Link: Learn more about the World of Hyatt Business Credit Card

The World of Hyatt Business Credit Card (review) is Hyatt’s small business credit card, complementing the World of Hyatt Credit Card (review). There are major differences between the cards, and if you ask me, there’s potentially merit to having both of the cards.

Often business credit card applications can be a bit more intimidating than personal card applications, so in this post I wanted to go over the application process for this card.

In this post:

Hyatt Business Card application restrictions

If you’re considering applying for the World of Hyatt Business Credit Card, let’s cover a few of the application and approval restrictions to consider:

- You’re eligible for this card (including the bonus) as long as you don’t currently have the card, and haven’t received a new cardmember bonus on this exact card in the past 24 months

- You’re eligible for this card (including the bonus) even if you already have the World of Hyatt Credit Card, which is the personal version of the card

- Chase has what’s known as the 5/24 rule, whereby you may not be approved if five or more new cards show up on your personal credit report in the past 24 months; however, this no longer seems to be totally consistently enforced, so it’s a “your mileage may vary” situation

- There’s merit to applying for Chase business cards before Chase personal cards, as applying for a Chase business card won’t count as an additional product toward the 5/24 limit

- With Chase, you’re generally best off not applying for more than two cards in a 30-day period (including at most one business card), but it should be possible to pick up this card plus a personal card in that timeframe

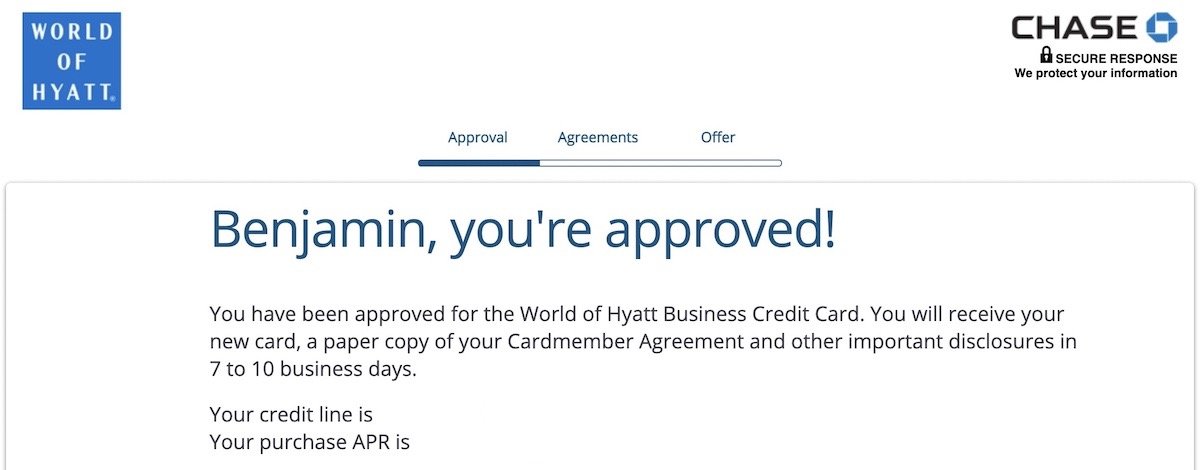

My Hyatt Business Card approval experience

I actually applied for the World of Hyatt Business Credit Card back in late 2021, when the card was first launched. However, practically speaking, the process hasn’t changed.

Back when I applied, I received an instant approval on the card, even though I had three other Chase business cards. I’ve heard a fair number of reports of people getting instant approval on this card, even when they may not get that on other Chase business cards.

Often the underwriting standards are different between products, and at least anecdotally, this seems to be one of the easier Chase business cards to get approved for.

Keep in mind that you can also apply for this card as a sole proprietorship, so you don’t need a corporation. In those cases, you can just put your social security number, use your name as your business name, and include your home address and phone number as your sole proprietorship information. You should always answer card applications truthfully.

Should you apply for the Hyatt Business Card?

The World of Hyatt Business Card has a $199 annual fee, and offers a big welcome bonus. The card provides a variety of benefits, including the following:

- World of Hyatt Discoverist status for as long as you have the card, plus the same status for up to five employees

- Five elite qualifying nights for every $10,000 spent on the card in a calendar year, with no limit

- Up to $100 in Hyatt credits annually, where when you spend $50 or more you’ll receive a $50 statement credit, up to two times; this is based on the anniversary year, and not the calendar year

- A 10% rebate on redeemed points, up to 20,000 points per year; you only unlock this if you spend $50,000 on the card in a calendar year, and the benefit applies for the remainder of the calendar year in which you complete the spending

- 4x points on Hyatt spending, 2x points in your top three spending categories from select options each quarter, and 1x points on all other eligible purchases

I think there’s merit to applying for this card for the great bonus and because you want to spend your way to World of Hyatt elite status. However, if your goal is simply to rack up World of Hyatt points, then I think there might be a better option.

There’s the excellent collection of Chase Ink Business cards, including the Ink Business Preferred® Credit Card (review), Ink Business Cash® Credit Card (review), and Ink Business Unlimited® Credit Card (review). If you’re simply trying to rack up as many points as possible, then I think applying for these cards could make more sense, as they potentially have a better overall value proposition.

For example, the $95 annual fee Ink Business Preferred® Credit Card is the biggest no-brainer in the collection. The card has a phenomenal welcome bonus, great bonus categories, cell phone protection, and gets you access to the overall Chase Ultimate Rewards ecosystem.

The other thing is that Chase Ink Business cards have even less restrictive eligibility requirements, as there’s not even a 24-month rule, meaning lots of people should be able to get approved.

Bottom line

The World of Hyatt Business Credit Card is Hyatt’s business card, and it offers a great bonus, plus the ability to spend your way toward status at a good rate. If you’re eligible for the card, it could definitely be worth applying.

The only thing I’d note is that if it’s simply World of Hyatt (or Chase Ultimate Rewards) points that you’re after, another strategy could be to instead pick up Chase Ink Business cards, like the Ink Business Preferred® Credit Card.

If you’ve applied for the World of Hyatt Business Card, what was your experience like?

The Hyatt biz has the same strict underwriting standards that have recently been put in place for Inks as of late 2024. I just got denied for this card with the reasons “too many requests for credit” and “insufficient business revenue” with 3 other Inks open. All of my other Inks were instant approvals, the last one in June 2024.

How many inquiries are you at?

Hi Ben - just so I'm understanding...you still have the 1st card you applied/approved for, and applied for a 2nd card and was approved? Or did you cancel the card in 2022 and reapply?

My understanding is that he applied in 2021 and is writing this post in 2025. Nothing in between.