There are a lot of misconceptions about how credit scores are calculated. When I explain to people that I have 20+ credit cards open at a given time, the first question I’m usually asked is “doesn’t that ruin your credit score?!”

The answer is no, and that in many cases it can actually improve your credit score. But it’s very difficult for that to “click” with people. So I figured I’d explain in more detail, in part by sharing my own credit score.

In this post:

My credit score is excellent

My Equifax and Transunion credit scores are currently 824 and 827, respectively, which is better than a vast majority of consumers. To be honest, my score is lower than it was several months back (when it was as high as 840), as I’ve applied for quite a few cards, and have been a bit sloppy with keeping my card utilization really low.

That being said, there’s really not much benefit to having a credit score of 840 vs. 800, for example, as either will qualify you for just about anything you may want. So while a super high credit score might be nice for bragging rights, there’s limited value beyond that. 😉

What’s the secret to a good credit score?

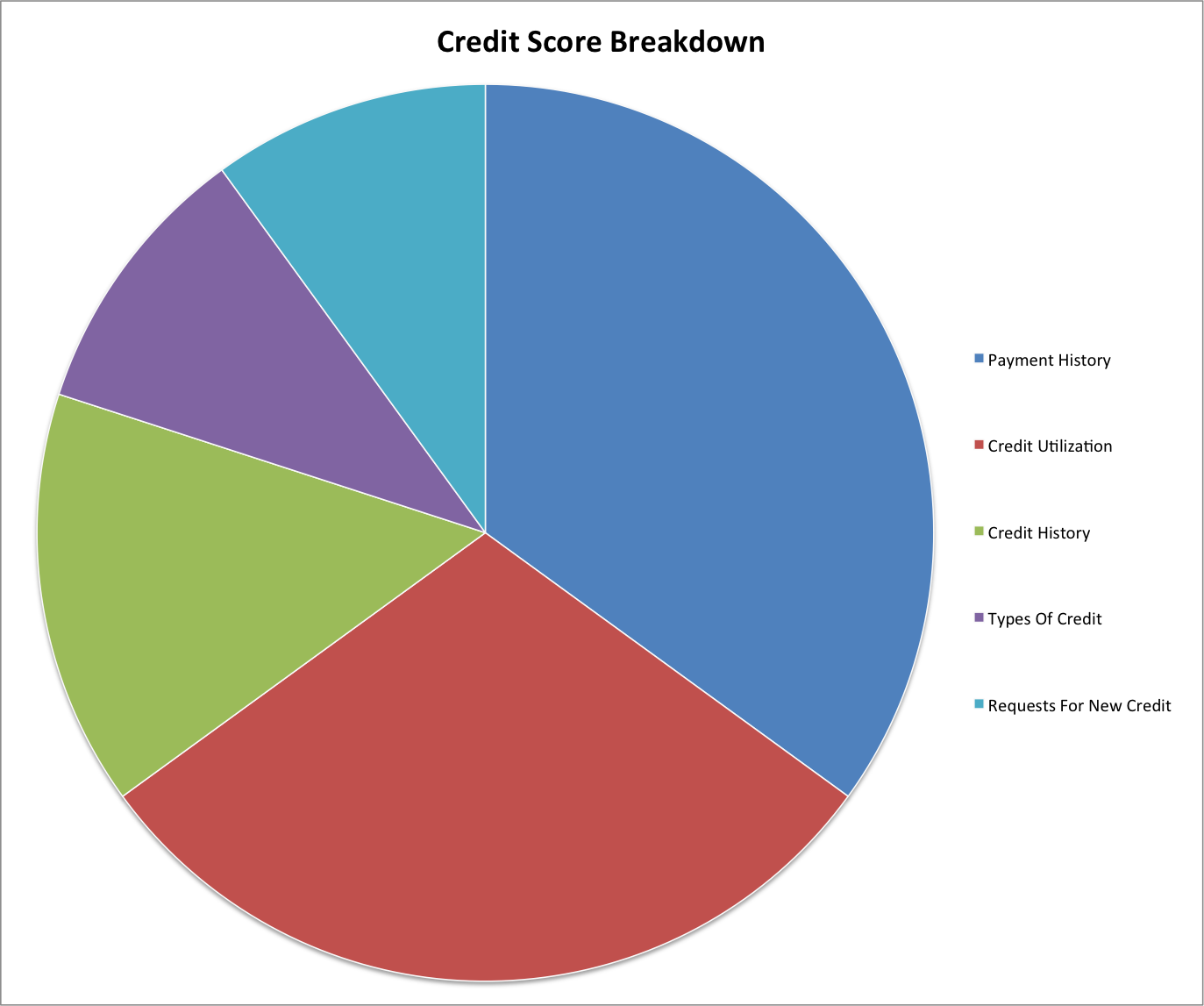

A lot of people are confused about how credit scores are calculated in the United States. To summarize, here are the major factors that determine your credit score:

- 35% of your score is made up of your payment history

- 30% of your score is your credit utilization

- 15% of your score is your credit history

- 10% of your score is made up of the types of credit you use

- 10% of your score is your request for new credit

How is it possible to have an excellent credit score while having a large number of credit cards open, and also consistently applying for new cards? Below are a few tricks that people easily overlook and/or can’t fully wrap their heads around.

Always make payments on time

35% of your credit score is made up of your payment history. That couldn’t be easier. Just pay your bills on-time, and you’ll basically get “perfect marks” for a third of your credit score. If you’re going to be involved in this hobby you’ll want to be well organized, which isn’t a lot of work, really. Just make sure you have payment due dates in your calendar, and have payment alerts set up.

Not only will you be hit with fees for making late payments, but your credit score will also be hit.

Keep your credit utilization low

30% of your credit score is made up of your credit utilization. This simply refers to what percentage of your overall credit you’re using.

Let me give an example. Say you have 10 credit cards, and have a $10,000 credit line on each. That means you have $100,000 of available credit. If you spend $90,000 on your cards each month, you’re utilizing 90% of your credit. That looks risky to the banks, because they start to wonder if you’re getting close to charging things you can’t actually pay for.

Conversely, if you have $100,000 of available credit but only spend $1,000 per month, you’re only utilizing 1% of your credit. If you apply for new cards, the banks view you as low risk, because you’re clearly not trying to max out your credit lines.

It actually helps to have a lot of cards, so that your overall available credit is high, while your utilization is very low. There’s one other trick here — pay off most of your credit card balance before the statement even closes. In other words:

- Say the closing date for a credit card is April 1

- The payment due date is usually a few weeks after that

- I simply pay most of my credit card bill two days before the statement even closes (in this case, March 30)

- That’s because what’s being reported to the credit bureaus is your utilization at the time your statement closes; so even if my credit line is $10,000 and I spend 90% of that, if I pay off most of that balance before the statement even closes, then the utilization rate will be super low

Keep some cards for a long time

15% of your credit score is made up of your credit history. One thing that largely factors into this is your average age of accounts.

In other words, the issuers want to see that you’ve been using credit consistently and responsibly for a long time. After all, if you’ve never had a credit card before and then suddenly get five at once, they’re not sure if you’ll be able to handle your credit responsibly (which is why it makes sense to apply for more cards gradually).

So while I apply for a lot of new cards, it’s important to also keep some cards long term. This is why I highly recommend a combination of cards that are worth paying annual fees on, as well as no annual fee cards that add value as well. Some cards are worth getting for their return on spending, while others are simply worth getting for their ongoing perks.

Not only are those cards worth it for the benefits they offer, but the added feature is that they help my credit score. That’s also why I do everything I can to keep no annual fee cards open, even if I don’t get much value from there.

That’s 80% of your credit score right there

The above alone accounts for 80% of your credit score. If you play your cards right (no pun intended), your score could actually be higher if you have a lot of cards than if you only have a few cards.

The last 20% of your credit score is made up of a combination of the types of credit lines you use, and your requests for new credit. The former refers to having diversified credit lines (credit cards, mortgages, etc.) — the more variety you have, the better. It might seem backwards, but having a home mortgage or car loan can actually help your score.

The only part of your credit score that will negatively be impacted by applying for new cards is your requests for new credit, whereby your score will be temporarily hit by a few points for the inquiry. After 24 months that falls off your report, though, and you’ll just reap the positive benefits of having a lot of cards.

Bottom line

I’m sure most OMAAT readers already know that applying for lots of credit cards doesn’t necessarily hurt your credit score, and in many cases even helps it. But for those who are “doubters,” hopefully this helps with seeing how credit scores work in practice.

I doubt I’d consistently have such a great credit score if I didn’t have so many cards, since it really gives you quite a buffer in terms of credit utilization, average age of accounts, etc. So maximizing credit card rewards isn’t just useful in terms of accessing great rewards, but it can also have a positive impact on your credit score.

I do not think you benefit much from paying off your credit cards before the statement closes. In fact depending on how much money you spent, it may be useful to have the extra few weeks. Perhaps your credit score may differ by a few points.

I was denied a Citi Globe due to having “too low credit utilization”. I have an excellent credit score otherwise and I’m rarely denied.

If you are paying your cards off before the end of the month, don't some issuers not report any utilisation, because they treat it as the card not being used at all?

Ben - do you ever get declined for cards? I also have excellent credit, but suspect too many new accounts/queries results in my being rejected sometimes. Thanks!

Here is what I find comical. Sometimes I make large purchases for example I make estimated tax payments with my credit card. Since the moment the statement closes, the amount shows as "unpaid debt" - and I only pay at the due date - sometimes my credit scores goes down 30-40 points. Only to then recover again once I pay the balance at the due date. I always pay at the due date and have...

Here is what I find comical. Sometimes I make large purchases for example I make estimated tax payments with my credit card. Since the moment the statement closes, the amount shows as "unpaid debt" - and I only pay at the due date - sometimes my credit scores goes down 30-40 points. Only to then recover again once I pay the balance at the due date. I always pay at the due date and have done so all my life. Yet the credit agencies suddenly see me as a big risk! The fact that your balance counts against you even before it is due makes no sense.

I know some folks pay the balance before the due date to avoid that, but that's also plain silly to have to pay something before it is due just to avoid this. As an example, let's say I pay 50k in taxes with my credit card, if I make the purchase towards the beginning of my billing cycle, I get almost 2 months of interest free "loans" while I keep my real.money invested or at least get 3-4% in a savings account. That's about $300 I get in interest for 2 months at 3.5%. Not a huge sum but worth it to me.

Leveraged purchases like this are how the rich stay rich...

Most Americans hear having 20 credit cards as having 20 maxed out credit cards.

I keep a credit balance of $5 on the cards I do not use but want to keep for history. They mail the $5 back after six months and then I pay them again. You have to pay it through your bank bill pay.

As I cannot understand the thinking behind such an action, would you care to elaborate Cbchicago?

It keeps the account open. Most credit cards will close your account if there is no activity. Keeping the account with a credit of $5 prevents this type of action. I have one store credit card that I have keeped open for 20 years with this practice.

The average American cares about their credit score entirely too much. Honestly, if you aren't buying real estate or a vehicle year after year, it means very little. Not saying you should have bad credit but anything above 650 if you aren't doing activities I mentioned above, is just fine.

The average American is also over leveraged.

Credit score affects home and car insurance too. But yes if you dont already own home/car and are not looking to buy then not an immediate concern.

According to some sources, the average U.S. citizen carries about of $60,000 of debt. With the average household carrying about $105k.

By comparison the average UK citizen only carries £35k, or about, $47.5k.

I find it interesting to compare such facts and appreciate that Ben, has provided me with the impetus to enquire further …. as I have said before …. “Every day is a school day”.

I'm impressed C1 will approve you... those of us with 30+ cards, LOL/24, etc. cannot seem to get far with them. My only hope for a C1 lounge is SQ in J at JFK T4 these days.

1990 …. the more you post and boast, the more convinced one becomes that you are actually Ben, pretending to be a

Joe Soap guest.

I wish; Ben clearly has an 'in' with these issuers that I clearly do not.

On current events, is the UK getting any snow this season? It's nearly 9AM in NYC, and we're getting a healthy amount so far. Supposed to really pick up this afternoon.

1990/BS, too many slip up, too many coincidental trips, too much knowledge and the like, all point to: 2+2=4!

Trust me you cannot kid a kidder, too much like DDT, for pure coincidence.

The C1 VX was easy to get approved for when it was released. That’s when I got it too despite many cards wich low balances. C1 wanted to expand their customer base. I don’t expect any special relationship was needed for Ben at that time.

InternationalTraveler, then I'm happy for you, Ben, and the others, but, unfortunately, I was not as lucky. Will need to wait for 0/24 to try again, it seems.

Auto pay is your best friend a high credit score. Add pay full balance every month and that keeps you solid credit score wise at zero interest

Hi Ben. Doesnt having no loan debt also hurt? I'm talking car loans, personal loans, etc. I don't have any of those and my credit reports ding me for not having any of that kind of debt. Not a big deal, but wanted to ask the expert.

It definitely hurts if you don’t have a CC or some kind of open credit line or loan. My father I has lots of assets and a very high net worth. My mother ran their business and also the CCs, loans, etc are in her name, partially for liability protection. Over 30 years, my father’s credit slowly slipped as he never used it. They retire, and he tries to buy a car. He as ample...

It definitely hurts if you don’t have a CC or some kind of open credit line or loan. My father I has lots of assets and a very high net worth. My mother ran their business and also the CCs, loans, etc are in her name, partially for liability protection. Over 30 years, my father’s credit slowly slipped as he never used it. They retire, and he tries to buy a car. He as ample assets and can buy any car cash. He has to finance to get the best deal on the car. They wouldn’t approve him. My mom had to go in and finance the car and pay it off.

I immediately started opening CCs to my wife to prevent that from happening as I noticed her credit was slowly slipping as well due to lack of loans or credit usage. It’s now rebounded and doing very well.

In the UK, ClearScore offers a free App, which utilises the Equifax database. Experian, is also available via a free App too. I utilise both from time to time.

The holder of only two Credit Cards and one who pays off my balances as I go, my maximum available credit score has never suffered because of my preferred method of use.

"35% of your credit score is made up of your payment history. That couldn’t be easier. Just pay your bills on-time, and you’ll basically get “perfect marks” for a third of your credit score"

Thats the hard part for Americans!

In regards to utilization, I have found that paying my balance before the statement closed and having a zero to very small balance consistently was hurting my credit score as it looked like I never used the card.

The moment I started leaving a couple thousand on my balance each month and then paid it off immediately after the statement closed my CC score was finally able to break past a wall. That wall being...

In regards to utilization, I have found that paying my balance before the statement closed and having a zero to very small balance consistently was hurting my credit score as it looked like I never used the card.

The moment I started leaving a couple thousand on my balance each month and then paid it off immediately after the statement closed my CC score was finally able to break past a wall. That wall being 835 for me. Prior to that it just hovered in the 825-835 area. The banks need to see you actually using your CCs. A balance of zero to them is basically not using your credit and they want to see you use it. This is under the assumption you keep it under 10 percent of utilization as well. They just need to know you can handle using and paying a CC.

This is why citi has repeatedly denied me any card for over a year. I have a 830+ score, more than adequate income, not too high of a credit limit across 5 cards (about 70k total credit limit), low utilization, and I always pay on time, usually well before the due date... And that's the problem, according to them. I haven't even been able to get a basic miles card from citi because of this.

Does Amex report a credit card utilization percentage? The cards don't have an advertised credit limit.

@ HejBjarne -- Nope, if there's no advertised credit limit (like on Amex hybrid cards), then utilization isn't reported.