Link: Apply now for the Capital One SavorOne Cash Rewards Credit Card (Rates & Fees)

I’ve just been approved for my latest credit card, the Capital One SavorOne Cash Rewards Credit Card (review). In this post I wanted to share why I applied, what my application experience was like, and talk about my overall take on applying for Capital One credit cards.

In this post:

Why I applied for the Capital One SavorOne

There are many reasons to get the Capital One SavorOne, though here’s the fundamental value proposition:

- The card has a welcome bonus of $200 cash back after spending $500 within three months

- The card offers 3% cash back on dining, grocery stores (excluding superstores like Walmart® and Target®), entertainment, and select streaming services, all with no foreign transaction fees

- Capital One and Uber have a partnership, and through November 14, 2024, the card is offering a complimentary Uber One membership, plus 10% cash back with Uber and Uber Eats

- In conjunction with other Capital One cards, rewards earned on the card can be converted into Capital One miles at the rate of one cent per mile, making this a great card for maximizing Capital One miles (I value Capital One miles at 1.7 cents each, for what it’s worth)

Why did I pick up this card, in my specific situation? There are certainly bigger welcome bonuses out there, and I already have lots of great cards for maximizing dining and grocery store spending. For me it’s quite simple:

- I otherwise pay for an Uber One membership, so getting that for free through November 2024 is a ~$200 value for me

- I spend quite a bit with Uber and Uber Eats, so being able to earn 10% cash back (which I’ll convert into 10x Capital One miles, and value at a ~17% return) is an incredible return on that spending, and will earn me tens of thousands of Capital One miles

- The welcome bonus of $200 cash back (which I’ll convert into 20,000 Capital One miles) is the icing on the cake

- The Capital One SavorOne has had some useful limited time partnerships in the past, and I trust we’ll see more of those in the future

- Ultimately holding onto cards in the long run is great for your credit, and I try to do that with no annual fee cards whenever possible; so I view picking up useful no annual fee cards as an important part of a balanced credit card strategy

This card really is an exceptional complement to the Capital One Venture X Rewards Credit Card (review) (Rates & Fees), and a great part of an overall Capital One card strategy.

My experience applying for the Capital One SavorOne

What was my experience like applying for the Capital One SavorOne? For what it’s worth, this is my third Capital One card application in roughly a year.

I find the Capital One credit card application process to be pretty straightforward. In fairness, having good luck with getting instant approvals on Capital One cards doesn’t hurt with that perception, though. 😉

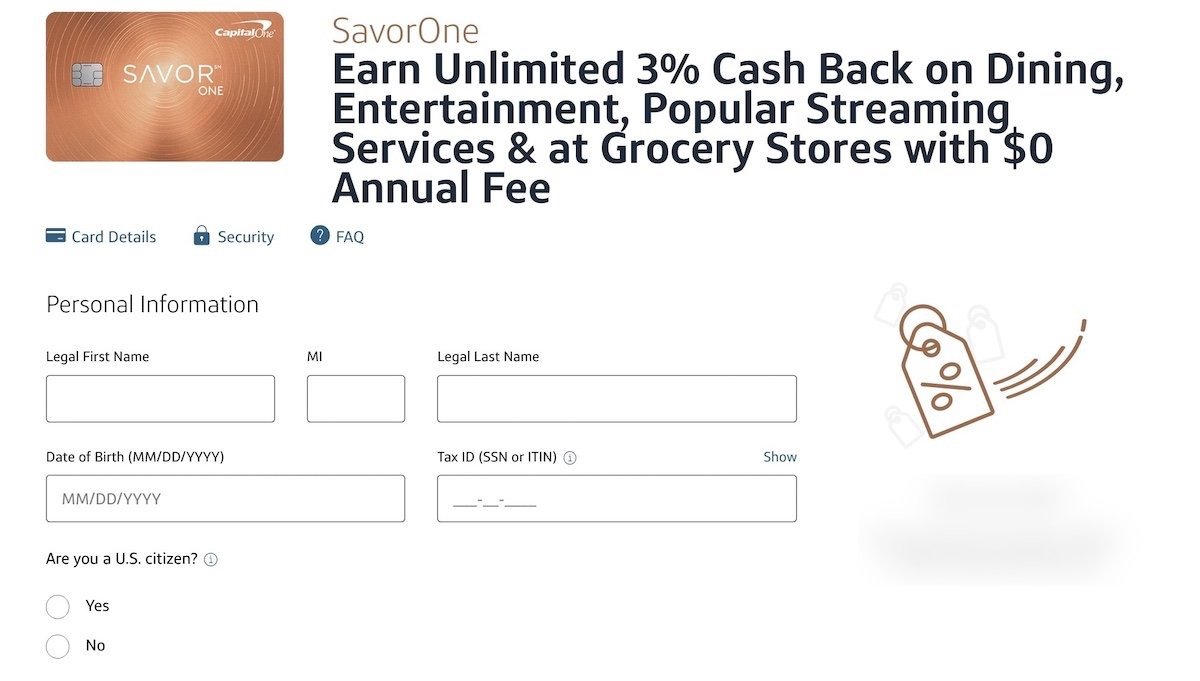

The application consisted of three different pages of information. The first page asked for basic personal details, like my name, date of birth, and social security number.

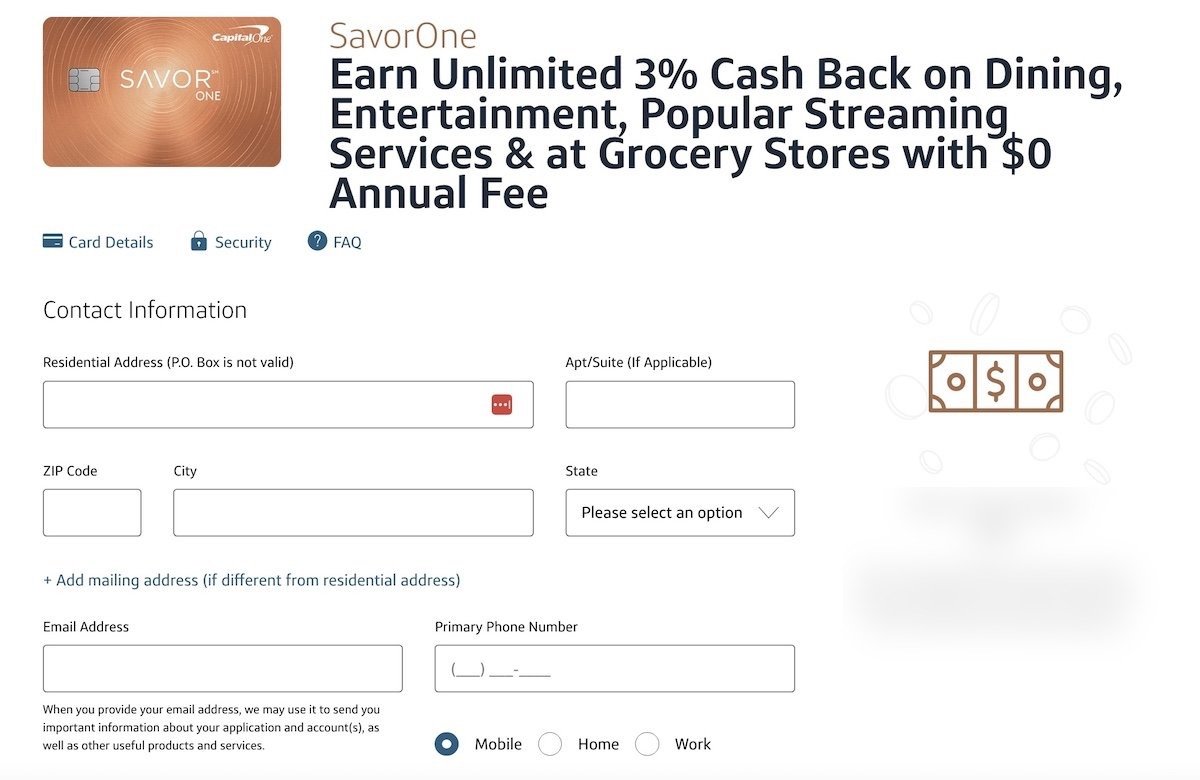

The second page asked for my residential address, email address, and phone number.

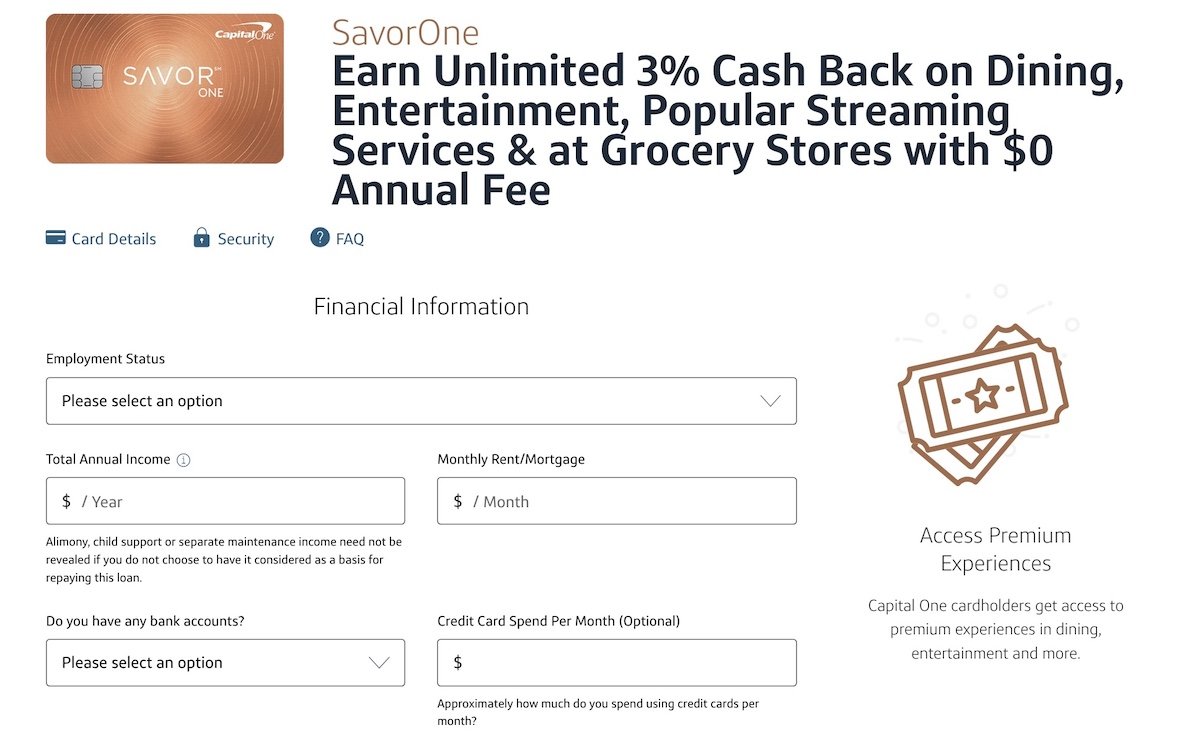

The third page asked for my basic income information, as well as my monthly rent or mortgage. This page also asks how much you typically spend per month, and also has some optional questions.

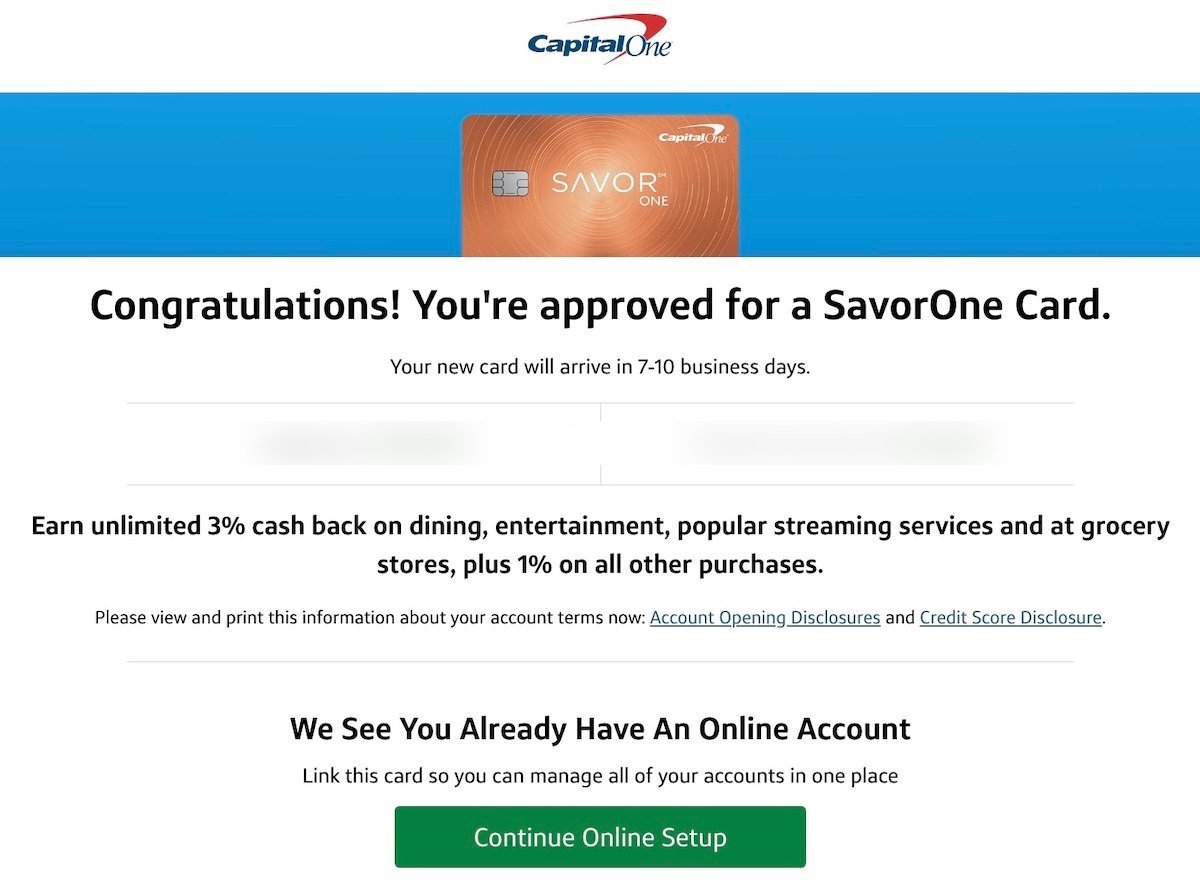

Then there were a couple of pages of disclosures and a summary of my application. I then hit submit, and received an instant approval, which you can’t beat!

I could then immediately link my new card to my existing Capital One online account, so that I could start managing my account.

What are Capital One’s application restrictions?

Anecdotally, Capital One has very few consistent application restrictions. For context, I applied for the Capital One Venture X Rewards Credit Card (review) roughly a year ago, and then applied for the Capital One Spark Cash Plus (review) (Rates & Fees) roughly nine months ago. I got an instant approval in each case.

You should be eligible for the welcome bonus on the Capital One SavorOne if you have any other type of Capital One card, though you won’t be eligible if you have this exact card, or have had this exact card in the past.

The one thing to be aware of is that Capital One can be quirky with approvals at times. While many report luck getting approved for Capital One cards, others with great credit report not having luck, and it can be hard to make sense of that at times.

Bottom line

I’m always happy when I can pick up a no annual fee (Rates & Fees) card like the Capital One SavorOne, which will help my credit in the long run, and will also add value for me. With the new partnership between Capital One and Uber, getting this card was a no-brainer, especially in conjunction with the Capital One Venture X.

Not only can I earn the welcome bonus of $200, but I’ll also get an Uber One membership for nearly two years (worth $200), and I’ll also receive 10% cash back (which I’ll convert into 10x Capital One miles) for my Uber and Uber Eats spending, which will really add up.

Anyone else planning on picking up the Capital One SavorOne?

Thanks Lucky.

Any reason to prefer the SavorOne over the Savor? Does the incremental 4% outweigh the $95 AF in your calculations?

Isn't the calculation very very obvious? The incremental is 1% not 4%.

So at rudimentary, you need to spend at least $9500 in the 4% category to guarantee a break even.

Right. And most people spend more than that on groceries and dining in a year (especially if you use a lot of Uber Eats), which is why I'm asking his reasoning for choosing the 3% instead of 4%.

Why is that folks are getting approved but don't qualify for the bonus? Is there a particular reason for this?

Anyone know anything about that capital one card that offer 250k signing bonus?

I have the Venture X and a 10-year old VentureOne (which is propping up my credit score). I would really love to convert the VentureOne to SavorOne, but only get offers to convert it to Quicksilver. Should I apply for SavorOne as a third CapOne card?

I just got approved for the no-fee Savor One. Along with the dining bonus, it’ll be nice to have the entertainment category bonus as none of my current cards include that category. It took about 10 minutes to finish the application and get the card. I was only offered the card without the bonus, but $200 isn’t that big a deal and Capital One has been extremely generous with the perks and bonuses on my...

I just got approved for the no-fee Savor One. Along with the dining bonus, it’ll be nice to have the entertainment category bonus as none of my current cards include that category. It took about 10 minutes to finish the application and get the card. I was only offered the card without the bonus, but $200 isn’t that big a deal and Capital One has been extremely generous with the perks and bonuses on my Venture X card which just completed its first year. Cap1 will pick up a lot of daily spending that I had been putting on my Wells Fargo Propel Amex card.

I did it a while back. It may be a fallback if I decide an AMEX Gold isn’t my jam and a VentureX is a long term keeper (and it was a fallback while I milked a 100k AMEX Platinum upgrade offer on an AMEX Gold).

Funny you say that. I was primarily using the Amex trio (Plat, Gold, and BBP) for most purchases. Now that I picked up the Venture X last year, this looks like a good (and cheaper) backup duo to recapture a lot of the Amex trio if I ever ditched it. Just a bit wary of the CO customer service, but it costs nothing extra to hold the Savor One.

Can you still transfer to miles if you don’t have the a Capital One miles earning card?

@ Andrew -- Nope, you need to have a card earning Capital One miles. However, if you earn cash back with the SavorOne and then in the future pick up a card earning Capital One miles, you could still transfer the rewards.

How many credit card apps/hard pulls did you have in the year prior to applying for this? I’m thinking of applying but I applied for 2 other cards in the past 12 months, and I’ve heard CO is sensitive to that.

@ Teckelspass -- For what it's worth, I've had five inquiries since last November. I applied for the three Capital One cards mentioned, plus two business cards (the Alaska Business Visa and AAdvantage Aviator Business Card).

Thanks! I might just go for it :)

I've had at least 4 hard pulls in the past year prior to applying, albeit 2 with capital one. This one made 5 pulls. Got approved for this card with no issue.

You seem to have amazing success getting approved for cards, based on all of your blog posts boasting about your various approvals. But that leads me to wonder, have you ever been denied a card? I think it would be interesting to your readers if you would also post about your card denials. It lets them know you're one of the people too and you get denied just like the rest of us, even with 800+ credit scores.

There’s a very good reason he has “amazing success”, particularly with Capital One. Not hard to figure out why he doesn’t get denied like the rest of us with similar credit profiles and history with Cap One.

@ Darin -- That's really not a fair accusation. I applied online just like everyone else. I have exceptional credit and don't apply for many cards. Like many others, I got approved.

Do I get a commission when people apply for select Capital One cards through my site? Yes, and I clearly disclose that. But please don't baselessly suggest that something else is going on here beyond that.

@ 9volt -- The truth is that I'm pretty conservative when it comes to applying for cards. For example, I only have three inquiries toward Chase's 5/24 limit in the past 24 months.

Over the years I have been denied for some cards. For example, the card I was most recently denied for was the Aeroplan Credit Card, a bit over a year ago. I just had too many cards with Chase at that point, I guess.

You don’t exactly need to churn cards when you get a lot of referrals from your blog and have a business where many expenses can go through a card. I doubt many of us would be super aggressive with apps if we were capable of generating 7 digits in multiple ecosystems AND able to use travel agent discounts for aspirational travel (and write it off as a business expense).

(No hate on that, it just...

You don’t exactly need to churn cards when you get a lot of referrals from your blog and have a business where many expenses can go through a card. I doubt many of us would be super aggressive with apps if we were capable of generating 7 digits in multiple ecosystems AND able to use travel agent discounts for aspirational travel (and write it off as a business expense).

(No hate on that, it just is what it is, you don’t need to be hyper aggressive in the status or points game if you have nothing to prove and what you earn is enough for your needs.)

People take 800+ scores for granted.

A good credit analysis would look into the whole profile rather than just based on a 3 digit algorithm. Something that many banks learned from 2007 and diamond hands starting to realize.

I didn’t realize just how compelling this card is, since I already have the Venture X. Thanks for this post!

Instant approval here, $30K limit, have the CapOne X and CapOne Spark already.

I was approved, but it said ineligible for the bonus. A bait and switch by Capital One.