2025 has been a turbulent year so far for airlines, particularly in the United States, given the economic uncertainty that we’ve seen. Airlines are now starting to report their Q2 2025 earnings results, and issue their forecasts for the rest of the year, and there are always some interesting details here.

Last week, Delta Air Lines was the first major US airline to report its financial results. Delta’s stock surged following the announcement, as the company had a more optimistic outlook for the rest of the year than expected. Now United Airlines has become the second major US airline to report its results. The results are good, given all that has been going on, but investors don’t seem overjoyed, as United’s stock is down pre-market.

In this post:

United reports reasonably good financial results

United has reported its Q2 2025 financial results, and has shared that it sees a positive inflection in both supply and demand for Q3 2025. Profits were a little higher than expected, while revenue was a little lower than expected. For Q2 2025, the airline reported:

- Operating revenue of $15.2 billion, up 1.7% compared to $15 billion in Q2 2024

- An operating margin of 11.6%, down 11% compared to 13.1% in Q2 2024

- Net income of $973 million, down 26% compared to $1.3 billion in Q2 2024

- Earnings per share of $2.97, down 25% compared to $3.96 in Q2 2024

- Total revenue per air seat mile of 18.06 cents, down 4% compared to $18.81 in Q2 2024

- Operating expenses of $10.4 billion, up 8% compared to $9.6 billion in Q2 2024

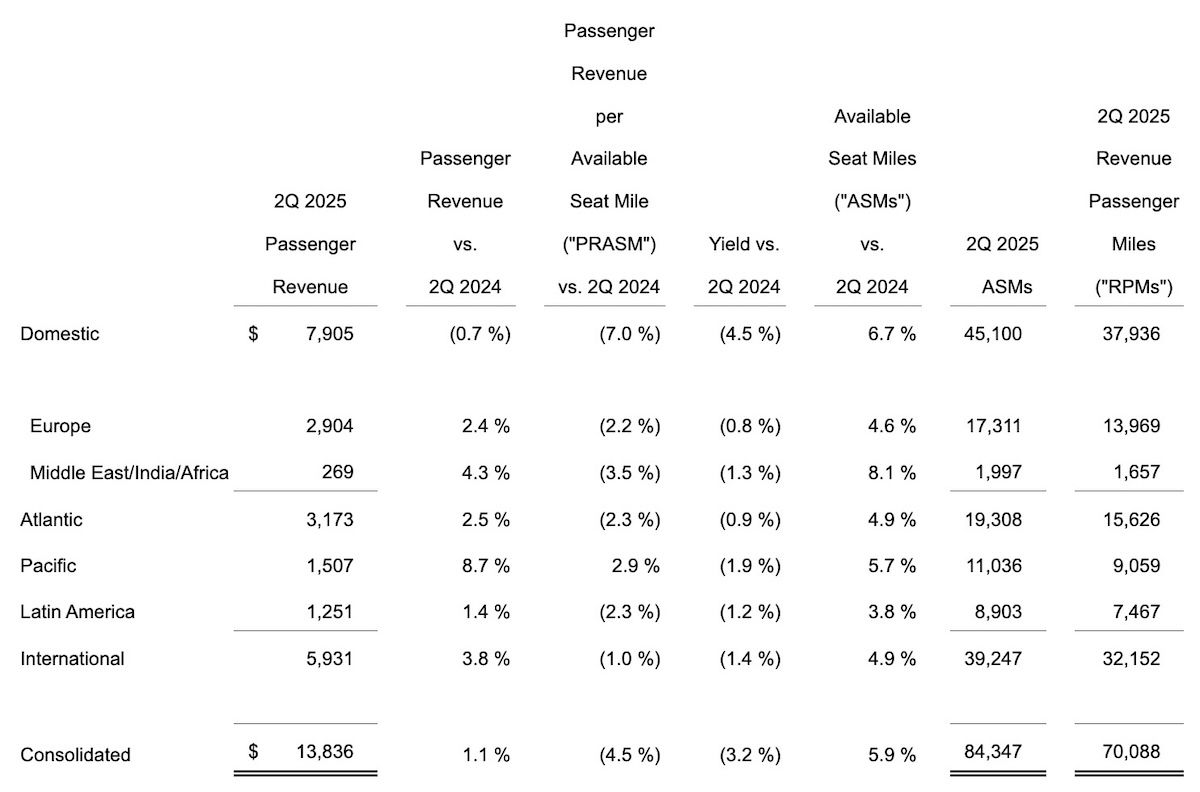

Given what a global airline United is, it’s interesting to take a look at performance by region, as a few things stand out:

- The Pacific saw both the most absolute growth in terms of revenue (8.7%), and even saw growth in revenue per available seat mile (2.9%), which is impressive

- We’ve heard a lot about airlines struggling domestically, and that’s reflected here, with United seeing a 0.7% decrease in total revenue, and a 7% decrease in yields

- In all other regions, we saw absolute revenue increase, while we saw yields decrease, which is more or less in line with the industry trend

United highlights how compared to the same quarter last year, premium cabin revenue grew 5.6%, basic economy revenue grew 1.7%, and loyalty program revenue grew 8.7%. As you’d expect, challenges at Newark negatively impacted the carrier’s performance — United believes this impacted its Q2 2025 pretax margin by 1.2 points, and that it will impact the Q3 2025 pretax margin by 0.9 points.

Here’s how United CEO Scott Kirby describes these results:

“Our second-quarter performance was more proof that the United Next strategy is working. I am extremely proud of the team for executing a strong operation and navigating through a volatile macroeconomic period, while still growing earnings and pre-tax margin for the first half of the year. Importantly, United saw a positive shift in demand beginning in early July, and, like 2024, anticipates another inflection in industry supply in mid-August. The world is less uncertain today than it was during the first six months of 2025 and that gives us confidence about a strong finish to the year.”

United upbeat about future, “less uncertain” world

As you can see above, United CEO Scott Kirby is upbeat about the rest of the year, claiming “the world is less uncertain” now than it was for the first six months of the year.

Specifically, United claims that in early July, the company has seen a sequential six point acceleration in demand and a double digit acceleration in business demand compared to the second quarter. The airline is attributing this to less geopolitical and macroeconomic uncertainty.

United has updated its full year guidance for earnings per share of $9-11, which the airline claims reflects the resilience of United’s “brand-loyal, revenue-diverse business model.” Earlier this year, before all of the uncertainty, United was forecasting earnings per share of $11.50-13.50.

The claim of a sudden increase in demand as of early July for both leisure and business demand is quite interesting, and I’m curious what’s driving that. Also, I think the description of the world being “less uncertain” is a good way to put it.

It’s certainly not “certain,” with everything seemingly just being pushed down the road by several weeks, and continued geopolitical unrest. But I suppose it’s less uncertain than it was at the beginning of the year…

Bottom line

United has reported its Q2 2025 financial results. The results are roughly what was expected, factoring in the general uncertainty, plus the mess at Newark. As we’ve come to expect, domestic yields were down, and most other regions saw absolute revenue growth, but a decline in yields. The Pacific was the only market to see both revenue and yields increase.

The most interesting revelation from United is its confidence in Q3 2025, and the claim that as of early July, the airline is seeing an increase in demand.

What do you make of United’s Q2 2025 financial results?

As is typically the case, Jeremy jumps in and argues against points that I didn’t make because he can’t accept the bottom line conclusions that I have made and he can’t accept. Having a dozen other people jump in support does not change the reality that he is arguing things I did not say while failing to address realities and conclusion which are absolutely factual.

1. The simple reality is that UA’s RASM deterioration was...

As is typically the case, Jeremy jumps in and argues against points that I didn’t make because he can’t accept the bottom line conclusions that I have made and he can’t accept. Having a dozen other people jump in support does not change the reality that he is arguing things I did not say while failing to address realities and conclusion which are absolutely factual.

1. The simple reality is that UA’s RASM deterioration was worse than DL’s and might be the worst among the big 4. UA stated very publicly that its goal was to aggressively grow its domestic system and take out a bunch of low cost carriers in the process. UA still generates over 1 billion less dollars in domestic revenue per quarter and its international size did not offset its smaller domestic size. DL is also adding domestic capacity but is able to offset domestic weakness with international growth and ancillary revenue.

2. DL IS GROWING its international network and has announced enough international routes to significantly cut into UA’s international network advantage including to the Arab Middle East, India and additional flights to Israel. DL is starting LAX-HKG and ORD because it has customers that want it and there simply are no comparably large adds that UA can make. DL IS GROWING ITS INTERNATIONAL NETWORK MORE SUCCESSFULLY THAN UA IS GROWING ITS DOMESTIC NETWORK, a reality which I said years ago would happen.

3. UA has benefited from low labor costs due to open labor contracts which have boosted its profits. The first of those is beginning to hit UA’s finances and there will be many more.

4. UA fans love to tout passenger revenue growth and size even though UA flies more ASMs than DL in every global region. UA simply cannot translate that higher capacity into higher profits on a system basis. Refinery revenue is a GAAP item but DL excludes it for comparison; UA tried and failed to acquire its own refinery. UA has had the same opportunity to build an industry-leading credit card and loyalty program but has trailed DL because they focused on the wrong things for those programs – international revenue.

5. DL is set to extend not only its lead over UA in LAX and NYC but also to add major corporate contracts in Chicago, further extending DL’s position as carrying the most corporate contract revenue.

6. The fall of EWR operationally was bound to happen and spring of 2025 was the point when it finally occurred. It is doubtful that UA will ever return to the size at EWR it was before EWR runway construction began.

My statement is completely accurate that 2024 was likely the high point of UA’s quest to match DL’s profits. They were living on borrowed time in many ways and hoping that DL would remain docile which is clearly not happening.

and let's keep in mind how bold UA execs were in telling us that they could give full year guidance one week after DL pulled its full year guidance -along w/ many other companies - in the wake of Trump's global tariff announcements

and yet, the US is not in a recession and UA is revising DOWN its non-recessionary full year guidance.

The arrogance of UA execs that think they know and perform better...

and let's keep in mind how bold UA execs were in telling us that they could give full year guidance one week after DL pulled its full year guidance -along w/ many other companies - in the wake of Trump's global tariff announcements

and yet, the US is not in a recession and UA is revising DOWN its non-recessionary full year guidance.

The arrogance of UA execs that think they know and perform better than anyone else is on full display because it is so apparent they really weren't any better at seeing the future and aren't performing better.

“The arrogance of UA execs that think they know and perform better than anyone else is on full display”

Replace “UA execs” with “me” and that’s literally what every single regular reader of this site thinks of you. It’s genuinely pathetic.

If Delta were a stuffed animal you would dry hump it 24-7 until it was just stuffing. Get a life.

It doesn't matter what anyone thinks of me regarding business issues.

I don't make public forecasts to Wall Street. UA execs do and they have repeatedly castigated other companies only to do the exact same things they call other airlines out for doing.

You and others can't stand that I call the shots the way they are and don't bow to anyone.

UA execs were so arrogant to argue that they could provide...

It doesn't matter what anyone thinks of me regarding business issues.

I don't make public forecasts to Wall Street. UA execs do and they have repeatedly castigated other companies only to do the exact same things they call other airlines out for doing.

You and others can't stand that I call the shots the way they are and don't bow to anyone.

UA execs were so arrogant to argue that they could provide earnings guidance in the weeks after tariffs were announced when other companies pulled them and yet UAL just revised down its own guidance.

Did you bother to read UAL's earnings transcript or listen to the recording?

They tried desperately to spin a whole lot of things that I have harped on but there is simply no way to ignore that I am right and have been.

UA execs repeatedly keep trying to put themselves in a league of 2 with DL and yet over and over they come up short on earnings even though they flew 10% more capacity than DL. UA simply cannot put the pieces together as well as DL does to get to the bottom line - even w/ the labor cost advantage that UA has had but is beginning to hit the bottom line.

UA execs specifically said that Boeing is not anywhere near in a position to deliver 787s per UA's contracts - which explains perfectly why DL has announced so many new routes. DL took the time during covid to retire its 777 fleet and will have retired close to two dozen 767s from the peak of the fleet and yet still has the airplanes to aggressively expand its int'l network - and do it with a much more efficient and capable fleet. UA simply does not have anywhere near the airplanes to match or challenge DL's international growth.

UA execs acknowledge that EWR simply will not be as large as it was - which means that UA's share of the NYC will be permanently lower.

Every single one of the issues I highlighted is accurate and THAT is why this has turned into one of the lowest reply articles between DL and UA. Jeremy tried to manipulate what I said in order to argue back and yet he repeatedly missed the reality which neither he nor you or Scott Kirby can deny.

UA had a great run telling the world how great it was but DL apparently has had enough and is growing into UA markets and doing so far better than UA can grow into any domestic markets.

Let's see how well AA and WN's domestic RASM looks for the 2nd quarter but I am betting that UA will be in the bottom tier of the industry

Do you think Delta might forgive you so you can get your job back Tim?

It is pretty clear that you and others aren't capable of handling the truth that I bring to the table.

UA has done a great job - but has repeatedly inserted itself into a group of two with Delta -and yet on an apples to apples basis - comparable number of ASMs and labor costs - UA is simply not delivering profits on the same basis as DL.

and for an airline like UA that...

It is pretty clear that you and others aren't capable of handling the truth that I bring to the table.

UA has done a great job - but has repeatedly inserted itself into a group of two with Delta -and yet on an apples to apples basis - comparable number of ASMs and labor costs - UA is simply not delivering profits on the same basis as DL.

and for an airline like UA that is so fixated on market share, it has been a difficult summer as UA execs have come to grips with the reality that UA has lost its position as the largest airline in NYC to DL because UA mismanaged a fairly simple runway reconstruction project at EWR and the FAA has likely permanently capped the number of flights at EWR well below what UA operated for years.

DL has been the largest airline at LAX and is once again horning in on the international routes that UA once used to fly - BNE, AKL, MEL and now HKG.

UA execs love to trash talk about what they are doing to AA in Chicago but DL is doing the same thing to UA in NYC and LAX and the conversation all of a sudden gets pretty quiet.

it's no surprise that you all want to throw insults when that reality is put on the table.

@Tim Dunn stop trying to manipulate and provide incorrect financial analysis by throwing a wall of text. You selectively provide information and have a ton of conjectures w/o any data and withhold data when it doesn't support your claims:

Your claim: Based on the revenue by region, UA increased domestic capacity by 7% and domestic passenger revenue fell by 0.7% with a decline in RASM that may well lead the big 4.

Full context: In...

@Tim Dunn stop trying to manipulate and provide incorrect financial analysis by throwing a wall of text. You selectively provide information and have a ton of conjectures w/o any data and withhold data when it doesn't support your claims:

Your claim: Based on the revenue by region, UA increased domestic capacity by 7% and domestic passenger revenue fell by 0.7% with a decline in RASM that may well lead the big 4.

Full context: In a vacuum the first part of that statement is accurate. But what about DL? DL increased domestic capacity by 4% and saw a 1% decline in domestic passenger revenue. As Cranky showed, DL and UA had identical stage-length adjusted PRASM declines domestically in Q1 when accounting for UA's larger capacity increase although there appears to be a slight yield gap in Q2. It's worth noting that not all carriers are seeing this SLA-adjusted PRASM decline in Q1. WN, AS, and F9 saw increases while AA's decrease was smaller (albeit with less capacity added). This negates DL and UA's claim that premium sales are offsetting main cabin issues - domestically the net result even if premium cabin is holding strong is lower yields.

Your claim: UA is twice as large as DL in Asia/Pacific - UA flies more TPAC capacity than ANY airline so DL is much closer to the size of the largest airlines than UA, UA is about 25% larger in Latin America, and DL's TATL system is as large as UA's just to Europe. UA breaks out the Middle East and India which is not a DOT reportable region. By the time you factor in all of the routes that DL has announced or says are coming - ATL-DEL, ATL-RUH, ATL-TLV, LAX-HKG - DL will be as large as UA in the TATL region and growing TPAC at a faster rate.

Full context: Passenger rev - Q1 + Q2 2025:

Domestic: DL: $17.4B UA: $15.1B

Atlantic: UA: $4.9B DL: $4.2B - take out MENA + India from UA and that's only ~$0.5B - also DL offers flights to Africa included in its Atlantic revenue, so you would also have to remove ~$0.2B from DL. UA is ~10-15% larger than DL to Europe

Pacific: UA: $3.0B DL: $1.4B

Latin America: UA: $2.7B DL: $2.3B

Capacity growth - Q1 and Q2:

Domestic: DL (+4%, +4%); UA (8%, 7%) - UA growing faster than DL domestically but both growing

Atlantic: DL (-3%, +4%); UA w/o MENA + India: (flat; +5%); total UA: (-1%; +5%)

Pacific: DL (+16%, +11%); UA: (flat, +6%)

Latin America: DL (+8%, -1%); UA: (+6%, +4%)

Yield growth - Q1 and Q2:

Domestic: DL (+1%, -1%); UA: (flat, -4.5%)

Atlantic: DL (+5%, -2%); UA w/o MENA + India: (+5%, -1%); UA total (+6%, -1%)

Pacific: DL (-7%, -6%); UA: (flat, -2%)

Latin America: DL (flat, flat); UA: (+3%, -1%)

So, UA is not struggling any bit more adding capacity domestically than DL is adding capacity on the Pacific. DL has added slightly less capacity than UA to TATL and the gap is only technically narrowing in the Pacific where DL is taking hits to yields to add capacity.

DL has announced its new routes earlier than UA, but UA is taking more plane deliveries this year and expects next year to be similar. We'll see how capacity growth ends up, but your claims are complete conjecture.

The mental patient at the insane asylum is banging on the bars

As tim does

Every post he does should be accompanied by a note saying “this guy was fired by delta yet has a mental disorder about them”

@ Jeremy -- Excellent analysis!

Jeremy, thank you for that detailed and fact-supported analysis!

I also saw UA reported a one time $591 million charge for the flight attendant retro payments. Without that one time charge, which will be a fraction of that amount going forward to accommodate higher flight attendant salaries, UA’s net results would be even higher.

With all the extra revenue UA is bringing in, and with a future huge increase in credit card revenue through...

Jeremy, thank you for that detailed and fact-supported analysis!

I also saw UA reported a one time $591 million charge for the flight attendant retro payments. Without that one time charge, which will be a fraction of that amount going forward to accommodate higher flight attendant salaries, UA’s net results would be even higher.

With all the extra revenue UA is bringing in, and with a future huge increase in credit card revenue through an updated agreement with Chase, there shouldn’t be any problem covering those extra salaries.

All other employee groups are already paid evenly with other airlines, and any future increases will be matched across the US3.

Mark,

UA HAS TO catch up to underpaying its workforce including FAs. You can't pretend that you can explain those overdue pay increases and then declare UA was just as good as DL in costs.

UA is NOT bringing in extra revenue. Did you fail to see or just ignore that UA, just like DL, is not seeing revenue increases in the domestic arena despite adding capacity. The difference is that DL IS getting...

Mark,

UA HAS TO catch up to underpaying its workforce including FAs. You can't pretend that you can explain those overdue pay increases and then declare UA was just as good as DL in costs.

UA is NOT bringing in extra revenue. Did you fail to see or just ignore that UA, just like DL, is not seeing revenue increases in the domestic arena despite adding capacity. The difference is that DL IS getting the ancillary revenue = including credit card revenue now - and is doing it all from an industry comparable cost basis.

ask the UA mechanics how well their contract compares to those at other airlines or non-union DL. They didn't put billboards up in Chicago because they are happy with what they have.

Jeremy thank you for bringing your machine gun to Timmy D’s teeny weenie knife fight!

Wow thanks! Poor Tim must be embarrassed now.

here we go again

Ben, I do believe that you know only too well that when it comes to the U.S. airline business I am all at sea. However, my judgment of the current situation is not based upon airline revenues, bums on seats or the like, but rather based upon customer and blogger’s experiences.

The facts that are staring me in the face is that (for whatever reasons) DL is doing better than UA and AA. Furthermore,...

Ben, I do believe that you know only too well that when it comes to the U.S. airline business I am all at sea. However, my judgment of the current situation is not based upon airline revenues, bums on seats or the like, but rather based upon customer and blogger’s experiences.

The facts that are staring me in the face is that (for whatever reasons) DL is doing better than UA and AA. Furthermore, all three lost ground in every customer survey and flight review I have read this year.

It may sound as if I have a bias against U.S. airlines, that is not the case (admittedly, I like winding up the bigots), however, I do not like to read the troll-like posts from those who cannot offer a qualified response to posts by the likes of Tim Dunn.

Jeremy, is something of an exception by taking the trouble to explain his position. One must appreciate his efforts …. even if they are meaningless to the vast majority of us. One believes that thereby lies something of the truth behind those who choose to troll Tim Dunn. They do not understand half of what he is talking about, therefore, it is easy for them to trash his posts.

Enough said Gunga Din.

Apologies: somehow my response to Ben has slipped down into Tim Dunn’s post area by mistake.

So basically people were being over dramatic and they expect a surge in demand for leisure and business demand got it.

to correct your commentary based on the revenue by region, UA increased domestic capacity by 7% and domestic passenger revenue fell by 0.7% with a decline in RASM that may well lead the big 4.

They have had as a key strategic goal for years to grow their domestic system and have made repeated statements about the failing low cost and ultra low cost carrier model.

in the international market, UA's RASM decline...

to correct your commentary based on the revenue by region, UA increased domestic capacity by 7% and domestic passenger revenue fell by 0.7% with a decline in RASM that may well lead the big 4.

They have had as a key strategic goal for years to grow their domestic system and have made repeated statements about the failing low cost and ultra low cost carrier model.

in the international market, UA's RASM decline across the Atlantic and to Latin America was larger than DL's. UA's bright spot is Asia/Pacific but DL is growing Asia/Pacific capacity faster than UA.

in comparing size of the two's regions, UA is twice as large as DL in Asia/Pacific - UA flies more TPAC capacity than ANY airline so DL is much closer to the size of the largest airlines than UA, UA is about 25% larger in Latin America, and DL's TATL system is as large as UA's just to Europe. UA breaks out the Middle East and India which is not a DOT reportable region.

By the time you factor in all of the routes that DL has announced or says are coming - ATL-DEL, ATL-RUH, ATL-TLV, LAX-HKG - DL will be as large as UA in the TATL region and growing TPAC at a faster rate.

The bottom line is that, as I have said many times before, it would be harder for UA to grow into the domestic marketplace than it would be for DL to grow in international markets and this data shows it.

notable also is that UA says the EWR meltdown and last minute capacity cuts cost it over a couple hundred million dollars in revenue for the quarter and will impact 3rd quarter (current) revenue but by a lesser amount.

from a cost side, UA is beginning to pay the price for borrowing from labor post covid to sustain its growth. It recorded a $561 million charge for the FA settlement - which they will reverse IF the FAs reject the contract. UA still has FIVE MORE labor contracts to settle assuming the FAs vote in their contract proposal.

and UA lowered its yearly guidance after touting how great its forecasting ability was when DAL and other airlines and companies pulled their yearly guidance after "liberation day" tariffs were announced. UA provided two sets of guidance, the lower of which was for a recessionary situation - which has not happened.

I have said before and will say again that 2024 was likely the closest that UA would come to matching DL's earnings. UA cannot grow its domestic network at the pace it is doing while DL is growing its international network and doing so with better revenue results. UA's labor costs will rise faster than the industry while the smaller airlines that UA thinks it will kill have not died and even when they do, their death will benefit other airlines more than UA.

AA and WN will report their finances next and it is likely that they will have more optimistic stories to tell than UA.

Loser.

Mt. Rushmore of unlikable commenters on the travel blogosphere