For the first time in years, I got outright denied for a credit card…

In this post:

Why I applied for the Citi AAdvantage Platinum Card

At the moment the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® (review) is offering a welcome bonus of 50,000 AAdvantage miles after spending $2,500 within three months. Given all the great uses of AAdvantage miles, I value those miles at 1.5 cents each, making the bonus worth $750.

There are several reasons the card can be worth getting, including the ability to spend your way to elite status, given how American’s Loyalty Points system works.

Best of all, many people should be eligible for this card, given the non-restrictive eligibility requirements on co-branded AAdvantage cards. You’re eligible for this card as long as you haven’t received a new cardmember bonus on this exact card in the past 48 months — it’s fine if you have or have had other Citi or Barclays AAdvantage products.

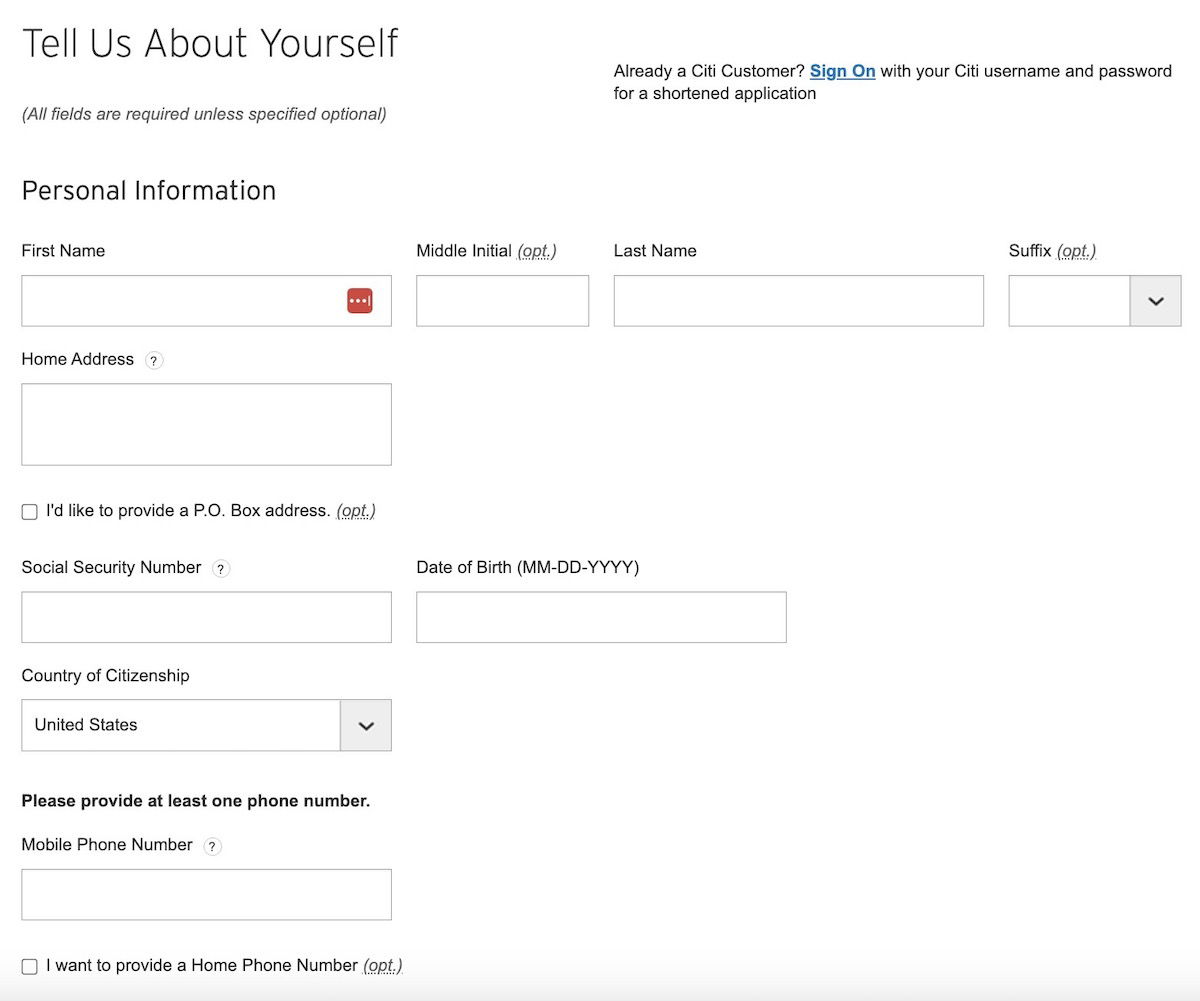

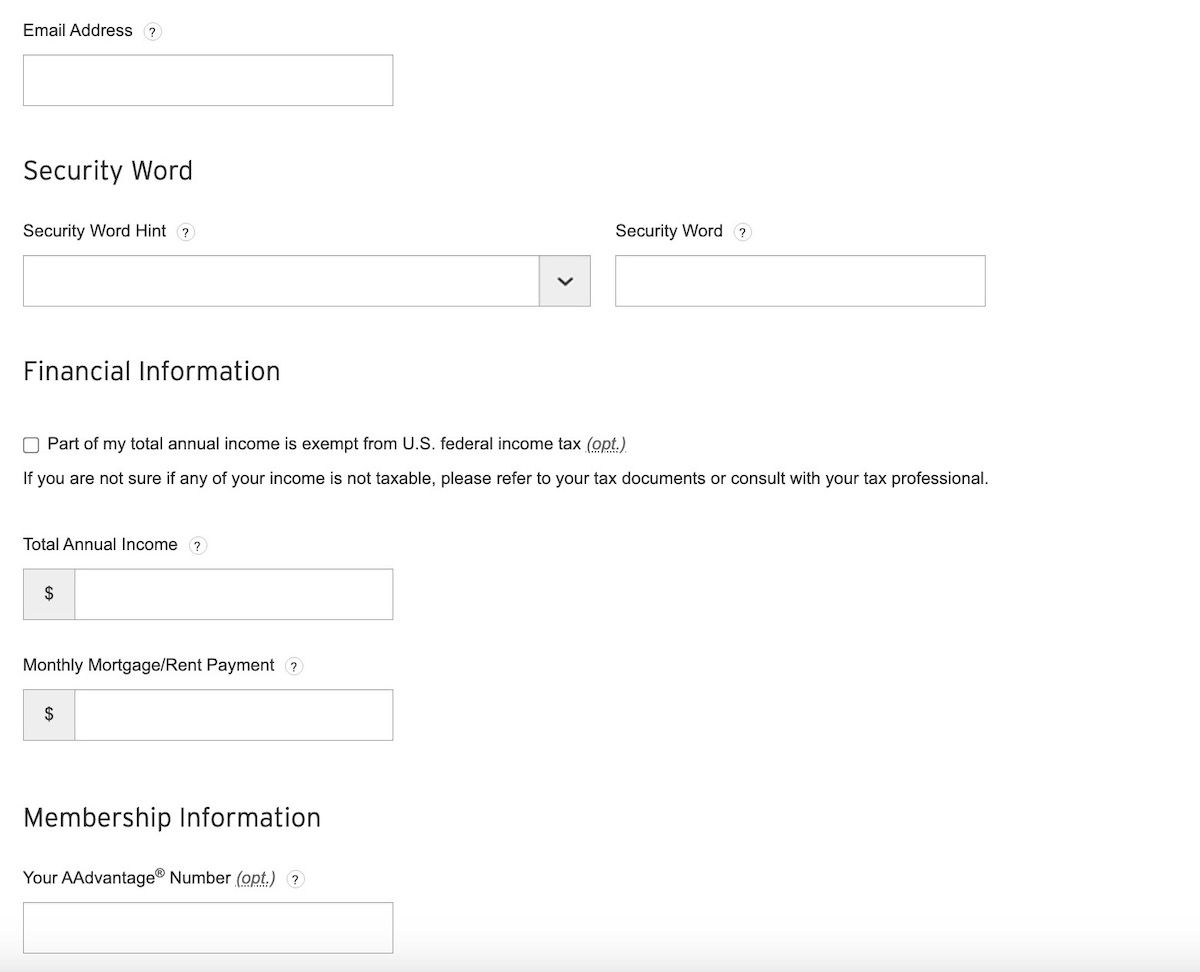

The Citi AAdvantage Platinum Card application process

The good news is that the Citi AAdvantage Platinum Card application process is pretty straightforward. Citi has among the shortest credit card application processes, and there’s a single page of information you have to provide, including your name, address, social security number, date of birth, income, rent or mortgage payment, and AAdvantage number.

This took me all of 60 seconds to complete, so applications don’t get much easier than that.

As a reminder, Citi has fairly few consistent restrictions when it comes to card approvals. There are two main things to be aware of:

- You can be approved for at most one Citi card every eight days, and at most two Citi credit cards every 65 days

- You can only earn the bonus on a Citi AAdvantage Card if you haven’t earned a bonus on that exact card in the past 48 months

My Citi AAdvantage Platinum Card denial

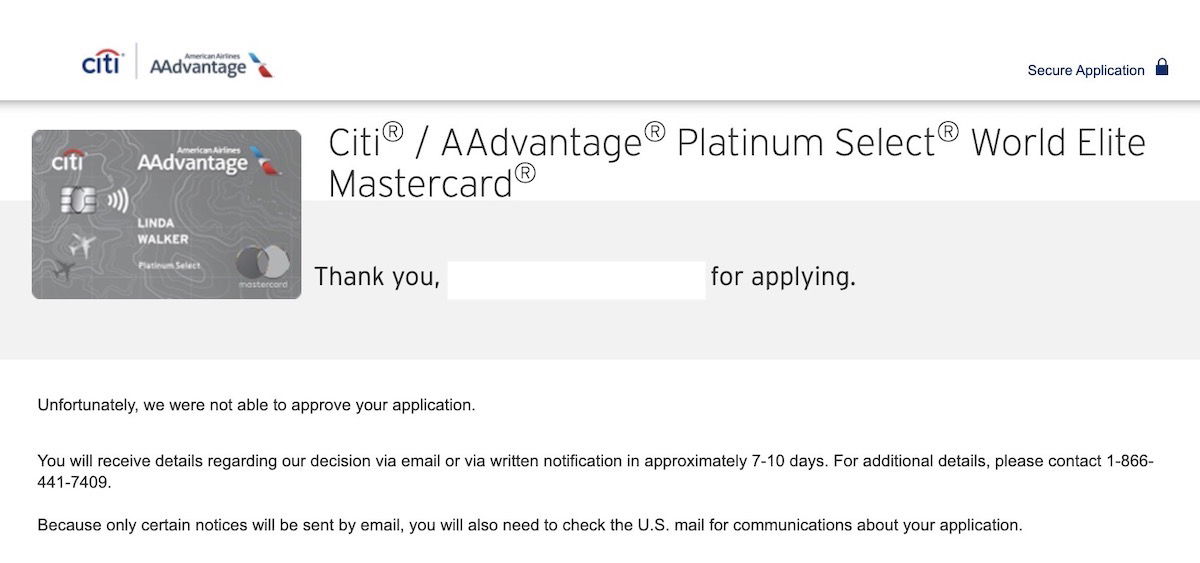

Applying for the Citi AAdvantage Platinum Card was quick… and so was my denial. Once my application was submitted, I didn’t receive a message stating that I had been approved, or that Citi would need more time to process my application… rather I received an instant denial.

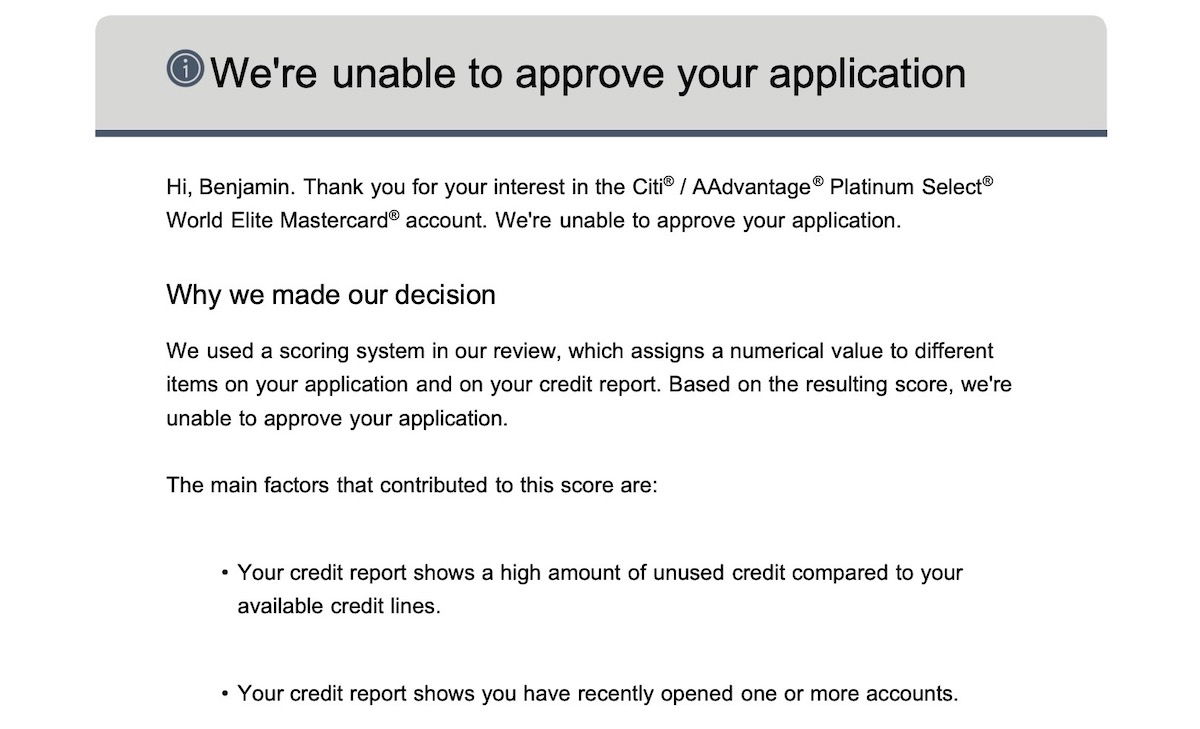

Shortly after this, I received an email containing the reasons my application wasn’t approved. This letter explained that Citi uses a scoring system when deciding whether to approve people, and I was denied for two reasons:

- My credit report shows a high amount of unused credit compared to my available credit lines

- My credit report shows that I recently opened one or more new accounts

I don’t remember the last time that I was denied for a credit card, let alone that I was instantly rejected for a card, so I was caught off guard a bit by this decision.

My take on my Citi credit card rejection

Credit card issuers all have some quirks when it comes to approving people for cards. Seemingly with no rhyme or reason, people with high credit scores and pretty good incomes are sometimes getting rejected for some cards.

Specific to my rejection on the Citi AAdvantage Platinum Card, I think the two reasons provided are interesting:

- It’s unusual to get rejected for having a low credit utilization, since low credit utilization is a major factor that contributes toward a great credit score, since it shows you can use your cards responsibly

- Yes, I have “recently” applied for “one or more accounts,” though that’s not very specific, and I wonder what the actual cutoff is for Citi

I suppose it’s logical enough, but Citi is seemingly targeting consumers that they think will be most profitable, rather than consumers who are necessarily most credit worthy. Of course card issuers make money when consumers finance charges, I’d imagine that Citi is assuming that those with higher credit utilizations are more likely to be financing charges.

I have no regrets applying for the card. You win some and you lose some, and a vast majority of the time I do pretty okay with my credit card acquisitions. 😉 A credit card denial has a limited impact on your credit score, so an inquiry isn’t something that I even consider when decided whether to apply for a card.

Bottom line

The Citi AAdvantage Platinum Card has a nice welcome bonus. My credit score is near perfect and I almost always get approved for cards, but that wasn’t the case here.

I was instantly denied for the card, apparently partly because I have a lot of unused credit. While that contributes to a great credit score, it worked against me here. I have no regrets applying for the card, and while I wish I had been approved, this is at least an interesting data point, and something new for me.

Hopefully others applying for the card have better luck!

If you’ve applied for this card recently, what was your experience like? Has anyone else been denied for having too low of a credit utilization?

Instantly denied today, my credit score is 833 and I have only applied for 1 card in the last 3 years. My house is paid for and I put $0 for my mortgage/rent payment. I wonder if that had something to do with it. I guess I will have to wait for the letter.

I had the same rejection instantly with first telling me to unfreeze my experian account (which was a daunting task) after doing that I applied again and rejected again with no message just a letter coming . I have the same financial status as you with credit score and $0 mortgage. What a waste of time. I guess Ill just stick with my Delta and United CC...

I had a similar experience when applying for the Citi Premier card. I got denied and one of the reasons was bizarre. They said my mortgage wasn't paid off enough basically. Also, too many inquiries. I called for reconsideration, mentioning my high credit score and they pulled out the "we have our own internal scoring system". I didn't give up easily as I had been putting a lot of spend on the Citi Double cash...

I had a similar experience when applying for the Citi Premier card. I got denied and one of the reasons was bizarre. They said my mortgage wasn't paid off enough basically. Also, too many inquiries. I called for reconsideration, mentioning my high credit score and they pulled out the "we have our own internal scoring system". I didn't give up easily as I had been putting a lot of spend on the Citi Double cash in order to build up my thanks you points but that didn't seem to matter to them. They invited me to reapply in the future and I think I will in a couple of months. A couple of my credit card inquiries will fall off my credit report by then but if they deny me again, I will be through with them for a long time.

My husband got the exact same denial letter. He’s mostly opened business cards in the last 6 months. Pretty bummed we missed out on the 75k bonus

I just applied today and got the same answer as Ben for exactly the same motives with a credit score above 800 (I called the reconsideration line). I accept the argument of detecting churners, but not the risk factor when you look at income and other credit history information. If anyone else has some insight, would love to hear about it.

Immediate denial for low utilization of available credit. Credit 830+, four open Citi personal cards that I use regularly, applied for and received AAdvantage business card eleven days prior to personal application. Had and closed both business and personal versions at a year five years ago. Called Recon and they said there was nothing they could do. Like others I use my cards extensively and pay off balances before they become due.

This might be kind of long, but I have some data points. Before I applied, I had gone over 30% credit utilization on my WOH card. I had only request for 5K credit taken from another Chase Card. So the 3K spend for the Hyatt 5 point bonus kicked me over 30% ONLY ON MY HYATT card. My credit score immediately plunged by 30 points to about 800!!

I then got declined by USBank...

This might be kind of long, but I have some data points. Before I applied, I had gone over 30% credit utilization on my WOH card. I had only request for 5K credit taken from another Chase Card. So the 3K spend for the Hyatt 5 point bonus kicked me over 30% ONLY ON MY HYATT card. My credit score immediately plunged by 30 points to about 800!!

I then got declined by USBank for their SAVINGS Bonus account, saying they couldn’t verify my identity. Then I got declined by Alaska. Then I discovered that Equifax had changed my BD from December 1st to December 31! I was afraid I was going to get declined by Bank Bank for SAVINGS too! But I wanted to take 100K out of the Milage Program at Bask to move to Savings. I was so frustrated. I really wanted more AA miles, and I thought “What the He**, my account is already screwed up. I don’t care at this point.”

So… I used Ben’s link to apply for the Citi AA card. There is a link in the app that asks if you already have a Citi Card, and since I did, I thought that might help. I applied through Citi (sorry Ben!) and fully expected to be declined. I was immediately approved!! I then opened a Savings and CD at Bask.

Was anyone able to actually call and be successful with reconsideration?

Also was denied for exact same reasons unfortunately.

It could be you have too many cards open with high amounts of available credit. The thought is if you then max all of your cards you could not repay them. Close cards you don’t use.

my last 3 apps with Citi have been like that. I gave up. There are other banks.

Keep in mind, if your FICO score is less than stellar the bank can make up for your “increased default risk” through higher interest rates. On the other hand, if you have lots of cards that you rarely use, there’s little the bank can do to actually turn you into a profitable customer.

Does anyone know any data points on the Citi AA Business credit card? Is Citi as unpredictable for the Business cards as well? All the various bank 'rules' I see are for consumer cards - haven't seen anything for business.

You should have called and spoke with a representative about you being denied. There's numerous occasions when they will review your concerns and approve the application.

My reconsideration call was not successful

This is actually a huge problem.

I also applied for this card. Also denied. Also have a credit score of 800+ and, like others who read this blog or those who follow advice from places like CreditKarma, pay off my credit cards before the end of the billing cycle.

What Citi does here is misinterpret the data given to them by the credit bureau (Equifax). They see month-over-month low credit utilization and defer from that...

This is actually a huge problem.

I also applied for this card. Also denied. Also have a credit score of 800+ and, like others who read this blog or those who follow advice from places like CreditKarma, pay off my credit cards before the end of the billing cycle.

What Citi does here is misinterpret the data given to them by the credit bureau (Equifax). They see month-over-month low credit utilization and defer from that the customer must not use the cards.

As in other people's cases, this is completely wrong in my case. The denial is based on this false assumption of "low utilization = unused credit,” and the further assumption of " unused credit = this customer only applies for the bonus of the card."

The issue at stake here is Citi using its own algorithm to calculate eligibility for the card. The current calculation generates false assumptions and produces denials based on these false assumptions and misinterpret of the credit bureau data.

To everyone impacted by this who thinks they were wrongfully denied based on this misinterpretation of their credit history: I would urge you to call Citi's Credit Card Application reconsideration line and explain the situation to a Supervisor (anyone you first speak to when you call is not authorized to do anything other than read out the denial reasons to you.)

Make the supervisors aware of the issue and explain to them that this is a false assumption made by Citi, resulting in a wrongful denial of your application.

This is clearly a Citi issue, but they will want to point to the credit bureaus for this, don't let them fool you. They are using "snapshot" data from the end of the billing cycles reported to the credit bureaus, but more importantly, they wrongly interpret that data for many of us, including Lucky.

I believe the more noise we can create, the higher the chances are that someone at Citi will hear and fix the broken system they attempted to implement.

I called three times, three different people, including a manager. I also told them I have a two decade credit history and I usually do not close accounts; of course I have lots of credit available.

Could you comment on the annual fee and the benefits of this card?

It is not good to get a new card just for the welcome bonus.

Same here. I called them, no luck. I doubt is mainly "churners". I was succesful with AMEX and Chase before under these kinds of circumstances. I even explained that my utilization on Barclays AA is more than 50% and this is how I mainly got the AA Gold and I will be using this card for the same reason. I was talking to a wall, kept on repeating it is the system and they can't...

Same here. I called them, no luck. I doubt is mainly "churners". I was succesful with AMEX and Chase before under these kinds of circumstances. I even explained that my utilization on Barclays AA is more than 50% and this is how I mainly got the AA Gold and I will be using this card for the same reason. I was talking to a wall, kept on repeating it is the system and they can't override; they just don't care. I was also told them than I barely use Citi Premier because Chase has been flooding their cards with 5x, 7x or 10x points for the last year and a half....

I had a similar experience with Citi. Exact same process and message like you, Ben, but it was for the Citi Costco Anywhere Visa. I did get approved some time before that denial for the Advantage Platinum World Elite Mastercard within seconds. My credit usage rate was at the time of denial around 10-12% I believe. I thought this must have been a joke. And with the Costco Visa, theres no real sign up bonus,...

I had a similar experience with Citi. Exact same process and message like you, Ben, but it was for the Citi Costco Anywhere Visa. I did get approved some time before that denial for the Advantage Platinum World Elite Mastercard within seconds. My credit usage rate was at the time of denial around 10-12% I believe. I thought this must have been a joke. And with the Costco Visa, theres no real sign up bonus, so the denial cant be to discourage hunting for signup bonuses.

When does the current 75k promo end? I seem to remember that it is the end of May, but do not remember the exact date.

I'm worried I'll be labeled a churner and get denied when the new strata cards come out. But I have a history of Citi offers in the mailbox, so they must think I'm a good customer. I'm still kicking myself for not accepting the Prestige offer they sent right before they closed applications.

Inquiries are the issue most likely. If you have opened some cards in the last 2 years, your credit report shows the inquiries - even if a card is not opened or credit line increased. From my viewpoint, many inquiries + low utilization shows that you are after the SUB. And yes, you better use those Citi cards long before you apply. My personal credit report has inquiries from Chase for Business cards - they...

Inquiries are the issue most likely. If you have opened some cards in the last 2 years, your credit report shows the inquiries - even if a card is not opened or credit line increased. From my viewpoint, many inquiries + low utilization shows that you are after the SUB. And yes, you better use those Citi cards long before you apply. My personal credit report has inquiries from Chase for Business cards - they may not count for 5/24 but the inquiries are listed by Experian, etc.

When the economy is uncertain, and on verge of a recession, banks get very nervous about large amounts of unused credit. If unemployment numbers rise, banks often don’t become aware of customers inability to pay their balances until it’s too late, if they have lots of outstanding credit. So it’s not surprising that all of a sudden Citi is citing this as a concern for so many people.

Exactly. The actual consideration for Citi may well be aggregate limit less peak monthly balance across all cards: there's a limit to how much risk they'll take that your circumstances change and you suddenly need all that credit.

Having another relationship with Citi, like opening a checking account into which you have a regular deposit made might loosen their risk sensitivity: the deposits stopping give them a shot at slashing exposure before you blow out.

...Exactly. The actual consideration for Citi may well be aggregate limit less peak monthly balance across all cards: there's a limit to how much risk they'll take that your circumstances change and you suddenly need all that credit.

Having another relationship with Citi, like opening a checking account into which you have a regular deposit made might loosen their risk sensitivity: the deposits stopping give them a shot at slashing exposure before you blow out.

Paying off the balance in full before the statement date (which you've written about, and note that I'm not saying "before the due date") also means they can't package the balance into a receivable security, which is the main reason credit card issuers want high-score cardholders.

@Grant

@Levi

Isn't that the whole point of having a credit scoring system. To evaluate risk profile.

Then based on this a simple fix should be punishing people with both low and high utilization.

Otherwise the FICO and Fair Credit Reporting Act is just a big scheme to benefit large financial institute, allowing them to charge higher interests while indirectly discriminating low income people.

Also, if credit exposure is their concern, why not...

@Grant

@Levi

Isn't that the whole point of having a credit scoring system. To evaluate risk profile.

Then based on this a simple fix should be punishing people with both low and high utilization.

Otherwise the FICO and Fair Credit Reporting Act is just a big scheme to benefit large financial institute, allowing them to charge higher interests while indirectly discriminating low income people.

Also, if credit exposure is their concern, why not reconsider allowing applicants to shift credit between cards.

Occam's razor says Citi is cracking down on churners. All the excuse given is BS.

Why not try to recon?

I don't think its unused credit. I recently was approved for that same card and I don't use much of my credit either. My suspicion is you have opened a number of cards and citi doesn't like that. In the past six months leading up to my app I opened a total of three cards. One citibank business card and 2 personal chase cards. The citibank card was opened like six months ago or maybe...

I don't think its unused credit. I recently was approved for that same card and I don't use much of my credit either. My suspicion is you have opened a number of cards and citi doesn't like that. In the past six months leading up to my app I opened a total of three cards. One citibank business card and 2 personal chase cards. The citibank card was opened like six months ago or maybe just over. The other two cards were much more recent one like three or four months ago and the other one like a month ago. At the time of the app I was 5/24 I got an instant approval.

Got approved for $25k+ CL with EXP score of 805. I churn quite a bit but also put organic spend on all three of my Citi cards.

I received an invitation last June from Citi with a 75k bonus for $3,500 spend. Approved on the spot and have used the card quite a lot. Also, fly monthly from Central America to Miami always on AA.

Was also denied for the same reasons however I called tge reconsider line an after a few days received an email with approval. Credit Score over 830. 3 cards opened in the last year. Utilization under 1%.

How did you convince them?

I was denied for a below $100 Capital One card.

First in all my life.

Reason was my loan history.

I have a Capital One One card which I used in the month before my application heavely +15K per month.

I never had a loan in all my life in the US 820+ credit score +400K income and very low usage as I pay all my cards 3 times a week.

I was denied for a below $100 Capital One card.

First in all my life.

Reason was my loan history.

I have a Capital One One card which I used in the month before my application heavely +15K per month.

I never had a loan in all my life in the US 820+ credit score +400K income and very low usage as I pay all my cards 3 times a week.

I called all credit agencies to find out what the loan history was all about.

They all had no loan history on file and when I asked them, what could be the reason for Capital One denial they all told me, because of my low usage Capital One can not make any money of me in form of interest etc.

WOW - so citi guts its cards of all travel protections and most benefits and then realizes people don't actually use their cards, so their strategy is then to ding people with who use credit responsibly. They want the folx who do not know anything and just think WOW if I use this card I get miles so ill just use this card all the time and carry a balance and its ok because I get points. VS having a reason for people to actually buy plane tickets on an AA card

I was denied by Citi for the Premier card about 6 months ago. Same reason: recent applications (my previous application…to another bank…was 6 months prior).

As a result, I stopped using my Double Cash in favor of the Capital One Venture X and Amex Blue Business, both of which earn more on all purchases.

I'm all about vindictive punishment, but how does Venture X earn more on all purchases than Double Cash? 2X is 2X, right?

Venture X is also 2X.

So Glad I didn’t apply for this card. Not a great long term card except waived bag fee flying with AA. I applied for Citi Custom Cash instead and got approved instantly. Good to know high scores and income doesn’t guarantee approvals anymore. Was denied for the CX1 Venture x last week.

This same thing happened to me when applying to the Citi Premier Card in 2022. I got the exact same reasons for denial and was kind of shocked in the moment. Glad to know I’m not the only one!!

I applied last week and was approved. Credit score is over 800 & low credit utilization. Why did I get approved? I haven't churned a card in a few years.

It's pretty obvious they are looking for card churners and turning them down. As the article states, the bonus is considered worth over $1,000. Why would Citi want to give that out to people who are likely to run away? They've finally smartened up.

In the past six months I have picked up three new cards (one was a citi business card) and was at 5/24 and was instant approved. I do wonder if maybe some of the inqs didn't show up on the report on the report they pulled.

I was denied for the same exact reason :(

Got denied for the same reason… oh well!

Citi has wised up to our little games. Capital One already too. We'll see about Chase and Amex. Is the gig up? All good things eventually come to an end.

Confirmed, was also rejected for a Capital One Venture today. I pay everything in full, only have 5 cards, low utilization.

Oh well!

Regarding my preceding comment: Just noticed Tim's comments below. That was what I was referring to.

My spouse got rejected for the exact same reasons--only her "recent" card was ~17 months old. She has confirmed 800+ credit ratings, which is likely irrelevant to an irrational credit card issuer. I was so outraged. I canceled my AAdvantage card. I know--irrational me--but I have had some other issues with Citi in the past which didn't sit well so this took me over the edge. I have read at least one comment on the...

My spouse got rejected for the exact same reasons--only her "recent" card was ~17 months old. She has confirmed 800+ credit ratings, which is likely irrelevant to an irrational credit card issuer. I was so outraged. I canceled my AAdvantage card. I know--irrational me--but I have had some other issues with Citi in the past which didn't sit well so this took me over the edge. I have read at least one comment on the internet that claimed AA may be behind whatever approval criteria exist--if any. I have no first hand knowledge about that, however. The poster also said that when he asked for reconsideration, he was told those two reasons for rejection were not negotiable. A sketchy card issuer clamming up--would be very concerning to me if I hadn't severed all of my relationships with the bank.

I had exactly the same denial last year when applying for the Citi Premier card. Also my first ever declination that I can remember. I called the reconsideration line and was told that there was nothing that could be done as it was a automated calculation whereby their system assigns points based on varying factors and I did not qualify. Banked with Citi for 25+ years, Citigold and no other Citi credit cards but none of that made any difference.

Same thing about low credit utilization for me on a Capitol One application. (For a free card.) They did offer one WITH an annual fee though. Credit score in the 830-850 range for years. Not baffling - just disgusting.

Yeah it's disgusting when credit card companies want to make money instead of just give away another sign up bonus.

Ffs. People

I wonder if the first reason with too much unused credit line is simply a way to spot churners, or people signing up for cards just for welcome bonuses (which a lot of us are, let's face it). That would be a pretty sensible criteria, if you think about it.

Lots of unused credit + many applications/approvals over the past several years = bonus churner.

This is a bummer. Had the same experience as others with Capital One Venture. If this is to discourage churners, why not just make the minimum buy higher? Like $4,000 to $6,000, or whatever would make it worth their while. What's the point of having great credit if you're gonna be rejected for a credit card?

FICO punish high credit utilization.

Banks punish bad FICO score.

Banks want high credit utilization but also high FICO score.

So banks want your utilization to be low and high at the same time?

Maybe time for FICO to move into quantum scoring system.

Meet Schrodinger's credit score.

Diddo. The same exact two reason. over 800 credit and have Citigold banking relationship. Baffling!

With that banking relationship you should try to call in to see if they will reconsider.

Same thing happened to my wife last week. First ever denial, same two reasons. It's been 5 years since she had a Citi card of any type. I have 3. Ugh.

Ditto. Same reasons provided. Citi obviously doesn't want our business and moving in the direction of Cap1.

I was denied for the exact same reason. I was shocked too.

Had exact same denial for Citi AA card last fall, for low credit utilization.

I was denied for the same reason. I have regularly been using my two other Citi cards, but I have also gotten 3 new cards in the past 2 years, including the AA Executive World Elite Mastercard.

It's not about percentage. They just want to see you spend something at least on all your cards

I suppose it’s logical enough, but Citi is seemingly targeting consumers that they think will be most profitable, rather than consumers who are necessarily most credit worthy.

Add Capital One Venture to this scenerio.

That is why what I have been doing recently is spend a little on all my (most recently) Chase cards, before applying for another new Chase card - not paying off the balance before the statement closes. It worked in the last 3 times

I was denied for the exact same reasons. Very odd. Then had my wife apply (even lower utilization and similar recent account openings), and she was approved. Only real difference I could think of is that I had previously had the Citi Platinum Aadvantage card (closed about 5 years ago), and she hadn't.

The first point, unused credit actually makes sense. Basically you have "too much" CL and you're not using it. Now, the only thing is that Citi isn't stating if it's overall unused CL, or *their* CL not being used.

Yes, FICO scores are influenced by credit utilization, but the banks/lenders go by more than just the FICO score. Apparently Citi likes to see people who use their cards (again, it's not clear if it's *their*...

The first point, unused credit actually makes sense. Basically you have "too much" CL and you're not using it. Now, the only thing is that Citi isn't stating if it's overall unused CL, or *their* CL not being used.

Yes, FICO scores are influenced by credit utilization, but the banks/lenders go by more than just the FICO score. Apparently Citi likes to see people who use their cards (again, it's not clear if it's *their* branded cards, or all cards in general).

Do you perhaps put most of your spend on your business cards, and thus Citi doesn't really see any of that?

At the least I would've called the recon line for more info.

My personal experience suggests this may not be the case. I got the same denial as Ben, even though my Citi credit utilization was actually comparatively high at the time. I was at about 30% utilization on my DoubleCash and 10% overall for Citi, despite an overall utilization of 3%.

I was instantly denied for same reasons, Ben, despite having an 800+ credit score. Really annoyed honestly, especially considering the lack of clear rules to plan around. I’ve opened 3 accounts in the last year and have none with Citi.

Applied for this sign-up offer last week, but was instantly denied by Citi as well. FICO 815+, two new cards opened recently (Amex Green Card 12/7/22) and (Amex Gold 1/6/23). Denial reason was exactly the same, “high amount of unused credit compared to available credit lines” and that I had “recently opened one or more accounts.” Called recon and they said that there’s nothing they could do as this AAdvantage card is not available for...

Applied for this sign-up offer last week, but was instantly denied by Citi as well. FICO 815+, two new cards opened recently (Amex Green Card 12/7/22) and (Amex Gold 1/6/23). Denial reason was exactly the same, “high amount of unused credit compared to available credit lines” and that I had “recently opened one or more accounts.” Called recon and they said that there’s nothing they could do as this AAdvantage card is not available for reconsideration for the reasons that they flagged me on. I asked her if this was a Citi Bank policy or solely the Aadvantage card policy and she confirmed that it was the latter. Seem like AA may have increased the sign-up offer, but also increased the difficulty to be approved for it. I've read about several others being denied for the same reasons across the points and miles blogosphere.

Interesting. Seems like AA stopped being an airline a few years back and now is doing better in the shopping portal business, and credit card underwriting business. And Apple is paying 4% on deposits. Everyone is a bank in 2023!

Will you call the reconsideration line? If I recall, Citi has a pretty robust reconsideration department.

To the overall point though, it would make sense for card companies to scrutinize unprofitable customers in this economic environment - it could be those that sign up for bonuses and don't spend regularly on cards, or it could be those likely to default. You are the definition of an unprofitable customer for this particular product - you are...

Will you call the reconsideration line? If I recall, Citi has a pretty robust reconsideration department.

To the overall point though, it would make sense for card companies to scrutinize unprofitable customers in this economic environment - it could be those that sign up for bonuses and don't spend regularly on cards, or it could be those likely to default. You are the definition of an unprofitable customer for this particular product - you are applying for the bonus, and you have stated that you don't like to spend on airline cards as you maximize elsewhere, etc. If you were Citibank - would you approve your own application? Probably not...

I see the linked post "Credit Card Application Rules By Bank (2023)" was updated one day ago, yet it is still incorrect. Citi got rid of the 24 month rule for ThankYou point earning cards (now 48 months) and no longer has "accounts closed" language in terms & conditions.

Maybe worth updating the basic rules for one of the major issuers? FrequentMiler and other blogs posted updates on this a few weeks back.

Lol. I saw this post today and right away decided to apply for this card. Since my score was 655 and guess what I was approved.

Similar issue happened when I applied for citi premier in 2022 when I already had a citi AA platinum. This year, I cancelled my citi AA card and then applied for the Citi Premier to get approved. Citi is apparently not approving new cards if you already have one or more with limited credit usage.

Citi and Capital 1 are the toughest for me even with a 825+ credit score. I was denied for the Citi premier 2 years ago. I waited around 8 months without opening any other cards and then got approved when I applied a second time.

We're in the same financial situation and my wife was rejected for the same reasons. She's working on lowering her credit utilization now and calling for reconsideration.

No that is not the same situation. I think they were saying Lucky was not using enough of his credit line not that he was using too much.

I had the exact same outcome and reasons provided when I tried getting the Premier card a couple of months ago when the bonus was 80k. My brother, on the other hand, has similar credit profile (in terms of new accounts, score, card utilization, etc.), with the only major difference being that he has a mortgage on his name. He was instantly approved for that card. Same stories for our Venture X applications last year.

It seems Citi is going the way of C1 with discouraging churners with these criteria, gotta hope Chase and Amex don’t follow suit.

its a slippery slope discouraging churners but keeping your the credit quality of your unsecured portfolio healthy. Yea, I can make a ton more short term money on subprime/low quality borrowers but I'll get murdered in front of credit, the board and my regulators. And no, I don't personally believe there is a magic formula to find churners so I think these are short term phases only that may feel right for a sliver of...

its a slippery slope discouraging churners but keeping your the credit quality of your unsecured portfolio healthy. Yea, I can make a ton more short term money on subprime/low quality borrowers but I'll get murdered in front of credit, the board and my regulators. And no, I don't personally believe there is a magic formula to find churners so I think these are short term phases only that may feel right for a sliver of the portfolio but would be terrible if done writ large.