Link: Learn more about the Hilton Honors American Express Aspire Card

The Hilton Honors American Express Aspire Card (review) is one of the most valuable hotel credit cards out there, thanks to all the great perks the card offers.

While the card has a steep $550 annual fee (Rates & Fees), I find that to be easy to justify, thanks to benefits like Hilton Honors™ Diamond Status, an annual free night reward, a $400 annual hotel credit (Get up to $200 in statement credits semi-annually for eligible purchases made directly with participating Hilton Resorts), a $200 annual flight credit (Get up to $50 in statement credits each quarter, for a total of up to $200 back each year, on flight purchases made directly with an airline or through AmexTravel.com), and more. The card also consistently has a good welcome offer.

In this post, I want to take a closer look at how the card’s $200 annual flight credit works. While this benefit (annoyingly) has to be used quarterly, I find it quite easy to use, so let’s cover the details.

In this post:

Details of the Hilton Aspire Card $200 flight credit

The Hilton Aspire Card offers up to $200 in flight statement credits every calendar year, in the form of a $50 quarterly credit. As you’d expect, there are some terms to be aware of:

- The $200 credit is broken down into a $50 quarterly credit, so you can use one in January through March, one in April through June, one in July through September, and one in October through December

- The credit applies toward airfare purchases made directly with an airline, or through amextravel.com

- To be eligible for the benefit, the airfare purchase must be for a scheduled flight on a passenger carrier

- The credit can’t be applied toward ticket change or cancelation fees, or flight purchases made through third parties

- It can take 8-12 weeks after an eligible purchase for the statement credit to post, though in practice they’ll typically post faster than that

- Eligible purchases can be made by either the basic card member or an authorized user, though you still only get a total of up to $200 in credits per year

- There’s no registration required to take advantage of this, as long as you make the correct eligible purchases with the card

How I use the Hilton Aspire Card up to $200 flight credit

The Amex airline fee credit (Enrollment required) on products like American Express Platinum Card® (review) can be difficult to use, given that it specifically excludes airfare, and only applies to airline fees, which many of us don’t spend much on. By comparison, the credit on the Hilton Aspire Card is awesome, as it’s specifically valid for airfare.

Now, the catch is that I try to maximize my points on airfare purchases, so I don’t just want to purchase all my airfare on the Hilton Aspire Card. So, what’s my strategy? Well, each quarter, I just book a very cheap ticket (of at least $50) with the Hilton Aspire Card, and then I receive the $50 quarterly credit.

With airlines nowadays not having change fees (at least for non-basic economy tickets, in most situations), I can also always cancel that ticket and then bank it as a credit toward another ticket that I’d book. Since I fly American most, that’s the airline with which I end up using the credit.

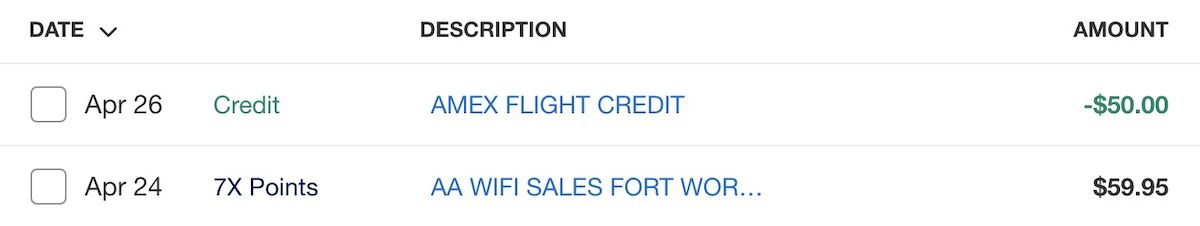

By the way, it wasn’t my intention, but I’ll share another way I’ve used this credit. I have my the Hilton Aspire Card attached to my American AAdvantage profile (since I book a ticket with the Hilton Aspire at least once per quarter).

I accidentally started billing my monthly Wi-Fi subscription for American to the card, and noticed that also got reimbursed under the flight credit. I can’t guarantee that will work for everyone, but that’s good to know as well.

Obviously in an ideal world, this credit wouldn’t have to be redeemed quarterly, but then again, we’re pretty used to Amex credits being broken up.

To me, this is one of the perks that helps justify the $550 annual fee on the card. The way I view it, the Hilton resort credit and flight credit helps to offset most of the annual fee, while the annual free night reward and Hilton Diamond elite status are what truly make this card special, and what offer outsized value.

Bottom line

The Hilton Aspire Card offers many valuable benefits, and among those is a $200 annual flight credit. This is a quarterly credit, so you get up to a $50 statement credit every three months that can be applied toward an eligible flight purchase.

I just end up putting a cheap flight purchase onto this card once per quarter. Ideally it’s for a flight I actually take, though otherwise I just buy a ticket with some flexibility (which most tickets have nowadays), and then I can always bank the credit toward another flight.

What has your experience been with using the Hilton Aspire Card $200 flight credit?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: Hilton Honors American Express Aspire Card (Rates & Fees).

7x airfare on Aspire isn’t exactly horrible, in & of, itself - not losing a terrible amt (any really?!) in opportunity cost by organically using this card for a flight without going thru gift card etc gyrations

Hilton Aspire Card $200 United Travel Bank credit. 'Nuff said.

Or any airline gift card.

Didn't realize that, better than travel bank. Thanks!