Credit card points can be lots of fun to redeem, and are probably one of the main reasons why most of us are here, but paying cards off is usually not as enjoyable. In addition to the obvious, tracking and linking different accounts can start to turn into a full-time job if you’re not careful. Maybe you’re one of those people who has been in the game for decades and you have all of your accounts linked, or maybe you’re really good at remembering passwords and usernames.

I happen to be neither.

Either way, personal and business cards are usually opened separately, and if you’re just starting out, chances are your online accounts may not all talk to each other yet.

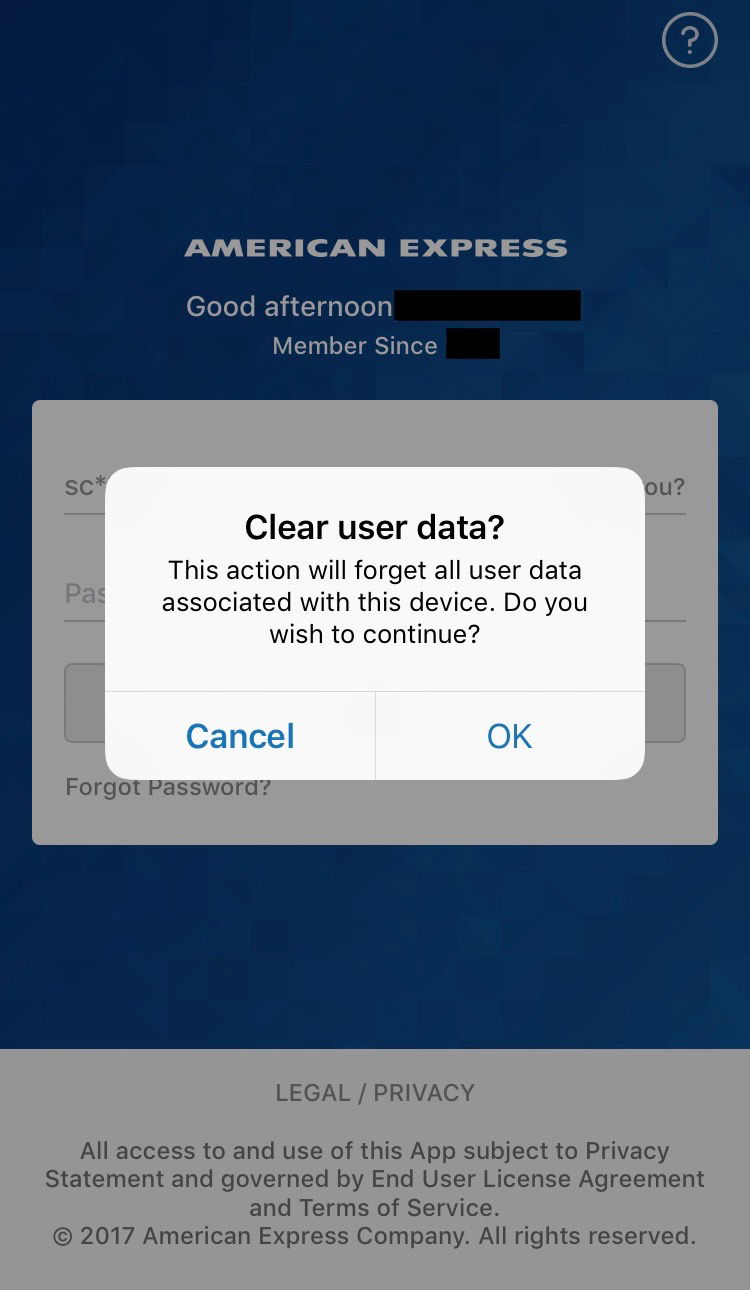

I spent years managing two separate American Express accounts – one for personal and one for business – with little to no difficulty. That is, until AMEX recently updated their app and started sending me this nastygram every time I tried to switch between accounts:

In the meantime, I also recently opened up an Ink Business Preferred® Credit Card, and decided that it was high time I streamline my unique logins into a single account.

Problem is, I couldn’t find anything about how to do this online, save for a few outdated FlyerTalk threads. So I decided to explore the dreaded world of 800 numbers and figure it out for myself.

Question is, can these business and personal accounts be linked?

Chase

This used to be very easy. In years past, you could add personal cards to a business profile (but not vice-versa), and it only took a few minutes to do so (or so I’m told).

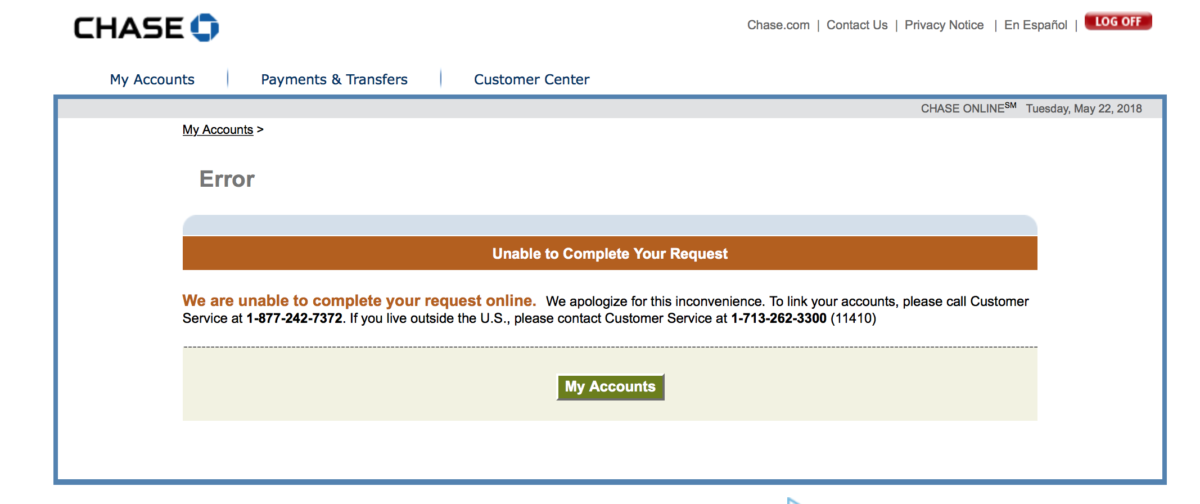

At present, however, whether or not you can combine your personal and business profiles depends. I tried doing this online several times, but couldn’t get around this error message:

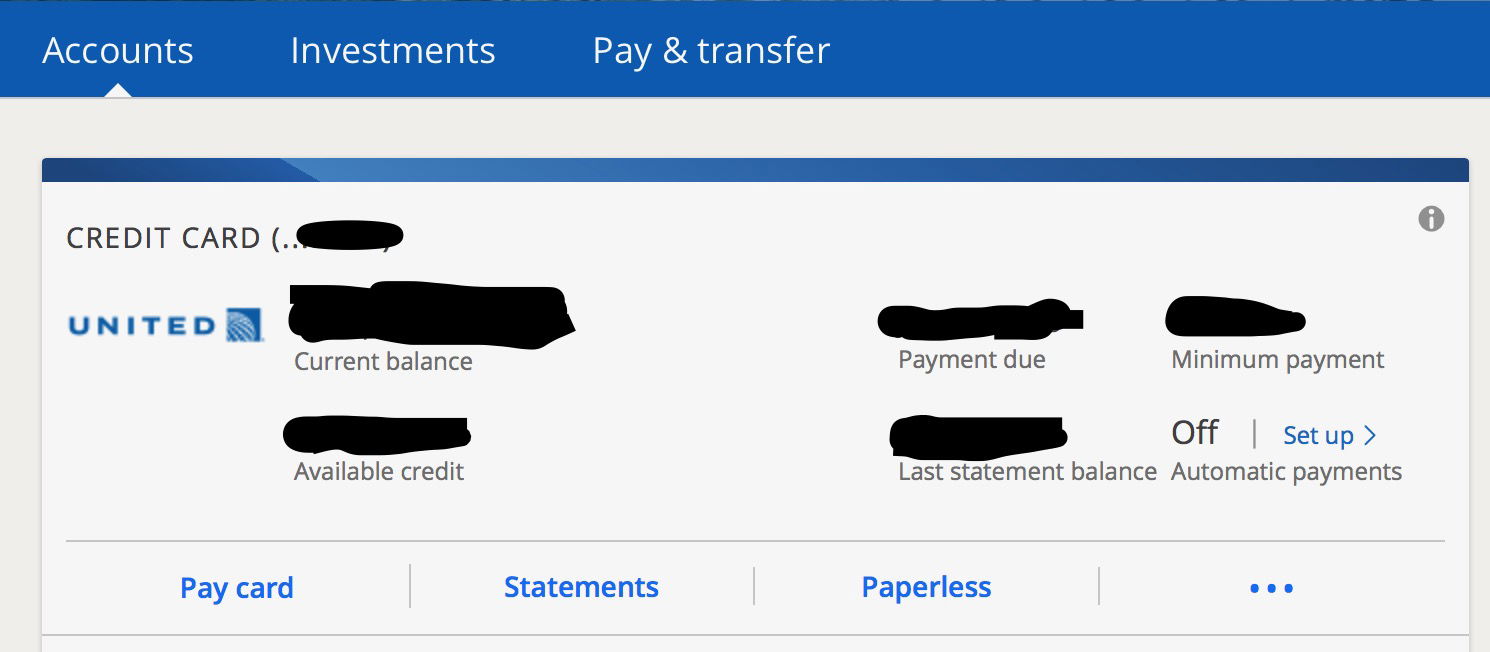

It sounds like the root issue here is the online interface – personal accounts have been updated to the newer platform, while a large percentage of business accounts still operate on the old platform. So, chances are that your personal account(s) will look like this:

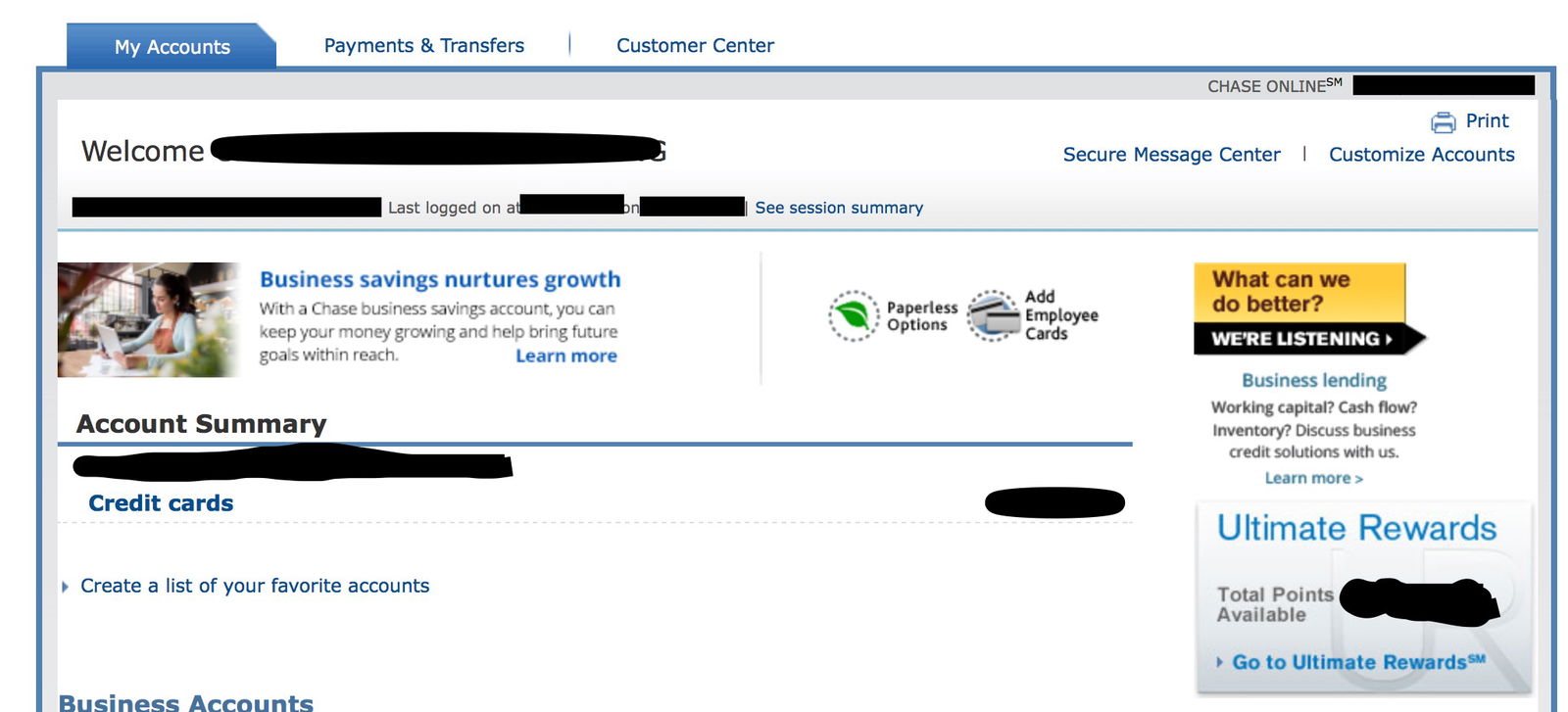

While your business account(s) may still look like this:

If both of your accounts are indeed on the new interface, then you should be able to add personal accounts to your business account, but not the other way around — just like the old days.

But if your accounts are on the two different platforms, you currently can’t add the personal account to your business account. Apparently, they have had too many issues with broken links over the past few months, so they’ve discontinued this option until everything is on the same online platform.

In the meantime, there is a workaround wherein you can have Chase delete your personal account user ID and then add a new one into your business account. However, this involves losing all of your online transaction details from your personal account, which just isn’t an option for me right now.

I’ve talked to a few reps now to see when the platform for Chase’s business accounts will be fully updated, and have gotten answers ranging from “everything will be updated by July” to “you can definitely expect to have access to the new platform by the end of the year.” All that to say that I wouldn’t place any Vegas-level bets on this.

If (and when) all of your accounts do have access to the new interface and you want to merge your online accounts, you can do this by:

- Calling 877-242-7372

- Then select option 3

- Followed by option 2

And make sure you have your EIN or Social Security number on hand for account verification.

Unfortunately, the phone number on the back of your card may not get you there – they will need to transfer you and have been struggling with their internal authentication system lately – so the phone number above is probably your best/fastest bet.

American Express– Do this, not that!

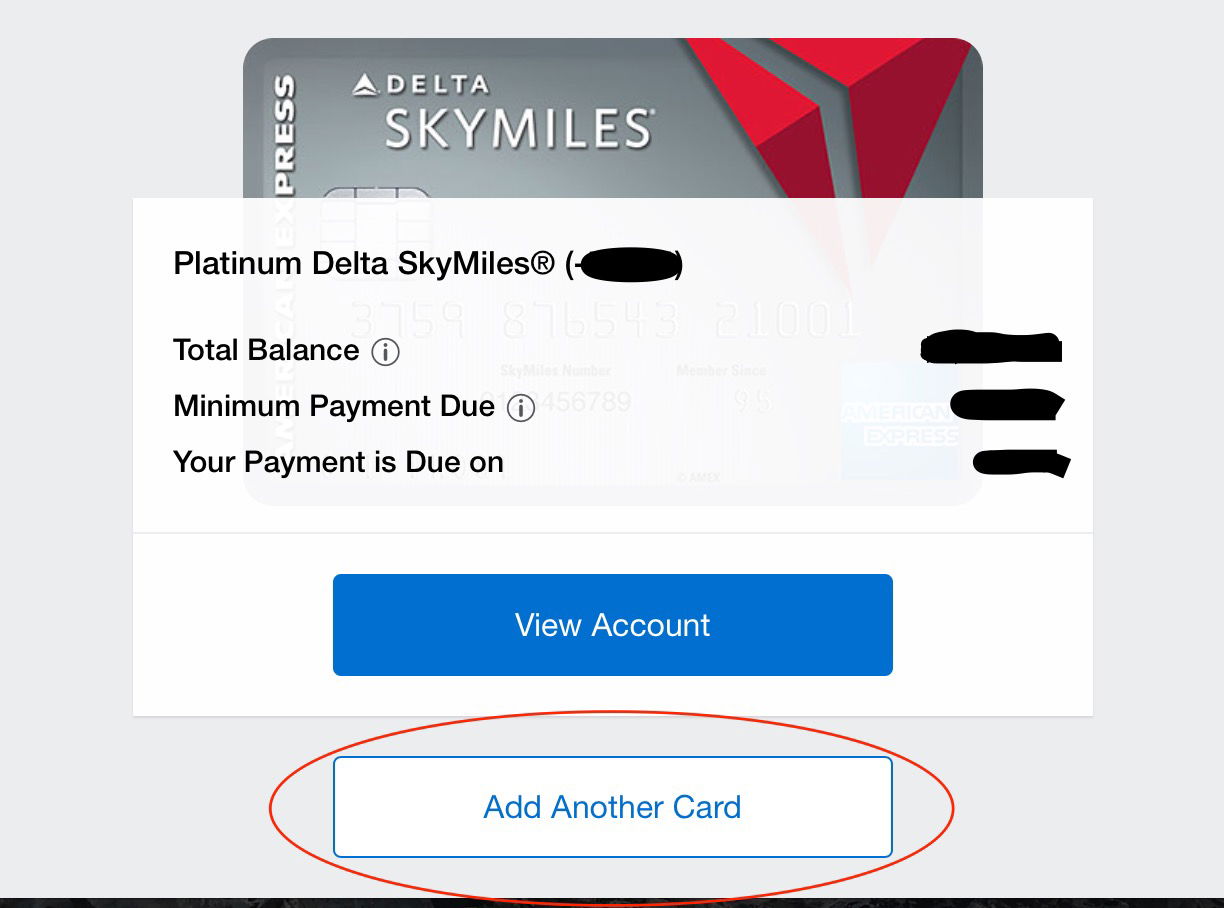

The process of linking American Express cards is much easier – if you know where to look. I mistakenly spent about ten minutes clicking through this link, which can be located via the “my cards” option on the main menu. It looks like it should cooperate:

But all this does, in reality, is toggle from one card back to the other. So while you can switch back and forth, you still need to enter a password every time you need to switch between cards. Problem not solved.

Eventually, I gave up and called the number on the back of the card. Once I got through and asked for the “online help” option, we were back in business, and both of my cards were visible on a single account in no time.

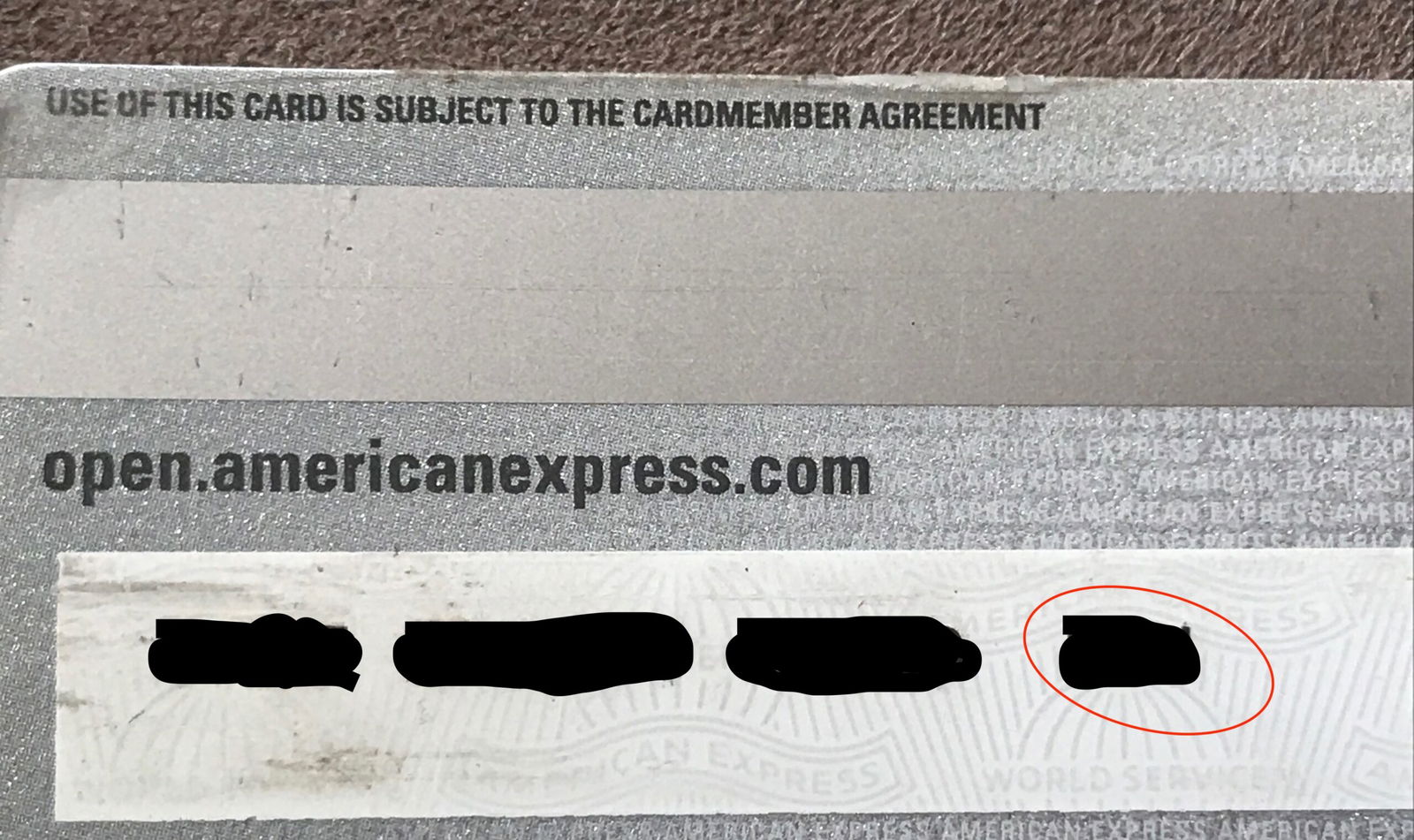

Again, this has to be done over the phone, at least according to the rep with whom I spoke. The one (slight) caveat here is that you will need the actual physical card in hand in order to complete the process. Even if you’re like me and memorize your go-to card numbers, you will still need to provide the three digit authentication code on the back of the card. It should be located here:

You know, the one that merchants sometimes mistakenly input when they’re not used to taking AMEX cards.

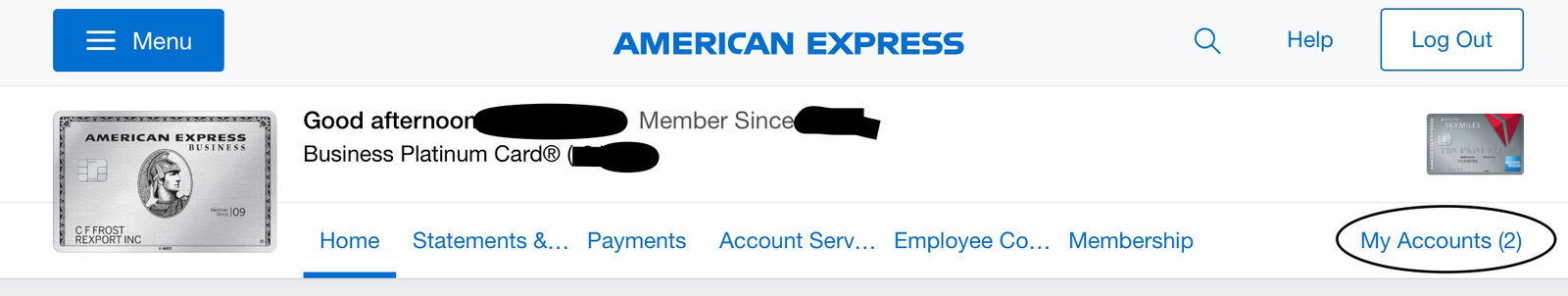

Once you’ve given the necessary information, you should be able to log out, log back in, and see the two cards linked here:

Happy card-paying!

Has anyone else had trouble with multiple accounts on Chase? Have you found any workarounds? Weigh in below!

Citi will NOT let you link business and personal cards. Need separate logins.

FYI I always keep my credit/debit card numbers, expiration dates, PINs, and CVV codes (including the weird Amex and Discover ones) in a secure file on my laptop. You never know when you'll need that info!

@ Linda. I have my sapphire reserve and my ink plus on the same business login. I download no problems via quicken. I think it is only direct connect they charge for. Express web connect set up through the add account, credit card chase usually works no problem in my experience.

I just got my first business card with Chase about a month ago. As soon as I got it I immediately called and they were about to move all my personal accounts over to my business account. Took all of 5 minutes. Mine are both still on the old platform.

@JimC - Thanks. Unfortunately, I don't have a Citi business card in my portfolio (yet) but I can easily do an updated post if and when that day comes.

@Shawn C and @Robert - I'm envious that you had such an easy time with this! Curious if your business accounts are still on the old interface or on the new one? I've had four separate reps over the course of about a month tell...

@JimC - Thanks. Unfortunately, I don't have a Citi business card in my portfolio (yet) but I can easily do an updated post if and when that day comes.

@Shawn C and @Robert - I'm envious that you had such an easy time with this! Curious if your business accounts are still on the old interface or on the new one? I've had four separate reps over the course of about a month tell me that I can't add my personal account to my business account until it updates to the new platform.

Anyway, when I logged in today, I got a popup notification that the new interface is coming, so hopefully this issue is moot soon enough.

No, in fact when I log in I get the business system for both my business and personal cards, and they all download to quicken for free.

Ok as discribed. I was able to combine my new Ink Businesses and all my personal under a new business Profile. Sounds good Right?

Problem is unless I want to pay $9.95 a monthly my transactions won’t download to quicken. It took me 2 months to figure out why all my accounts were downloading except Chase.

I not going to pay $9.95 because of 1account (Ink)

So when I get home I’ll have Chase set up a personal acct.

Has anyone else had this problem?

Chase is super easy. The catch is that you can't add biz cards to a personal account, you can only add personal cards to a biz account. My local banker recommended I keep my personal account around, just in case. Again, incredibly easy to do.

AmEx - Really easy, was able to add a biz card to my existing account without calling in.

Citi - Had to create a new login, even though it's the same platform.

Barclays - Uses the ugly, outdated Juniper platform, totally different system.

Do I need to link my chase personal and business cards to transfer ultimate rewards between them or thats not necessary?

Useful post. What about Citi Bank cards--personal and business? Thanks.

Just two weeks ago Chase did exactly this for me. I’ve never tried to do this myself but the BRM easily did it. It is my first business card so he created a second login for me that has the business account and all personal accounts linked. Both logins remain active which is important because as he explained to me the business login doesn’t provide access to all features available on the consumer accounts.