Link: Learn more about American Express Platinum Card® or The Business Platinum Card® from American Express

The American Express Platinum Card® (review) is one of Amex’s most premium cards, and it recently underwent a full refresh. While the card now has an $895 annual fee (Rates & Fees), it offers benefits that will more than help offset that for many, and I’d argue the value proposition is better than ever before.

The card potentially offers thousands of dollars in benefits and credits, and in this post, I’d like to take a look at one of the single biggest potential credits offered by the card, which is an annual hotel credit of up to $600. As you’d expect, enrollment is required, and there are terms to be aware of, so let me share how the credit works, and my strategy for maximizing it.

For what it’s worth, this same credit also applies on The Business Platinum Card® from American Express (review), which is also a card worth considering.

In this post:

Basics of the Amex Platinum Card $600 hotel credit

The Amex Platinum Card and Amex Business Platinum Card offer up to $600 per year in hotel credits. To take advantage of this, you just have to book a prepaid hotel through Amex Fine Hotels + Resorts® (no minimum stay) or The Hotel Collection (two-night minimum stay) through American Express Travel®. As you’d expect, there are some terms to be aware of:

- This is a semi-annual credit, so you receive one $300 credit in January through June, and one $300 credit in July through December; that timeline is based on when you make your booking and not when you stay, so in theory you could have multiple qualifying stays in either the first or second half of the year

- The credit is up to $300, so you don’t have to spend $300+, though if you spend less than that amount, you’d only be reimbursed as much as you spent on the hotel booking

- This is available on both the personal and business version of the card issued in the United States, and it can be used by the primary cardmember or authorized users (though authorized users don’t get incremental credits)

- There’s no registration required to take advantage of this, as long as you have a card in good standing

- An eligible hotel stay can be booked through the Amex Travel website, Amex Travel app, or by calling the number on the back of your eligible card

- Only prepaid bookings qualify for this perk (referred to as “Pay Now” bookings); this doesn’t mean the stay is non-refundable, but instead, just that you pay at the time of booking

- Statement credits will typically post within a few days, though in some cases it could take up to 90 days for credits to post

Amex Fine Hotels + Resorts® & The Hotel Collection basics

For those not familiar with Amex Fine Hotels + Resorts® or The Hotel Collection, these are programs that those with the Amex Platinum Card and Amex Business Platinum Card can take advantage of. The credits specifically have to be used with one of these two programs.

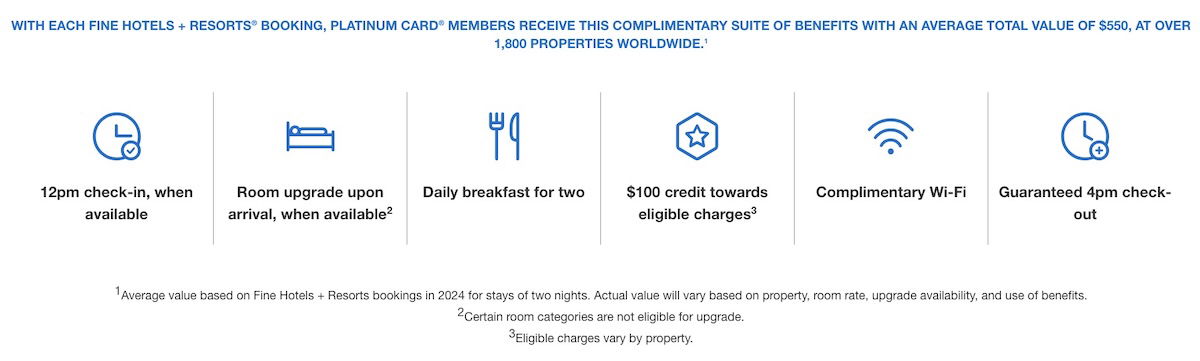

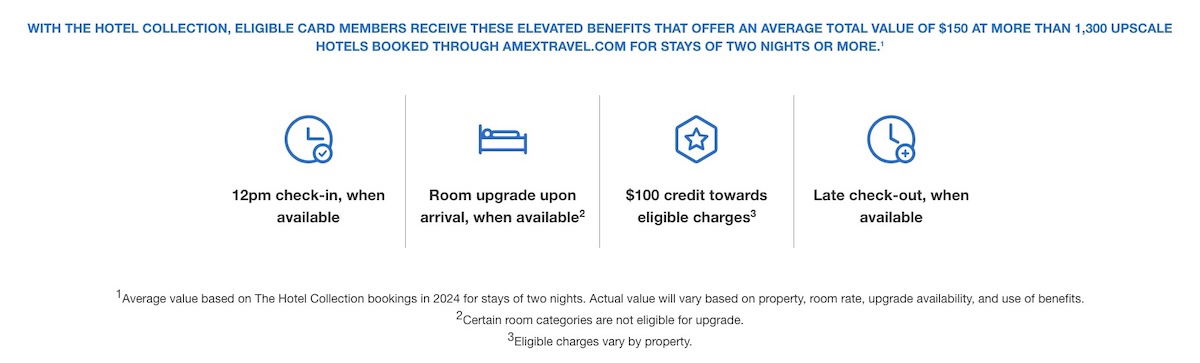

Amex Fine Hotels + Resorts® is a program that gives you access to a selection of 1,800+ luxury hotels around the globe. You’ll typically pay the same as the flexible rate charged directly by the hotel, and will receive extra perks, including complimentary breakfast, a room upgrade subject to availability, a hotel credit, guaranteed 4PM check-out, and more.

The Hotel Collection is another program by Amex, giving access to a selection of 1,300+ hotels around the globe. These are also typically luxury properties, but a tier down from Fine Hotels + Resorts®. You’ll typically pay the same as the flexible rate charged directly by the hotel, and will receive extra perks, including a room upgrade subject to availability, a hotel credit, and more.

There are two other points worth clarifying:

- While you need to book a prepaid reservation to take advantage of the hotel credit, that doesn’t mean the stay is non-refundable; instead, it just means you’re paying upfront, but it’s often possible to still cancel for a full refund, in line with a property’s typical flexible cancellation policy (you’ll want to check the terms when you book)

- You can usually still earn points and receive perks with your preferred hotel loyalty program if booking stays through these programs, as they’re usually considered “qualifying” stays for those purposes, unlike most other third party bookings; this is consistently the case with Amex Fine Hotels + Resorts®, while it’s a bit less consistent with The Hotel Collection

My Amex Platinum Card $600 hotel credit maximization strategy

While the Amex Platinum Card and Amex Business Platinum Card offer lots of perks, the truth is that there are hurdles to using many of the credits. Often the credits are issued monthly, registration is required, etc. Personally, I find the hotel credit to be one of the easier perks to use (along with the $400 Resy dining credit on the personal card, for which enrollment is required).

That’s because this isn’t a benefit that you need to use monthly (like some other Amex credits), but rather you can extract big value from it once every six months. There are many ways to get value from this perk, though my approach is pretty straightforward.

I use this benefit for Amex Fine Hotels + Resorts®, since there’s no minimum stay, and there’s a great collection of hotels. Yes, there are lots of Amex Fine Hotels + Resorts® properties that cost thousands of dollars per night, but there are also some reasonably priced ones.

There are plenty of eligible properties that cost in the $200-400 range, and sometimes even less. The value here is simply excellent. Not only can you get an up to $300 statement credit applied to such a stay, but you can also take advantage of the Amex Fine Hotels + Resorts® perks, including complimentary breakfast, a $100 property credit, and more. Best of all, if you’re staying with a hotel belonging to a major hotel program, you can even earn points.

With my travels, I often have one-night stays in some cities, and there’s something nice about staying one night at a luxury property while paying close to nothing, and getting super valuable perks. For example, I’ve used these hotel perks for stays at properties like the Raffles Europejski Warsaw and the Waldorf Astoria Kuwait. Both hotels were phenomenal, and I got an amazing deal thanks to a combination of perks plus the credit.

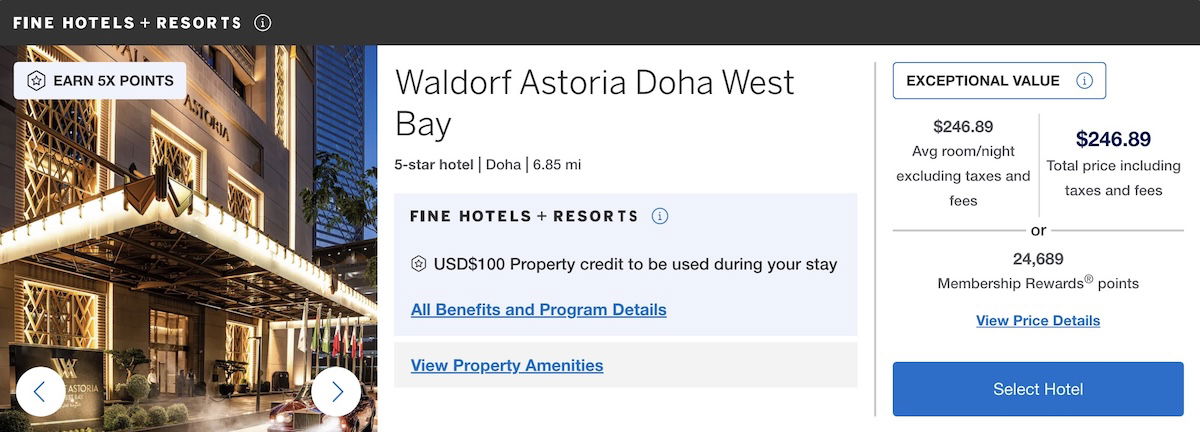

Just to give some totally random examples of Amex Fine Hotels + Resorts® bookings (obviously rates vary by night), you could spend a night at the Waldorf Astoria Doha West Bay for $246.89, so the $300 credit would more than cover that.

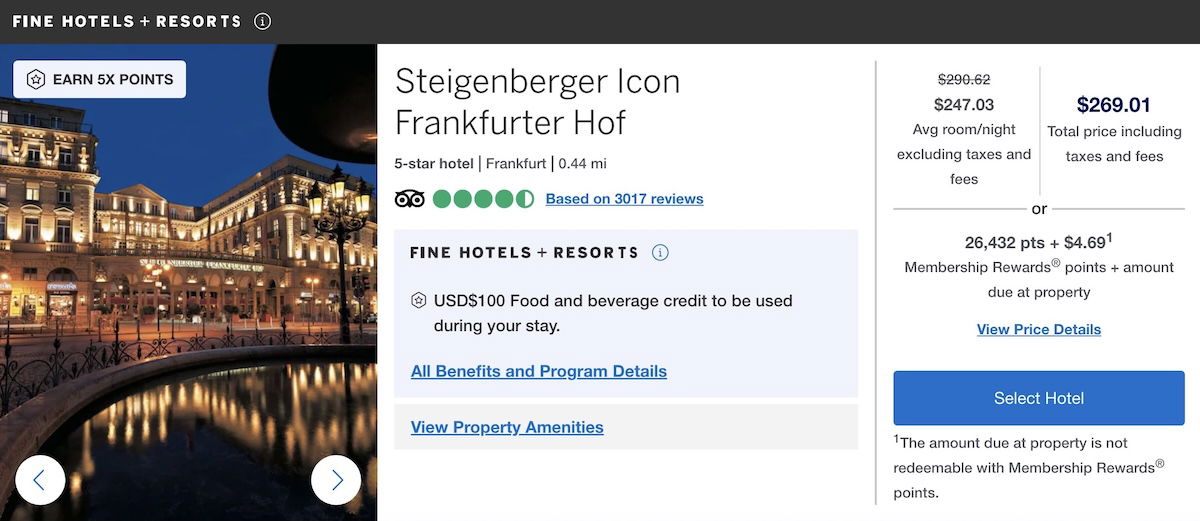

Or if you have an overnight in Frankfurt, you could book the Steigenberger Icon Frankfurter Hof for $269.01, also more than covered by the $300 credit.

Or you could book the Four Seasons Jakarta for $214.17 per night, covered by the credit, with even quite some residual value.

Or the St. Regis Kuala Lumpur can be booked for $307.61, so when you subtract $300, you’re looking at paying $7.61.

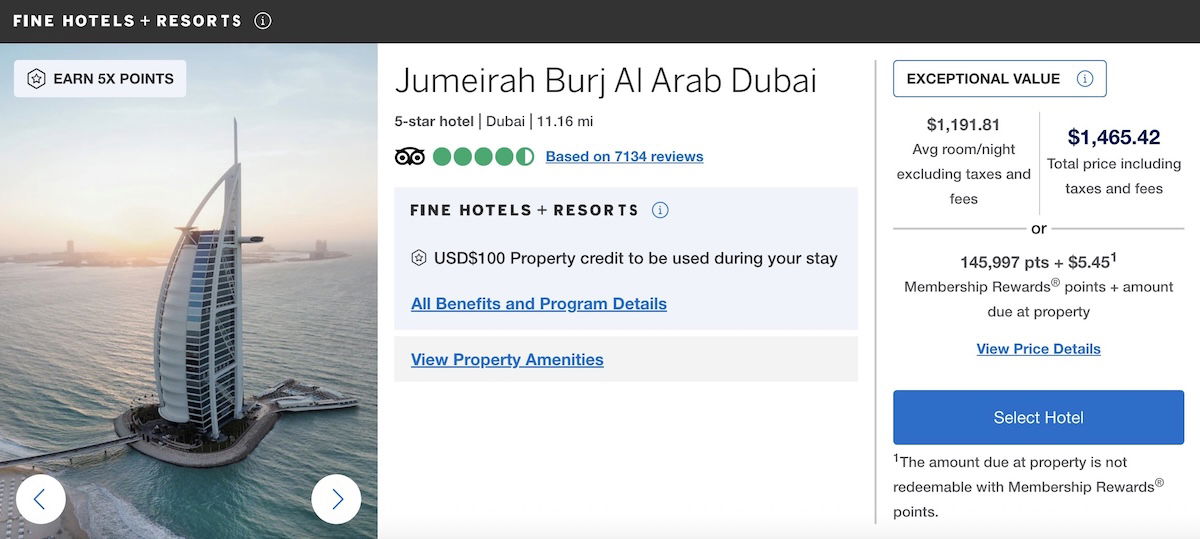

I’m going to argue that the Burj Al Arab Dubai is an incredible hotel that’s worth staying at once, if you can swing it. While it’s pricey, a $300 credit helps a little bit with offsetting the cost of that.

The Amex Platinum Card $600 hotel credit economics

I know some people are curious about the economics of card benefits, so how does Amex justify giving up to $600 in hotel credits per year to those with the Amex Platinum Card and Amex Business Platinum Card? Who is funding this?

This perk is pretty easy to make sense of. All the major card issuers are trying to massively increase the volume of bookings on their travel platforms, essentially taking on the major online travel agencies. After all, there’s a lot of money to be made there.

Generally speaking, online travel agencies get significant commissions on hotel bookings, so Amex’s logic here is to use this benefit to get people to switch their hotel bookings to Amex’s travel portal.

The goal, of course, is that this benefit will transform how people book hotels. Amex hopes that a $300 semi-annual credit will get you to try Amex Travel, and to then keep booking that way.

For example, Amex would be making a lot of money on this perk if you book a $10,000 hotel stay in Paris with this benefit, since the commission would be way bigger than the credit offered. Meanwhile if you’re good at maximizing and book a hotel that costs close to $300, Amex would almost certainly lose money on that.

However, I imagine the expectation is that this balances out, and that between the direct commissions and the increased bookings through the platform, the benefit will work out nicely for Amex.

Bottom line

The Amex Platinum Card and Amex Business Platinum Card offer lots of perks, and I’d argue that one of the most valuable benefits is the up to $600 hotel credit. While there are some terms to be aware of, I expect to easily get close to full value out of this each year, going a long way to making this a “profitable” card for me.

My primary strategy is to just use this benefit for two one-night hotel stays each year at luxury properties bookable through Amex Fine Hotels + Resorts®, where the perks on such a short stay are especially good. Ideally they’ll even be at properties belonging to major loyalty programs, so that I can double dip and earn points.

What’s your take on the Amex Platinum Card $600 annual hotel credit?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: American Express Platinum Card® (Rates & Fees).

Last week, I spent 2 nights at the Waldorf Astoria Versailles Trianon Palace just outside of Paris (Dec 8, 25). The perks were lovely!! The room, by European standards, was enormous! The bed was second to none I'd ever experienced in a hotel. I used my Amex Business Platinum and everything went smoothly! We received a fancy welcome letter listing all the Amex benefits we'd be receiving.

The 2nd night was needed because my husband...

Last week, I spent 2 nights at the Waldorf Astoria Versailles Trianon Palace just outside of Paris (Dec 8, 25). The perks were lovely!! The room, by European standards, was enormous! The bed was second to none I'd ever experienced in a hotel. I used my Amex Business Platinum and everything went smoothly! We received a fancy welcome letter listing all the Amex benefits we'd be receiving.

The 2nd night was needed because my husband and I were exhausted and I was fighting a virus (not Covid).

I meant to use my Hilton Aspire card to knock that card's resort benefit off my list before Dec 31st, but too be honest, because of the virus and fatigue, I FORGOT! Lessoned learned! I won't make that mistake again (hopefully.)

But...At 4pm on the day we needed to checkout, I went to the Amex Travel App and booked our second night. I then called the front desk to ask (beg) them to allow us to stay in the upgraded room as we were not feeling well. She needed to verify us staying in the upgraded room with her manager. She called back and said we could stay in that upgraded room!!! We were ecstatic! Just one more plus for the Amex Platinum as I believe our status and their availability cinched the deal for the 2nd night's complimentary upgrade.

The bed was the most comfortable bed of our trip that started in London and finished in Zurich and long story short- we stayed in 7 different hotels over 2.5 weeks.

I definitely got outsized value from the Amex Business Platinum card's benefits for that stay. And, my first time in a Waldorf! But for the card, that never would have happened.

Amex is making this credit harder to use by limiting the number of prepaid options. This sounds nuts- on most hotel booking sites you can always prepay. But on the Amex site they often yuonly allow 50-75% of the total hotel stay cost to be prepaid. This is how they cheat you out of more money- instead of being able to use $300 of your credit towards a $350 stay- you end up only being...

Amex is making this credit harder to use by limiting the number of prepaid options. This sounds nuts- on most hotel booking sites you can always prepay. But on the Amex site they often yuonly allow 50-75% of the total hotel stay cost to be prepaid. This is how they cheat you out of more money- instead of being able to use $300 of your credit towards a $350 stay- you end up only being able to use $250 of the credit and then pay $100 out of pocket. This is not an accident and no one seems to be pointing that out.

Amex is making this credit harder to use by limiting the number of prepaid options. This sounds nuts- on most hotel booking sites you can always prepay. But on the Amex site they often only allow 50-75% of the total hotel stay cost to be prepaid. This is how they cheat you out of more money- instead of being able to use $300 of your credit towards a $350 stay- you end up only being...

Amex is making this credit harder to use by limiting the number of prepaid options. This sounds nuts- on most hotel booking sites you can always prepay. But on the Amex site they often only allow 50-75% of the total hotel stay cost to be prepaid. This is how they cheat you out of more money- instead of being able to use $300 of your credit towards a $350 stay- you end up only being able to use $250 of the credit and then pay $100 out of pocket. This is not an accident and no one seems to be pointing that out.

In the second paragraph you state, “As you’d expect, enrollment is required”, but further down in the article you say, “There’s no registration required”.

I like to wait for AMEX 3rd Night Free promos for using these

Do I understand correctly that the $200 FHR credit is gone and replaced with this $300x2 version? Was that effective immediately or is the FHR credit still active for this year?

What does this mean? "(though authorized users don’t get incremental credits)" What are "incremental credits"?

Hey Ben...TBH, I have more responsibilities at work now, life has so many things to tackle. Would you be willing to put together sort of an omnibus credit maximizing article on all of AMEX?

Baglioni Hotel Regina, Rome, Italy, $338 for the last day of my three day quickie. $100 F&B credit, I’ll need a late check out for my 1910 flight home per favore, grazie.

Waldorf Astoria Beverly Hills weekend, bookended with the Aspire FNC. Doesn’t matter if the room’s not ready, I’ll be at The Rooftop having brunch with my F&B credit. Please store my beloved backpack until then, no need to be gentle with it,...

Baglioni Hotel Regina, Rome, Italy, $338 for the last day of my three day quickie. $100 F&B credit, I’ll need a late check out for my 1910 flight home per favore, grazie.

Waldorf Astoria Beverly Hills weekend, bookended with the Aspire FNC. Doesn’t matter if the room’s not ready, I’ll be at The Rooftop having brunch with my F&B credit. Please store my beloved backpack until then, no need to be gentle with it, and arrange the house Rolls Royce for 8pm to the closest In-N-Out Burger, thank you.

Too easy, and so much fun.

Booked a 2 night-stay at Nolinski Paris (Part of Hotel Collection).

Got $300 credit within a week on my Amex.

You're missing an important detail here. The reservation for the credit can be for Amex Fine Hotels + Resorts or The Hotel Collection, but one of them requires just one night and one of them requires two.

FHR 1 night; HC 2 nights. FHR properties tend to be nicer, too. YMMV. Cost is relative to where you are looking, time of year, etc. Frequent Miler featured that maxFHR search tool which can show you where the cheap ones are for a given date range. For instance, Royal Palms Resort and Spa is currently lowest FHR 1/1/26 at $116, so well-under the $300 credit. Cool tool, actually. I bet Amex hates that someone mapped that out instead of them.

Which ones don't cost thousands? A list of reasonable FHR properties would be great.

There was that site that FrequentMiler featured: https://maxfhr.com/ which you can find the cheap ones at any given time.

Long time reader!

Only prepaid bookings qualify for this perk (referred to as “Pay Now” bookings); this doesn’t mean the stay is non-refundable, but instead, just that you pay at the time of booking

Is this new? Before when it was $200 credit, I could choose "pay later at hotel" and still get the $200 credit, as long as the room is charged to the AMEX card.

This is right and they don’t allow you to prepay 100% of the booking on most hotels.

Ben does this apply to the UK Platinum card? And only to be used at US hotels? Or other countries?

The one thing not mentioned or I missed it is ….

One night stay for $240 still leaves you $60 in credit unused.

If you were to book the same room for another night (as a 2 night booking you would lose a $100 per stay hotel credit.

Booking your second night on a separate reservation…. gives you an additional $100 hotel credit for a total of $200.

Sneaky. I’ve done it. It works.

Did you have to check out and check in in between the stays?

You've phrased this as a surefire thing, so I want to comment to everyone else that this is well documented as a hit or miss thing with the vast majority of stays being a miss. This is not to take away from your experience, and congrats for double dipping the $100 property credit.

Apart from Kuwait and Kuala Lumpur, where the hell do you find a US property that costs less than $500-800 per night? Any recommendations to burn these credits in the Northeast?

I was already in Las Vegas and posted up at the Waldorf Astoria. After the credit, $30. I'll do it again, it was a great night in a non-gaming 5 star. Well worth it.

I didn't know Kuwait and Kuala Lumpur are in the US /s

Two popular usually less expensive US locations off the top of my head are San Diego and Austin, but all cities can have good deals if you're flexible/lucky.

It sounds like you're looking for a very specific area at potentially a specific time, which is not the way to go about getting some impressive deal. Flexibility is key. I'd suggest you do a lot of research on how others structure their search process.

I'll vouch for the Steinberger Frankfurt, had a great FHR stay there this summer and used the prior $200 credit on it. Upgraded to a massive room, had excellent room service that I used the $100 F&B credit on, and very easy when transiting Frankfurt. And unlike a certain competitor, one night FHR stays qualify.

These credits are just not that hard to use for frequent travelers, plus if you already used the $200...

I'll vouch for the Steinberger Frankfurt, had a great FHR stay there this summer and used the prior $200 credit on it. Upgraded to a massive room, had excellent room service that I used the $100 F&B credit on, and very easy when transiting Frankfurt. And unlike a certain competitor, one night FHR stays qualify.

These credits are just not that hard to use for frequent travelers, plus if you already used the $200 for this year, you get another $300 before 12/31/25. Almost like someone is rewarding the users of this card for their loyalty. But don't worry, all of those new "excellent" benefits for the CSR still haven't kicked in yet... maybe that's a good thing and Chase will make some further positive changes to the CSR before 10/26.

Easier to use relative to the CSR's hotel credit. Coincidentally, while reading this article, an ad popped up regarding the CSR's "access to the Sapphire Lounges." The Platinum, via Priority Pass, offers one annual visit to the Sapphire Lounges. For a person who has multiple Priority Pass memberships (via any card), the collective single visits might be just enough to meet that person's needs and there's less of an argument to hold the CSR.

PS - In a broader sense, to me, the Platinum's credits as a whole seem easier to use than the CSR's credits. And, both the CSR's earn rates and benefits are otherwise obtainable (although, not exclusively via just the Platinum Card). If so, where's the CSR's incremental value? To be fair, others will have different circumstances and might find the CSR compelling. Nonetheless, food for thought.

You are of course 100% correct. And I think Chase has made a massive mistake. But at the end of the day, I view these as lounge access and travel insurance cards. If you are a frequent flier between, say, LGA-BOS, and you fly AA, you're going to want a CSR because there is no Centurion lounge in Boston and the LGA and BOS CSR lounges are fantastic. So specific circumstances may vary, but on...

You are of course 100% correct. And I think Chase has made a massive mistake. But at the end of the day, I view these as lounge access and travel insurance cards. If you are a frequent flier between, say, LGA-BOS, and you fly AA, you're going to want a CSR because there is no Centurion lounge in Boston and the LGA and BOS CSR lounges are fantastic. So specific circumstances may vary, but on the whole, no question that the Plat offers access to more lounges, excellent travel insurance (although not as good as CSR in some areas), and much much much better value.

@Fred WRT "collective single visits" if I'm understanding you correctly, you're referring to multiple credit cards giving separate Priority Passes, each of which would give one single visit to a Sapphire lounge. I do not think that works as I believe it is one visit per person, regardless of which PP is used.

Most of the hotels in places my wife and I are likely to visit the next few years are way too expensive for us. We're going to make the card "profitable" by using the RESY credit, the streaming credit, full use of the airline incidental credit, partial to full use of the Lululemon, Saks and Uber credits, and the savings we'll get from no longer paying the fee for our Gold card, which we upgraded...

Most of the hotels in places my wife and I are likely to visit the next few years are way too expensive for us. We're going to make the card "profitable" by using the RESY credit, the streaming credit, full use of the airline incidental credit, partial to full use of the Lululemon, Saks and Uber credits, and the savings we'll get from no longer paying the fee for our Gold card, which we upgraded to the Platinum. We'll use the Capital One Savor's 3X for dining and groceries.

Nice article, thanks Ben. One comment, however: You say that normally, stays booked through Amex are considered qualifying stays by hotel chains and their loyalty programs. I have experienced the opposite several times, particularly with GHA Discovery, where both in the hotel and the customer support told me my status was worthless when booking through Amex and I’d not receive elite nights or points.

Do you have more detailed insights on this? Perhaps an...

Nice article, thanks Ben. One comment, however: You say that normally, stays booked through Amex are considered qualifying stays by hotel chains and their loyalty programs. I have experienced the opposite several times, particularly with GHA Discovery, where both in the hotel and the customer support told me my status was worthless when booking through Amex and I’d not receive elite nights or points.

Do you have more detailed insights on this? Perhaps an idea for a separate post? Thanks!

@ Tim -- To be clear, specifically stays through FHR and THC qualify, and not other Amex Travel hotel stays. Did you book the stay through one of those two specific programs, or?

GHA Discovery can be a bit quirky (since it's not as closely integrated as some of the other programs), but at least this works with programs like Hilton Honors, Marriott Bonvoy, World of Hyatt, etc.

@Ben, thanks for the reply. Yes, both stays were indeed booked through THC. Perhaps it’s just about GHA then…

If nothing else, it might be worth a call to Platinum Travel to confirm that your loyalty program is linked. Certainly, it's an extra step and things ought to just work without the extra step. But, if it's a known issue, better safe than sorry.

Earning points on your stays can be hit or miss. I used the Hotel Collection to stay at the Tokyo Station Hotel. I gave my Hilton number on booking but noticed the trip didn’t show up in my Hilton account. Tried to add the Hilton number at the hotel (twice, two different reps) but both refused to do so because it was a third party booking.

I have received points at Crockfords in Las Vegas on a FHR booking. So it definitely depends.

I have not had success getting Hotel Collection bookings to qualify for Hyatt points and EQNs. FHR bookings have not had that issue, but I haven't tried with Hyatt.

@ JohnnyBoy -- I appreciate the data point. Let me update the post, as it seems earning loyalty benefits is consistent with FHR, and less consistent with THC.

The Leela Palace Delhi had an all inclusive rate of around $150, where including all fhr benefits also threw in complimentary airport pickup in a BMW (A service they independently charged around $80 for).

The $300 amex credit can cover 2 separate one night stays at this place!

Can I book one night for 6/30 and a second night for 7/1 at the same hotel and get credits for both reservations?

If you book the first before 6/30 and the second one on 7/1, yes. The credit is issued when you book, not when you stay. You could even book the 6/30 stay today and it would use the 2025 credit.

Isn't there some new language about back to back stays that was added recently? Might want to check T&C.

Ben, if we use the credit now for a booking next year, but subsequently close the card, are there any negative ramifications from either Amex or the hotel itself? At checkout, do I need to present the card used to make the booking, or any old Amex card will do?

In Las Vegas once I was able to give a non amex card. But other places they required you to pay the rest of the fee using Amex card to get the FH benefits. Doesn't need to be platinum.

I don't know any ramifications for closing the card. If the renewal comes after your stay, it's fine for closing. May be you could chat with them and get addition points for retention.

@ Dan -- As noted by Ross, at least with FHR you need to pay with any Amex card, but it doesn't have to be with the same card used to make the booking. So what you describe shouldn't be an issue.

Be careful with cancelation. You may lose the $300. If for example it's jan, you booked something for nov and come October you decide to cancel, I don't think you'll get that $300 back since it was the first half of the year.

I found since really good deals on the Amex portal. I was surprised. I thought there would be some catch but ended up being 40% cheaper than the direct rate with the...

Be careful with cancelation. You may lose the $300. If for example it's jan, you booked something for nov and come October you decide to cancel, I don't think you'll get that $300 back since it was the first half of the year.

I found since really good deals on the Amex portal. I was surprised. I thought there would be some catch but ended up being 40% cheaper than the direct rate with the hotel.

The portal is also better than chases hotel portal in 1 important way. Amex includes resort fees while chase let's the hotel charge the fees to you after your stay. Very sneaky.

"Lose" the $300? You didn't spend it to begin with. And you get the credit back in your account a few days after the cancellation.

Obviously the poster means "lose" as in the credit is no longer available to use for another booking! I guess they don't have brains or manners in Topeka! Or maybe your mother just didn't teach you any or dropped you.

It is the Fine Hotels program that requires the 2 night minimum stay not the Hotel Collection. The article has these 2 programs transposed.

@ Englishder -- Per the card terms (which you can find at the link in the post), "The Hotel Collection requires a minimum two-night stay." Or am I misunderstanding what you're saying?

Actually no, you have it backwards. Hotel Collection requires minimum 2 nights. Fine Hotel program does not.

Ben and Tristan are correct; Englishder is wrong.

FHR 1 night; HC 2 nights.

I made a direct booking at the Standard in Bangkok for a couple of nights a few weeks ago. Cancelled it the other day, booked same again through amex at pretty much the same rate but with additional benefits. Prepaid, and the $300 credit posted the same day as the charge. All is good!