In September 2024, JetBlue made some exciting announcements. The airline revealed plans to open airport lounges, which is something that has been rumored for years. The lounges will be located in New York (JFK) and Boston (BOS), and we’ll see the first opening in late 2025.

As part of this announcement, JetBlue also revealed plans to launch a premium credit card. There’s an exciting update, as applications for the card go live as of today, and we now know all the details.

In this post:

Details of JetBlue’s new premium credit card

JetBlue and Barclays have just expanded their card portfolio, with the launch of the new JetBlue Premier World Elite Mastercard.

All the details of the card have now been revealed, so here’s what we can expect:

- The card has a $499 annual fee for the primary cardmember, plus a $150 annual fee for each authorized user (authorized users also receive some perks, like lounge access)

- The card has a welcome bonus of 70,000 TrueBlue points and five tiles toward Mosaic elite status qualification after spending $5,000 within the first three months; per the terms, the offer isn’t available to those who have or have had the JetBlue Plus Card

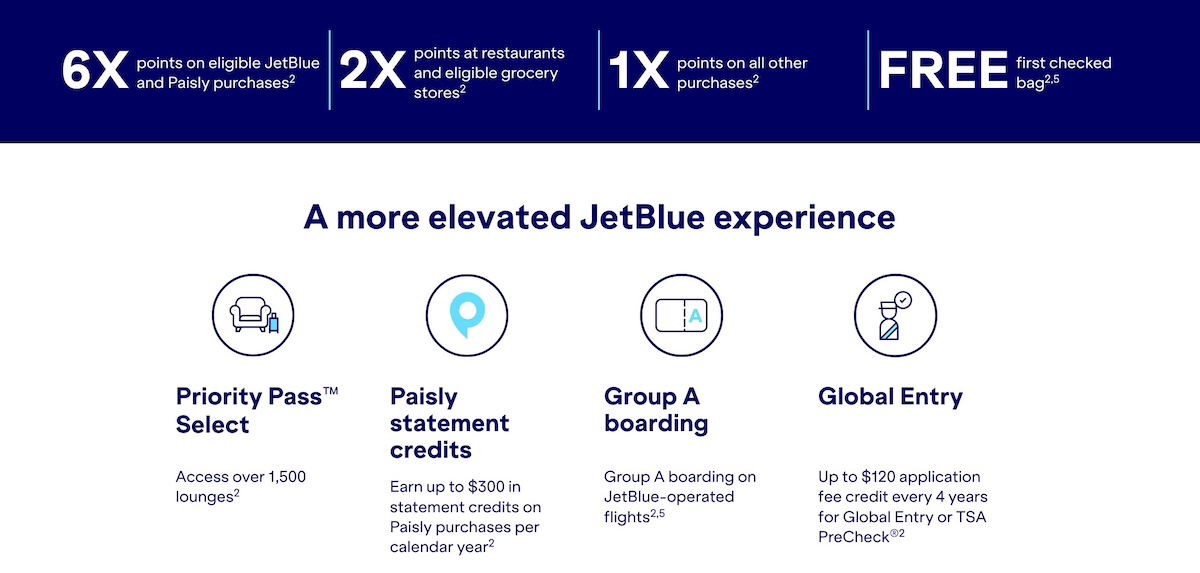

- The card offers 6x TrueBlue points on JetBlue and Paisly purchases, 2x TrueBlue points at restaurants and grocery stores, and 1x TrueBlue points on other purchases, all with no foreign transaction fees

- The card offers one tile toward Mosaic elite status for every $1,000 spent, which is the same pace of qualification that’s offered by other JetBlue cards

- The card offers a Priority Pass™ Select membership, plus access to JetBlue’s new lounges, once they open

- The card offers up to $300 in statement credits on Paisly purchases each calendar year; this comes in the form of a $50 credit for each transaction of $250 or more, up to six times per year

- The card offers an anniversary bonus of 5,000 TrueBlue points upon paying the annual fee every year

- The card offers 10% of redeemed points back after traveling on JetBlue award flights

- The card offers a Global Entry or TSA PreCheck application fee credit of up to $120 every four years

- The card offers Group A boarding on JetBlue flights for the cardmember and up to four companions on the same reservation

- The card offers a free first checked bag free on JetBlue flights for the cardmember and up to three companions on the same reservation

- The card offers 50% savings on eligible food and beverage purchases on JetBlue flights

Here’s how JetBlue’s VP of Loyalty and Partnerships describes this new card:

“Adding products and perks our customers want is a key part of our JetForward plan, and we couldn’t be more excited to introduce the JetBlue Premier Card. As our first-ever premium credit card, designed with input from our customers and most loyal Mosaic members, it builds on the perks of our TrueBlue and Mosaic programs to deliver more benefits both on the ground and in the air. With features crafted to compete with other top-tier travel cards, the Premier Card gives JetBlue fans more reasons to love our award-winning experience, while earning extra points and enjoying exclusive benefits before takeoff.”

I’m underwhelmed by JetBlue’s new credit card

I’ve gotta say, I had higher hopes for JetBlue’s new premium credit card, and I think the execution here leaves a bit to be desired. A few thoughts:

- For some people I’m sure the card will be worth picking up, and the bonus is quite good

- This card isn’t necessarily better for spending than the less premium JetBlue credit cards, which offer a similar return on spending, plus Mosaic elite status qualification at the same pace

- The fact that the $300 Paisly credit comes in the form of $50 off $250+ purchases up to six times is perhaps the most disappointing aspect of how this has been executed; that benefit is worth nowhere close to face value, and if anything, is worth very little

- The only unique aspect of this card is the JetBlue lounge access, and the first lounge won’t be open for close to a year

So yeah, I can’t say that I’m all that impressed here. I’m sure this card will make sense in the long run for frequent JetBlue flyers who fly out of airports with JetBlue lounges. But unless you value an incremental Priority Pass™ Select membership (so many of us already have one through other cards), I just can’t make the math work on this card for the time being.

Bottom line

JetBlue has just introduced its new premium credit card, branded as the JetBlue Premier Card. The card has a $499 annual fee, and offers a variety of benefits, though nothing is particularly compelling. The unique aspect of the card is that it’ll offer access to JetBlue lounges, but those won’t even start to open until late 2025, so that’s not all that useful as of now.

There’s a lot of competition in the premium card space, and I was hoping for a bit more from JetBlue.

What do you make of JetBlue’s new premium credit card?

On September 19th, 2024 on the now seemingly overwritten iteration of this page, which I had to access via the Internet Archive - Thanks, One Mile at a Time - I wrote: "Barclays doesn’t have the same strong presence in the U.S. as institutions like American Express or Chase, especially when it comes to premium travel and co-branded credit card offerings. So, I’m curious how Barclays and JetBlue plan to make their likely higher annual...

On September 19th, 2024 on the now seemingly overwritten iteration of this page, which I had to access via the Internet Archive - Thanks, One Mile at a Time - I wrote: "Barclays doesn’t have the same strong presence in the U.S. as institutions like American Express or Chase, especially when it comes to premium travel and co-branded credit card offerings. So, I’m curious how Barclays and JetBlue plan to make their likely higher annual fee (AF) card valuable.

Regarding the AF, I’m concerned about how high it might be. For JetBlue’s current Plus card, the $99 AF with 6x points per dollar (PPD) is a fair trade. One of the perks hinted at for the new premium card is lounge access, but JetBlue has only confirmed two planned lounges so far—one at NYC’s JFK and the other at Boston Logan. Does this mean they’ll never open more lounges? It’s too early to say for sure, but given JetBlue's fluctuating financials, I’m starting to question my level of investment in this airline.

For now, let’s assume there will only be those two lounges. I don’t know much about other airlines’ lounge offerings, but if the AF lands in the $500-700 range and lounge access is the only major perk, it’s going to be a hard pass from me, dawg. I currently have the Amex Platinum, which still provides a lot of value through its range of benefits—bonuses, discounts, free memberships, rebates, etc.—despite recent cuts (like lounge access). Typically, with super-premium AF cards like the Amex Platinum, I expect broader lounge access. However, maybe JetBlue’s strategy is to limit access to control crowding, catering to only the most loyal “Jetbluvians” who might not always fly in Mint class but still want exclusive perks.

Long story short, I’d prefer to see an AF in the $250-400 range to justify having just two lounges. However, if there are other enticing perks—such as reduced tile earning thresholds (as mentioned in the article, possibly down to $50 per tile), or the premium card offering a faster route to Mosaic status—this could change my perspective. During the COVID-19 era, JetBlue offered a 50% spend qualification threshold for status, and a similar approach here would be appealing. An increase in PPD would also be interesting, but what would be realistic? 12x PPD? 50x PPD? Perhaps even a unique perk, like a one-time annual coupon that boosts the PPD to 100 points on a major purchase or trip, or reserving more space seats for free on one booking regardless of how far in advance? And some more flexibility with points overall would be nice. These are just a few ideas."

Obviously, the only thing that even remotely came to pass was the possible annual fee price range I and others theorized would make sense. The benefits of this "premium" card are a joke. I was hoping there would be some killer benefit to signing up for this new card. I'll still fly with you, Jetblue, but this card IS a hard pass from me, Dawg.

They basically had someone in their company use AI to write the best rewards program, and then did the complete opposite.

Most of the rewards are already part of the Plus card.

I really hope they fix this.

Very disappointing. I'm a West Coast flyer so it has no value to me.

My trips are to Florida, not the Northeast.

Has any Barclays card ever offered strong perks? I can't think of one.

Epic failure!!!

Ok, so JB Plus card holders may be lifetimed out. It wasn't in the T&Cs on Barclays, but on the JB website and app it says this:

"Cardmembers who currently have or previously had a JetBlue Plus Card are not eligible for this offer.⁶"

Hard pass.

Underwhelming, but I fly out of JFK frequently so it works for me.

Even if you are a dedicated JetBlue flier, it makes no sense to get

I fly 90% JetBlue, but in Boston there's also a Chase and (soon) Centurion lounge. Why would I get the JetBlue card over a Reserve or Platinum then?

They really fumbled here.

Yeah, I have the plus card and am not going to bother with this one. No bonus for existing cardholders, I have other cards that come with priority pass, and the earning toward Mosaic is the same. I should be their target audience too as I'm in Boston and fly JetBlue regularly.

Current Plus card members like myself would have been a great group to target, as they would be likely to upgrade with a bonus and great benefits. This has neither!

I’ve been a Boston based JetBlue loyalist for years, but between this card and what they did to the Mosaic program, has caused me to move primarily to Delta. Mosaic 1 is useless (I have that this year after reaching 4 last year). This new credit card sucks! I was really hoping it would be cool enough to get. At this point, the only time I’ll fly JetBlue is when I have no other choice or where I can fly Mint.

The JetBlue Plus card (which I have) is good - in particular, the 10% off on redemptions is actually a pretty good perk.

This card isn't good

Hard pass. Benefits are super weak. I can’t imagine this will be popular.

I say this as someone who is quite a B6 fan....this card is a flop. $499 is just way too much, even if it (likely) includes the upcoming Mint lounges. It really feels like JetBlue leadership threw something together last minute to try and generate more ancillary revenue.

In addition to the earning and status point rates being the same as on other JetBlue cards, the SUB isn't even higher than we've seen on them (80K-100K from time-to-time) despite the higher fee. Basically not worth it for anyone who isn't flying out of JFK or BOS on JetBlue practically every week once the lounges open. Yuck.

The "lifetime" terms only seem to mention the premier card, not the plus card:

INTRODUCTORY BONUS OFFER

Your credit offer may contain additional information about qualifying events, exclusions, and restrictions. That information can be found by logging in to your Card Account online and visiting the Rewards and Benefits section or calling the number on the back of your Card. These bonuses and/or incentives are intended for applicants who are not and have not...

The "lifetime" terms only seem to mention the premier card, not the plus card:

INTRODUCTORY BONUS OFFER

Your credit offer may contain additional information about qualifying events, exclusions, and restrictions. That information can be found by logging in to your Card Account online and visiting the Rewards and Benefits section or calling the number on the back of your Card. These bonuses and/or incentives are intended for applicants who are not and have not previously been JetBlue Premier World Elite Mastercard cardmembers. You understand and agree that you may no longer be eligible for any bonuses and/or incentives in connection with a new JetBlue Premier World Elite Mastercard Card Account after this Card Account is opened. If you receive a bonus or incentive for which you are not eligible due to your status as a current or former JetBlue Premier World Elite Mastercard cardmember, we may revoke the bonus or incentive, or reduce your TrueBlue points by the amount of the bonus or incentive or charge your Card Account for the fair value of the bonus or incentive, at our sole discretion.

I called and asked, they said any prior Plus SUB makes you ineligible, but maybe the rep was just misinformed.

The benefits are kind of stunning. You have to be one hell of a B6 loyalist, based near BOS or JFK for this card to remotely make sense over their basic card. While 6x points is admirable (esp with the 10% back) the only other real addition is their lounge access, which I feel screams of desperation that they are already trying to maximize profits from a product that is still months away

If the PP benefit is with restaurant access, it would be something to hand your hat on.

So few Mastercards have PP, that might be possible. It would help them in BOS, where I believe one PP restaurant does exist. But PP is functionally useless in JFK T5 and LGA Term B. Unless some of the new JFK T6 lounges will be connected airside and offer PP access, I don't even know what PP gets you flying JetBlue. I guess a few major destinations in the Caribbean have it?

Off of the top of my head, PP helps with lounge access for several jetBlue outstations: SYR/BUF/PIT/DTW/CHS/ATL -- not enough to move the needle (especially given SYR, DTW, and others might be once-daily markets for some routes) but for flyers in these markets who don't already have PP access might find this valuable. (They might also find holding the card valuable for the lounge access in BOS and JFK, given that a route like, say,...

Off of the top of my head, PP helps with lounge access for several jetBlue outstations: SYR/BUF/PIT/DTW/CHS/ATL -- not enough to move the needle (especially given SYR, DTW, and others might be once-daily markets for some routes) but for flyers in these markets who don't already have PP access might find this valuable. (They might also find holding the card valuable for the lounge access in BOS and JFK, given that a route like, say, SYR-JFK-CHS can have some pretty meaty layovers on B6).

If you get this card because you want to go to the Priority Pass Lounge in Concourse F in ATL, you may as well get in line now, and make sure you leave yourself an hour to get back to the T-Gates 30 minutes before departure.

And there's "lifetime" language for the sign-up bonus: not available to people who have or have had the JetBlue Plus Card.

they already killed the card link... maybe they'll boost the sub

@ churnobull -- I have the link in the post, but it actually hasn't been live yet. It's my understanding it should go live very shortly.

The card has been up on jetblue.com for a while now...