Hyatt has been on quite the shopping spree lately. In recent years, we’ve seen Hyatt acquire Two Roads Hospitality, Apple Leisure Group, Mr & Mrs Smith, Dream Hotel Group, Standard Hotels, me and all hotels, and more.

In late December 2024, Hyatt disclosed that it was in discussions to acquire yet another hotel group. There’s now an update, as a deal has been reached, and this one is a little bit different than past ones, as it’s not in line with Hyatt’s traditional asset-light approach (at least initially).

In this post:

Hyatt buying Playa Hotels & Resorts For $2.6 billion

Hyatt has entered into an agreement to acquire all outstanding shares of Playa Hotels & Resorts, for $13.50 per share. This values the deal at around $2.6 billion, including around $900 million of debt, net of cash.

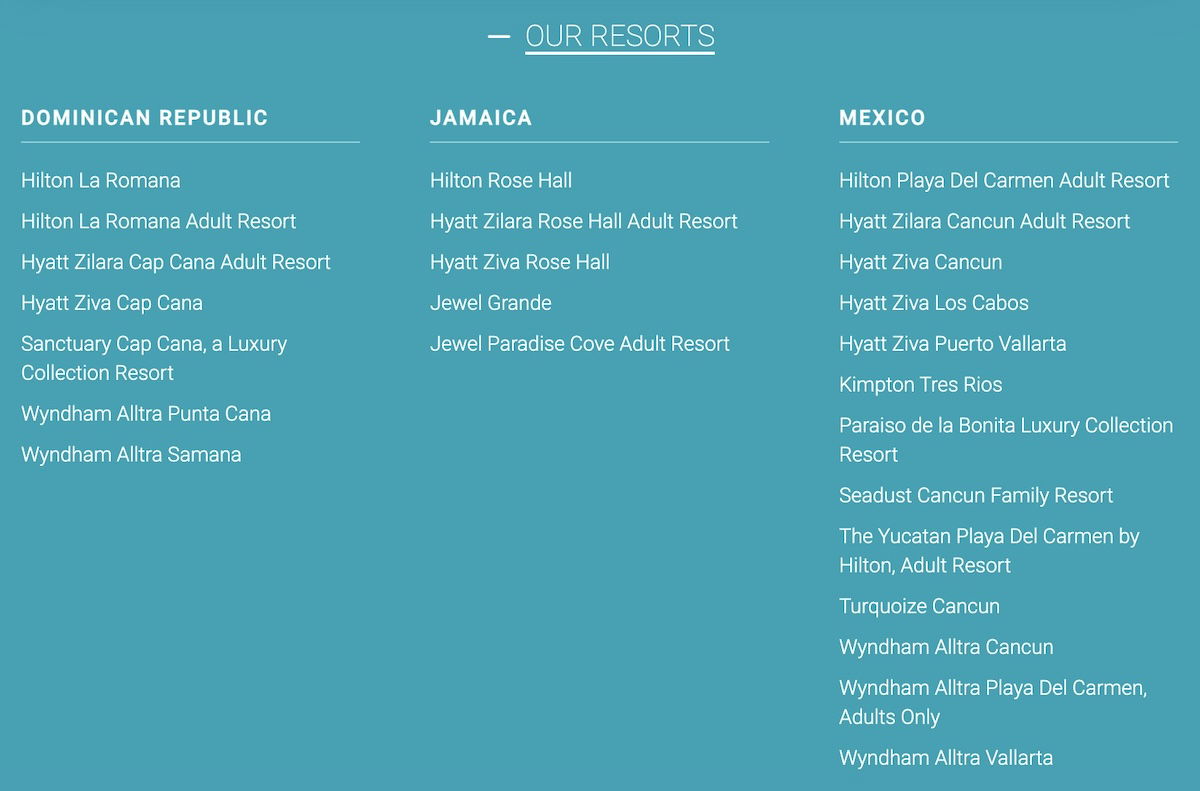

For those not familiar, Playa Hotels & Resorts owns around 25 resorts in the Dominican Republic, Jamaica, and Mexico. The company actually owns those properties, rather than Playa being a marketing or branding company (in other words, it’s the opposite of Hyatt’s business model, as Hyatt takes an asset-light approach).

Currently Playa properties belong to a variety of hotel groups, ranging from Hilton, to Hyatt, to Kimpton, to Wyndham. As you can see, roughly one-third of the Playa portfolio already has Hyatt branding, including Hyatt Zilara Cap Cana, Hyatt Zilara Rose Hall, Hyatt Ziva Cancun, and more.

Hyatt’s strategy is to secure long-term management agreements for these properties. It will also expand Hyatt’s distribution channels, including ALG Vacations and Unlimited Vacation Club, to Playa’s portfolio, offering additional benefits to guests of Playa properties.

Hyatt believes that it is well positioned to drive value creation through complementary business segments and further optimize its existing all-inclusive infrastructure in Mexico and the Caribbean.

Hyatt will maintain its asset-light strategy, so the plan is to identify third-party buyers for Playa’s owned properties. Hyatt anticipates realizing around $2 billion of proceeds from asset sales by the end of 2027, and expects asset-light earnings to exceed 90% on a pro forma basis in 2027.

Here’s how Hyatt CEO Mark Hoplamazian describes this deal:

“Hyatt has firmly established itself as a leader in the all-inclusive space, a journey that began in 2013 through an investment in Playa Hotels & Resorts that launched the Hyatt Ziva and Hyatt Zilara brands. We have respected and benefitted from Playa’s operating expertise and outstanding guest experience delivery for years through their ownership and management of eight of our Hyatt Ziva and Hyatt Zilara hotels. This pending transaction allows us to broaden our portfolio while providing more value to all of our stakeholders through an expanded management platform for all-inclusive resorts.”

I have to imagine that part of Hyatt’s motivation here is to prevent a competitor from trying to acquire Playa, since Hyatt is taking a major lead in the all-inclusive space. Still, you’d think that this acquisition on Hyatt’s part would almost lead to oversaturation in some markets for a single hotel brand, no? Like, how many dozens of all-inclusive Hyatt branded properties can there be in one country, without there being cannibalization?

Why is Hyatt so focused on all-inclusive resorts?

Hyatt has been growing like crazy lately, though a disproportionate amount of that growth has been in the all-inclusive sector. Admittedly all-inclusive resorts are a bit polarizing — some swear by them, while others would almost never consider such a vacation.

One logical question is why Hyatt has been so focused on all-inclusives. It seems like a vast majority of Hyatt’s growth is either in the limited service sector or in the all-inclusive sector, rather than than in the full-service hotel sector.

So, why is Hyatt taking this strategy? I suspect it comes down to several factors:

- Hyatt already has a lead in the all-inclusive space, so the company is trying to maintain that momentum, and keep it a competitive advantage

- Part of the issue is that interest rates are quite high, so the current appetite for building expensive new hotels isn’t that high; rebranding and managing all-inclusives is a big opportunity

- Many people vacation at the same all-inclusive property every year (or at least in the same region), so it’s a way for Hyatt to appeal to a wider customer base, and get continued revenue

- For some business travelers, all-inclusives are a great incentive to participate in World of Hyatt, since it’s an easy vacation that they like to take their families on

- With the continued strength of leisure travel, Hyatt obviously sees all-inclusives as being a key part of being appealing in that market

Personally, these Caribbean all-inclusive properties don’t appeal to me much. So for my own travels, I don’t love how heavily invested Hyatt is in this concept, and I wish we’d see growth in other sectors. However, I also see why this is a lucrative segment for Hyatt to tap into.

Bottom line

Hyatt will be acquiring Playa Hotels & Resorts, whereby we’ll see Hyatt buy the company all its 25 all-inclusive Caribbean properties. Since Hyatt has an asset-light strategy, the strategy here is to establish long term management contracts for all the properties, and then sell them off to third-party buyers.

I can’t say that I love Hyatt’s laser focus on all-inclusives, but that seems to be the direction the company is headed, and I can understand why. I’m just confused by the level of saturation we’re going to see in some markets.

What do you make of Hyatt acquiring Playa, and of Hyatt’s general focus on all-inclusives?

My wife and I have stayed at the Zilara Montego Bay a number of times in the past. Nice enough place but not generally worth the cash price and with the recent sets of points price increases it's not worth it on points anymore either.

To those that keep saying that they wish Hyatt would focus on adding higher end hotels in cities and in resort locations, there are not many group really doing a lot of that right now. The two that are are...

Four Seasons - they continue to add urban hotels and resorts, though almost all through third party owners

The New Starwood! 1 Hotels has opened up in Nashville, Hawaii, Seattle, San Francisco recently, adding to...

To those that keep saying that they wish Hyatt would focus on adding higher end hotels in cities and in resort locations, there are not many group really doing a lot of that right now. The two that are are...

Four Seasons - they continue to add urban hotels and resorts, though almost all through third party owners

The New Starwood! 1 Hotels has opened up in Nashville, Hawaii, Seattle, San Francisco recently, adding to exposure in New York, South Beach, etc. Starwood's real estate arm has shown the interest/ability in owning real estate, redeveloping, and then selling to third parties.

Hyatt's strategy is completely different than Marriott, Hilton or IHG's strategy. Someone's strategy is right and someone's strategy is wrong.

And so many of these all-inclusive properties being acquired by Hyatt are really down-market. Wyndham! Hyatt has always claimed it commands higher RevPar than other chains and that it has richer customers. But buying a Wyndham?

I don’t think this is right. Hyatt’s strategy is very similar to Marriott and Hilton - growing the system size (through third party development and/or acquisition) while minimizing hotel ownership (and cash outflows generally). Like Marriott and Hilton, Hyatt either manages or franchises most of its properties (in terms of how the financial world views it, there is little difference between managing and franchising). Hyatt may have higher RevPAR, but that is probably just a...

I don’t think this is right. Hyatt’s strategy is very similar to Marriott and Hilton - growing the system size (through third party development and/or acquisition) while minimizing hotel ownership (and cash outflows generally). Like Marriott and Hilton, Hyatt either manages or franchises most of its properties (in terms of how the financial world views it, there is little difference between managing and franchising). Hyatt may have higher RevPAR, but that is probably just a function of mix; there are more Hampton Inn in Hilton’s portfolio than Hyatt Place in Hyatt for example. Property for property, room rates are going to be similar across these brands

In terms of this deal, I think I posted this already, but Playa was likely always going to be sold, and Hyatt was the logical buyer. They are used to taking on assets and selling over time.

In terms of complaints about Hyatt’s focus, they are just working with what is available in the market. There aren’t many portfolios of luxury urban and resort hotels they can rebrand to Park Hyatt or something. Developers want to build select service. Investors don’t want Hyatt spending billions of its own money building new hotels from the ground up. It is what it is. There are plenty of options to chose from in terms of urban hotels and resorts as a customer.

What is the point of going for Globalist status when in 9.5 out of 10 Hyatt properties the status means nothing (AI, HP, HH, M&Ms)??

An increasingly valid question.

I get Hyatt's ambition ('asset light = we do a little and get a lot selling our brand'), but the issue is the more they move into the space, the less control they get over the actual experience. WoH concierge just throw their hands up whenever a hotel doesn't stick to terms.

More locally, this move looks like a private equity takeover: we're going to buy it for billions, sell the land to investors, operations...

I get Hyatt's ambition ('asset light = we do a little and get a lot selling our brand'), but the issue is the more they move into the space, the less control they get over the actual experience. WoH concierge just throw their hands up whenever a hotel doesn't stick to terms.

More locally, this move looks like a private equity takeover: we're going to buy it for billions, sell the land to investors, operations to hospitality specialists and turn an ongoing profit for ourselves.

Great, now some of the Hiltons are going to be sadly infected...

Like you, I get it, but for Hyatt would have preferred making some more luxury acquisitions or something that would expand footprint for middle market in the US a bit more. That said, I'm sure they ran the numbers etc.

Impression by secrets moxche or the secrets moxche is no cookie cutter all-inclusive. Really luxurious experience, especially the food exceeds many of those a la carte restaurants. Like the suki offers unlimited otoro tuna cuts

Meh. Went to Impression Secrets near Playa del Carmen a couple of years ago due to a great redemption. It was my last gasp for All Inc and it failed. Over 4 nights, still not nearly the diversity and quality of food and drink to keep my attention.

On the other hand, the Thompson in the city was first rate. Was able to use free night certs (beach house was a level 5), but that...

Meh. Went to Impression Secrets near Playa del Carmen a couple of years ago due to a great redemption. It was my last gasp for All Inc and it failed. Over 4 nights, still not nearly the diversity and quality of food and drink to keep my attention.

On the other hand, the Thompson in the city was first rate. Was able to use free night certs (beach house was a level 5), but that allowed those that stayed at the Thompson to use the beach house facilities, including pool, beach and breakfast. Nice to have access to both properties. Not sure how the Centric rebranding affects their status/relationship.

I can't help but recall one reader's comment to another article. In essence, Hyatt's growth focus seems to be on a certain type of guest (warm-destination leisure) and not on a more common guest (who seeks a broader footprint of "regular" properties). My guess is that there might be greater consistency of revenue . . . which might lead to less dependence on loyalty . . . which might free Hyatt to pursue dynamic pricing.

So dynamic pricing is coming - I'm not convinced this acquisition is related though. I think this really falls more into a "because they could" and wanted to prevent someone else from acquiring.

Dynamic pricing will be a slow rollout as Hyatt has so many elite and even credit card aspects related to the categories. However, we will likely start seeing more elements very soon.

When they are charging 58K for a night at Impressions or 115k if no standard rooms available....thats is already dynamic pricing...

How many all-inclusives can Hyatt own? So many of its acquisitions seem repetitive. How about adding some Hyatt Regency or Grand Hyatt (let alone some Hyatt or Hyatt Centric) in North America and Europe?

See my comment immediately above. I think this might be very intentional. I think there might be a shoe waiting to drop.

I don't understand Hyatt's thinking here. Even though some of the resorts are nicer, they're all in three countries considered the bottom-tier of Caribbean destinations. IMO, the $ would've been much better spent expanding their European (or even US) footprint.

As a Globalist member, this is disappointing because it's a lot of Hyatt $ tied-up in places I have no desire visiting. I thought Hyatt was targeting higher-end properties (Park Hyatt & Andaz) in higher...

I don't understand Hyatt's thinking here. Even though some of the resorts are nicer, they're all in three countries considered the bottom-tier of Caribbean destinations. IMO, the $ would've been much better spent expanding their European (or even US) footprint.

As a Globalist member, this is disappointing because it's a lot of Hyatt $ tied-up in places I have no desire visiting. I thought Hyatt was targeting higher-end properties (Park Hyatt & Andaz) in higher end Caribbean countries. Guess not. The only benefit I can see (for those who visit) is that at least Hyatt elite benefits should be enforced.

Maybe they're thinking there's a lot of $$$ to be made partnering more with AA on Caribbean vacation packages?

What benefits at an all-inclusive? Everyone gets "free" food.

Free food and free drinks. It is not that what everybody wants? lol

Interesting but don’t think it matters. Many folks go to AIs not for the country, but instead just to stay on the property. We did it at Ziva cap Cana and had a great time

Lucky you might enjoy one of the two Impression properties, if you’d like to humor us with an AI review.

The downtown playa del Carmen Hilton will be interesting. The beloved Royal became a Hilton several years back, did a terrible remodel, and the property has been in a downward spiral. Will most likely become a Hyatt Zilara - as the Zilara in Cancun used to also be the Royal.

You have to wonder what the plan is for differentiation in some of these saturated markets. They now have four properties in a half-mile stretch of downtown Playa Del Carmen: Hilton AI, Grand Hyatt, Centric Main House, and Centric Beach House. These are practically next door to each other. Maybe the Hilton becomes a Ziva?