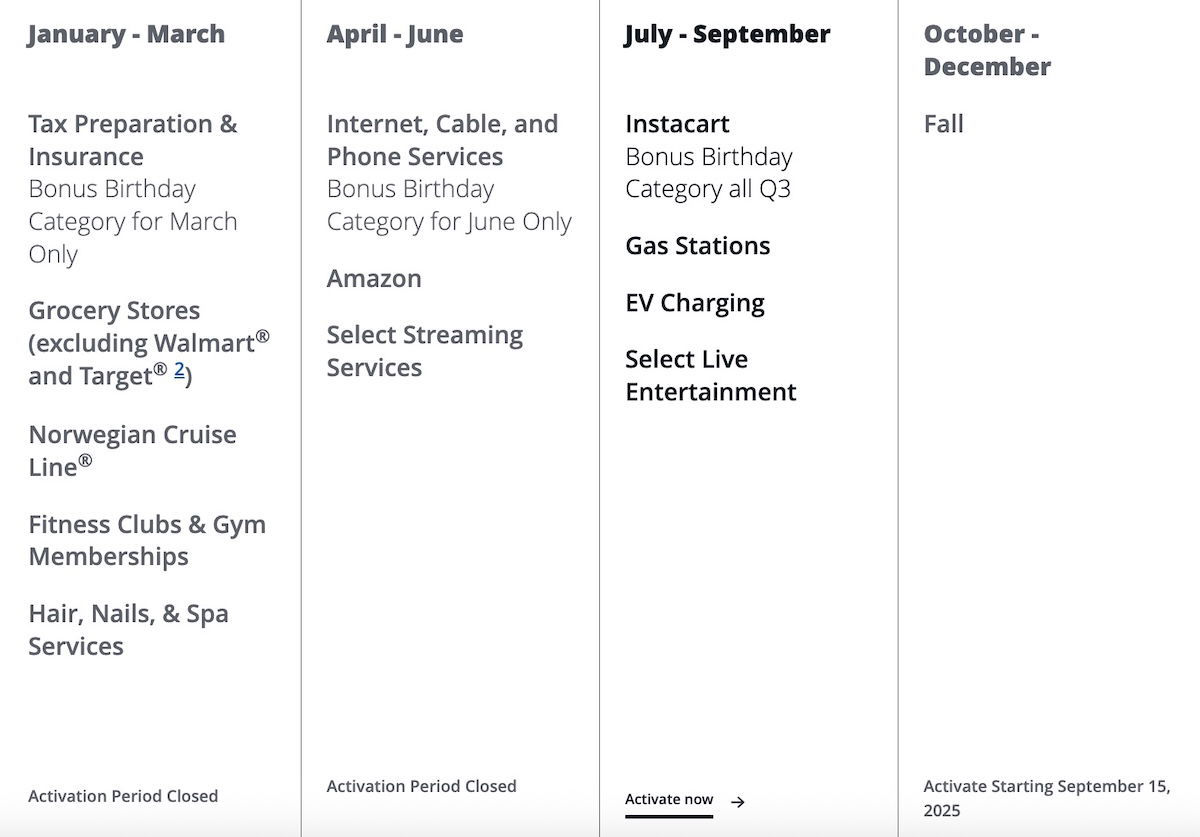

The Chase Freedom FlexSM Credit Card (review) is an incredible no annual fee card belonging to Chase’s Freedom portfolio, which can help you maximize your points, thanks to its quarterly bonus categories. With it now being a new quarter (I can’t believe 2025 is already half done!), Chase has just launched its Q3 2025 bonus categories, so I’d highly recommend registering ASAP.

Note that these same bonus categories are also valid for the Chase Freedom Card, which is no longer open to new applicants.

In this post:

Why I love the Chase Freedom Flex

The Chase Freedom Flex Card is easily one of the best no annual fee cards out there, as it offers 5x points in rotating quarterly categories, for up to $1,500 of spending per quarter. Most people use this as a cashback card, meaning the 5x points really translates into 5% cashback in these categories.

The card has other bonus categories as well, as it offers 3x points (or 3% cash back) at drugstores and on dining.

The best part is that in conjunction with the Chase Sapphire Preferred® Card (review), Chase Sapphire Reserve® Card (review), Sapphire Reserve for BusinessSM (review), or Ink Business Preferred® Credit Card (review), points earned on this card can be converted into Ultimate Rewards points, and be transferred to the Ultimate Rewards airline and hotel partners, or can be redeemed at a favorable rate through the Chase Travel Portal.

Since I value one Ultimate Rewards point at significantly more than one cent, that’s my preferred use of those points.

Chase Freedom Flex Q3 2025 bonus categories

For the third quarter of 2025, the Freedom Flex Card is offering 5x points on the first $1,500 spent on gas stations, EV charging, select live entertainment, and Instacart. As far as key dates go:

- You need to register between June 15 and September 14, 2025

- If you register, you can earn 5x points between July 1 and September 30, 2025

How to register your Chase Freedom Flex for 5x points

Registration is easy — just go to the registration page and enter your last name, billing zip code, and the last four digits on your card, and you’ll be registered.

What’s included with Q3 2025 5x points categories

It’s always worth clarifying what qualifies for 5x points within each of the categories, so let’s look at the terms.

The gas station category includes the following:

Merchants in this category sell automotive gasoline that can be paid for either at the pump or inside the station, and may or may not sell other goods or services at their location. Merchants that do not specialize in selling automotive gasoline are not included in this category; for example, truck stops, boat marinas, oil and propane distributors, and home heating companies.

The EV charging category includes the following:

Merchants in this category sell electric vehicle charging services that can be paid at the charging station, via mobile app, account/subscription or an attendant, and the merchants may or may not sell other goods or services at their location. Merchants must use the electric vehicle charging MCC for transaction to be rewarded against. If electric vehicle charging services are offered for free by a merchant or are included in their services, but other services/goods require payment, the transactions will not be rewarded against. In the event, parking facility merchants, such as valet parking, airport parking, and parking garages, charge to the MCC that results in the highest sales volume, the transaction will not be rewarded against. Residential electric vehicle charging is not included in this category. Electric vehicle charging equipment purchases and servicing for any use, including residential or commercial, are not included in this category.

The select live entertainment category includes the following:

Merchants in this category sell tickets for live in-person entertainment such as major sporting events, zoos and aquariums, concerts, theatrical productions, museums, tourist attractions and exhibits, amusement parks, circuses, carnivals, bands, and entertainers. Ticket agencies selling on behalf of the entertainment venue are included. Some merchants that sell tickets for in-person entertainment are not included in this category; for example, movie theaters, bowling alleys, horse racing tracks, casinos, and dance hall/clubs. Purchasing from a hotel/concierge is not included nor excursions or purchases as part of a travel package.

The Instacart category includes the following:

This category includes purchases made directly through Instacart. Restaurant transactions through Instacart are not eligible for 5% cash back.

My take on Q3 2025 5x points categories

Everyone has different spending patterns, so will have different takes on the quarterly bonus categories. Personally, the Q3 2025 bonus categories don’t excite me much. I don’t really don’t spend much on live entertainment or Instacart. For me, this will simply be useful for the gas station category, but I also don’t spend anywhere close to $1,500 per quarter on gas. But still, some bonus category is better than none.

How to make Chase Freedom Flex points more valuable

To recap, you earn points on the Chase Freedom Flex, and each point can be redeemed for one cent cashback.

However, if you have this card in addition to one of the cards that accrues Ultimate Rewards points, you can transfer these points to Ultimate Rewards. Cards that accrue Ultimate Rewards Cards include the:

So 5% cashback converts into 5x Ultimate Rewards points per dollar with one of the above cards.

Bottom line

The Chase Freedom Flex is one of the best no annual fee cards out there, thanks largely to the ability to earn 5x points in rotating quarterly categories. The Q3 2025 bonus categories have just launched, so now is a good time to register. Between July 1 and September 30, 2025, it’s possible to earn 5x points on gas stations, EV charging, select live entertainment, and Instacart.

What do you make of the Q3 2025 Chase Freedom Flex bonus categories?

"Why I love the Chase Freedom Flex" - there is nothing to love about it. The card used to be much better. It used to offer generalized categories that did not conflict with other cards or when it did they were offering the better return such as travel or restaurants. Now like many card perks it is too specific.

Thanks! I just got this card a few months ago and wasn't very excited about the live entertainment category until I read this article! I have a weekend trip coming up with some family and this will come in handy. I am excited about the 5x in gas since I have yet to get a card that offers more than 2x for gas.

Link states offer not available but I can manually select it.

FYI - Freedom Flex is closed to new applications and not eligible for product changes.

Will this be available on the the Freedom Unlimited..rood trip coming up

Thanks

No

No. Freedom Unlimited is a different card that offers 1.5% back on all categories, no bonus categories.

Better than I thought at first. I've got a small 800 mile road trip set up for July so that will help. In September I may have a road trip, but in Europe. Foreign transaction fees cancel out 5 pts.

This card has become increasingly useless. The categories have become more specific or overlap with other cards that provide the same or a better offer

Yay finally someone included ev charging with gas not that it cost that much to charge.

F’ing worthless and worse than last quarter, what a pisser. Particularly since I just downgraded my Sapphire to a Freedom and I already had the Flex.

Useless for me. The reward categories seem to be becoming less and less valuable over time...

Ugh - Useless categories for me. Wish they had included public transportation for those who don't have or don't frequently use a car.

Yeah that's a bust for me. Try to get gas at Costco and if course that's visa only. Ah well

Citi and discover also have 5% back for gas. Would be nice if they had travel, restaurants and grocery.

Citi Custom Cash gives 5X on the first $500 of spending in the highest spending category during each billing cycle. Conceivably, you would have one card to earn 5X on groceries, a second card to earn 5X on gas, a third card to earn 5X on dining, etc. You should check out the card's terms and conditions. To get there from here, you need to product change from other cards.

These categories tend to always come at the most inconvenient time for me, but finally this one is perfect timing. Going on a big road trip out west in August!