Suffice it to say that 2025 has been a turbulent year so far for airlines, particularly in the United States, given the economic turbulence that we’ve seen.

Delta Air Lines has consistently been the most profitable airline for years, and typically kicks off the airline earnings season. The Atlanta-based carrier has just announced its Q2 2025 financial results, and they’re better than expected.

In this post:

Delta stock surges as airline reports solid results

Delta stock is surging by roughly 13% pre-market, following the carrier announcing its financial results. Not only was the performance better than expected, but the company has also reinstated its full-year outlook.

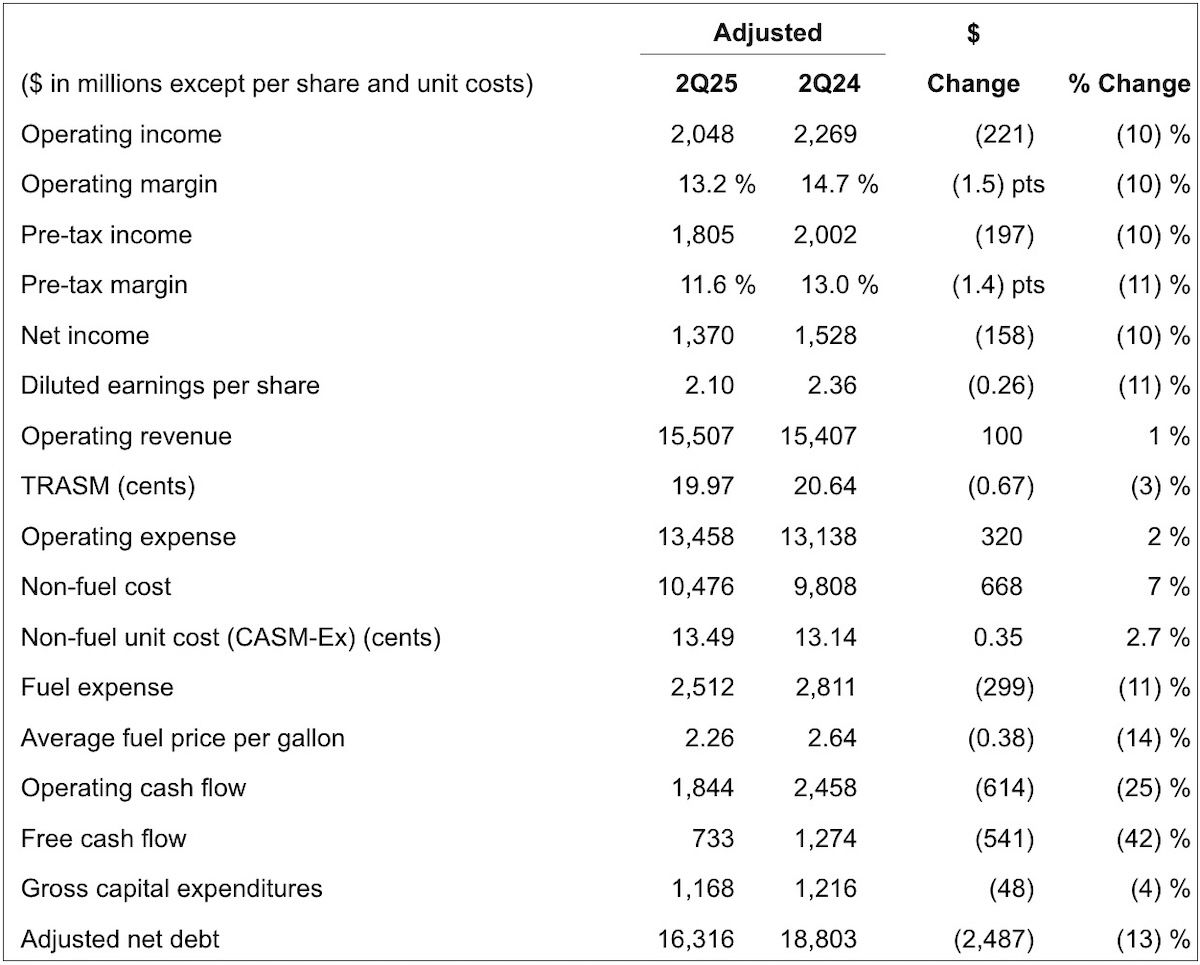

At the beginning of the year, Delta claimed that 2025 would be its most profitable year in history. While that’s no longer expected to be the case, the airline still expects to make a healthy profit. For Q2 2025, the airline reported:

- Operating revenue of $15.5 billion, up 1% compared to $15.4 billion in Q2 2024

- An operating margin of 13.2%, down 10% compared to 14.7% in Q2 2024

- Pre-tax income of $1.8 billion, down 10% compared to $2.0 billion in Q2 2024

- Earnings per share of $2.10, down 11% compared to $2.36 in Q2 2024

- Total revenue per air seat mile of 19.97 cents, down 3% compared to $20.64 in Q2 2024

- Operating expenses of $13.5 billion, up 2% compared to $13.1 billion in Q2 2024

Looking at more specific trends, international revenue grew 2%, premium revenue grew 5%, cargo revenue grew 7%, loyalty revenue grew 8%, and American Express renumeration grew 10%. Furthermore, fuel costs were down 11%, which certainly helped margins as well.

The airline now expects Q3 2025 revenue to be flat to up 4% compared to the same period last year, with adjusted earnings per share of $1.25-1.75. Delta has also reintroduced its full year earnings projections, expecting adjusted earnings per share of $5.25-6.25. However, the airline notes that it will provide an update on its outlook once “current uncertainty” is over.

Here’s how Delta CEO Ed Bastian describes these results:

“In the June quarter, Delta delivered record revenue on a 13% operating margin, generating $1.8 billion in pre-tax profit and leading network peers across key operational metrics. This strong performance is a direct reflection of the outstanding contributions of our people, who continue to set the bar for industry performance.”

“As we look to the second half of our centennial year, we remain focused on executing our strategic priorities and managing the levers within our control to deliver strong earnings and cash flow. Reflecting our confidence in the business, we are restoring financial guidance with an expectation for earnings per share of $5.25 to $6.25 and free cash flow of $3 to $4 billion, consistent with our long-term free cash flow targets.”

Have airlines actually become resilient businesses?

Historically, whenever there was any sort of an economic downturn or uncertainty, airlines would be in huge trouble. They’d be mildly profitable during the best of times, and would nearly instantly lose money when there were even signs of any economic problems.

So it’s pretty impressive to see how resilient Delta has become. In fairness, part of the issue is the profitability divide we’re seeing in the industry — Delta, United, and Alaska have solid margins, American and Southwest are profitable, but don’t have great margins, and everyone else in the US is seemingly in trouble.

Several months back, it was looking like airlines were going to be in for a rough ride, but at least in the case of Delta, things are still looking to be quite good. Sure, the airline might not reach its goal of having the most profitable year ever, but it’s still expecting to deliver healthy profits.

I think the situation at airlines is pretty reflective of what’s happening in society at large — premium demand is strong, while non-premium demand is really struggling.

Is premium demand just going to be permanently strong? If so, is that because the stock market is strong due to the current tech/AI revolution, or is it because many Gen Z folks are struggling with affordability, and with the goal of buying a house seeming unrealistic, they’re instead treating themselves to better day-to-day experiences (I realize that’s an oversimplification, but I do think it reflects the general “vibe”)?

Post-pandemic, a summer trip to Europe has basically become standard for so many Americans, and airlines are certainly capitalizing on that. I’m curious to see how demand evolves in the fall, especially with so many summer trips increasingly being earlier in the summer rather than later. Nowadays, the peak summer demand really only goes through early August, and not early September, as used to be the case.

Bottom line

Delta has reported its Q2 2025 financial results. While it won’t be Delta’s most profitable year in history (as the company had hoped), the airline beat expectations, especially given the uncertainty we’ve seen in recent times. The airline reported record revenue, but margins are down a bit compared to last year, which isn’t surprising.

As you’d expect, continued profitability has largely been thanks to premium demand and the loyalty program, reflecting the overall industry trend. With the exception of United, don’t expect other airlines to weather this situation quite as well.

What do you make of Delta’s Q2 2025 financial results?

I think the airlines have learned about diversifying their revenue.

For example: we've seen them offer very cheap economy fares that include almost nothing to compete with the so-called discount airlines

For example: they are make decent money on other revenue sources such as fees, partnerships, frequent flyer points, memberships, etc which has become a focus too.

Good for Delta.

And the much sensationalized downturn in expected travel? No effect then?

DL was asked about a super premium card -which Ben has mentioned - which they did not address - as well as an increase in premium cabin capacity in order to keep upgrades coming. They clearly recognize that keeping the "hope" of upgrades out there has to exist in order to propel loyalty programs.

Great work by Delta. Hoping to see more international flights from ATL.

I think the mass adoption of travel credit cards by high income travelers and the Gen Z and young millenial travelers who have given up on ever buying a house (or are open to buying one someday but in a cheaper country) has created a permanent "lock-in" effect similar to the rollout of corporate-sponsored 401K plans decades ago. The low redemption rate of points for cash (if available at all) provides a strong incentive to...

I think the mass adoption of travel credit cards by high income travelers and the Gen Z and young millenial travelers who have given up on ever buying a house (or are open to buying one someday but in a cheaper country) has created a permanent "lock-in" effect similar to the rollout of corporate-sponsored 401K plans decades ago. The low redemption rate of points for cash (if available at all) provides a strong incentive to use points for premium travel, even during downturns. Young travelers face parental pressure to reduce "unnecessary" expenditures during hard times, but they can justify using points for travel to their parents because of the difficult-to-convert nature of these points.

Two other factors are worth noting: obesity and social media. Many Americans gained 30-40 pounds during restrictive Covid lockdowns (especially in politically blue states and cities) and are still struggling to lose all of that extra weight. For these travelers a premium cabin is now a necessity, not a splurge, until they can lose the weight. Social media and travel influencers have increased information about travel to young travelers. Young travelers are more knowledgable about premium travel options than prior generations were at the same age. Instead of going to an overpriced Disney World for the fourth time, they may instead go to Dubai, Ibiza, or Thailand.

the economics also show that a growing number of people are using the GLP weight reduction drugs with Lilly winning the race even though they were 2nd into the market with a new generation drug.

and there are plenty of healthy weight people that are flying in premium cabins and there are plenty of of overweight people in coach. In fact, it might be because they consume less of their budget that they can afford more for travel.

Gen Xs and Gen Zs are not fan of credit cards. More often than not, they use other payment methods such as BNPL for their large dollar purchases.

GenX here... my friends and I use our cards and never use BNPL. Not sure where you came up with that stat.

@Lucky Allegiant is selling Sunseeker. Not sure if you passed on this one, but seems like your kind of post.

I will say DL's front cabin demand is very robust. From what I see, almost all of the D1 cabins on the West Coast go out completely full.

Regardless of what you think about their quality of service, it seems consumers are paying up for premium seats on longhaul.

good results but unfortunately their profitability depends on the moron-in-chief not starting a full blown trade war and wrecking the economy. hopefully the market makes him blink again

I think getting rid of change fees also helps in making airlines more resilient businesses. Before, if there was any threat of economic downturn, most people would stop booking airline tickets for leisure because booking an airline ticket used to be a huge commitment. With change fees gone, it isn't as big of a commitment as it used to be. You can easily change or cancel for no fee and get the value back in...

I think getting rid of change fees also helps in making airlines more resilient businesses. Before, if there was any threat of economic downturn, most people would stop booking airline tickets for leisure because booking an airline ticket used to be a huge commitment. With change fees gone, it isn't as big of a commitment as it used to be. You can easily change or cancel for no fee and get the value back in travel credits. At least for me, that makes a huge difference in my willingness to book non-business related travel on airlines despite economic uncertainty (to a certain extent).

I don't have any data to back this up, but personally, I 100% agree with it. I often have multiple trips booked, months ahead of time. Something I never would've done in the days where every modification was a fee.

completely agree. My booking patterns changed dramatically without change fees to the benefit of the airlines and me.

“ I’m curious to see how demand evolves in the fall…”

Not to just pick on you Lucky, but I feel like travel bloggers have tried to make this case/prediction for several years now. “Demand will fall off a cliff in the fall once leisure demand goes away!” Yet every year, the fall is normal. Remember that business travel picks up, and some regions (Italy, Spain, etc) have solid fall leisure demand.

In terms...

“ I’m curious to see how demand evolves in the fall…”

Not to just pick on you Lucky, but I feel like travel bloggers have tried to make this case/prediction for several years now. “Demand will fall off a cliff in the fall once leisure demand goes away!” Yet every year, the fall is normal. Remember that business travel picks up, and some regions (Italy, Spain, etc) have solid fall leisure demand.

In terms of the overall post, the economy hasn’t entered into a broad based recession yet, which I define as a meaningful increase in unemployment (in to the high single digits, like 8 or 9%) nor have asset prices seen a big drop (you would have to see say a 33% sustained drop in the S&P, Nasdaq, Bitcoin). When that happens you will see a big travel demand drop.

it's not just Ben.

markets as a whole are a constant pull from both optimists and pessimists - both of which are looking to make money.

well-run businesses are capable of adapting to relatively predicable economic changes.

DL's greatest strategic success is seeing further down the road than its competitors and benefitting from those that fail to adapt.

Not to larp as a socialist, but the saying that the rich get richer still holds true.

I think to the extent that leisure demand has fallen thats mostly the economy travelers. Front cabin premium demand holds extremely strong, with more and more high end leisure travelers. This is perhaps why we see UA, AA, and DL all increasing their front cabin footprint so significantly.

So even if times are more economically challenging, perhaps even...

Not to larp as a socialist, but the saying that the rich get richer still holds true.

I think to the extent that leisure demand has fallen thats mostly the economy travelers. Front cabin premium demand holds extremely strong, with more and more high end leisure travelers. This is perhaps why we see UA, AA, and DL all increasing their front cabin footprint so significantly.

So even if times are more economically challenging, perhaps even for the broader majority, the top 1% to 10% remain as wealthy as ever, with an ever growing penchant for front cabin.

Anthony, that's not the definition of a recession -- it's two consecutive quarters of economic contraction. That level of unemployment is a MAJOR recession.

a couple things stand out...

Revenues did not collapse as many have feared but passenger revenue was flat; cargo revenue was up, likely as a result of DL's growth over the Pacific and the move to using the A350 as the near-exclusive TPAC aircraft.

Premium cabin(s) revenue grew as much as economy was down on a percentage basis. Loyalty award revenue was up.

The refinery is not contributing to DL's bottom line -...

a couple things stand out...

Revenues did not collapse as many have feared but passenger revenue was flat; cargo revenue was up, likely as a result of DL's growth over the Pacific and the move to using the A350 as the near-exclusive TPAC aircraft.

Premium cabin(s) revenue grew as much as economy was down on a percentage basis. Loyalty award revenue was up.

The refinery is not contributing to DL's bottom line - in fact, it lost money in Q2. It serves as a hedge and delivers little to no benefit when fuel prices are low. Still, DL will likely have the lowest fuel costs per gallon of the big 4 and probably most of the industry

DL continues to grow capacity faster than the rate of GDP growth

DL continues to pay down debt

DL's salaries and related expenses are up about as much as fuel is down. Airlines continue to shift expenses away from fuel to salaries. DL is using its leverage as the leader in airline compensation to put pressure on other airlines. AS and UA face significant increases in labor expenses.

DL's equity in other airlines is stronger, driving a big chunk of its non=operating income.

It should be noted that Delta said domestic capacity will be flat to down in the fall. Delta is reporting modest softness with the lower end consumer. This will certainly not bear well for the ULCC’S.

correct.

DL grew domestic capacity by 4% in line w/ its system capacity growth so they are putting enough new capacity into the system to make life difficult for lower cost rivals. AA and UA are likely to do the same

Its also interesting to note that economy tickets are extremely cheap domestically, even for tickets in late July/ early August. This also applies to transatlantic flights. I cannot recall ever seeing tickets so cheap during the summer. This will definetly not be good for certain airlines, including ULLCs. I also expect this to hurt Southwest and JetBlue, and it will be interesting to me to see how much it affects them.

I do second this as I have seem some pretty attractive close-in pricing for tickets recently. It looks like capacity was just a bit too high industry wide to sustain any real pricing power.

I’ve noticed this too. Domestic F fares are holding up (if anything they are even higher this year), but I’ve started seeing some crazy cheap domestic Y fares going into the fall, like a one way basic Y fare LAX-BOS for less than $100