Many people are probably familiar with the Amex Offers program, which gives American Express cardmembers the opportunity to earn cash back and bonus points for purchases with select retailers.

Well, not as many people are familiar with a similar program offered by Chase, which I wanted to cover in more detail in this post. This can offer savings with popular Chase cards, like the Chase Sapphire Preferred® Card (review) and Ink Business Preferred® Credit Card (review), among others.

In this post:

What is the Chase Offers programs?

With the Chase Offers program, Chase credit card members can earn cash back when making purchases with a constantly changing list of retailers. Here are a few general guidelines to be aware of:

- Chase Offers is available both on cards earning Ultimate Rewards points, as well as on co-branded credit cards, including those issued for Hyatt, IHG, Marriott, Southwest, and United

- Chase Offers promotions are targeted, and each card will be eligible for different deals

- You need to register for any Chase Offers deal that you want to take advantage of before making an eligible purchase, and you need to use that same card to make the purchase

- It can take 7-14 days for statement credits to appear on your account after making a purchase, though in practice statement credits often post faster than that

How to access Chase Offers on your credit cards

If you have a Chase credit card then you’re eligible for the Chase Offers program, but you may not even realize it.

You can access your targeted Chase Offers either through the Chase website or the Chase mobile app. If you’re on the Chase website, simply log-in and on your account summary page you’ll see the Chase Offers section on the right side. To get access to this part of the website, click on “See all offers.”

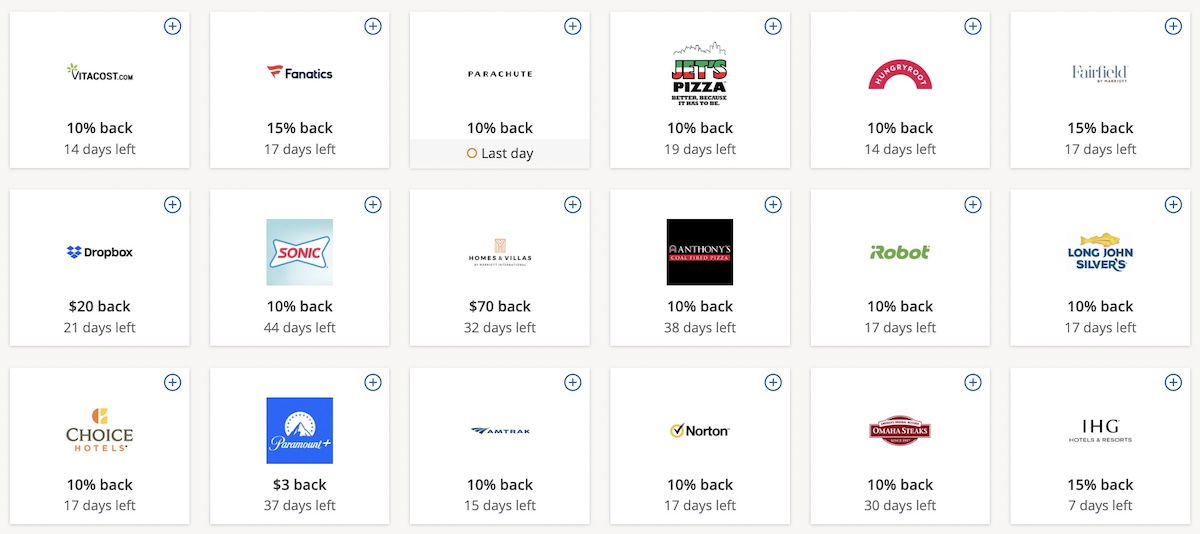

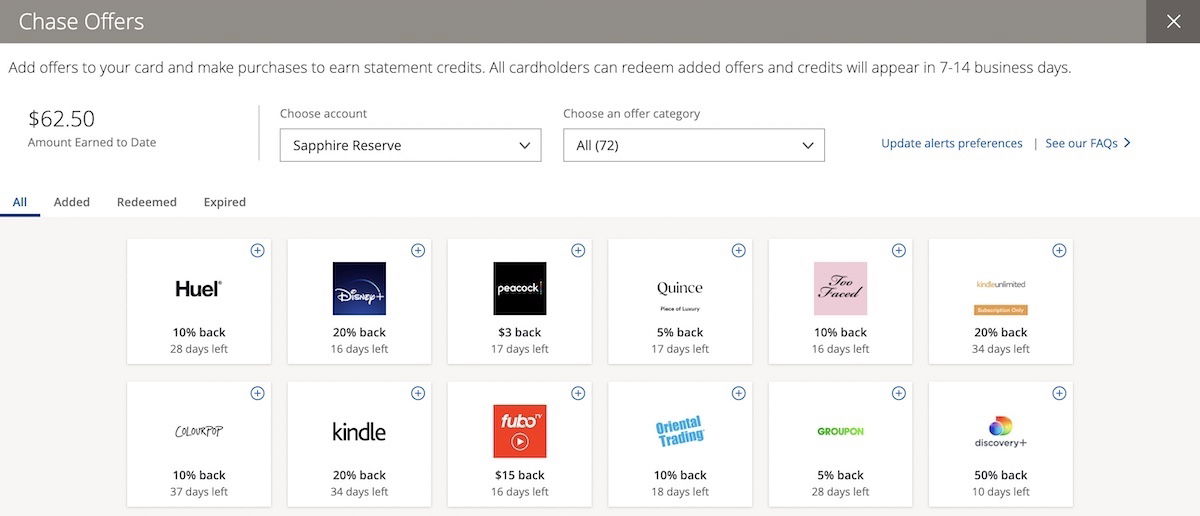

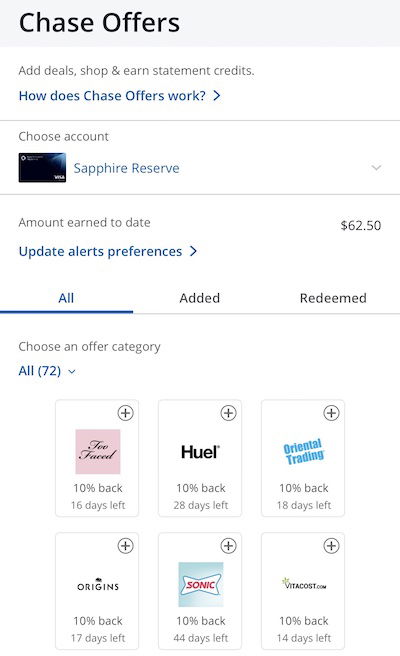

At that point you’ll be able to see your Chase Offers across all cards:

- There’s a dropdown that says “Choose account,” allowing you to see which offer is available on each card

- You can further sort by category in the “Choose an offer category,” with the choices of dining, entertainment, services, shopping, and travel

- At the very left you’ll see the amount of money you’ve saved with the Chase Offers program for a particular card

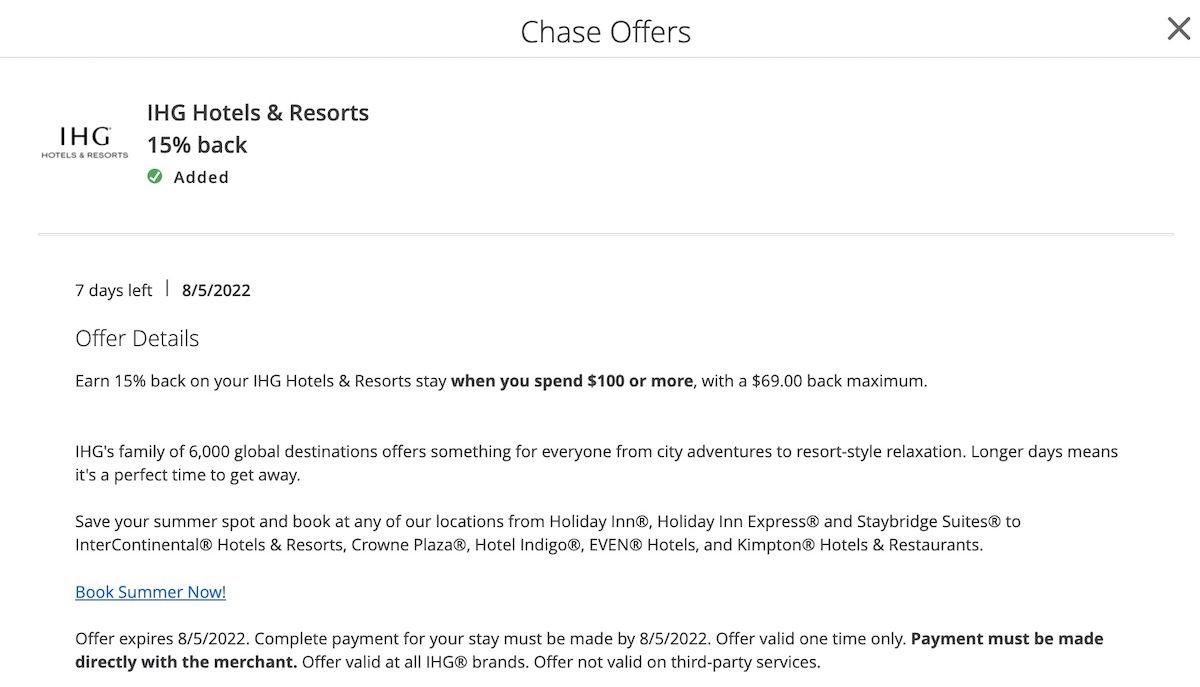

To add a Chase Offers deal to one of your cards, simply click the “+” sign at the top right of a box (the “+” symbol will turn into a green checkmark once you’ve registered). That will bring you to a page confirming you’ve registered. This also displays the terms of the deal, so make sure you read the terms carefully.

For example, in the case of a 15% statement credit on IHG purchases, you’ll notice that:

- You receive 15% back when you spend $100 or more, but there’s a maximum statement credit of $69 (which you’d get with $460 of spending)

- This lists the expiration date, which is when the purchase needs to be made by

- It clarifies that only direct bookings qualify, and not third party bookings

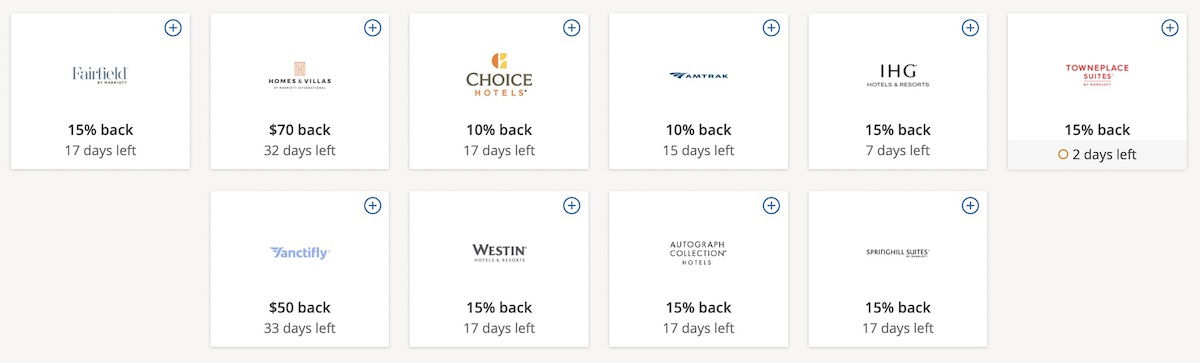

It’s especially cool to see how many Chase Offers are available for travel right now.

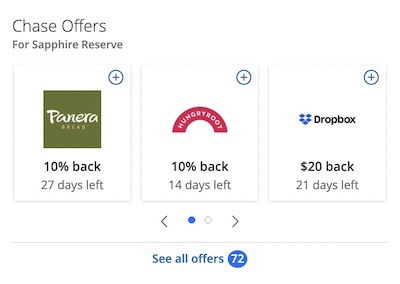

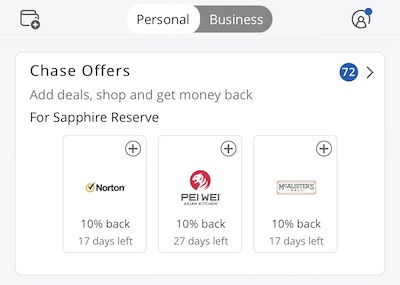

The process of adding Chase Offers through the Chase mobile app is similar. Just log into the app, and then scroll to the very bottom of your account where you’ll see Chase Offers.

You can click the arrow at the top right, and then you can see all the deals, sort by card, etc.

Tips for maximizing Chase Offers program

With the logistics of the program out of the way, here are a few tips for maximizing value with the Chase Offers program:

- If targeted, you can add the same Chase Offers deal to multiple credit cards, so that you can take advantage of it multiple times (this is in contrast to Amex Offers, which only lets you add an offer to one card)

- For online purchases you can stack Chase Offers with online shopping portals to really maximize value, since all that typically matters is that your purchase is made directly with a retailer

- New Chase Offers deals are constantly being added, so I’d recommend checking at least once every week or so to see if any new valuable offers have been added to your account

- Ideally use a card that also maximizes points on your purchase:

- If there’s a Chase Offers deal for a statement credit on a Hyatt stay, ideally use the World of Hyatt Credit Card (review), which offers 4x points for Hyatt spending

- If there’s a Chase Offers deal for a statement credit on Starbucks spending, ideally use the Chase Sapphire Reserve® (review), which offers 3x points for dining spending (and that includes Starbucks)

Bottom line

The Chase Offers program can save you money on purchases you’d make with select retailers anyway. Admittedly the program isn’t quite as robust as Amex Offers in terms of the number of deals available, though the program is constantly getting better, and in particular we’re seeing lots of great travel deals.

I’ve used the Chase Offers program to save money on travel purchases that I would have paid for with a Chase card anyway, so it was basically like free money. This is yet another perk that can add value for Chase cardmembers.

If you have a Chase credit card, what has your experience been with Chase Offers?

Does anyone know if I can still get the credit if the transaction was posted before I added the offer?

Recently maxed out the Autograph Hotel Collection offer with $94 back (15%). Quite nice...

Offers are illegibly small and even after going through the hassle of logging onto a computer where I can enlarge them and finally see what the offers are, I find I’m interested in precisely none of them. They’re simply not merchants I’d ever use or plan to use before the expiration date. I no longer bother with the hassle of trying to figure out what the offers are. I use Amex Platinum offers all the time.

Chase offer are basically worthless (even for my CSR). As opposed to Amex offers that can be material most Chase offers are something like 5-10% back usually with a cap limiting it to a few dollars. You would think Chase would try to be more competitive with Amex. These are basically a joke.

I use the MaxRewards app, which is only $60/year but automatically opts into all the card offers for you on Chase/Amex, and shows them all in one place, so much easier to manage.

Does it opt you into an Amex offer on a less desirable Amex card? Also, does it cycle past the first 100 offers to find desirable ones that may be hidden? Perhaps you can restrict the search to merchants in the travel and dining space?

There's also the 'shop through Chase' program as well which I have used once...and won't again. It works just like the airline programs ones do, but the time I used it, it took over 4 months to get a payout from it and that was after contacting them 3 times.

The program in this article works better.

I for one am glad to see that they're finally offering some "real" deals. In the past many of these were along the lines of "save 5% up to a maximum of $2" which wasn't overly helpful to offset a $99+ annual fee or really worth the brain damage.

I recently took advantage of the Springhill Suites deal for a one-night biz trip and saved $33.02 by using my Chase BA card, not accounting...

I for one am glad to see that they're finally offering some "real" deals. In the past many of these were along the lines of "save 5% up to a maximum of $2" which wasn't overly helpful to offset a $99+ annual fee or really worth the brain damage.

I recently took advantage of the Springhill Suites deal for a one-night biz trip and saved $33.02 by using my Chase BA card, not accounting for the opportunity cost of not using a card offering better return-on-spend for holtes/Marriott.

Yeah, the offers usually suck but have been getting slightly better. Last year Chase had a 20% off at Tumi, so we went to Tumi and most things were 30-40% off and then everything was an additional 30% off, and then I got 20% cash back, so we cleaned up on that deal. Aside from that I have been underwhelmed by most offers.

I find the chase offers to be 99% better than Amex these days. Sure its a lot of 10% off up to $5 but its at places where im generally already spending money and a lot of the fast-casual dining places i eat at regularly. So sure they arent the big ticket savings that amex used to be but $3-5 off at a place im going to be spending money at regardless isnt bad.