Barclays issues a Frontier Airlines credit card, and today they’ve announced some major changes to the card. I’m very impressed by the changes they’ve made to the card, but it doesn’t change the fact that I won’t be getting it, and that I still don’t think it’s compelling for most. However, I’m still impressed, because I think this is about as good as they could possibly do for an ultra low cost carrier co-brand credit card.

Frontier Airlines World Mastercard basics

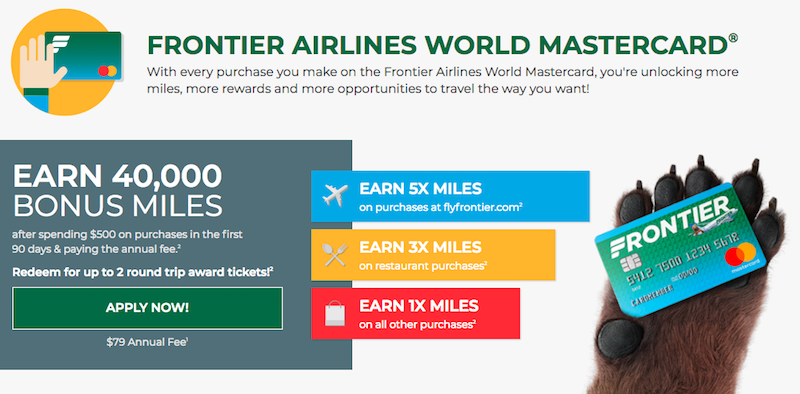

Here are the basic things to know about Frontier’s refreshed credit card:

- Welcome bonus: 40,000 miles after spending $500 within 90 days of account opening

- Annual fee: $79

- Points earning structure: 5x miles at flyfrontier.com, 3x miles on restaurant purchases, 1x miles on everything else

- Other perks: your miles won’t expire as long as you make at least one purchase every six months (previously they expired after six months), and you receive a $100 discount voucher when you spend at least $2,500 on the card in a year, the award redemption fee is waived, and you receive priority boarding

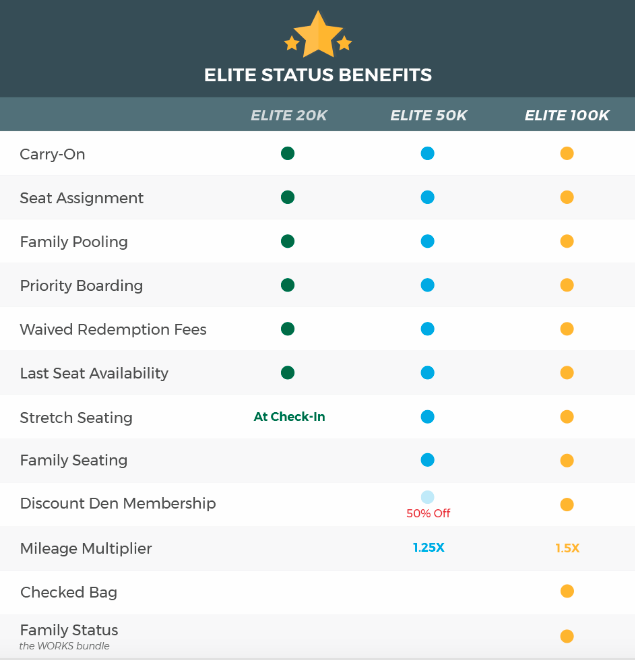

What makes this card especially interesting is that Frontier is revamping their elite status, and they’re giving those with the credit card one elite qualifying mile for every dollar spent. Here are the benefits of elite status:

Since Frontier is an ultra low cost carrier, they charge for just about everything, so the benefits you get are potentially pretty valuable, like seat assignments, priority boarding, and potentially even free checked bags. They’re also introducing family pooling as part of their elite program, allowing one primary member and up to eight contributors to combine their miles for the purposes of increased award redemptions.

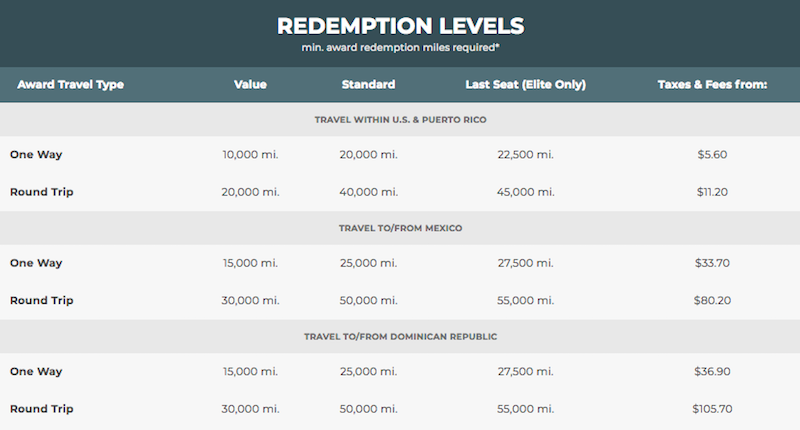

For context, here’s Frontier’s award chart, and all of these prices are the minimum number of miles required:

Previously Frontier miles expired after six months, though as long as you make at least one purchase with the credit card every six months, your miles won’t expire.

The problem with Frontier’s new credit card

Seriously, I have to give Frontier and Barclays big credit for this product. It’s a unique card, and they’ve added some innovative benefits that we haven’t seen from other cards.

The problem, really, is that Frontier is an ultra low cost carrier. How much value can you reasonably offer with a card like this, given how cheap Frontier fares usually are? I just fail to see any circumstances under which one would come out ahead with this, compared to just earning 2% cash back on a no annual fee card.

I value Frontier miles at maybe half a cent each, given the typically low prices for Frontier fares. So when you’re earning just one mile per dollar you’re earning a return of 0.5% (by my valuation), compared to 2% with other cards. While being able to earn elite status with credit card spend is great, there’s a huge opportunity cost to the money you’re spending there.

For example, say you spent $100,000 on the card to earn top tier status. You’d earn 100,000 Frontier miles, you’d have a lot of benefits when flying Frontier, but the opportunity cost of that spend would be $2,000, compared to using another card. Not only would you probably get more value with the cash, but you’d have a ton more flexibility.

I suppose in niche situations this might make sense. For example, if you have the card and spend $2,500 on it per year you’d get a $100 discount voucher, your Frontier miles wouldn’t expire, and you’d get some other perks. But personally for anything beyond that, I feel like you’re giving up way too much flexibility to justify using this card.

What do you make of the refreshed Frontier Card, and do you see circumstances under which it could make sense to put spend on it?

Does the 40k bonus points you get count as EQM?

I used to fly them a lot before they were a UCC. Was summit (highest status at the time but only needed 25k miles) and you got front seating (economy plus style), free drinks (good selection) and a snack. Friendly service as well. UCC is more profitable for them now though.

I’d like to see a Frontier trip report

The problem with the Frontier card is, no matter how it works, you still have to fly Frontier.

Got this card because I was new to the game, didn't understand all the rules and they used to fly nonstop from Detroit to Phoenix. My sister lives in Scottsdale and I could easily get by on a short trip with just the personal item. Now, almost two years later, I'm sitting on about 60,000 miles and a $100 voucher and have no idea how I'm going to use them. I put one charge on...

Got this card because I was new to the game, didn't understand all the rules and they used to fly nonstop from Detroit to Phoenix. My sister lives in Scottsdale and I could easily get by on a short trip with just the personal item. Now, almost two years later, I'm sitting on about 60,000 miles and a $100 voucher and have no idea how I'm going to use them. I put one charge on the card every 3-4 months to keep the miles from expiring and need to make a decision before next February, because I'm not paying the annual fee again.

One advantage not noted is that it actually makes the points usable. Frontier has an award redemption fee that sucks most of the value out of award flights, which you can only avoid as a general member if you book at least 180 days in advance. However, points expire after 180 days as well so in practice it is nearly impossible to avoid the fee. This fee is waived for cardholders.

However, do you trust...

One advantage not noted is that it actually makes the points usable. Frontier has an award redemption fee that sucks most of the value out of award flights, which you can only avoid as a general member if you book at least 180 days in advance. However, points expire after 180 days as well so in practice it is nearly impossible to avoid the fee. This fee is waived for cardholders.

However, do you trust it? This program is as shady and sketchy as they come. I don't see any value in pursuing loyalty with this airline.

I used to fly Frontier a ton when I lived in Denver and had status, before they became ULCC. I took 1 flight on F9 last fall from Bozeman to Denver, and only because of the substantial savings vs Delta and United - even with adding a carry-on bag and preferred seat, it was hundreds less. However the problem is that Frontier doesn't work for frequent business travelers. One problem or cancelled flight and you're...

I used to fly Frontier a ton when I lived in Denver and had status, before they became ULCC. I took 1 flight on F9 last fall from Bozeman to Denver, and only because of the substantial savings vs Delta and United - even with adding a carry-on bag and preferred seat, it was hundreds less. However the problem is that Frontier doesn't work for frequent business travelers. One problem or cancelled flight and you're screwed and tatooed and on your own. Plus, their seats are now like emergency rescue backboards which I found so tortuous even on a <2 hour flight, and their joke of a tray table is less than half the size of a standard size one, so you can't really work on your laptop. I wonder if Spirit or Allegiant or Sun Country will try to mimic the offers that F9 has come out with?

@philco - Well, I don't think it's as fringe as you make it be, but even an individual doing that (or something similar) could make the benefits worthwhile. Easily.

You're missing the savings from free carry on and checked bag that comes with 20k-100k spend.

Your apples-to-oranges benefits comparison makes sense if Frontier was a full service carrier, but this is like AA selling only Basic Economy fares. So $2000 in opportunity cost which otherwise would have went to bag fees isn't real.

Otherwise it'd sound ridiculous to tell people to fly Southwest all the time since it's "full service" but never get the...

You're missing the savings from free carry on and checked bag that comes with 20k-100k spend.

Your apples-to-oranges benefits comparison makes sense if Frontier was a full service carrier, but this is like AA selling only Basic Economy fares. So $2000 in opportunity cost which otherwise would have went to bag fees isn't real.

Otherwise it'd sound ridiculous to tell people to fly Southwest all the time since it's "full service" but never get the credit card because of opportunity cost of miles. AFAIK every blogger and their dog used to hawk the card, especially convincing people to get the Companion Pass.

The idea of flying on Frontier at all makes me shudder, the thought of putting in 100K miles on Frontier would make me suicidal

I think there is a huge problem with the opportunity spend. I can spend 50K on the Delta Reserve, get Silver Medallion alone based just off that, and get more benefits than they are giving for 100K. Not to mention getting free bags and lounge access from that card. While Frontier has cheap routes, like Spirit, their schedules are often awful and require either taking more time or having to go at insane hours.

@Colin I think a family for four doing 10 x 4k mile trips a year is a real corner case. I am sure some exist but there cannot be many of them.

The EQMs from credit card spend are interesting...I do think it's funny that you have to get to 100K miles a year before they provide a free checked bag. Hah!

@Lucky, I had the Frontier card as a product conversion from a Midwest Airlines card, but after Frontier went from full-service to ULCC, I stopped using it, and let it close last year. Do you know what Barclay's policy is on how long a product needs to have been closed before you can earn a signup bonus?

Umm, it seems you're missing the value of actually flying. Sure, spending $100,000 on the card and not flying wouldn't make much sense, and you could claim "$2000 opportunity cost". But what about a family (or even an individual) who flies 40,000 miles a year and spends $60,000 on the card? This would lower your own opportunity cost calculation to $1200, but that $1200 would EASILY be made up with the benefits of actually utilizing...

Umm, it seems you're missing the value of actually flying. Sure, spending $100,000 on the card and not flying wouldn't make much sense, and you could claim "$2000 opportunity cost". But what about a family (or even an individual) who flies 40,000 miles a year and spends $60,000 on the card? This would lower your own opportunity cost calculation to $1200, but that $1200 would EASILY be made up with the benefits of actually utilizing your status when flying the 40,000 miles. For a family of four making ten 4000 mile roundtrips in a year, the savings and benefits could be substantial.