In the US we don’t typically see airlines charging fees for using credit cards. That’s primarily for a few reasons:

- Most merchant agreements prohibit charging an extra fee for using a credit card

- Co-branded airline credit cards are a massive profit center for many airlines, so they want to encourage people to use credit cards as much as possible

- On the most basic level, credit cards are necessary for airlines to do business, given that it’s the fastest and most convenient way for people to pay; you don’t want to create barriers for people to pay for their tickets

Unfortunately similar policies aren’t in place in many other countries, where there are still fees when paying for airline tickets with a credit card. One of those countries is the UK.

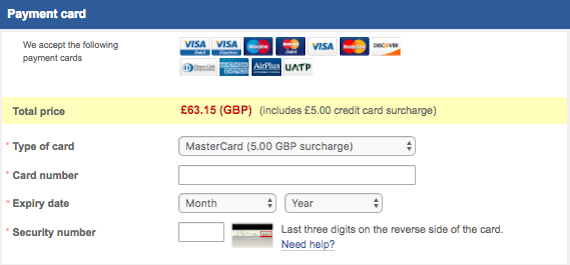

British Airways has just announced that they’ll be adjusting their fee structure for those paying with UK credit cards. Per Business Traveller, starting December 14, 2016, British Airways will begin charging a 1% fee on the total ticket price for credit card payments, up to a maximum of 20GBP. Under the current policy, customers are charged a 5GBP per ticket fee for paying by credit card.

Whether or not this policy change is good depends on the type of ticket you book:

- If on average you pay less than 500GBP per British Airways ticket, you’ll be better off under the new policy

- If on average you pay more than 500GBP per British Airways ticket, you’ll be worse off under the policy

I will say that the new policy is more logical, as far as I’m concerned, since the credit card fee is more reflective of the cost of processing a transaction. It’s sort of silly that under the current policy you pay the same amount whether you’re booking a 100GBP reservation or a 10,000GBP reservation.

Perhaps the bigger story here is that Virgin Atlantic has cut credit card fees altogether as of last week, while previously they charged a 1.5% fee. Of course that hardly makes up for the horrible changes that Virgin Atlantic is in the process of making to their Flying Club program.

Too bad British Airways likely won’t match Virgin Atlantic’s credit card change.

Bottom line

While I don’t generally like British Airways, I think the change in credit card fees is logical. I see a lot of people suggesting British Airways is hiking credit card fees here, but I don’t think that’s the case. Instead they’re charging the fee more rationally, so that people booking cheap short-haul tickets aren’t paying a 10% fee, while others are paying a 0.1% fee.

This only applies to tickets booked with UK credit cards, so if you’re a US-based British Airways passenger, you shouldn’t be hit with this fee.

What do you make of British Airways adjusting their credit card fee structure?

Any change they fix Avios award search before January 11? It's totally broken.

@Simon - when did QF have this per sector charge? Until recently they had a $7 fee on domestic, and $30 on intl (fees per ticket) but certainly nothing per sector for longhaul.

I've never really understood why in Europe they prefer to accept Debit cards over Credit. I mean I guess the merchant is charged a lower fee and that's about it.

But as a consumer, I avoid using a debit card 99 % of the time, or if the shop i'm in does not take a credit card, I will just go somewhere else. To me there is always way more protection when paying with a...

I've never really understood why in Europe they prefer to accept Debit cards over Credit. I mean I guess the merchant is charged a lower fee and that's about it.

But as a consumer, I avoid using a debit card 99 % of the time, or if the shop i'm in does not take a credit card, I will just go somewhere else. To me there is always way more protection when paying with a credit card. It can take months to get your money back if someone clones and spends on your debit card.

I mean its 2016....not 1984, credit cards should be accepted everywhere and have no fees to use them.

Interbank interchange(Mastercard, VISA) on INTRA EEA (and the UK inside this bloc) consumer credit card transactions is legally limited to 0,3%. Card scheme fees are much lower, lets say 0,15%. BA will be on interchange++ pricing and, given their size, will be paying max 0,1%. They will be paying a few pence per transaction if they are using an external IPSP. Lets round this all up and say they are paying 0,6% for EEA consumer...

Interbank interchange(Mastercard, VISA) on INTRA EEA (and the UK inside this bloc) consumer credit card transactions is legally limited to 0,3%. Card scheme fees are much lower, lets say 0,15%. BA will be on interchange++ pricing and, given their size, will be paying max 0,1%. They will be paying a few pence per transaction if they are using an external IPSP. Lets round this all up and say they are paying 0,6% for EEA consumer card transactions. Somebody is being ripped off here and its the consumer!

INTRA EEA Interchange for business cards is not limited but the fees are the same as for consumer cards.

Use a USA issued card in the UK and not only is there a high interchange but also extremely high card scheme fees. So it would be completely illogical not to surcharge for non European cards if processed through a UK located merchant ID.

I can only hope that the PSD2 prohibition of surcharging for transactions with a regulated interchange finally effect in 2017 and that this entire rip off is finally stopped.

Dominic Wood - You're not giving them your money, you're giving them your banks money. And your bank is charging them for that...

Alan - I don't know if you're just pointing out a technicality in the back-end system, but all UK retailers are charged to accept debit card payments.

There's been a big hullabaloo about credit card fees here in Australia of recent times. QF used to think it appropriate to charge a fixed fee (I think it was $7) - which would have been almost acceptable, however it was applied per person, per flight sector!!! So for my wife and I to travel ADL-MEL-LAX-JFK-LAX-MEL-ADL last year saw us hit with $7 x 6x flight sectors x 2x Pax = $54. It was the...

There's been a big hullabaloo about credit card fees here in Australia of recent times. QF used to think it appropriate to charge a fixed fee (I think it was $7) - which would have been almost acceptable, however it was applied per person, per flight sector!!! So for my wife and I to travel ADL-MEL-LAX-JFK-LAX-MEL-ADL last year saw us hit with $7 x 6x flight sectors x 2x Pax = $54. It was the same fee regardless of ticket price, fare class or cabin travelled..... It had been that way for years, but it's recently changed to something more reasonable. Thank God!

I've always found it a total liberty that BA charge ME for the privilege of giving THEM my hard earned money. Even more weird when I pay with my BA Amex for which I'm sure they get a decent kickback!

For what it's worth, it's generally seen as a way to encourage debit card transactions, which the majority of Europeans are using far more than credit cards to begin with. That and most banks in the U.K. don't charge any fees on debit transactions to merchants.

Aer Lingus, also under the IAG umbrella, doesn't charge any card fees at all, hopefully it stays this way.

"This only applies to tickets booked with UK credit cards, so if you’re a US-based British Airways passenger, you shouldn’t be hit with this fee"

Okay everyone, put away your pitchforks. Unpack your kittens and move along.