In the past, I’ve written guides about how to redeem points with some major hotel loyalty programs, like Hilton Honors, Marriott Bonvoy, and World of Hyatt.

Accor Live Limitless (ALL) is a major hotel program that I don’t write about much, and in this post, I thought it would be interesting to talk about redeeming points with the French hotel group. After all, Accor is an absolutely massive brand (especially outside the United States), with over 5,000 properties spread across a staggering 50+ brands.

Accor is unique among the major hotel loyalty programs, as it’s the only program that’s strictly revenue based. So there’s not much of a trick to maximizing these points, but it’s still worth understanding how the program works.

In this post:

Redeeming Accor Live Limitless points for hotel stays

The best way to redeem Accor points is for hotel stays, and the math is very simple. Every 1,000 Accor points gets you €20 (~$23.50) toward the cost of an Accor stay. In other words, each point is worth exactly two cents, in euro.

You can redeem points to just partially pay for a hotel stay. While you can redeem just 1,000 points, for everything above that, you need to redeem in increments of 2,000 points (meaning every 2,000 points gets you €40).

There really is a ton of flexibility in terms of when you can redeem. You can redeem your points online when making a hotel booking, by phone, or even on-property. You can also redeem toward room rate, or even toward incidentals, whether it’s a meal or spa treatment.

As you can see, this couldn’t be much more straightforward. On a per-point basis, Accor points are actually extremely valuable, more valuable than any other major hotel points currency, based on my valuations.

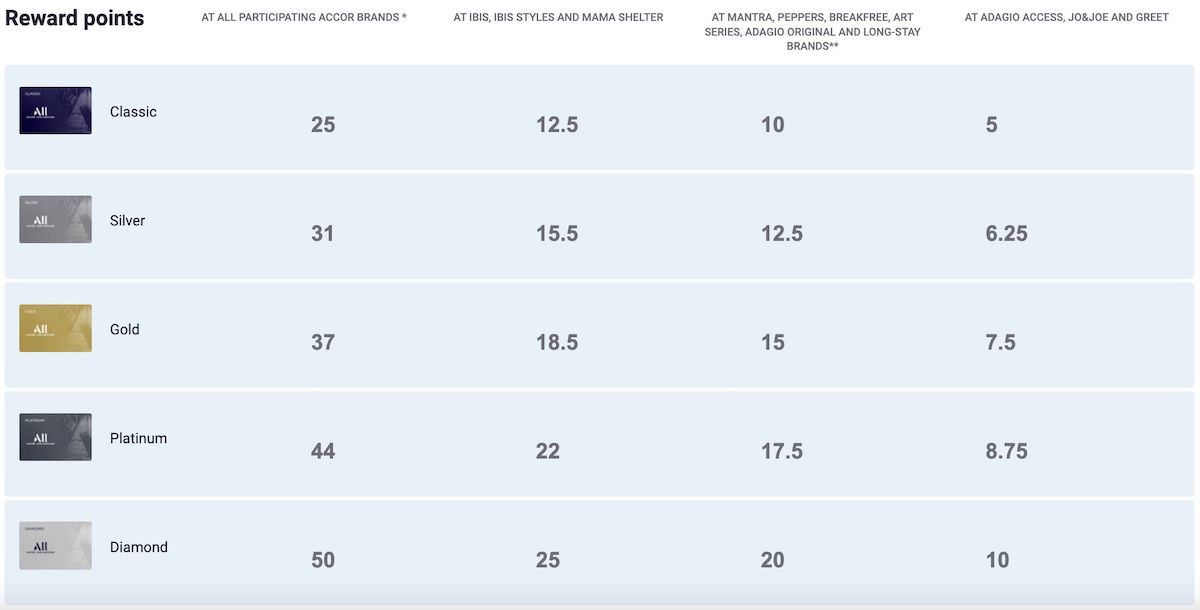

The catch is that earnings rates with the program are also lower. For example, below are how many points you earn per €10 spent at various Accor brands. As you can see, at most brands you earn 25x points per €10 spent, the equivalent of 2.5 points per €1, or a return of 5% (since each point gets you two cents toward hotel costs). Elite members do receive points bonuses of 24-100%.

This makes the math on redemptions very easy. Just redeem Accor points as you earn them, because your points aren’t earning any interest, while cash can. There’s no reason to hoard Accor points, but rather just view it as a rebate program.

Now, it’s generally a best practice to redeem Accor points at properties with lower points earning rates. That’s because you don’t earn points for the portion of the stay you’re redeeming for. So you should redeem at properties with the lowest opportunity cost in terms of points earning rates.

Accor also has one of the stricter expiration policies, as points expire after 12 months of inactivity.

The other ways to redeem Accor Live Limitless points

In the interest of being thorough, I should mention there are other ways that you can redeem Accor Live Limitless points. That being said, these will typically not represent a good value, unless you’re certain you absolutely have no plans to stay at an Accor property again.

For example, you can convert Accor points into airline miles with several programs. The absolute best transfer ratio is 1:1, which is with Air France-KLM Flying Blue. Most other partners have a transfer ratio of 2:1. Given that each Accor point is worth around two cents, that’s like “paying” anywhere from two to four cents per airline mile. That’s simply not a good acquisition rate.

You can also redeem your points for everything from rental cars, to charity. However, these redemption options won’t get you anywhere close to two cents of value per point, so it’s not how I’d recommend redeeming them. For example, you can redeem Accor points toward a Hertz rental at the rate of 2,000 points per €20 of rental cost, slashing the value of your points in half.

Perhaps the one other redemption that might sometimes make sense is checking out the Limitless Experiences by ALL platform, where you can redeem points for special experiences and items. In some cases, you can outright buy something for a certain cost, while in other cases, it’s a bidding system.

Should you move transferable points to Accor?

Among transferable points currencies, both Citi ThankYou and Bilt Rewards partner with Accor Live Limitless, allowing you to transfer points:

- Citi ThankYou points transfer to Accor at a 2:1 ratio

- Bilt Rewards points transfer to Accor at a 3:2 ratio

Since each Accor point is worth exactly 2.0 cents (in euro), that means transferring Citi points to Accor gets you around 1.0 cents (in euro) of value per Citi point (or 1.18 cents in USD), while transferring Bilt points to Accor gets you around 1.33 cents (in euro) of value per Bilt point (or 1.57 cents in USD)

I generally wouldn’t recommend transferring Citi points to Accor without a transfer bonus, since it’s easy to do better than that. Based on the current exchange rate between the USD and EUR, moving points from Bilt definitely isn’t a bad value, and it’s a good way to cash out points with few hurdles, but I also think there are ways to do better than that.

Bottom line

With most hotel loyalty programs, there are opportunities to get outsized value with your points if you put in the effort. In the case of Accor, 1,000 points will consistently get you €20 toward a hotel stay, and that’s the best use of points. There are no aspirational redemptions with the program, but rather it’s one where you want to earn and burn as quickly as possible, since your points won’t get more valuable over time, and there’s no point in saving up.

What’s your take on redeeming Accor Live Limitless points?

It's not entirely true that "the absolute best transfer ratio is 1:1, which is with Air France-KLM Flying Blue."

For those based in Australia (and potentially other regions too - I don't know what the restriction is), you can transfer to Qantas Frequent Flyer at a rate of 1:1.25 - in other word 2,000 ALL points becomes 2,500 Qantas Frequent Flyer miles. Plus, if you link your QF and ALL accounts and you're QF Gold...

It's not entirely true that "the absolute best transfer ratio is 1:1, which is with Air France-KLM Flying Blue."

For those based in Australia (and potentially other regions too - I don't know what the restriction is), you can transfer to Qantas Frequent Flyer at a rate of 1:1.25 - in other word 2,000 ALL points becomes 2,500 Qantas Frequent Flyer miles. Plus, if you link your QF and ALL accounts and you're QF Gold or above, you also earn 1 ALL point for every A$4 spent on Qantas flights, which both tops up your ALL points *and* helps to keep your points alive even without any actual Accor stays.

If you are American and/or if you are used to getting points from credit cards, I understand why Accor is very unsexy.

However, as someone based in Europe, I find Accor to be the best option by far.

They have hotels at all price points, while the American hotels tend to have very few affordable options. They also have a programme that is easy to use and easy to benefit from.

Huh? “I generally wouldn’t recommend transferring Citi points to Accor without a transfer bonus, since it’s easy to do better than that.” How’s that? Please share with the group. Only 3 programs transfer to Accor, but BILT has its constraints. And transfer bonuses are rare (nonexistent with cap1). Also the euro is worth more than USD.

Add to my Christmas wish list, US Bank makes Accor a transfer partner… at 1:1. lol.

One thing about Accor that is often overlooked are the bonus offers. 4x base points (10x per euro essentially) is very common, albeit for specific - often generously wide - geographic regions. If you can take advantage of those bonuses, you can make out like a bandit, even with base earning.

Also, and someone correct me if I’m wrong, but I believe Accor has a double dipping scheme in place with Flying Blue where...

One thing about Accor that is often overlooked are the bonus offers. 4x base points (10x per euro essentially) is very common, albeit for specific - often generously wide - geographic regions. If you can take advantage of those bonuses, you can make out like a bandit, even with base earning.

Also, and someone correct me if I’m wrong, but I believe Accor has a double dipping scheme in place with Flying Blue where you can earn Accor points AND Flying Blue points, similar to how the old Delta-SPG partnership used to work.

Qatar Airways allows double dipping also.

And they will match Accor status so that a flight with QR for someone with Accor Platinum or Diamond will give you QR Gold (subject to an annual quota)

They used to match Accor Diamond to QR Platinum but sadly from 2026 that gets downgraded to Gold (same as what Accor Platinum gets)

Couple of quick points:

*Avios is 1:1 if you go into Iberia Club and not BA, Qatar or Finnair

*when 50% transfer bonuses are running, moving into Club Eurostar from cross-channel rail tickets is actually a decent deal (niche, I admit)

*branding seems to be 'ALL Accor' now, not Accor Live Limitless, although in typical Accor fashion they never announced it

And in typical Accor fashion ‘ALL Accor’ doesn’t make much sense as it’s akin to saying ‘Accor Live Limitless Accor’

Capital One Miles also transfer to Accor at a 2:1 ratio

Not the best redemption, but you do you. C1 will never approve me anyway… LOL/24.

I view Accor points as my ‘sensible’ points - a way I can save real money but obviously not one where you can ever get outsized value. The funny thing is I think it actually saves me more real money than some of the aspirational programs, since I’d never pay the actual cash price for most of the high end hotels that can be fun with e.g. Hyatt.

That’s a good point. Like, PH Paris for 40K? Deal. Same room for $1,500? No freaking way. Accor… 80€ off for redeeming points that are about to expire towards partial payment on a stay? Meh, fine. Like you’re not covering Sofitel in Mo’orea with just Accor points unless you’re burning a plethora of pointies.