Credit card issuers offer all kinds of targeted promotions to keep cardmembers engaged. In particular, we frequently see bonuses for spending in certain categories, so that cardmembers keep a particular product front of wallet.

Chase frequently offers targeted, limited time spending bonuses on select cards, and the latest of these have just been rolled out, for spending in the third quarter. While these seem a bit more narrowly targeted than usual, it’s still worth checking to see if you’re eligible.

In this post:

Chase’s card spending bonuses for 2024

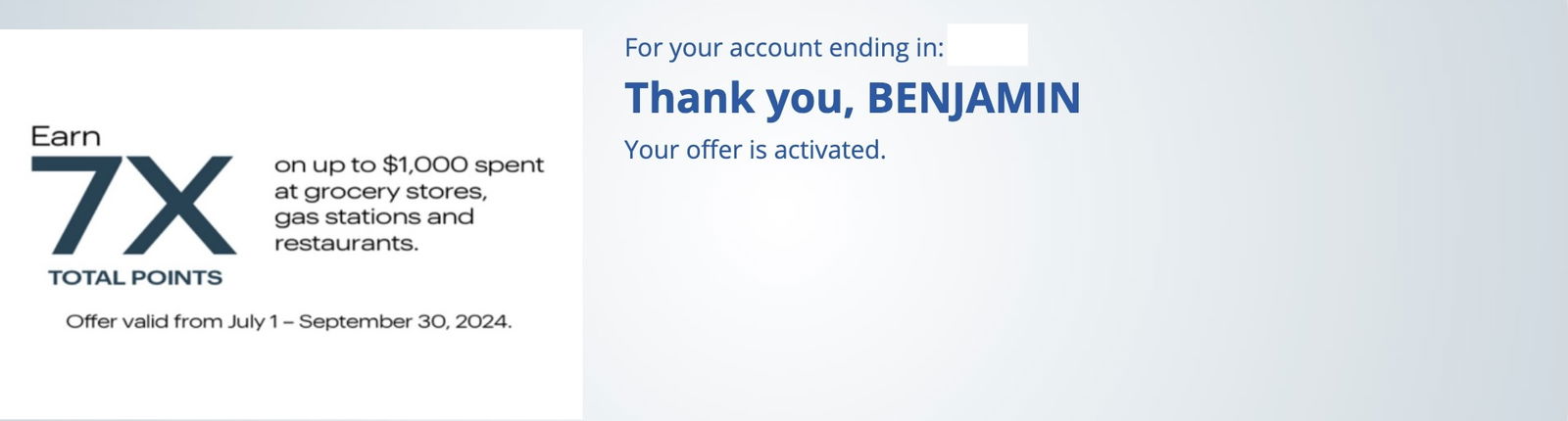

Chase is offering targeted spending bonuses on many of its credit cards, with registration being required. These deals are available for purchases between July 1 and September 30, 2024.

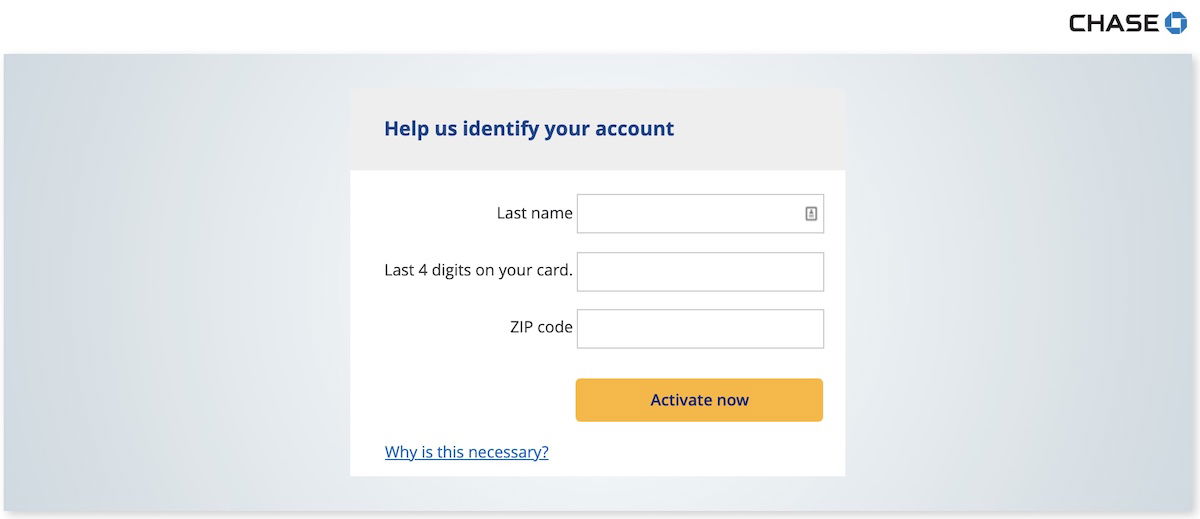

To see if you’re eligible, just visit chase.com/mybonus and enter your last name, zip code, and the last four digits of your card number. If you have multiple Chase cards, you’ll have to check your eligibility for each card individually.

What kind of bonuses is Chase offering?

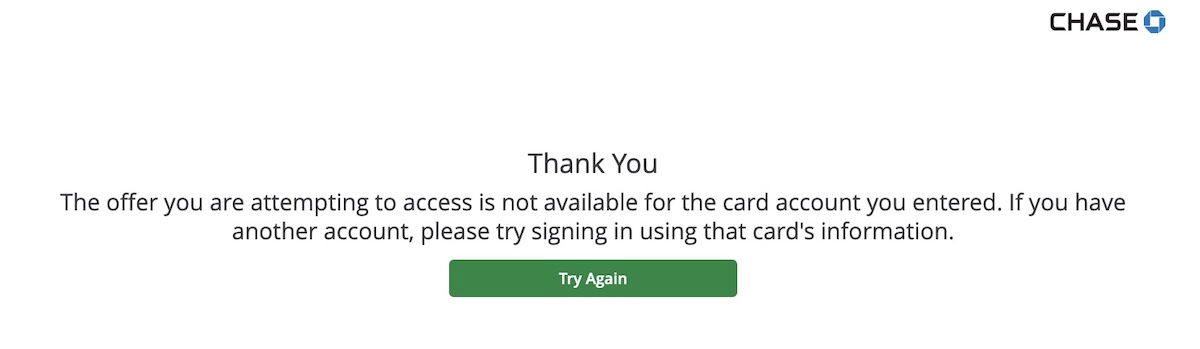

Chase credit cards are offering bonuses tailored to the particular rewards currency offered by a card. You can check what each card is eligible for at this link. These bonuses are targeted — not everyone will be eligible, and even those who are eligible may be presented with different offers. If you’re not eligible for an offer, you’ll see a message stating that an offer isn’t available to you.

Bonuses are primarily available on co-branded credit cards, including those issued in conjunction with Hyatt, IHG, Marriott, Southwest Airlines, and United Airlines cards. On top of that, the Chase Freedom FlexSM Credit Card (review) and Chase Freedom Unlimited® (review) may be targeted for bonuses.

In my experience, Chase doesn’t target people for an offer on the same card two quarters in a row, so you might only be targeted for offers every other quarter (and even that isn’t a guarantee).

What kind of offers can you expect? Best I can tell, the most common offers seem to be offering 5-7x points or miles on spending at gas stations, grocery stores, and restaurants, valid on up to $1,500 in combined purchases. Some people are also being targeted for bonuses on Amazon purchases.

You may see an offer on cards like the IHG One Rewards Premier Credit Card (review), World of Hyatt Credit Card (review), United℠ Explorer Card (review), British Airways Visa Signature® Card (review), etc.

Whether or not these offers are worth taking advantage of depends on how you value various points currencies, and what other cards you have. For example, based on my valuation of points, 5x World of Hyatt points is worth way more than 5x IHG One Rewards points.

This time around, I’m only targeted for a bonus on my IHG credit card, and it’s an offer I probably won’t take advantage of.

Bottom line

Chase has some new targeted spending bonuses on credit cards, valid for purchases between July 1 and September 30, 2024. You can check your eligibility here. Some cardmembers should be eligible, and this could be a fantastic way to pick up some bonus rewards. The catch is that often if you’re targeted for an offer in one quarter, you won’t see any offers the next quarter.

It seems that the most common offer is for 5-7x points on gas stations, grocery stores, and restaurants. Just remember that not all points currencies are created equal.

Were you targeted for Chase spending bonuses, and if so, do you plan on taking advantage of them?

Same target received, well, not sure if I should feel happy, especially in Ihg card too. But in short, it’s a bonus and gesture, thx.

I don't normally put spending on airline cards but I have had several offers on the United Quest card this year for bonus PQP, 25% rebates on reward travel and/or flight credits based on hitting spend targets. Not especially lucrative but in my case will allow me to coast into 1K again earlier than expected (yes I am one of the ones getting there with less butt in seat due to the new focus on...

I don't normally put spending on airline cards but I have had several offers on the United Quest card this year for bonus PQP, 25% rebates on reward travel and/or flight credits based on hitting spend targets. Not especially lucrative but in my case will allow me to coast into 1K again earlier than expected (yes I am one of the ones getting there with less butt in seat due to the new focus on PQP and cc spending) and be a free agent in the 4th quarter. Bottom line, if you're looking for UA PQPs and have or can get a Chase card and spend a bunch on it there may be opportunity beyond the published PQP earning bc you can double dip w/ the promos.