Promo: If you’re new to InKind, follow this link to get $25 off your first dining experience of $50+

There are all kinds of ways to maximize your return on dining, from using the right credit card, to taking advantage of airline and hotel dining programs. Along those lines, over a year ago I started using an awesome app that can save you money on dining.

Since then, I’ve consistently used this at least once or twice per week for dining out, and have had nothing but great experiences. I can’t believe it took me so long to download this app, so I want to recap my experience, for anyone who may not be familiar with this app.

Long story short, I find this to be significantly more rewarding than your typical airline or hotel dining program, with the caveat that it has a smaller network of restaurants. It’s also super straightforward to use, and has virtually no restrictions in terms of when you can dine, what you can order, etc. I love the simplicity of it. Separately, I also shared my experience using the Seated dining app.

In this post:

What is the InKind dining app?

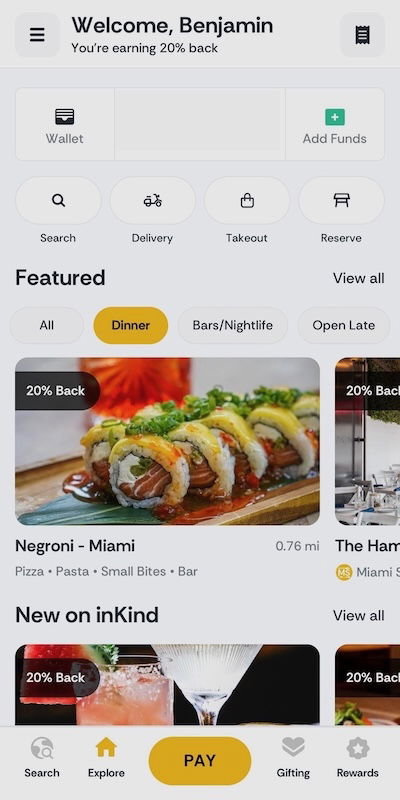

On the most basic level, InKind is a free app that offers a 20% discount (or more) at over 5,500 restaurants around the United States. The participating restaurants are primarily in major cities, from Chicago, to Los Angeles, to Miami, to New York, to San Francisco. So if you live in a smaller market, unfortunately this app probably isn’t for you, unless you’re traveling.

What impresses me about InKind is that the restaurants on the list are actually largely high quality and popular, unlike with many other dining rewards programs, which basically try to incentivize you to eat at crappy restaurants.

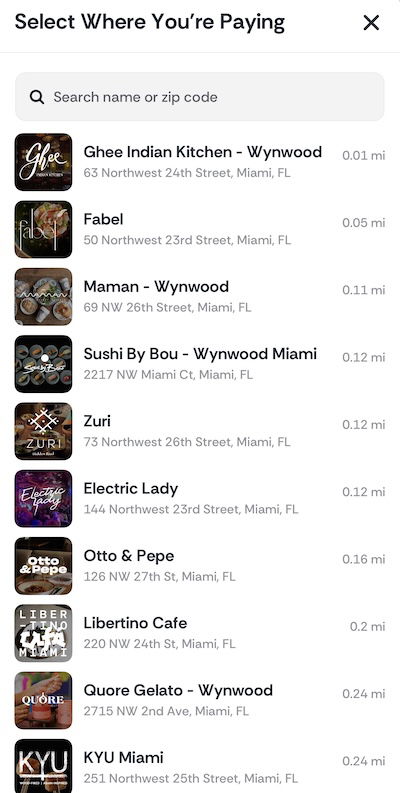

For example, I live in Miami, and several of the restaurants participating on InKind are ones I’d frequent anyway, from Chug’s Diner, to Ghee, to KYU, to Michael’s Genuine, to Otto & Pepe, to Phuc Yea, just to name some. Even some of the more popular “clubby” restaurants are on the list, ranging from Sparrow Italia to Casa Madera.

I also find it interesting that InKind’s business model is different than that of most other dining rewards programs. With most other dining rewards programs, the dining network simply takes a percentage of the bill in exchange for offering guests rewards for using a particular credit card.

InKind, meanwhile, seems to work more closely with restaurants, and has a different business relationship, whereby it provides financing to restaurants. The idea is that ordinarily when private equity firms invest in restaurants, they take a huge stake. Instead, InKind provides capital to restaurants, in exchange for dining credits.

It’s a very interesting business model. Obviously I can’t speak to it from the perspective of a restaurant owner, but I appreciate the concept that InKind is going for. The company isn’t simply skimming a percentage off each transaction under the guise of sending new diners to restaurants, but it’s a closer partnership than that (which is also why the restaurant network is smaller).

How does the InKind dining app save you money?

There are so many ways that the InKind app can save you money for dining at a participating restaurant. At a minimum, you should look at it as receiving 20% off your bill, though potentially you can get a much better return than that. Let me go through each of the ways you can save.

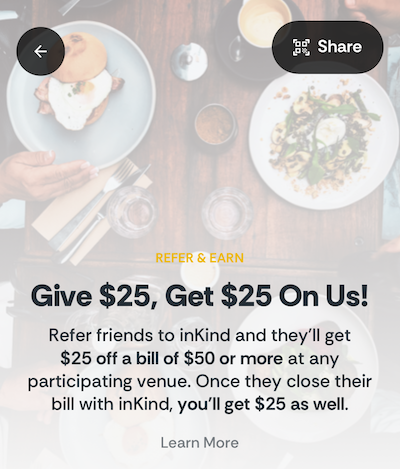

Get a $25 refer a friend credit on your first meal

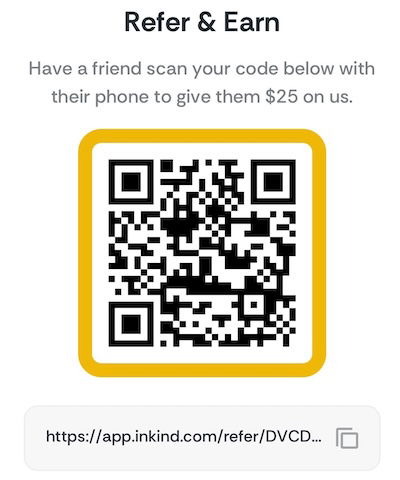

InKind has a refer a friend program. When you’re referred by an existing user, you’ll get $25 off a bill of $50 or more, to use at a participating restaurant. Similarly, the friend who refers you can get a $25 credit as well (or sometimes even more, if there’s a limited time offer).

You can find my refer a friend link here, and others are welcome to leave their link in the comments section as well.

Get 20% off at InKind restaurants

If you’re going to pay with your card linked to your InKind account, then you can always receive 20% off your meal, with no maximum savings. That 20% back comes in the form of credits you can use toward future dining at InKind restaurants.

Note that you don’t receive the 20% back on tips, fees, or portions of the bill covered by discounts or paid with InKind Cash. This credit expires two months after the calendar month in which it’s earned. So if you earn credit on September 15, it would be valid through November 30. The oldest accrued credit is always used first for redemptions.

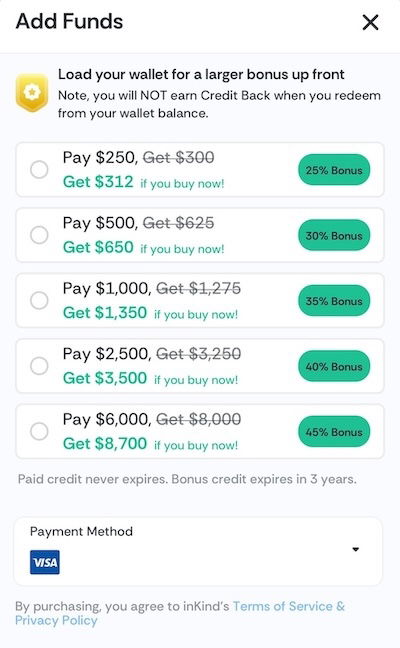

Buy InKind Cash at a discount

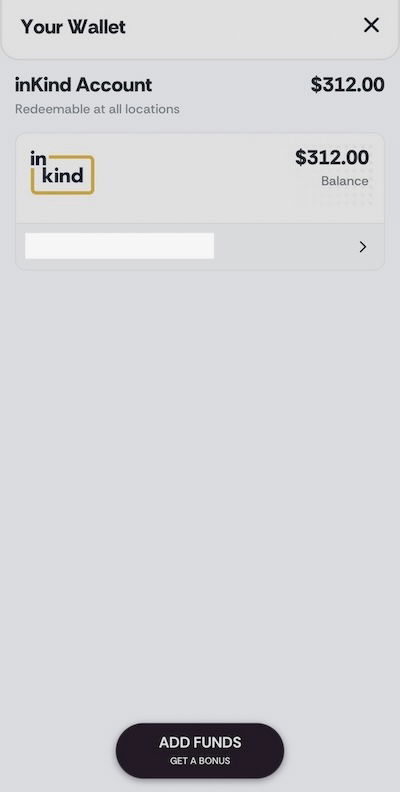

The InKind dining app also lets you purchase InKind Cash at a discount. The exact offers vary over time, but in my account I’ve seen the opportunity to buy a $312 InKind dining credit for $250, or an $8,700 dining credit for $6,000. As you can tell, this offers anywhere from a 25% to 45% bonus.

If you go this route, then you won’t earn the 20% back, but instead you potentially get a larger discount. Of course you should only use this if you frequent restaurants that are part of the InKind network, so I don’t recommend taking advantage of this if you’re just trying out the app.

For example, I decided to buy the $312 credit for $250, since I know I’ll spend that at participating restaurants.

Often there are additional promotions where you can buy credits with an even higher percentage bonus or discount, so keep an eye out for that. The base credit purchased never expires, while the bonus credit purchased this way expires after three years.

Keep an eye out for other InKind promotions & offers

Beyond the above, InKind often has other promotions you can take advantage of, so it’s worth keeping an eye out for those. For example, sometimes there are promotions with Amex Offers and SimplyMiles, which can be stacked with the above.

Furthermore, InKind often emails members with targeted and other limited time promotions. For example, I’ve had offers for an extra 10% back if I make two InKind transactions at the same restaurant within a month, or targeted promotions for larger savings at specific restaurants.

If you go directly to the website of a participating InKind restaurant, you may also see a pop-up offering savings of a certain amount for dining at that restaurant. The catch is that this can’t be combined with the refer a friend offer, so while it can at times be lucrative, it doesn’t offer the same flexibility.

Lastly, Costco often sells InKind credit at a discount. Typically you can buy $100 in InKind credit for $69.99, and sometimes it’s even cheaper than that.

How does the InKind dining app work at restaurants?

All of that sounds great, but what’s it like using the InKind dining app at when you’re actually at the restaurant? Is there confusion from the servers? Do they roll their eyes? Well, that’s what delights me the most about the experience.

When using InKind to pay, you don’t need to make a reservation in any particular way, there are no restrictions on what days or times you can dine, and you don’t even need to let the server know when you’re seated that you’ll be paying with InKind.

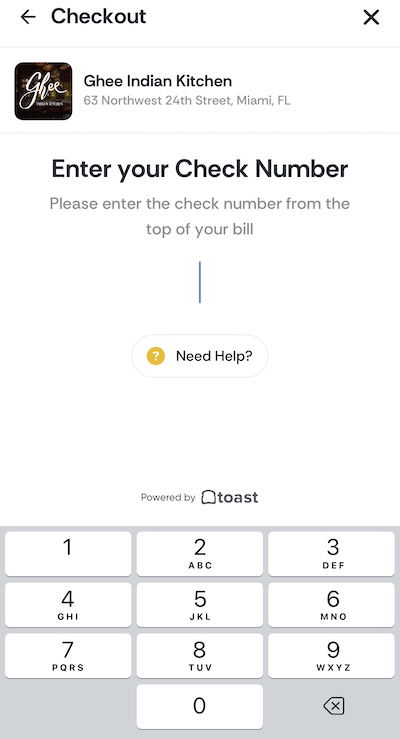

There’s not even any confusion, since you actually pay the bill on your end, without even interacting with the server. That’s because all InKind restaurants use the Toast platform for payments, so it’s all connected pretty nicely on the backend.

For example, one of my most recent InKind meals was at Ghee Indian Kitchen. At the conclusion of the meal, I was presented with a check, so I pulled up Ghee Indian Kitchen on the InKind app…

…and then clicked the “Pay Bill” button.

The app asked to enter the check number, which was clearly visible on the check.

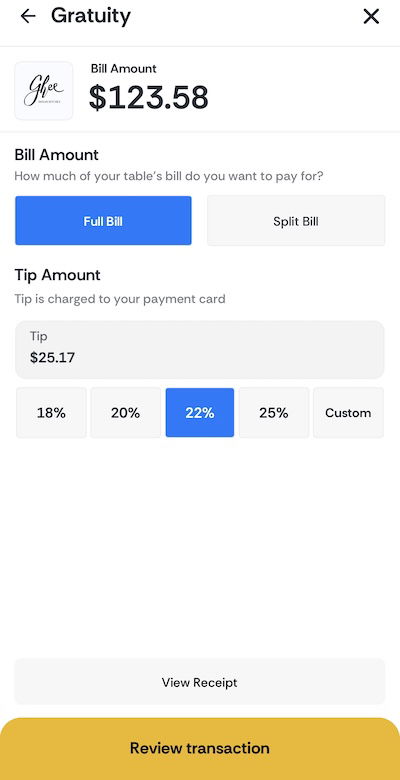

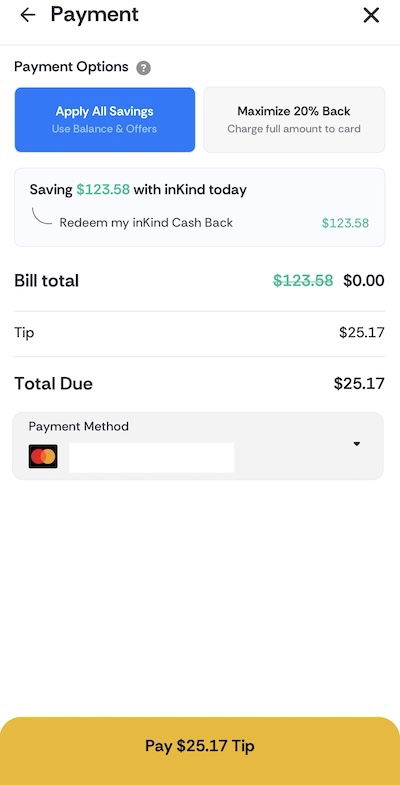

I was then asked how much I wanted to tip. Note that the gratuity will always be charged to your card on file, and will not be taken from any balance you may have.

I had two options for how to pay. I could either use my existing InKind balance (which I acquired with a 35% bonus), or I could pay with my linked credit card, and receive 20% back, in the form of InKind credit.

I competed that all on my phone, and a minute later our server showed up, and said we were all set, without me even having to mention that I paid through InKind. It honestly couldn’t have been more seamless, and that matches every experience I’ve had with InKind.

Since I had purchased the credit for 35% off, I ended up saving around $43 on the $123.58 total. Alternatively, if I had gone for the 20% back, I would’ve received around $25 in credit to use toward a future dining experience.

Which credit card should you use with InKind?

Another great thing about InKind is that all purchases are categorized as dining for the purposes of credit card rewards, based on my experience. So whether you’re paying for your meal with a linked card or buying InKind credits, I’ve always had InKind purchases earn me credit card bonus points for dining.

I recommend using a card that maximizes your return on dining spending, as you don’t have to forgo any credit card rewards by using this program.

Bottom line

I’ve now consistently been using the InKind dining app for well over a year, and it has saved me a lot of money. Personally, I like this a lot more than most of the dining rewards programs out there. While InKind doesn’t have the largest network of restaurants, I find them to overwhelmingly be good quality.

With InKind, you can save at least 20% every time you dine at a participating restaurant. Unlike some other dining programs, there are no restrictions on when you dine, and there are no reservations requirements.

The best part is that you can save way more than 20%, by using a refer a friend link, taking advantage of the additional once monthly savings, and even by buying credits in advance.

If you live in a major city that has restaurants you like that participate in InKind, then using the app is a no-brainer. There are several restaurants on the list that I frequent, so I use this consistently.

If you’ve used the InKind dining app, what was your experience like?

Can you use it for takeout?

Unless you're in a very large place the selection is restaurants is extremely limited. My options are far from home and still not even places I want to eat. Which makes the fact that my local Costco sells gift cards even more amusing. I literally have one coffee shop within 10 miles of my house, no restaurants closer than that. I can appreciate good value coming from them and I'm happy for those who have...

Unless you're in a very large place the selection is restaurants is extremely limited. My options are far from home and still not even places I want to eat. Which makes the fact that my local Costco sells gift cards even more amusing. I literally have one coffee shop within 10 miles of my house, no restaurants closer than that. I can appreciate good value coming from them and I'm happy for those who have a good assortment close to home. But, as others have mentioned, check out their restaurant map before putting any money into this

Overall, I love inKind - good restaurants in their network, super-convenient to use, and fantastic discounts. But two warnings about buying credit directly from inKind (versus buying discounted gift cards from Costco). First, and the biggest problem - I was told by my credit card company (Chase Sapphire Reserve) that when buying credit directly from inKind, it codes as a cash advance, not as a credit transaction. Which means the transaction is subject a number...

Overall, I love inKind - good restaurants in their network, super-convenient to use, and fantastic discounts. But two warnings about buying credit directly from inKind (versus buying discounted gift cards from Costco). First, and the biggest problem - I was told by my credit card company (Chase Sapphire Reserve) that when buying credit directly from inKind, it codes as a cash advance, not as a credit transaction. Which means the transaction is subject a number of additional charges - a high cash advance fee and interest charges that kick in right away (no grace period). Second, even putting aside the cash advance fees, buying the Costco gift card is almost always a better deal. The Costco gift card is quoted as a discount, the inKind offers are quotes as a bonus. For example, an inKind bonus of 40% sounds better than a Costco gift card discount of 35% (the typical discount when Costco runs an inKind promotion, the normal discount is 25%). But for example, getting a 40% bonus when buying $100 from inKind, means you’re getting $140 - mathematically, that translates to a discount of 29% (140/100=71). Between those two factors, you’re always better off buying the Costco gift card. And even if you don’t have Costco membership, given steep cash advance fees, you may be better off just taking the normal inKind 20% discount at the time you dine instead of buying inKind credit.

Does it work for takeout?

Fortunately, their website lets you see participating restaurants. They have places I'll never go (CA Pizza Kitchen), a local casual chain that's decent at fair prices (that I haven't been to in at least 5 years), and a bunch of properties that cost 50% more for the same food as places with lesser egos. That is, of course, based on my tastes and relates to the only two dozen locations in my 2+ million SMSA.

We've saved a bunch using InKind. 37x in 13 months. Even all the California Pizza Kitchens are on it and there's some awesome restaurants in many cities, including a bunch of Jose Andres' restaurants.

Here's our link. We'd love it if you'd use it to get your free $25 and we get a bonus too. Win win for us both.

https://app.inkind.com/refer/DFNXTTC4

I regretted it after Buying it for a few months (It looked almost as Bad as "Open Tables" By Chase) But now they seem to have added a lot of new restaurants and have decided to Buy more at Costco.

Costco sells inKind gift cards routine for $75 for $100. Occasionally they have a promo and sell $65 for $100.

I use it often and...

"There’s not even any confusion, since you actually pay the bill on your end, without even interacting with the server. That’s because all InKind restaurants use the Toast platform for payments, so it’s all connected pretty nicely on the backend"

This hasn't been my experience at all.

Some places have a QR code on the paper bill.

Others require you enter the check number.

Others require you enter the total.

...I use it often and...

"There’s not even any confusion, since you actually pay the bill on your end, without even interacting with the server. That’s because all InKind restaurants use the Toast platform for payments, so it’s all connected pretty nicely on the backend"

This hasn't been my experience at all.

Some places have a QR code on the paper bill.

Others require you enter the check number.

Others require you enter the total.

Last week the server asked to take a photo of my phone showing I paid because their system didn't show it

Looks dope but I've already got fatigue from all the tools I use at the office, not sure I need the same vibes from my leisure time needing too many tools as well

The problem with InKind in my experience is using the Toast platform. Too often when you ask for the check the waiter just reads their kiosk and gives you a verbal amount owed. When you ask if you can get a check, they show you their handheld device with a total on it, and then stand over your shoulder as you enter a tip. And although you can customize that, some restaurants start the suggested...

The problem with InKind in my experience is using the Toast platform. Too often when you ask for the check the waiter just reads their kiosk and gives you a verbal amount owed. When you ask if you can get a check, they show you their handheld device with a total on it, and then stand over your shoulder as you enter a tip. And although you can customize that, some restaurants start the suggested tip amount at 22%. When you tell them you need a paper ticket so you can expense the meal, they roll their eyes and take their time getting back to you. Occasionally you'll get someone nice who doesn't mind printing a check for you, but in my experience that's in the minority.

Buy credit from Costco for a discount - https://www.costco.com/p/-/inkind-one-egift-card-thousands-of-restaurants-100-value/4000233859?langId=-1

And stack with this $25 off $50 offer by signing up using my referral: https://app.inkind.com/refer/Y63PURGE

Thanks

Very city specific. Great in NYC, poor in NYC.

You're not saving anything if you go more often.

Credit card rewards from spending on groceries, gas, childcare etc is real money back in your pocket because those were purchases you would of made anyways.

Going to a restaurant because you got a $25 off $50 coupon is a straight $25 loss.

Because you otherwise wouldn’t eat at all that night? Check your math. Food isn’t free, no matter where you get it or who prepares it.

And nice to sometimes pick a more expensive restaurant (knowing 35% off with Costco).

Just signed up, quite a few restaurants in there that I frequently go to. Thanks Ben!

Sorry it had to come to this.

E tu, Brutus?

I have used this app before and it blows every single one of it's competitors outta the water. Don't knock it until you try it, you brute.