.

Note that when you add a new recipient you may sometimes need to verify further information, or provide invoices.

How Does Plastiq Pay Your Recipient?

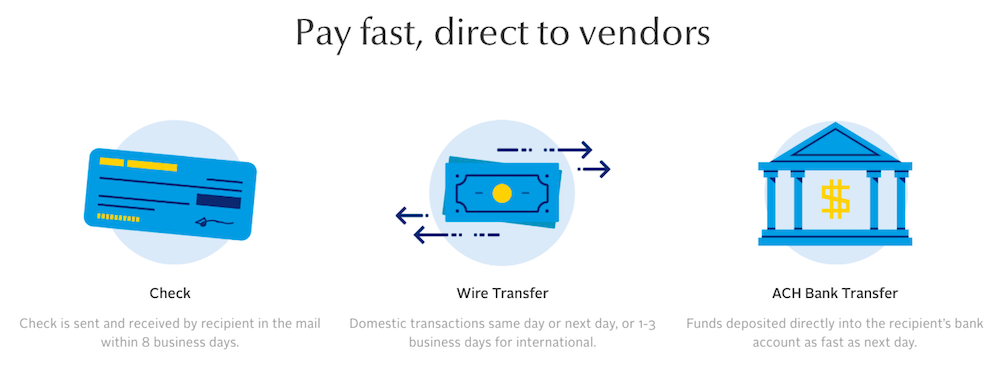

Once you’ve gone through the process of submitting the payment, Plastiq will make the payment on your behalf, with the following options:

- You can pay by check, and the check will be delivered within eight business days

- You can pay by wire transfer, and domestic transfers take place same or next day, while international transfers take 1-3 days

- You can pay by ACH bank transfer, and funds can be deposited in the recipient’s bank account as soon as next day

How Is Plastiq Customer Service?

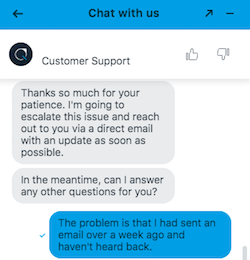

This has been a major source of disappointment. Until recently I never had to actually contact Plastiq customer service. Well, unfortunately in the past week I’ve learned that it’s virtually non-existent, which seems like a big problem for a company that promises a prompt bill pay service.

I’ve had trouble logging into my account for the past week, and Plastiq has been unresponsive by email. Plastiq also doesn’t have any number you can call.

They do have a chat feature, but that didn’t prove particularly helpful either…

Is Using Plastiq Worth It For The Rewards?

While Plastiq opens up all kinds of opportunities to make payments by credit card, the cost is now 2.85%. The question becomes, is it worth generating credit card spending at a cost of 2.85%?

At a fee of 2.5% I personally thought it was worth it, while I have a harder time getting excited about a 2.85% fee, at least under most circumstances.

Let me actually state upfront that I do pay my personal income taxes by credit card. I can do this at a cost of 1.87% through a different service (Pay1040.com), and that’s a price that’s very much worth it to me.

Historically I’d pay taxes with the Chase Freedom Unlimited® (review), since it earns 1.5x points per dollar spent, and in conjunction with the Chase Sapphire Reserve® Card (review), you can get the maximum value out of those Ultimate Rewards points.

Personally, I think it’s very much worth picking up Ultimate Rewards points for ~1.25 cents each, as I value them at significantly more (~1.7 cents each).

The value proposition has gotten even better with the Citi Double Cash® Card (review), which earns 2x ThankYou points per dollar spent in conjunction with a card earning ThankYou points.

Under what circumstances is it worth making payments with Plastiq?

If You Need To Complete Minimum Spending On A Credit Card

It could be worth using Plastiq if you’re struggling to meet the minimum spending on a credit card, but being able to pay expenses by card would help you.

For example, say you get the Ink Business Preferred® Credit Card (review), which offers 100,000 Ultimate Rewards points after spending $8,000 within three months. If being able to pay bills by credit card would help you reach that, it could be well worth it.

Paying $228 for the ability to unlock a huge welcome bonus, plus the points you earn for that $8,000 of spending, could very well be worthwhile.

If You’re Unlocking Some Threshold Bonus

There could be value in generating incremental credit card spending with a 2.85% fee. In addition to the general return on spending offered by cards, some cards also have threshold bonuses, where you get a further bonus if you spend a certain amount.

To give one example, the World of Hyatt Credit Card offers a Category 1-4 free night certificate when you spend $15,000 on the card in a cardmember year, plus two additional elite nights for every $5,000 spent.

Let’s say you’re expecting to end the cardmember year having spent $10,000 on the card, and have no easy way of increasing that. It could absolutely be worth using Plastiq for that $5,000 of spending (at a fee of no more than $143) so that you can get a Category 1-4 free night certificate, 5,000 more points, and two more elite nights.

If You Value Rewards Highly/Have Really Good Cards

I’d argue that there are some cards where it could be marginally worthwhile outright spending for a 2.85% fee:

- The Blue Business® Plus Credit Card from American Express (review) offers 2x Membership Rewards points on the first $50,000 spent every calendar year, after that 1x.

- The Citi Double Cash® Card (review) is technically a cash back card, but in conjunction with a card earning ThankYou points, you could earn 2x ThankYou points per dollar spent

Both of these cards let you generate transferable points for 1.43 cents each. While that’s not a slam dunk, it is below my valuation of 1.7 cents per point.

If Plastiq Has A Further Promotion

Back in the day Plastiq would constantly offer promotions for lower transaction fees. I would get incredible offers all the time, but it seems that they’ve greatly reduced the number of offers in recent months.

That takes away a lot of the appeal of Plastiq, unfortunately.

Plastiq Summary

I used to be very excited about Plastiq, when they had a 2.5% fee and constantly has promotions that lowered my average transaction cost even more.

They’ve now raised the fees to 2.85%, and promotions seem few and far between. When you combine that with their (very) lackluster customer service and lack of promotions, I have a hard time recommending Plastiq under most circumstances.

I do think Plastiq could still be worthwhile if you’re trying to reach the minimum spending requirement on a credit card, or if there’s a particular threshold bonus you’re going for. However, in general I just have a hard time getting excited about a 2.85% transaction fee.

With a 2.5% fee I thought Plastiq could make a lot of sense with cards like the Citi Double Cash® Card, though to me it’s much less worthwhile with the fee hike.

How do you feel about the value proposition of Plastiq, especially in light of recent changes?

Please note that As of Feb 2023 you can no longer use Amex with plastiq! This is a salient point considering student loan repayments are restarting!

Still worth it. It's better than what my apartment company charges for credit card payments, my rent in NYC is over $6k and they don't take Amex (Plastiq does). I already hit the $250k Diamond MQD waiver, Plastiq helped considerably with places I normally couldn't use a CC for.

It’s worth noting that Clickpay, is currently offering 0 percent credit card rent payments.

If you have the ability to use clickpay with your landlord like I do, please use your credit card. I am using my chase freedom unlimited.

Normally they charge 2-3 % in fees. This doesn’t make sense at those rates and I would pay cash if they start charging again.

I would argue your cover photo for this article needs to be updated. What exactly can you do with a Visa on Plastiq? Close to nothing.

Really not helpful to leave up old comments when you re-post an article with updated information.

Thanks for the headsup. Its sad. I would often pay my rent with the amex business plus but with the increase of the fee charged I think plastiq is getting the boot, unless I need to make a signup bonus spend quickly or there is some sort of threshold. Honestly with the current state of travel and the significant diminishing of premium travel services I don't see the value of points at this time and...

Thanks for the headsup. Its sad. I would often pay my rent with the amex business plus but with the increase of the fee charged I think plastiq is getting the boot, unless I need to make a signup bonus spend quickly or there is some sort of threshold. Honestly with the current state of travel and the significant diminishing of premium travel services I don't see the value of points at this time and even 2021 is questionable at this point given the way the US is going.

Some of the information certainly was/is out of date. There was a problem with some cards not processing Plastiq but that seems to be over at least here in Canada. Unfortunately the fee free MC deal is no longer valid.

In business the marginal tax rate probably nears 50% so that the after tax hit even if the fee is 2.85% will see only as a cost of 1.425%. I certainly get better value than...

Some of the information certainly was/is out of date. There was a problem with some cards not processing Plastiq but that seems to be over at least here in Canada. Unfortunately the fee free MC deal is no longer valid.

In business the marginal tax rate probably nears 50% so that the after tax hit even if the fee is 2.85% will see only as a cost of 1.425%. I certainly get better value than that from my points so with large purchases like property taxes on rental properties I use Plastiq when it is cheaper than the tax department CC (unfortunately only one has their own CC plan). I also compare to Paytm to see which is cheaper.

@Nick,

Absolutely. This was the main reason I used Plastiq for about 5 years while paying for an additional mortgage. You are referring to Hyatt Globalist and I was going it to achieve Delta Diamond. The ability to do what I did back in the day has partially disappeared with new rules from Delta, and I no longer own the home, so I am not doing this anymore, but when I was, the cost of...

@Nick,

Absolutely. This was the main reason I used Plastiq for about 5 years while paying for an additional mortgage. You are referring to Hyatt Globalist and I was going it to achieve Delta Diamond. The ability to do what I did back in the day has partially disappeared with new rules from Delta, and I no longer own the home, so I am not doing this anymore, but when I was, the cost of doing it was far outweighed by the benefits I was getting by achieving Diamond status. So a no brainer. You need to put a $$ figure to the benefits of being a Globalist and how often you would use those benefits to see if the cost of the fees is worth it. I too am a globalist and it is a very worthwhile hotel status. I would venture to say that if you travel globally a lot (at least before Covid 19 and no pun intended) then it is probably worth it to help you get there by paying the small fee to pay for something you have to pay for anyway, and help you get to Globalist quicker or at all. Good luck

I have paid a couple of hundred thousand through plastiq. All has worked fine, but I agree that 2.5% was about the max fee that makes it worthwhile. I told plastiq that I have no plans to use them further at 2.85%. (barring a promotion...)

Yes I think Ben was targeted for these promotions as a blogger. I was never targeted except to sign up another person. But if they are not a miles/points maven, would not happen.

It still makes sense when you can write off as a business expense to get 2 points/$ as in Citi Double Cash where I pay the mortgages on my rent houses.

But personal expenses it is not so compelling anymore, except as Ben says to complete minimum spend for a sign up bonus.

Agreed with Hodor. That stupid Andrew back in September was using he VA MC and he now uses the Citi double cash to get 2 VA points per dollar.

The new opinions are challenging to read through all the tutorial in this article.

When you bump these old posts, it would be great if you could please try and make it clear what's new material and what isn't. You've been doing it quite often lately, and it could be viewed as a somewhat lazy approach to leave it to the reader. Thanks very much for all your work.

At 2.5% it doesn't make sense. At basically around 2% it does assuming you use the Freedom Unlimited card because with the 50% bonus after you merge them with the Reserve points then you're doing well. The real question is how you're targeted for all of these promotions? Without this then it doesn't make sense and myself an many others never get targeted.

@Manish

Unable to edit my post, but wanted to add that another good option for paying mortgages via Plastiq is the Citi Double cash card, which now allows you (since Sept '19) to transfer your cash back to Citi ThankYou points (2% cash back becomes 2 points per $ spent).

So, the earning rate would be ~50k points vs. 52.75k points with VA, at which point it would make sense for some to use...

@Manish

Unable to edit my post, but wanted to add that another good option for paying mortgages via Plastiq is the Citi Double cash card, which now allows you (since Sept '19) to transfer your cash back to Citi ThankYou points (2% cash back becomes 2 points per $ spent).

So, the earning rate would be ~50k points vs. 52.75k points with VA, at which point it would make sense for some to use the Citi card due to the increased flexibility.

I live in Atlanta and am a DL PM, so end up flying DL and VS a lot. The VS card helps to qualify for VS elite status and carries additional perks, like companion tickets and upgrades to Upper Class, hence the reason to carry the VA card and put spend on it.

If I fly less or move from Atlanta, I would definitely switch to the Double cash card. But either way, Plastiq makes sense if you are paying your card off monthly and not simply using the service to transfer mortgage debt to your credit cards.

@Manish

Huh? Of the transferable cards (assuming you mean Amex Plat, CSR, Citi Prestige, etc), on the Citi Prestige is eligible to pay mortgages via Plastiq. It has to be a Mastercard. Citi Prestige only gives 1 point per dollar, so although it is more flexible, I would earn less than half (25k points per year vs. 52.75k points from the VA card).

The bulk of my spend goes on Amex Plat and CSR (depending...

@Manish

Huh? Of the transferable cards (assuming you mean Amex Plat, CSR, Citi Prestige, etc), on the Citi Prestige is eligible to pay mortgages via Plastiq. It has to be a Mastercard. Citi Prestige only gives 1 point per dollar, so although it is more flexible, I would earn less than half (25k points per year vs. 52.75k points from the VA card).

The bulk of my spend goes on Amex Plat and CSR (depending on what I'm buying). The mortgage certainly isn't the "bulk" of my spend, and again, is restricted to Mastercard only.

How did I spend extra $? I paid $370 in Plastiq fees and redeemed most of the resulting points for a first class ticket that would otherwise have cost $1103 (or 130k Skymiles + $11).

If you don't understand that is a net savings of ~$720 ($1103 - $11 ticket fees - $370 Plastiq fees), I don't know what to tell you.

I redeemed my points for about 2.4cpm (a reminder, I earned them at 0.7cpm), which although not ideal was certainly better than paying cash or burning 130k Skymiles for a last second ticket.

@WT

Thanks for making my point.

You consider yourself a points master and “savvy” but you put your bulk spend on a VA credit card rather than a transferrable one.

You still spent extra $ to visit your in-laws. Who’s the sucker now?

@Manish

There are enough promotions that my average fee is slightly below 1.5%. My total annual mortgage payments are just shy of $25k, and just over it after fees. I pay with my Virgin Atlantic Mastercard, which gives 1.5x points on any purchase, and 15k miles for 25k in annual spend.

It costs me $370 to earn 52,750 Virgin Atlantic Miles, a cost of 0.7 cpm. They are worth at least double that - I...

@Manish

There are enough promotions that my average fee is slightly below 1.5%. My total annual mortgage payments are just shy of $25k, and just over it after fees. I pay with my Virgin Atlantic Mastercard, which gives 1.5x points on any purchase, and 15k miles for 25k in annual spend.

It costs me $370 to earn 52,750 Virgin Atlantic Miles, a cost of 0.7 cpm. They are worth at least double that - I used the points this past year to purchase a first class ticket while visiting in-laws in the Bay Area. Cash price was $1100, but I used just 45,000 miles + $11.

The year before, my wife and I flew business class to Japan with Virgin miles, at a redemption rate of nearly 4.0 cpm.

If you don't travel or are bad at redeeming points, maybe it doesn't make sense, but if you are savvy, it's a great way to generate points.

What about using the Bank of America premium rewards card if just looking for $ and not points? If platinum honors reward member you get 2.6% cash back which would always be a 0.1% minimum return and then if promotion even a better return

Using it for car payments and house payments with the Double Cash. Yes, I will pay quite a bit in Paypal fees less their promotions. But, I call these pajama points because it takes no effort on my part, no gas, no ugly walmart people, and no suspicious bank people. That is well worth the fee for having to do nothing to earn points. Those points will go for costly business class tickets where I will get outsized value for those points.

Outside of occasional, low fee use, the idea of using this service on a continuous monthly basis for mortgages, taxes, etc is total lunacy.

“Paying” a debt by going into greater debt is inherently an irresponsible action.

While I’m sure most of us on this site pay off our cards monthly, the vast majority of Americans do not. This service takes advantage of those individuals unable to meet basic monthly expenses by shifting them to...

Outside of occasional, low fee use, the idea of using this service on a continuous monthly basis for mortgages, taxes, etc is total lunacy.

“Paying” a debt by going into greater debt is inherently an irresponsible action.

While I’m sure most of us on this site pay off our cards monthly, the vast majority of Americans do not. This service takes advantage of those individuals unable to meet basic monthly expenses by shifting them to high interest credit cards.

At best, using Plastiq is an irresponsible decision. At worst, they are no different from corner street paycheck lenders and loan sharks.

I think it’s wrong for you to give these guys free advertising like this.

I had heard of Plastiq but for pure laziness, never looked into it. Awesome guide, Ben. Might be worth putting my mortgage on the Blue Business Plus, at least during promo months. My Amex points stash was depleted recently and I agree with your 1.7 cpp valuation, so even at the full 2.5% fee I would still come out slightly ahead.

Thoughts on using Plastiq to get elite status? For instance, using it to get globalist status with Hyatt card.

Note for Canadians with an Aeroplan TDCT card: TDCT considers Plastiq a cash advance process. No points are accrued for your Aeroplan account. It was, in my case, a costly mistake.

Has anyone had any issues with tardy payments or non-payments?

@Paolo, if miles earning is just a hobby and you're accumulating them to make trips that you wouldn't otherwise take (ie all your mileage travel is just a "bonus" on your spend), then paying any amount of money for miles/points might not make sense. Some of us view miles/points/cash back as rebates and the miles and points have actual cash value towards travel expenses that you would make regardless. If you do the math Ben...

@Paolo, if miles earning is just a hobby and you're accumulating them to make trips that you wouldn't otherwise take (ie all your mileage travel is just a "bonus" on your spend), then paying any amount of money for miles/points might not make sense. Some of us view miles/points/cash back as rebates and the miles and points have actual cash value towards travel expenses that you would make regardless. If you do the math Ben has laid out with higher earning cards, paying a 2.5% fee can net a bigger return in that investment toward travel expenses. Any economist would see the value in that.

During the Masterpass promo I made a mistake in the last digit of my mortgage account. Lucky for me that is the difference between my mortgage and checking account. After the first few checks cleared my account I realized this was an awesome mistake. Moving forward I have been using this loophole for every promo that comes up.

The math is actually better than you make it out to be. When you add the 2.5% fee to the base amount, you also earn points on those extra fee dollars. So if you pay a $1000 bill you also earn points on the $25 fee. With Amex Blue or Doublecash, you then earn 2,050 points (1000 plus 25 fee x 2) for a $25 fee. 25/2050 means your cost is 1.2195 cents per point....

The math is actually better than you make it out to be. When you add the 2.5% fee to the base amount, you also earn points on those extra fee dollars. So if you pay a $1000 bill you also earn points on the $25 fee. With Amex Blue or Doublecash, you then earn 2,050 points (1000 plus 25 fee x 2) for a $25 fee. 25/2050 means your cost is 1.2195 cents per point. However, I calculate it as better because of bonuses. I have teh Rewards+ card that gives me an extra 10% back, so then I'm buying those Citi ThankYou points with my mortgage payment for only 1.11 cents each. For Amex I usually transfer points with a bonus as well (Virgin at 30% or this year Air Canada at 20% bonus) so my effective rate with good bonuses can be under one cent. For someone who is not flush with extra points and uses all that I earn, this makes Plastiq compelling. If I had more business travel and were flush with points I would not do it.

If my employee withhold tax for us, how can we ask them not to do it so that we can pay with our credit card? Every year, I am basically getting tax return instead of paying tax. Is it worth it to not doing tax withholding and pay yourself?

Also, let's say if withholding tax is a better deal, can we "overpay" tax to meet retention/signup bonus requirements? (and we will get return of those payment of course.)

I use Plastiq on a month-by-month basis, depending if I get the 1% or 1.5% offer that month. So far I've received it each month for the past 5 or 6, so fingers crossed that continues in 2020. Paying my rent in NYC has been a huge points boost for me, and I'll gladly pay an additional ~$20-30/month for that amount of points.

There will be less plastiq deals offered if bloggers keep feeding plastiq customers. This is one of those situations where too much publicity is going to kill any value in doing this. Either plastiq will raise their rates or credit card companies will further curtail the types of things that can be paid with plastiq which has been a growing trend.

Capital one cards are not accepted anymore. Dont bother

@Ak You had me panicked! However I checked, and my $20k in Plastiq payments on 7/31/19 did in fact get 2x Capital One points.

For a business it makes a lot of sense as Plastiq fees are tax deductible, UR points tax free. The Ink Unlimited gives you UR points for under 1.2 cents per point after taxes which you can redeem for at least 1.5 cents per point.

Amex unfortunately only allows Plastiq for very limited purposes.

What about cash advance fees?

https://bit.ly/2RRAhgd

@Matt

Yes, point taken.

@Nate nate -- I think he's saying if you used the Chase Freedom card (1.5x points per $) with Pay1040 to pay your taxes. If you pay $1000, their fee of 1.87% translates to an $18.70 fee so that you're paying a total of $1,018.70. You'd then earn 1.5x = 1,528 points. So the $18.70 fee / 1,528 points = $0.0122 per UR point. So I *think* he's saying at Plastiq's 2.5% rate that wouldn't...

@Nate nate -- I think he's saying if you used the Chase Freedom card (1.5x points per $) with Pay1040 to pay your taxes. If you pay $1000, their fee of 1.87% translates to an $18.70 fee so that you're paying a total of $1,018.70. You'd then earn 1.5x = 1,528 points. So the $18.70 fee / 1,528 points = $0.0122 per UR point. So I *think* he's saying at Plastiq's 2.5% rate that wouldn't make as much sense (the same math works out to 1.6 cents/point, much closer to his valuation). But none of that math matters if you get a refund on your taxes, which I think most of us probably do?

@Paolo -- I think if you were $1k short of not hitting the minimum spend to get the Alaska card miles bonus, Warren Buffet would approve of spending $25 in fees to get 40,000 miles. To use the service on a normal basis, though, for no other reason than earning basic miles/points, of course, I agree with you that it isn't worth it. But so does Ben, mind you.

@Ron -- Who cares if Ben gets thousands in fee-free dollars? Jealous much? I for one welcome the $500 in fee-free dollars I'll get from signing up with his referral link. I'll just wait until there's a 1% (or < 2%) promo and use my Citi Double Cash 2% back card. I end up making 1% back, I get $500 in fee-free dollars to put towards my mortgage and get 2% of that back, and so I care about Ben getting $1000 ... why exactly?

I think it's worth it. I use the Virgin Atlantic card (which is a MasterCard) to get 1.5x VA miles on my mortgage and that helps me hit the threshold for $25k / year for an extra 15k miles.

On the output side, I get a free set of R/T ANA first class tickets per year (and this is part of that earn), so overall I would say it's worth it in my situation.

I could see why 2X MR points would be even better, but... mortgage limitations on credit cards suck. =\

Setting Plastiq aside, does anyone opt to pay more on certain bills to use credit card fees?

For example, my auto payments have the option to pay with a credit card, but it has a $5 processing fee. While I technically would come out ahead, I've never opted to because I'm lazy and have a slight preference to hold cash rather than points.

I always try to remind myself that "winning" in this hobby...

Setting Plastiq aside, does anyone opt to pay more on certain bills to use credit card fees?

For example, my auto payments have the option to pay with a credit card, but it has a $5 processing fee. While I technically would come out ahead, I've never opted to because I'm lazy and have a slight preference to hold cash rather than points.

I always try to remind myself that "winning" in this hobby is to earn/redeem from what you originally planned to spend anyways. The second one tries to spend more, even for good reasons, I perceive it as new level of risk. I don't like the idea of award charts and availability determining whether I breakeven on cash I parted with.

Regardless, I still always wonder about "what else" can I earn points on.

Paying an additional, unnecessary 2.5% on significant monthly outgoings is not merely unwise...It’s lunacy. Anyone imagine Warren Buffett’s views on this kind of BS?

2.5% out, chicken feed points in.

Small whine. In Canada the same offer was/is available BUT at 2% instead of 2.5%.

Then there is Paytm at free if using MC (but with limited payees and no checks).

Why is Plastiq useful? Because if you click here, here, here, here, here, here, here on my affiliate links I get thousands of fee-free spend. Only fools would pay 2.5% fees, but always plenty of them to swindle in this hobby

I have not read the terms and conditions. Is one permitted to have a check issued/payment made to one's self or one's spouse?

@David oh good the internet needed another comment complaining about a guide on plastiq

Some payments - insurance, mortgage I have found that VISA and AMEX cannot be accepted on Plastiq.. Fortunately Mastercard is possible

@KahunnaTravel - this might be the problem

@Peter, the Plastiq offer is for payments that are processed before September 26th. Before submitting a Plastiq payment, you can click on the delivery date and it will tell you when the processing date will be (for regular check delivery it is 10 days before the scheduled delivery date). So you can keep changing the delivery date until the processing date falls on or before the 26th. The 1% fee should show up in the...

@Peter, the Plastiq offer is for payments that are processed before September 26th. Before submitting a Plastiq payment, you can click on the delivery date and it will tell you when the processing date will be (for regular check delivery it is 10 days before the scheduled delivery date). So you can keep changing the delivery date until the processing date falls on or before the 26th. The 1% fee should show up in the total before submitting. I had an issue with my account and had to email Plastiq inorder to fix it to get the 1% to show up.

Heads up on that 1% for 3 transactions promotion - I got the same thing for August (have it processed by August 30th). I scheduled them at the very beginning of August, so essentially one month for them to process on time. Plastiq put the process date at September 3rd for some reason. No idea why, so I didn't get the 1% rate. Not too upset about it because my payment/fee isn't that much, but...

Heads up on that 1% for 3 transactions promotion - I got the same thing for August (have it processed by August 30th). I scheduled them at the very beginning of August, so essentially one month for them to process on time. Plastiq put the process date at September 3rd for some reason. No idea why, so I didn't get the 1% rate. Not too upset about it because my payment/fee isn't that much, but definitely annoying.

I had never had a problem with them before this. TBT to the days when the CSR rent payments coded as travel....

I’ve wracked my brain trying to figure out how to transfer car lease payments to credit cards and make it work for me but I haven’t been successful.

I’m confused - you say that it makes sense to buy UR Points at 1.25 cents / point, but don’t describe how to buy points at that price. Then you assume it’s possible to buy at that price in the examples.

How do you buy points at that price?

Thanks Ben for this article. I have almost $8K going out towards mortgage payments on a monthly basis from my personal bank accounts. Is there a good travel rewards master card that i should be targeting to get some value out of Plastiq ?

About 9 months ago, I tried using Plastiq to set up the payment of my monthly mortgage using my Chase Southwest card. The goal was to create some guaranteed spending as a baseline for Companion Pass re-qualification. When I tried to enroll the SW card into Plastiq, I have received an error message indicating that Chase would not allow Plastiq transactions on that card. I inquired about this from both Chase and Plastiq, and they...

About 9 months ago, I tried using Plastiq to set up the payment of my monthly mortgage using my Chase Southwest card. The goal was to create some guaranteed spending as a baseline for Companion Pass re-qualification. When I tried to enroll the SW card into Plastiq, I have received an error message indicating that Chase would not allow Plastiq transactions on that card. I inquired about this from both Chase and Plastiq, and they confirmed the "no go". I don't know if that is still the case, but I got a sense when I talked with Chase about the matter, that "the ban" applied to several of their cards.

In a pinch, if you own property you can likely pay the property tax online for less than a 2.5% fee. My last two houses in different states had a 2.35% fee via Official Payments. This is more likely to go smoothly since there is already a link from the county taxation department to their approved payment processor and you'll save $1.50 per $1000 to boot.

Two things:

Plastiq is having problems processing capital one cards, meaning u can’t earn capital one venture double points.

The 2.5% fee can be a tax write off if paying a small business bill. The IRS allows writing off convenience fees for business-related expenses. Thus, the 2.5% is more like a 1.8% fee. Oh, and the IRS doesn’t tax reward points as earnings ASFAIK.

oh good the internet needed another guide on plastiq