With reduced oil revenue in the Middle East, we’ve seen all kinds of changes in the UAE, Qatar, etc. Businesses (including airlines) are being run in more of a sustainable way, and we’re seeing existing taxes being increased, and new taxes being introduced. For example, in the past I’ve written about how the airport taxes have increased in Abu Dhabi and Dubai.

Well as of today (January 1, 2018), the UAE has introduced a controversial new 5% VAT on purchases. This new tax applies to clothes, hotels, utilities, gas, etc. However, the tax doesn’t apply to everything, as medical treatment, public transportation, etc., are excluded.

If you’re planning on staying at a hotel in the UAE anytime soon, this means you can expect to pay even more for your room. While the UAE hasn’t had an across the board sales tax up until now, there has already been a municipality tax on hotel stays, which varies based on the Emirate you’re in. For example, in Dubai that municipality tax has been 10%, while in Abu Dhabi it has been been 6%. There has also been a 10% service charge on hotels, and an additional tourism tax and municipality fee.

Emirates Palace Hotel Abu Dhabi

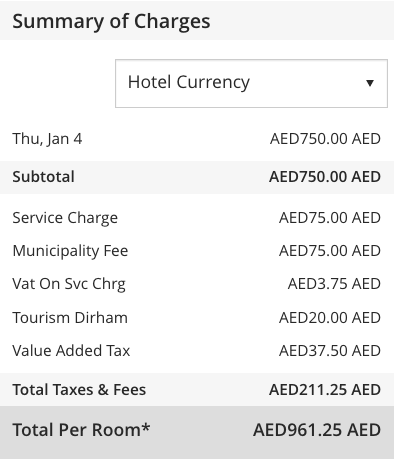

For hotel stays as of today, you can expect to pay a further 5% on top of that. For example, I pulled up rates at a Hyatt in Dubai, where the base rate for a one night stay is 750AED. Now you’d end up paying a 10% municipality tax, 10% service charge, 5% VAT, plus a tourism tax. That 750AED hotel room now costs 961.25AED, which is 28% more than the base rate. Ouch!

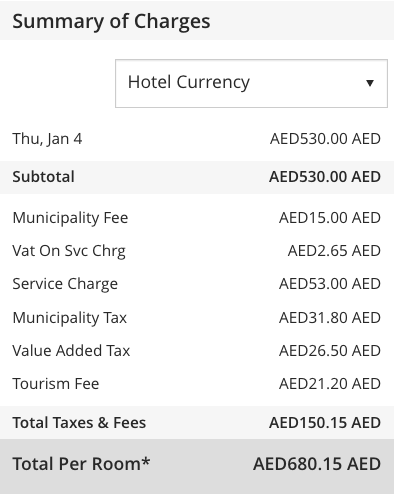

Let’s look at a Hyatt in Abu Dhabi with a base rate of 530AED, where you’d end up paying a 6% municipality tax, 10% service charge, 5% VAT, plus a tourism tax. That 530AED hotel room now costs 680.15AED, which is 28% more than the base rate. While the municipality tax is lower as a percentage, there are some additional fees in Abu Dhabi.

The UAE is now one of the markets with the biggest markups beyond base rate at hotels. In some places hotels have a 20-25% combined service charge and tax, while 28% is on the very high end globally.

Keep in mind that if you redeem points for a stay you don’t pay any of the taxes or fees that are calculated as a percentage of the room rate, so it now makes even more sense than before to redeem points for hotel stays in the UAE.

I don’t see the difference from hotels in the US. Las Vegas in particular. Resort fee is compulsory yet not included in the advertised rate. At some lower end properties, this is more than the room rate!

FYI - Saudi Arabia has also introduced a 5% VAT effective January 1st, 2018. We were also greeted with an increase on petrol (gasoline) and electricity rates.

Fun times.

@Red - The tourism dirham charge applies on award stays or any other type of promotional or complimentary stay. If it was waived, then that only means that the hotel paid it out of pocket rather than collecting it from you.

@JRMW - Service charges go to the hotels pocket so they are VAT chargeable like the room rate is.

Gonna only use points in the UAE now, their taxes are outrageous. I was planning on staying at a Jumeirah resort this spring, but will stay at the Ritz or St. Regis now using points.

Nothing like paying more taxes to a totalitarian regime with no transparency on how they spend the ‘public’ coffers on their own ‘royal’ household. :/

I mean, what can we do? Still wanna go back to Dubai, this extra 5% wont deter me.

Just wondering, is the Dubai Hyatt the Grand Hyatt?

So really, taxes and fees on hotel stays went from ~23% to ~28%. Yes, that’s an increase, but if I were a tourist willing to pay 23% in taxes/fees, I am not sure an extra 5% would make all that much difference.

Wow, a VAT on the service charge?

That’s a bitter pill to swallow

@ Bumbles: Why would you use such vile language? Do you talk to your mother with that mouth? Shame on you.

@Bumbles don’t you have anything better to do than insult and chat shit on new years day mate?

The taxes are anti tourist and the countries will see a decline in tourist revenues

We will be voting with our money.

28% in extra taxes??? No, sorry.

I've had to argue pretty hard before to get the tourism dirham waived on an award stay.

The service charge is an optional charge levied by the property and is not imposed nor collected by the government. You can negotiate it away in corporate rates.

Also, the tourism dirham charge is a flat per night charge that has to be paid directly to the property (viz. Not included in prepaid rates via third party agents). It's value ranges from AED 7 to AED 20 depending on the hotel quality. It is not applicable to stays of 30 consecutive days or longer.