Note: This partnership has an end date of November 14, 2024.

In mid-November 2022, Capital One launched an awesome partnership with Uber, for those with the Capital One Savor or Capital One Savor Cash Rewards Credit Card (review). If you ask me, this is an especially compelling reason to pick up the no annual fee Capital One Savor Cash Rewards Credit Card. As a matter of fact, I applied for the card precisely because of this perk.

While this perk is limited time, there’s still plenty of time to take advantage of this. So I wanted to recap how this partnership works, because there’s a lot of value to be had.

In this post:

Details of the Capital One & Uber partnership

Capital One and Uber have a partnership, which is initially valid for two years, from November 15, 2022, through November 14, 2024. It’s open to those with the Capital One Savor, Capital One Savor, Capital One Savor Student, and Quicksilver Student.

This includes not only elevated cashback for Uber and Uber Eats purchases, but also a complimentary Uber One membership. Let’s go over all the details.

Get 10% cashback with Uber & Uber Eats

Thanks to this partnership, eligible Capital One cardmembers can receive unlimited 10% cashback with Uber and Uber Eats through November 14, 2024.

There’s no registration required — just set your eligible Capital One card as your default payment method with Uber or Uber Eats, and you’ll automatically receive 10% cashback in the form of statement credits with Capital One. The only major restriction is that this is limited to eligible purchases in the United States, so foreign purchases wouldn’t qualify.

Keep in mind that while the Capital One Savor Card is technically a cashback card, these rewards can be converted into Capital One miles in conjunction with a card earning those rewards, like the Capital One Venture X Rewards Credit Card (review) or Capital One Venture X Business (review). I value Capital One miles at 1.7 cents each, so to me that’s like a 17% return on that spending, which is incredible. Of course even if you’re choosing to earn cashback, getting 10% back is awesome.

Keep in mind that you can stack this with earning Marriott Bonvoy® points with Uber.

Get a complimentary Uber One membership

Thanks to this partnership, eligible Capital One cardmembers can receive a complimentary Uber One membership through November 14, 2024.

To access this complimentary Uber One membership, eligible Capital One cardmembers should enroll in an Uber One monthly membership in the Uber or Uber Eats app. Once they set their eligible Capital One card as the form of payment for the Uber One membership, they will receive a monthly statement credit through the end of the offer period.

An Uber One membership ordinarily costs $9.99 per month or $99.99 per year, and offers the following perks:

- 5% off eligible rides and orders of food, groceries, alcohol, and more

- Being matched with top-rated drivers

- An Uber One Promise, whereby on eligible deliveries you’ll get $5 in Uber Cash if the latest arrival estimate (shown after the order is placed) is wrong

- Unlimited $0 delivery fees on eligible food orders over $15 and grocery orders over $30

- Access to premium member support, special offers and promotions, and invite-only experiences

Why I applied for the Capital One Savor Card

Prior to this partnership, the Capital One Savor Card had been on my radar for quite some time, as part of an overall Capital One strategy. This partnership is what finally gave me the push that I needed to apply.

This is a great card in general — it offers 3% cashback on dining, grocery stores (excluding superstores like Walmart and Target), entertainment, and popular streaming services, all with no foreign transaction fees. On top of that, those rewards can be converted into Capital One miles at the rate of one Capital One mile per cent cashback, which is a great deal.

While I typically use Lyft for my ridesharing, I place more orders with Uber Eats than I’d care to admit. Having this card allows me to get Uber One at no cost, and also allows me to earn 10x Capital One miles on all of my Uber and Uber Eats spending.

Otherwise I earn at most 5x points on Uber and Uber Eats, so this is a minimum of an incremental 5x points on those purchases compared to what I previously earned, so I value that at 8.5%. Getting an incremental 8.5% return on my Uber and Uber Eats spending is something that is proving to be incredibly valuable.

Being able to get all of this just by having the Capital One Savor Card is an obvious choice.

My experience with the Capital One Uber benefits

What has my experience been like so far with the Capital One Savor Card Uber benefits?

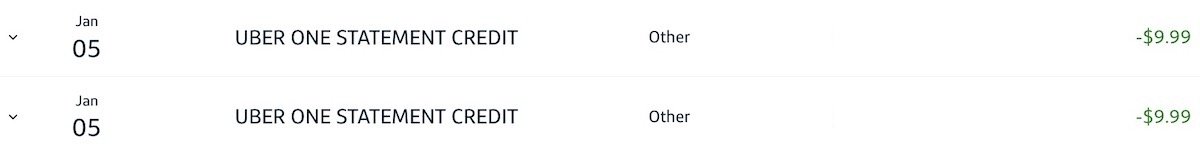

Let’s start with the $9.99 monthly Uber One credit. It seems like there’s some inconsistency when it comes to the timeline of this posting. I’m billed $9.99 by Uber on the 29th of each month. These credits seem to post with some delay, and then also often post in batches all at once. So don’t be surprised if the $9.99 credit doesn’t post right away.

If you don’t want to keep manually checking whether these post, it seems like Capital One sends an email when the credit posts, congratulating you on using the credit, so that’s an easy way to keep track of it.

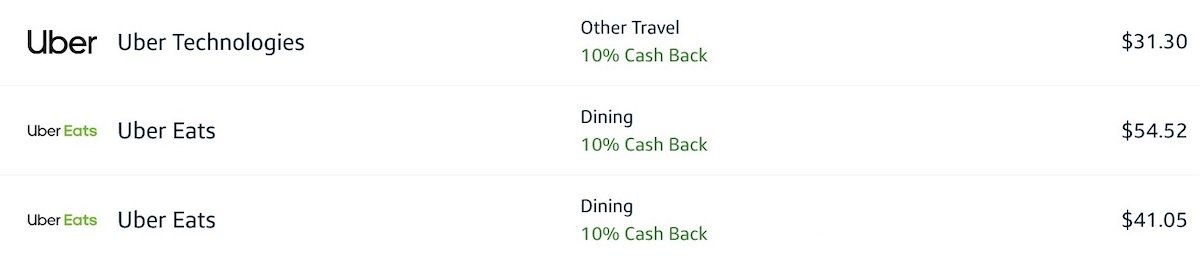

As far as the 10% cashback goes, I’m finding that this is posting very quickly. Shortly after an Uber or Uber Eats transaction hits my account, there’s a note in green showing that I earned 10% cashback for those purchases — awesome!

Bottom line

Capital One and Uber have a useful partnership. Through November 14, 2024, those with select Capital One cards can receive a complimentary Uber One membership (ordinarily $9.99 per month), plus 10% cashback on Uber and Uber Eats spending (which can be converted into Capital One miles, in conjunction with select other cards).

This is a valuable partnership, especially since it’s available on no annual fee cards. This is the push that I needed to apply for the Capital One Savor Card, and I’m loving the benefits.

What do you make of this Capital One and Uber partnership? Anyone else considering getting the Capital One Savor Card because of this?

This seems like a great card, hopefully they keep adding more perks like this in the future. Thinking about dropping my Amex Gold when the next yearly fee hits and grabbing this to pair with my VentureX for the elevated points on dining and groceries.

After the initial year with the Gold card of getting the sign up bonus I do not see myself getting the yearly fee's worth out of it....I only use...

This seems like a great card, hopefully they keep adding more perks like this in the future. Thinking about dropping my Amex Gold when the next yearly fee hits and grabbing this to pair with my VentureX for the elevated points on dining and groceries.

After the initial year with the Gold card of getting the sign up bonus I do not see myself getting the yearly fee's worth out of it....I only use the $10 monthly Uber credit. The $10 a month dining credit is useless for me. I don't have the restaurants in my area, so my last resort is to use it for Grubhub. Their fees are so jacked up it's not even worth using with the free $10.