With the recent launch of Marriott Bonvoy, as well as Marriott’s recent award chart changes, I thought it would make sense to address the current value of Marriott Bonvoy® points.

I wrote a post over six months ago with my perceived value of Marriott points, though obviously it’s time to revisit that, given the recent introduction of Category 8 hotels, hotel category adjustments for this year, and the general state of the loyalty program.

Let me start by acknowledging that the valuation of points is always highly subjective, so if you come up with a completely different valuation, that’s fine. For reference, here’s the page with my valuation of miles & points.

How to value points

Aside from fixed value points currencies (where each point is worth a certain dollar value), there’s no scientific way to value points. Everyone will have different valuations based on their redemption patterns, so the best I can do is share how I value them, and then everyone can crunch their own numbers.

Travis has written a series explaining how to value points based on your earning and redemption patterns. He’s much more of a scientific thinker than I am, so check out his series:

- Miles Aren’t Free: How To Value Your Redemptions

- Miles Aren’t Free: How To Value What You Earn

- Miles Aren’t Free: Establishing An Overall Value

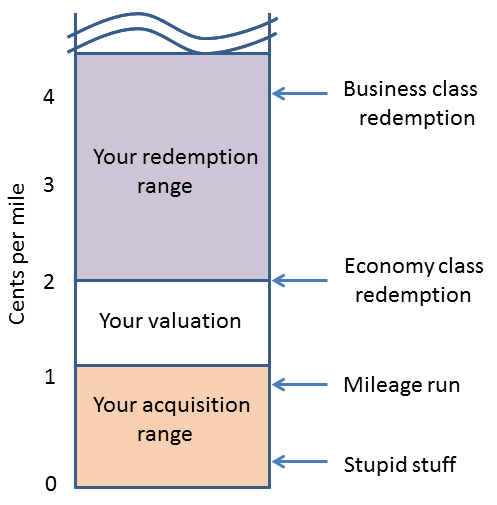

The simplest way to explain it is that points are worth some amount between your acquisition cost and your redemption value. Where in that range your valuation falls depends entirely on how you choose to redeem points.

In a simple diagram, here’s how he explained his methodology for valuing miles (it’s the same concept for hotel points):

My valuation of Marriott & Starwood points prior to September 2016

Before the programs merged, I valued Marriott Rewards points at 0.8 cents each, and Starwood Preferred Guest points at 2.2 cents each. Those were my valuations before it became possible to convert Starpoints into Marriott points at a 1:3 ratio in September 2016.

My valuation of Marriott points prior to March 2019

Prior to Marriott’s award chart changes this week, I said Marriott points were worth up to 0.9 cents each. This was based on the ability to redeem 60,000 points per night for Marriott’s top properties, with a fifth night free.

But now that we’ve seen the introduction of Category 8 award pricing (meaning Marriott’s top properties have increased in price by more than 40%), and also have seen hundreds of hotels move up in categories, it’s time to talk about what the new value of Marriott points is, in my opinion.

It has been possible to redeem 60,000 points per night at the St. Regis Maldives

How much I value Marriott Bonvoy® points

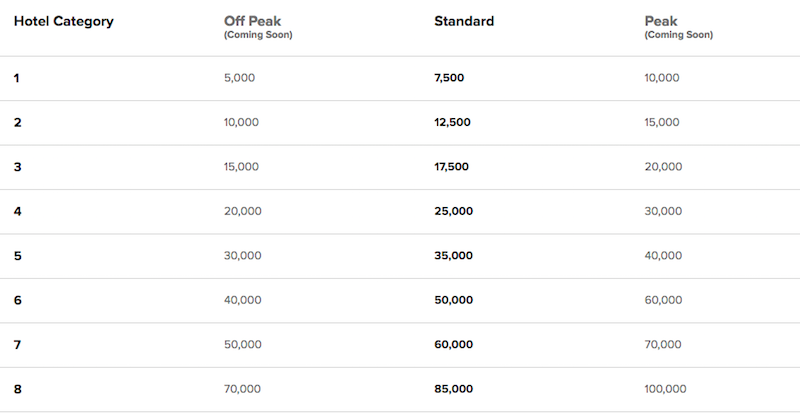

To start, here’s Marriott’s current award chart:

As you can see, this reflects the new Category 8 award pricing. Later this year Marriott will be introducing peak and off-peak pricing, but that hasn’t happened yet.

With that in mind, at this point I value Marriott Bonvoy® points at ~0.7 cents each. How do I arrive at that valuation? A large part of my valuation of Marriott points is based on how versatile they are:

- Marriott points can efficiently be redeemed for hotel stays, either for individual nights, or you can take advantage of the fifth night free benefit for a longer stay

- Marriott points can efficiently be converted into airline miles in over two dozen programs at a 3:1 ratio; if you transfer in larger increments, you can convert 60,000 Marriott points into 25,000 airline miles, meaning that one Marriott point is worth ~0.42 airline miles

Converting Marriott points into airline miles

Marriott has some excellent airline mileage transfer partners. Using a valuation of 0.7 cents per point, you’d be paying 1.68 cents per airline mile when converting in increments of 60,000 points

I’d say that 1.68 cents per airline mile is potentially a great deal, so I’d have a hard time valuing Marriott points much lower than that.

Transfer Marriott points to Alaska for redemptions in Japan Airlines first class

Redeeming Marriott points for hotel stays

0.7 cents per Marriott point is a rate that I’ve found checks out pretty well for hotel redemptions I’d consider making.

When valuing points for the purposes of hotel redemptions:

- You have to factor in the points you’re forgoing by redeeming points rather than booking a paid stay

- You shouldn’t just compare the number of points required to what a stay would otherwise cost, but rather should compare it to what you’d be willing to pay for that stay

In other words, just because you can redeem points at a mediocre hotel in Times Square on New Year’s Eve that costs $1,000+ per night, doesn’t mean you should value points based on that amount, unless you’d otherwise be willing to pay that much. Instead I’d base the value more on redemptions I’d realistically make.

So at this point Marriott’s top hotels cost 85,000 points per night, and you can get a fifth night free on redemptions. So over the course of a five night stay, you’re paying an average of 68,000 points per night.

The St. Regis Aspen now costs 85,000 points per night

At a rate of 0.7 cents per point, that’s like paying ~$477 per night for Marriott’s top properties. Now, some of Marriott’s top properties retail for $1,000+ per night, but:

- When doing the math you have to subtract the value of the points you’d get on a revenue stay

- You have to account for the general games that Marriott is playing with award stays, and how difficult they’re making it to redeem points in some cases

While I think that math makes sense for high-end properties, I think the math checks out similarly for many mid-range properties. A lot of mid-range properties cost 35,000 points per night, so with a fifth night free you’re looking at an average of 28,000 points per night, which is ~$196 per night at a valuation of 0.7 cents per point.

That seems fair to me.

Bottom line

Ultimately there’s no right or wrong way to value points, as long as you’re valuing them at more than your acquisition cost and at less than your redemption value.

However, at this point I think about 0.7 cents per Marriott point is a fair valuation. That values airline miles at 1.68 cents each (which I think is a fair and conservative valuation), and it means we’re valuing stays at Marriott’s top hotels at just under $500 per night, factoring in a fifth night free. Furthermore, I don’t want to value them higher simply because the sheer number of problems that people are reporting when trying to redeem Marriott points.

That’s just my take, though. You could just as easily argue Marriott points are worth 0.5 cents each, of that they’re worth a cent each. There’s no right or wrong answer here, it all comes down to your redemption patterns.

How much do you value Marriott Bonvoy® points with the new award chart?

Don't forget the "add-on" costs such as "resort fees" (to even use the pool at a Ritz Carlton resort - are they kidding!) and now, "destination fees" (e.g., $25/night at the W in New York). I loved the SPG program and signed up for it when it first came out (some time in the 80's or 90's). They always accurately posted my points after a stay, always offered me a drink or extra points and...

Don't forget the "add-on" costs such as "resort fees" (to even use the pool at a Ritz Carlton resort - are they kidding!) and now, "destination fees" (e.g., $25/night at the W in New York). I loved the SPG program and signed up for it when it first came out (some time in the 80's or 90's). They always accurately posted my points after a stay, always offered me a drink or extra points and an upgrade as a gold member upon checkin. Being a gold member is virtually worthless now. I am never offered a bonus upon checkin (that benefit has, no doubt, been eliminated), never offered an upgrade without paying for it (I ask for my upgrade and they tell me that one is not available except for an increase in price (even as upgrade as small as from a lower to an upper floor in the same room category) and speaking to someone on the phone is nigh impossible. The elimination of competition always hurts the consumer - the same devaluation of benefits for loyal, elite members, is particularly true of American Airlines after it bought out U.S. air. Too bad because I sure liked the St. Regis and Ritz Carlton and will now avoid them in order to avoid Marriott Bonvoy. Lucky, are you still able to book former SPG hotels for folks who book through you and get the benefits such as free breakfast, upgrades, etc., or did they take that away from travel agents also?

For the average person not gathering buisness points we are screwed with the new Marriott system-I think in the long run they will have to do something to keep the spg members- everyone I know has stopped using their spg credit card and for me I just got the chase reserve card

@Stewart

A guess is that there are so many tickets in the queue that it will take Marriott decades to remove them if they even just peek at them one at a time and do nothing.

So everyone please get the tickets removed if your problem is solved.

So when Marriott actually agreed to reimburse me some points I was able to remove three tickets which had been in the queue since January and will...

@Stewart

A guess is that there are so many tickets in the queue that it will take Marriott decades to remove them if they even just peek at them one at a time and do nothing.

So everyone please get the tickets removed if your problem is solved.

So when Marriott actually agreed to reimburse me some points I was able to remove three tickets which had been in the queue since January and will hopefully help some others get theirs dealt with. Hopefully but no confidence.....

@alcw I have submitted missing stay requests the past weeks and they are never responded to. I have to end up calling and the agent then goes in to delete them as a ticket and do it herself. Why she feels the need to delete them I have no idea as no one is even dealing with missing stay forms at this point.

@Stuart: Have you tried writing instead of calling to get points?

I'm finding the customer care otp about the same as a platinum elite...I'm going to be back at Ambassador status soon (yay : ( ,....work travel ) and will be curious to see if it's better/worse.

I'm happy to have free hotel nights for pleasure since I'm tending to travel to NYC, SFO, BOS where hotels are damn expensive...so free is good since I've...

@Stuart: Have you tried writing instead of calling to get points?

I'm finding the customer care otp about the same as a platinum elite...I'm going to be back at Ambassador status soon (yay : ( ,....work travel ) and will be curious to see if it's better/worse.

I'm happy to have free hotel nights for pleasure since I'm tending to travel to NYC, SFO, BOS where hotels are damn expensive...so free is good since I've earned almost all of these via reimbursed travel expenses to cheaper towns like Wilmington and PHI.

At these valuations, how does it ever make sense to use a marriott card for anything other than staying on a marriott property? (And even thats iffy given that u can earn 5x points using amex plat).

Unless you live year round at a marriott, it seems like theres never a good reason to earn on a bonvoy card

@Bob - @Huang on March 6, 2019 at 1:46 pm above did define it correctly:

"Here is a quick math I did, for BonVoy before March 5th.

Titanium Elite+Credit Card = 17.5+6=23.5 points per USD spent at hotels."

Breaking it down:

10pts/$ [base] + 7.5pt/$ [75% bonus on base] + 6pts/$ [CC spend earn rate] = 23.5pts/$

@DCS

What is 23.5 pts/$ value that you used in your post?

@Stuart: Your analysis is 100% correct! These calculations are an exercise in futility because stays at Marriott properties are NEVER credited to your account. Rather, you must call the customer service line, which is a minimum 20 minute time commitment. I hope the Marriott IT issues are fixed soon!

@Homer: Agree with you about SF but my problem is that I only go there for business so won't use my points for hotel stays. I was there last week and a Residence Inn close to SFO was asking $750/night before taxes. I changed my flight (cost me $200) and I came home earlier and slept on my own bed. People really lost their minds there.

Here is a quick math I did, for BonVoy before March 5th.

Titanium Elite+Credit Card = 17.5+6=23.5 points per USD spent at hotels.

10000 USD spent at hotel = 235000 points.

And with just 5000 points more which is 5000/23.5 = 212.77 USD (thereabout) of spent you could redeem 5 nights at a Cat7 hotel. So NYC Regis, or Regis Maldives. Which often cost 1000-1500 USD per night. (granted it was very hard...

Here is a quick math I did, for BonVoy before March 5th.

Titanium Elite+Credit Card = 17.5+6=23.5 points per USD spent at hotels.

10000 USD spent at hotel = 235000 points.

And with just 5000 points more which is 5000/23.5 = 212.77 USD (thereabout) of spent you could redeem 5 nights at a Cat7 hotel. So NYC Regis, or Regis Maldives. Which often cost 1000-1500 USD per night. (granted it was very hard to get any basic room in Maldives, they limited redemption to Overwater and wants 100-200k extra depends on when you made the reservation.)

Thus 10212.77 USD of spent could get you 5000-7500 USD worth of free nights, meaning if you do it optimally you are looking at around 48-73% percent of return on spent at Marriott hotels. Provided if you value your stay at NYC/Maldive Regis at face value. Personally I think Maldives is worth it at least once a lifetime, NYC Regis' rooms are not that new but the service is pretty good and the location is good as well. Plus it is pretty easy to redeem a points stay there.

I believe Marriott will nerf the points redemption further, it is still probably too good of a value right now (for Marriott). With the blackout dates now allowed for Marriott properties and horrible changes to the phone agent quality. All without any prior or open notifications to members, I have no doubt it will only get worse from here.

A Treatise on the Value of Loyalty Points Currencies: The Emphasis on CPP May Be Misguided

Axiomatically,

-- Loyalty points/miles do not have a redemption value in 'cpp' or 'cpm' until the points/miles are redeemed.

--- There is an AVERAGE redemption value that each person can calculate for themselves based on their redemption pattern to establish a cutoff below which they would use cash and above which they would redeem points.

-- Average values...

A Treatise on the Value of Loyalty Points Currencies: The Emphasis on CPP May Be Misguided

Axiomatically,

-- Loyalty points/miles do not have a redemption value in 'cpp' or 'cpm' until the points/miles are redeemed.

--- There is an AVERAGE redemption value that each person can calculate for themselves based on their redemption pattern to establish a cutoff below which they would use cash and above which they would redeem points.

-- Average values of loyalty points cannot be used directly for cross-program comparisons because each is in a distinctly different 'denomination', so that a direct comparison would be like comparing different hard currencies without using a currency exchange rate. 100 JPY have the same buying power as ~1 USD, despite the large difference in MAGNITUDE of the numbers. It is why Marriott knew to convert 1 starpoint to 3 MR points, or the other way around. So, if one subjectively valued a Marriott point at 0.7cpp, one had to value a starpoint at 0.7 x 3 = 2.1cpp. That did not mean that the starpoint was more "valuable." It simply meant that the two points currencies used different scales (like the JPY and USD do) that could be interconverted using a 1:3 currency conversion rate.

-- The most useful metric for cross-program comparisons is the "Spend per Free Night" -- the closest thing to the monetary cost of an award night -- because (a) it takes into account both the EARN and REDEMPTION sides of the mile/point equation, and (b) it does not suffer from the subjectivity of 'average' redemption values, which never consider the earn side of things.

-- Lastly, it is infinitely better to estimate the 'rebate' that one gets from, say, a promo or having the 5th award night free than using the highly subjective average redemption value of a points currency, which usually underestimate the true monetary value.

Case in point: above @ Lucky estimated that paying 68K points rather than 85K points for a 5-night award stay with the 5th award night free is like paying:

68,000 pts * $0.007/pts = ~$476

He used his highly subjective AVERAGE redemption value of the BONVoY point of 0.7cpp. A range of values from .5 to .9 or 1.0 cpp have been claimed for a Marriott point, which would affect the estimated monetary value quite a lot!

But the size of the 'rebate' for having the 5th award night free, which, BTW, depends on one's elite status on the EARN side, is actually much bigger, and the math requires almost no subjective assumptions.

For a top BONVoY elite w/o the 5th award night free, the monetary cost of the award, including bonus points from CC spend, would be:

85,000pts/(23.5pts/$) = $3,617

(this would be different [higher] for a Gold, e.g.)

For the same top BONVoY elite w/ the 5th award night free, the monetary cost of the award, including bonus points from the CC spend, would be:

68,000pts/(23.5pts/$) = $2,894

The size of the 'rebate' due to the free 5th award night is just the difference between the award night costs without and with the 5th award night free:

$3,617 - $2,894 = $723

which is much bigger than $476.

The preceding is just the process of earning the required points, which do not grow on trees, in reverse. We assume all points are earned through revenue stays, but they could come from other sources too, which would further DECREASE the spend per free night or increase the size of the 'rebate'.

To earn 85K points through revenue stays, you'd need to spend:

$3,617 * 23.5 = 84,999.5 (rounding off error) = 85,000

To earn 68K points through revenue stays, you'd need to spend

$2,894 * 23.5 = 68,009

Q.E.D

So for top tier credit card holders (Bonvoy Brilliant vs Hilton Aspire) without other status, here is how earnings shake out:

Paid stays

Hilton: (10 points per dollar base + 10 points per dollar elite bonus) *.05 cents per point = 20 points per dollar = 10% return per dollar

Bonvoy: (10 points per dollar base + 2.5 points per dollar elite bonus) *.07 cents per point = 8.75% return per dollar

Credit...

So for top tier credit card holders (Bonvoy Brilliant vs Hilton Aspire) without other status, here is how earnings shake out:

Paid stays

Hilton: (10 points per dollar base + 10 points per dollar elite bonus) *.05 cents per point = 20 points per dollar = 10% return per dollar

Bonvoy: (10 points per dollar base + 2.5 points per dollar elite bonus) *.07 cents per point = 8.75% return per dollar

Credit card spending at Hotels

Hilton: 14 points per dollar * .05 cents per point = 7% return per dollar

Marriott: 6 points per dollar * .07 cents per point = 4.2% return per dollar

Credit card spending at Restaurants

Hilton: 7 points per dollar * .05 cents per point = 3.5% return per dollar

Marriott: 3 points per dollar * .07 cents per point = 2.1% return per dollar

Non-bonus spend

Hilton: 3 points per dollar * .05 cents per point = 1.5% return per dollar

Marriott: 2 points per dollar * .07 cents per point = 1.4% return per dollar

A few observations:

1) It really pays to make Platinum in Marriott's system if you can. At that point, paid stays earn similar or more relative to Hilton, with more earnings if you can reach Titanium or whatever. The lounge is also a benefit for Platinum members

2) If you can't reach Platinum on Marriott, and if you can't redeem Marriott points for more than 0.07 cents per points consistently, Hilton offers a better return, and much better so for credit card spend

3) A lot of this depends on availability - if Marriott has more availability in the 35,000 to 60,000 point range, then maybe it is actually easier to get value out of the Marriott system. A lot of people seem to have difficulty getting more than 0.04 cents per point out of Hilton at that redemption level (the benefit for Hilton is more at the top earnings properties)

I would like to see a detailed analysis from you and others on which system offers the best cents per point value at varying points totals

@Tara

25000 airline miles = 60000 marriott points

0.7 cents * 60000/25000 = 1.68 cents

I think new Bonvoy points vary far more than the average award currency in value depending on the expertise of the person redeeming them. For Marriott properties the true value is probably even lower, something like .6 cpp as the rates do not feel substantially better than Hilton/IHG. A more experienced frequent flyer should probably be valuing them higher than the .7 CPP suggested here though.

The first gain in value is in simply...

I think new Bonvoy points vary far more than the average award currency in value depending on the expertise of the person redeeming them. For Marriott properties the true value is probably even lower, something like .6 cpp as the rates do not feel substantially better than Hilton/IHG. A more experienced frequent flyer should probably be valuing them higher than the .7 CPP suggested here though.

The first gain in value is in simply the fantastic award charts you get access to. At the end of the day if I can transfer ~105K points for a *A J transatlantic via Asiana, I find it hard to call that only 735$ of "value" when I'm valuing United points at ~1.5 CPP, which is in no small part based on the ability to spend 60-70K United miles for that same privilege (900$ - 1050$).

And then in many ways Marriott points are more flexible, not less, than United miles for air travel, since you get access to nearly any airline's award space that they hold back for their own members. Airlines like Asiana/KE have exceptionally liberal amounts of own-metal award space and this availability can far surpass what's bookable via partner airlines.

Sorry I don’t understand “That values airline miles at 1.68 cents each”. Can you please explain?

Well the pts are also worth different amounts depending on Marriott status. If you’re platinum or above and can get an upgrade to a suite with breakfast with a redemption stay, those pts are worth more than someone who gets a base room that would be better off paying for a better room with breakfast included even at a higher end place.

Right now at $0.00 as no stays are getting credited.

I get really good value in San Francisco using points. Usually when there is some conference hogging all the rooms. I have an upcoming reservation where the least expensive geographically suitable hotel wants $780 a night for a standard room so 50K points a night for a better one is fine with me. I would not necessarily use points when I could get a good $ deal.

Nice analysis, many thanks!

Yeah, 0.7 is fair. Except just calling Marriott brings that down to 0.2.

@Lucky, please post some trip reports! Thanks and as always I love your blog