As far as US airlines go, American is in the unique position of having co-branded credit cards with two issuers. This came after the merger of American and US Airways, as American’s credit cards were issued by Citi, while US Airways’ credit cards were issued by Barclays. American made the decision to have a non-exclusive co-brand agreement, thinking that would maximize profits.

American has different marketing agreements with both issuers, though. For example, Citi products can be advertised on American’s website, through the mail, and in Admirals Clubs, while Barclays products can be advertised in airports and on flights. For those interesting in picking up one of these cards, there’s a good new bonus on the most popular Barclays American Airlines credit card.

In this post:

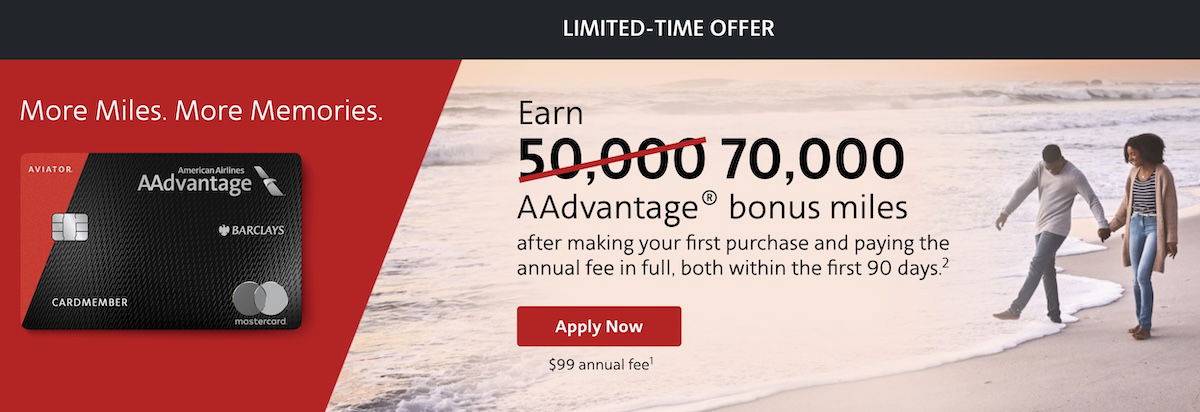

Aviator Red Mastercard welcome bonus

The AAdvantage Aviator Red World Elite Mastercard has a new limited time welcome offer of 70,000 AAdvantage bonus miles after making a single purchase within the first 90 days (thanks to Doctor Of Credit for flagging this). The card has a $99 annual fee, which isn’t waived for the first year. See this post for restrictions on getting approved for AAdvantage cards.

Note that while spending on the card can earn you Loyalty Points (and you can even earn AAdvantage elite status exclusively through credit card spending), the bonus miles won’t qualify as Loyalty Points.

Citi® / AAdvantage® Executive World Elite Mastercard®

Citi® / AAdvantage® Executive World Elite Mastercard®

Citi® / AAdvantage Business™ World Elite Mastercard®

Citi® / AAdvantage Business™ World Elite Mastercard®

AAdvantage Aviator Red Mastercard benefits

The Aviator Red Mastercard offers a bunch of benefits, including the following:

- First checked bag free for you and up to four companions on a domestic itinerary

- Preferred boarding for you and up to four companions on a domestic itinerary

- 2x miles for American Airlines purchases

- 25% inflight savings on food and beverages

- $25 back as statement credits on American inflight Wi-Fi purchases every cardmember year

- Earn an anniversary companion certificate each anniversary year good for one guest at $99 (plus taxes and fees) after spending $20,000 on purchases; your account must remain open for 45 days after your anniversary date

How valuable is the American companion certificate?

As you can see, the major incentive to spend money on the Aviator Red Mastercard is a companion certificate. Personally I wouldn’t go through the effort of spending money on the card for that, given all the restrictions:

- It’s only valid for travel within the lower 48 (the Alaska Airlines companion certificate is valid for travel anywhere Alaska flies)

- It’s only valid for a roundtrip ticket in economy

- You have to book your ticket through American Airlines Meeting Services, so it can’t be booked online

- The certificate is valid for one year from the date of issue

- You have to pay $99 plus taxes and fees when redeeming it

- The companion booked with this certificate isn’t eligible for mileage accrual or upgrades

Bottom line

The Aviator Red Mastercard is offering an excellent welcome bonus of 70,000 AAdvantage bonus miles when you make a single purchase. This is a great initial bonus, though there’s not much reason to keep this card in the long-run, in my opinion.

If you prefer a card with an annual fee waived the first year but a higher spend requirement, consider one of the co-branded Citi AAdvantage Cards.

Although the $90 membership fee is waived for the first year, they institute an immediate denial should you drop the card and then apply again later before you pony up with the annual fee -- this is a forever denial that will not be removed from their system.

This is why I was denied recently. After being denied within minutes, I called for reconsideration and was told point blank that it was because I...

Although the $90 membership fee is waived for the first year, they institute an immediate denial should you drop the card and then apply again later before you pony up with the annual fee -- this is a forever denial that will not be removed from their system.

This is why I was denied recently. After being denied within minutes, I called for reconsideration and was told point blank that it was because I did not use it repeatedly and/or hold a credit balance and because I cancelled before I paid the $90 membership fee due after one year. Unfortunately, I did state this to them when asked why I cancelled it (a surprise charge on the card). However, at the time I did not remember it was not a "no fee" card after the year-long grace period.

This stays on their/your records, and an applicant's stellar credit rating is not considered in the decision. This is a retaliatory response from them because my guess is that this is done frequently by other "unwelcome customers." Doesn't make me feel very warm and fuzzy about AA either. The person I spoke with seemed to be reading from a script and had no qualms about telling me why. She said it goes straight to reconsideration, which prompts an immediate denial should this situation be evident.

How often can you apply for this card after product changing to a no fee card to receive the bonus?

I reviewed the card, then made my first purchase ($5.13) and paid the $99 fee all with a week of receiving the card and before ever getting my first statement.

Then I called CS to inform them of the purchase and payment. The CS rep updated my acct and bonus points came in 2 weeks after our conversation.

You have to be the one to initiate the fee payment especially if you want your points sooner than later.

how long does it take for them to post the $99 annual fee charge so that i can pay it and get the miles? i have had the cc open for a little while already and no posting of the $99 fee. please advise.

Just last week, I was just approved for the Aviator Red at 60K miles. Is there any way to request the 70K mile offer instead?

Nope.

@Ben you wrote an article in January regarding the Oneworld Upgrade scheme, I see AA are offering miles to upgrade with Qantas, no reciprocal arrangements yet but I see on the oneworld website they are moving forward with the scheme;

https://upgrade.plusgrade.com/offer/AmericanAirlines

https://www.oneworld.com/news/2024-06-03-oneworld-alliance-celebrates-25-years-of-excellence-and-outlines-enhanced-customer-focus