The United Kingdom has the world’s highest taxes for airline passengers, known as the Air Passenger Duty (APD). In this post, I want to look at how the APD works — what is it, how much does it cost, when does it apply, and are there any tricks to minimizing it? The UK has made changes to the APD as of April 2025, so I’d like to go over what those changes mean for passengers.

In this post:

What is the UK Air Passenger Duty?

The UK’s Air Passenger Duty is a steep tax levied on any flight originating in the UK — this means that if you’re simply transiting the UK between other countries on one ticket then you shouldn’t be on the hook for this. Rather it’s charged based on having a journey originating in the UK (even if it’s the return portion of a ticket), regardless of where you’re connecting.

Suffice to say that the UK APD is controversial:

- It’s a tax against those traveling from the United Kingdom, rather than those who simply connect in the United Kingdom, as the latter group doesn’t have to pay this

- High taxes negatively impact demand for air travel, since it makes flying more expensive; airlines serving the UK have long fought against this tax, since it raises the cost of airline tickets

For some historical context, the UK APD was first introduced in 1994 and was intended to raise money for the government. When it was first introduced, the tax was £5 for destinations within Europe, and £10 for destinations outside of Europe (as you’ll see below, it has gone way up).

Over the years the tax has almost been viewed as an environmental tax, intended to encourage other forms of transportation. Then again, those are pretty limited if you’re traveling long haul from the UK. From an environmental standpoint, there are two issues with this:

- It does nothing to encourage airlines to invest in more efficient aircraft, since you’d think that would be a consideration in terms of emissions

- If this is about the environment, you’d think transit passengers would be on the hook for this, since they have an even bigger environmental impact when taking two flights

How much is the UK Air Passenger Duty?

The UK Air Passenger Duty amount is broken down based on the distance you’re flying, and the class of service you’re flying in. There are four different pricing bands, and here’s the pricing as of April 1, 2025:

- For domestic flights (only within England, Scotland, Wales, and Northern Ireland), the APD is £7 (~$9) in economy, and £14 (~$18) in a premium cabin

- For international flights of up to 2,000 miles (short haul), the APD is £13 (~$17) in economy, and £28 (~$36) in a premium cabin

- For international flights of 2,001 to 5,500 miles (long haul), the APD is £90 (~$117) in economy, and £216 (~$281) in a premium cabin

- For international flights of more than 5,500 miles (ultra long haul), the APD is £94 (~$122) in economy, and £224 (~$292) in a premium cabin

Now, there are some further details to be aware of:

- For these purposes, a premium cabin would include anything other than economy, so it includes premium economy, business class, and first class

- If you upgrade your seat the higher UK APD applies, which is why many airlines will request a co-pay when upgrading a flight out of the UK (to account for this cost)

- The distance isn’t measured between your origin and destination, but rather between London and the capital city of the country you’re traveling to

- The distance isn’t measured by the distance of your nonstop flight from the UK, but rather by your final destination on your itinerary (assuming continuous travel with no stopovers of more than 24 hours); in other words, the same APD applies whether you fly from London to New York nonstop, or from London to Paris to New York, even though the former itinerary has a much longer nonstop flight out of London

- The UK APD is in addition to any airport taxes and fees, so this isn’t even all you’ll pay in taxes and fees when originating in the UK

When does the UK Air Passenger Duty apply?

Understandably there’s confusion about under what circumstances the UK Air Passenger Duty applies, so let me try to break it down as simply as possible:

- The UK APD applies based on whether you have a flight itinerary originating in the UK; an itinerary is considered to be originating in the UK if you’re on the ground there for more than 24 hours

- The UK APD doesn’t apply for any flights to the UK, as it’s purely a departure tax

- The UK APD doesn’t apply to people who are simply connecting in the UK for under 24 hours on a single ticket

- The UK APD doesn’t apply to children under the age of 16

Let me give some examples, and with each, I’ll explain whether or not the UK APD applies:

- Are you flying from London to Los Angeles? You’ll have to pay the long haul APD

- Are you flying from Los Angeles to London? You won’t have to pay the APD

- Are you flying from New York to London to Paris, and are connecting in London for under 24 hours? You won’t have to pay the APD

- Are you flying from Dubai to London to New York, and are connecting in London for under 24 hours? You won’t have to pay the APD

- Are you flying from London to Amsterdam to Los Angeles, with a connection of under 24 hours in Amsterdam? You’ll pay the long haul APD

- Are you flying from London to Amsterdam to Los Angeles, with a connection of over 24 hours in Amsterdam? You’ll pay the short haul APD

Hopefully that covers most scenarios. As you can see, the APD is calculated based on the final destination of your ticket departing the UK, with continuous travel within 24 hours.

When do you pay the UK Air Passenger Duty?

The UK Air Passenger Duty is collected by airlines directly at the time of booking. So when you book a ticket that’s subjected to the APD, you can expect that your ticket price will include the APD. This isn’t something you have to pay at the airport, or after the fact, for example.

What’s the difference between the UK APD & fuel surcharges?

There’s often confusion about the distinction between the UK Air Passenger Duty and fuel surcharges, given that UK airlines are known for charging both, and it’s also why award tickets originating in the UK can cost so much. Just to clear that up:

- The UK APD is a government-imposed fee that can cost up to £224 on a one-way flight

- Fuel surcharges are imposed directly by airlines, and are a junk fee that has nothing to do with the government

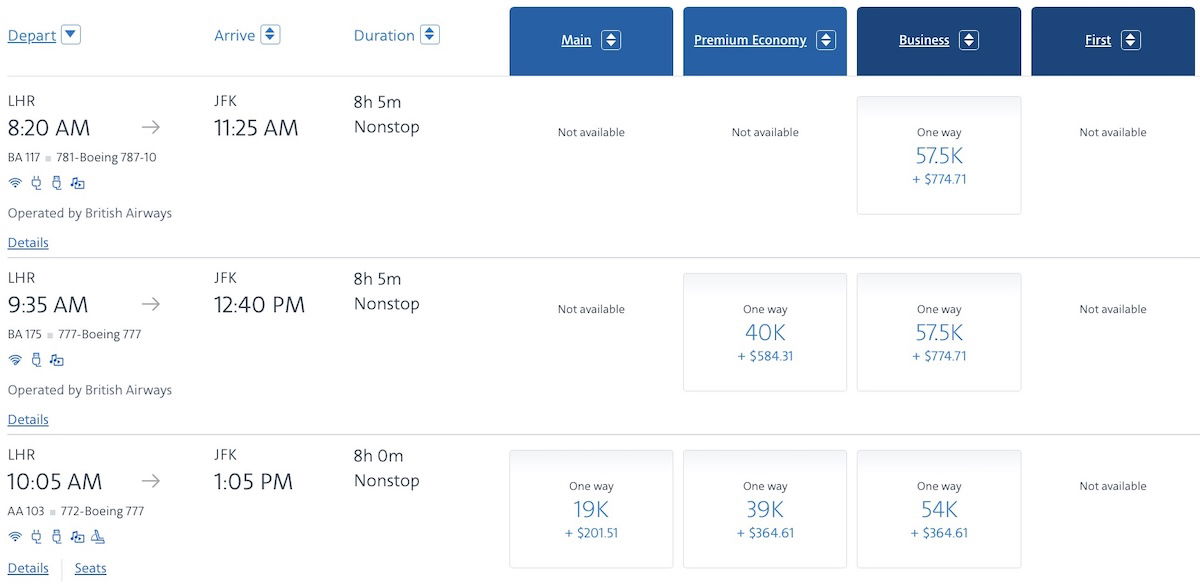

While only some airlines add fuel surcharges (like British Airways), all airlines have to charge their passengers originating in the UK the Air Passenger Duty. Just to give an example of that, say you’re redeeming American AAdvantage miles for business class travel between London and New York.

If you book for travel on American, there are no fuel surcharges, and you’d pay a total of $364.61, which accounts for the UK APD, as well as all the airport taxes and fees (which are on top of the UK APD). Meanwhile, if you were to book British Airways instead, there would be fuel surcharges, and you’d pay $774.71. As you can see, in this case, the fuel surcharges are $410.10.

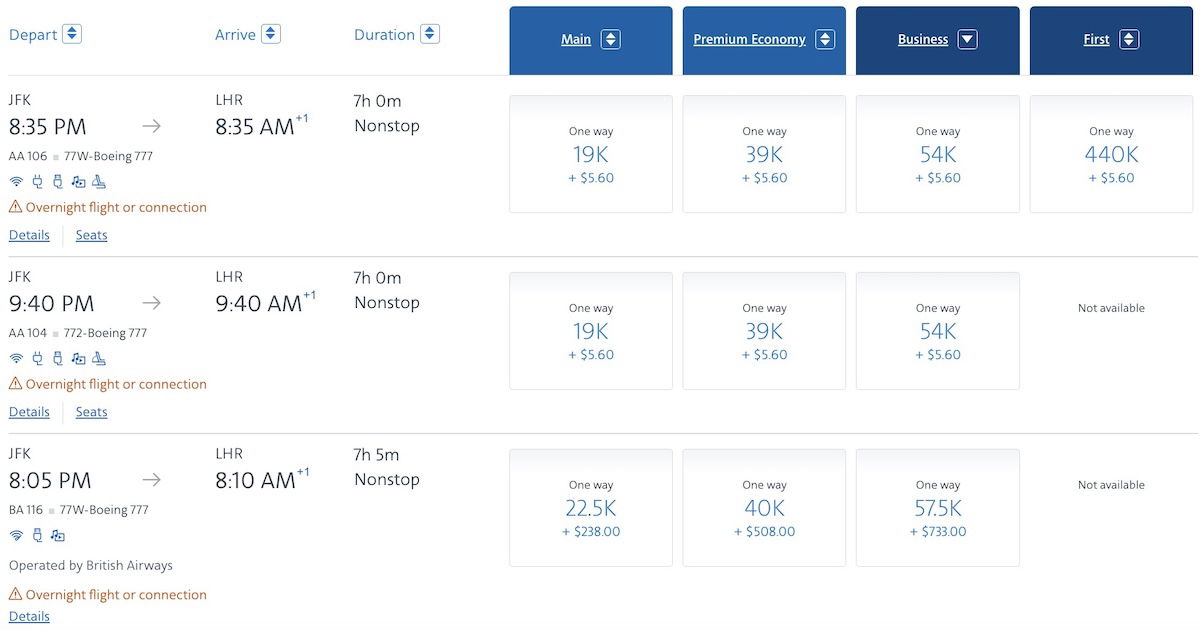

Since this often creates confusion, let’s look at flights in the other direction, from New York to London. If you were to book American, you’d pay just $5.60 in taxes and fees (there are no fuel surcharges or UK APD). Meanwhile, if you booked British Airways, you’d pay $733, meaning that the fuel surcharges are $727.40. Yes, fuel surcharges are higher originating in the US than the UK, but there’s still no UK APD here.

Hopefully, that clears up any confusion regarding the distinction between the UK APD and fuel surcharges.

Are there any ways to minimize the UK APD?

There’s no real way to “beat” the UK Air Passenger Duty, though there are some ways to minimize it, or at least be strategic about it. Different people will have different takes on the extent to which these strategies are worth it, but I figure they’re at least worth pointing out. Let me give a few examples.

Plan your stopover strategically

For example, say you’re redeeming British Airways Avios to fly roundtrip from New York to Paris via London, and you plan to have a stopover of more than 24 hours in London in one direction. If you’re going to do that, I’d highly recommend having your stopover in London on the outbound, rather than the return. Why? Because you’d only pay the short haul APD (£28), rather than the long haul APD (£216).

At the point in your itinerary where you’ve been in London for over 24 hours, you’ll be embarking on an itinerary of under 2,000 miles (to Paris), rather than an itinerary of over 2,000 miles (to New York).

Furthermore, if you want to visit London but only briefly, try to plan a stopover of just under 24 hours. That way you can avoid paying the UK APD altogether, all while still visiting the UK for a bit.

Mix economy & business class

When booking award tickets, some people like to travel one direction in business class and one direction in economy class, to splurge without redeeming too many miles. If you’re traveling to & from the UK and are using this strategy, ideally fly business class on your flight to the UK, and economy on your flight from the UK.

For one direction of travel, this would lower your APD from £216 to £90.

Fly out of Inverness

While Inverness is part of the United Kingdom, the Scottish Highlands and Islands are exempt from the UK APD. This is part of an agreement that dates back all the way to 1994, so it’s a nice little loophole. The catch is that not many people would naturally be starting there, and Inverness has fairly limited service.

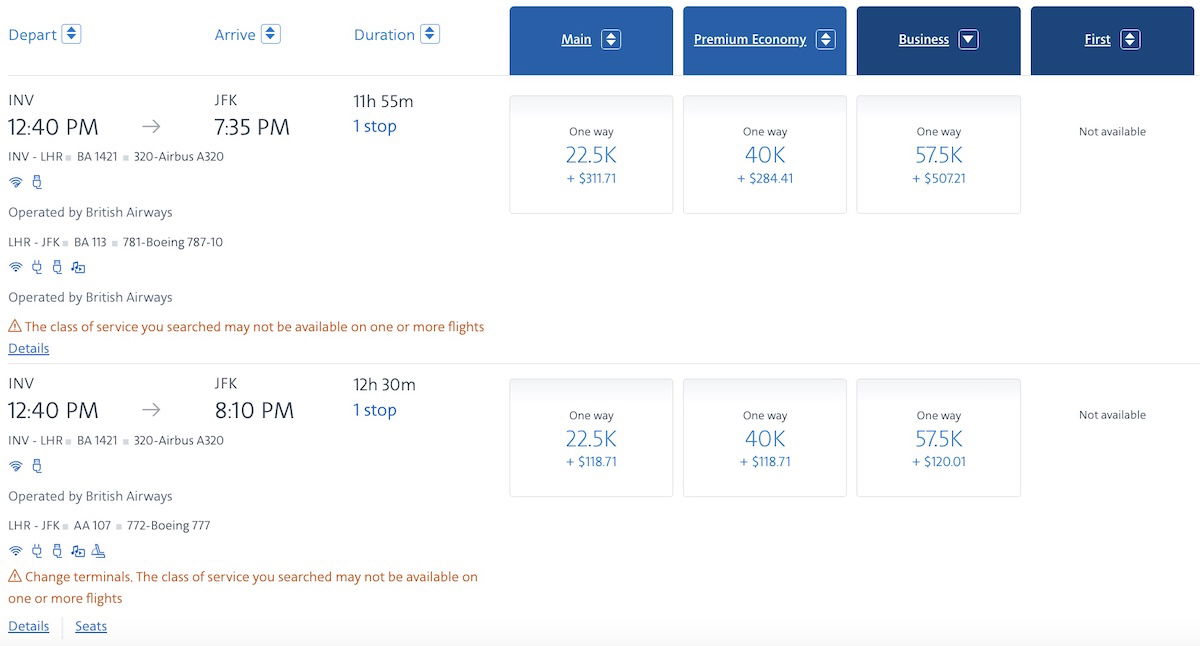

For example, if you fly from Inverness to London to New York using American AAdvantage miles in business class, you’d pay just $120.01 if your transatlantic flight is on American, while you’d pay just $507.21 if your transatlantic flight is on British Airways.

Meanwhile if you just took those same flights from London to New York, without originating in Inverness, you’d pay a total of $364.61 on American or $774.71 on British Airways, accounting for the UK APD.

Position yourself to another country

You can avoid the UK APD by flying out of a country other than the UK, and that could potentially save you quite a bit, especially on a business class ticket. There are a few ways to go about this:

- Some people will position themselves to Dublin to start their itinerary, because flights from Ireland aren’t subjected to the UK APD (and as a bonus, flights out of Ireland are often cheaper than flights out of the UK, even taking that out of the equation); in some cases flights between the UK and Ireland can cost under $20, so this could save you some significant money

- Some frequent flyer programs allow stopovers, including Air Canada Aeroplan, Air France-KLM Flying Blue, and Alaska Mileage Plan, so you can use those strategically; for example, you could fly from London to New York via Amsterdam with a stopover of just 24 hours there, and then you’d only have to pay the short haul APD rather than the long haul APD

Bottom line

The UK Air Passenger Duty is the world’s highest tax that’s levied on airline passengers. This applies to passengers with itineraries originating in the United Kingdom, and the tax ranges from £13 for an international short haul economy flight, to £224 for an international premium cabin long haul flight.

Hopefully the above provides a useful summary of how this works, and if anyone has any questions, please let me know. While the UK APD can’t be avoided altogether, there are most definitely ways to minimize it.

What has your experience been with the UK APD?

Question: I often fly from Europe (short-haul) to the UK and stay under 24 hours there. I often use separate tickets for outbound and inbound. Could I technically get a refund of the APD on the grounds that I'm only stopping over in the UK for less than 24 hours? And if so, how?

Because the surcharges impact the travel budget with 3 children we do not transit or go to the UK opting for other destinations mostly now in the Pacific. The lost revenue to hotel's, car rentals and businesses must be huge as we are not the only family avoiding the UK tax. This comes out to 1,200 dollars for us which pays for a lot of meals somewhere else.

Have you ever had trouble with American Airlines and air passenger duty surcharge that they charge when using a system wide upgrade? They should not be charging this when you are upgrading from premium economy to business because the air passenger duty in both classes is the same. But they still charged my credit card and will not give me a refund. Any tips?

I've found the Inverness tax exemption also applies to flights out of Aberdeen.

And, for some odd reason, BA flights that originate out of MAN *Sometimes* don't have the full UK surcharge applied (I paid $150, IIRC, when I last flew from there). Does anyone know why this might be?

When I visit the UK I almost always book an open jaw and return from somewhere outside the UK. The savings from not paying the APD pay for the positioning flight and hotel night. I see it as an opportunity to visit new places for a day or two. Ironically my return itinerary will often transit through LHR.

Sounds like someone who is content to cut off their nose to spite their face.

The Brits do love to ream travelers. Consider that Heathrow changes £6 for every vehicle dropping off a passenger at a terminal. Glad they're using all of those fees for resilient infrastructure. Oh, wait....

There is absolutely no hope for the inhabitants of this planet whilst the insanity which is U.S. influence persists.

Some countries can dish out the dirt in spade-fulls, however, any adverse comments or retaliation causes the children’s toys to be flung from their prams.

To quote Mason: “What a hypocrisy” …. coming from someone who quite possibly lives in the very country which is reportedly crashing the world economy.

To quote Mason: “What a hypocrisy” …. coming from someone who quite possibly lives in the very country which is reportedly crashing the world economy.

@AeroB13a

Again, your assumption was wrong. How sad.

@Jack

Not everywhere is the USA where major airports are inaccessible or incredibly inconvenient to reach by anything other than private cars. Heathrow has good rail and bus connections last I checked, so a charge for private vehicle dropoffs to reduce traffic congestion seems more than fare. It's still cheaper than paying rail fare for instance, so honestly it should be higher.

Just because the US has the ESTA, the UK doing the same is right?

Two wrongs don't make a right, full stop.

If that's the case, then why would practically the majority of the world be distancing from this?

What a hypocrisy.

Except this isn't like ESTA.

This is UK airport 'resort fee' money extortion.

Mason, do not be surprised that one is about to agree with you.

“What a hypocrisy” (in English it would be ‘an hypocrisy’) however, moving on. Coming from someone who appears to be a U.S. resident, how do you feel about country which is about to crash the world economy?

Is it not hypocritical to criticise another country because they simply follow by example?

@AeroB13a

Sorry, I'm not an American and I don't support Trump. Try again.

Also, what a shame that you don't know English as a Brit.

"A" is used instead of "an" if "h" is pronounced.

How much did you sleep in your English class? You should have a nicer place to sleep.

@Mason,

Thank you. I was just about to correct the English.

The “English” have no need for any corrective action from those who only observe the corrupt American version, thank you.