In September 2019, American Express revealed some significant changes to the travel & purchase protection offered on some premium cards. This announcement came just two days after Citi made massive cuts to the purchase and travel protection offered by their cards.

The changes are both positive and negative, as we’re seeing improved travel protection, while we’re also seeing reduced extended warranty protection and purchase protection, and some other protection being cut as well.

This coverage is exciting, because it’s an area where Amex has historically lagged. Meanwhile, these changes are potentially bad news for those who valued the purchase and protection benefits previously offered by the card.

So here’s a refresh of the details:

In this post:

Amex Trip Cancelation & Interruption Coverage

As of January 1, 2020, Amex offers reimbursement for trip cancelation and interruption:

- This is valid for roundtrip tickets paid for entirely with your eligible Amex card (“roundtrip travel may consist of roundtrip, one-way, or combinations of roundtrip or one-way tickets”)

- Paying taxes on an award ticket with your card would qualify for this, as would using the Amex Pay With Points feature to pay for your ticket

- This applies to covered reasons, which includes accidental bodily injury, inclement weather, military orders, terrorist action, call to jury duty, one’s dwelling made uninhabitable, and a quarantine imposed by a physician for health reasons

- You can be reimbursed for up to $10,000 in non-refundable travel expenses per trip, up to $20,000 per 12 consecutive month period

- Coverage applies to you and your family members (including domestic partners) and traveling companions who purchase a trip with your card

- You must file your claim within 60 days of the covered event

Of course, you’ll want to check your benefits guide for all of the details, because there are a lot more things to be aware of (here’s a look at a sample benefits guide for the Amex Platinum, for example).

This coverage applies to the following cards:

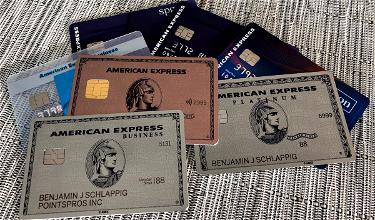

- The Platinum Card® from American Express (review)

- The Business Platinum Card® from American Express (review)

- Delta SkyMiles® Reserve American Express Card (review)

- Delta SkyMiles® Reserve Business American Express Card

- Hilton Honors Aspire Card from American Express

- Marriott Bonvoy Brilliant American Express Card

The information and associated card details on this page for the Hilton Honors American Express Aspire Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Trip Delay Coverage

As of January 1, 2020, Amex offers reimbursement for trip delays. The terms are largely the same as with the trip cancellation & interruption coverage. The major difference is that:

- This applies if you’re delayed by at least six hours

- If eligible, you can be reimbursed up to $500 per trip for necessary expenses, like hotels, meals, and other essentials

This coverage applies on the following cards:

- The Platinum Card® from American Express

- The Business Platinum Card® from American Express

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

- Hilton Honors Aspire Card from American Express

- Marriott Bonvoy Brilliant American Express Card

Additionally, American Express is offering similar coverage with lower reimbursement limits ($300) and longer delay requirements (12 hours) on the following cards:

- American Express® Green Card (review)

- American Express® Gold Card (review)

- American Express® Business Gold Card (review)

- Delta SkyMiles® Platinum American Express Card (review)

- Delta SkyMiles® Platinum Business American Express Card

The information and associated card details on this page for the Hilton Honors American Express Aspire Card and American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Amex Extended Warranty Protection Reduced

As of January 1, 2020, Amex has made significant changes to their extended warranty protection:

- Amex is reducing the extended warranty on most of their cards from two years to one year

- Some no annual fee cards will lose extended warranty coverage altogether

Amex Purchase Protection Reduced

As of January 1, 2020, Amex has made significant changes to their purchase protection. Specifically, Amex cards that currently offer purchase protection are seeing the eligible period reduced from 120 days to 90 days.

Amex Travel Accident Insurance & Roadside Assistance Removed

As of January 1, 2020, American Express has eliminated two types of protection altogether:

- Amex is cutting travel accident insurance, which covers expenses related to death or dismemberment while traveling

- Amex is cutting roadside assistance

My Take On Amex Coverage Changes

Whether or not these changes are good or bad news depends entirely on your purchase patterns. Personally, I’ve never taken advantage of roadside assistance, travel accident insurance (thank goodness), extended warranty, or purchase protection.

Suffice to say I’m thrilled to see Amex adding proper travel protection for delays and cancelations, especially given that The Platinum Card® from American Express offers 5x points on airfare purchased directly from airlines or through Amex Travel, on up to $500,000 on these purchases per calendar year and then 1x.

This coverage rivals what’s offered by the Chase Sapphire Reserve® Card (review), which was previously the gold standard for travel coverage (that card offers just 3x points on airfare, rather than 5x points, though).

So for my purchase patterns, I’m quite happy with this, though others may not view these changes so positively. I’m absolutely using my Amex Platinum for all airfare purchased directly with airlines as of today.

What do you make of these changes to Amex’s travel & purchase protection?

Where is Amex Business Platinum in this entire conversation

I don't see travel medical insurance on your list. Is that only a Canadian thing?

Travel medical is usually deceptive - with offers of 30 day coverage for under 65's and only in the fine print does it indicate 3 days coverage for over 65's.

So if travel medical is included what are the fine print details for under and over 65's?

Losing roadside coverage sucks, as it saved me from having to get AAA. Combine that with NOT having the Priority Plus restaurant benefit anymore either and it's a big chunk out of getting reimbursed for the $550 yearly cost of my Platinum card.

I’m not seeing anything about coverage for non refundable hotel fees on cancelled trips. Maybe none of the cards cover this?

Does the new Amex Trip Cancelation & Interruption Coverage and Trip Delay cover RT tickets purchased from third-party sites like hotwire or expedia? What about Multi-City trips with same depart/return city? I have the Aspire and waited to purchase our tickets.

CSR still seems better overall as it has a coverage for emergency or detnal care while traveling. It would easily say pay a $100-$300 ER copay. Also, I am not sure what type of baggage insurance for both delay and loss that the Amex Plat offers, but I think CSR readily covers both baggage delay (an amount per day for incidentals) as well as baggage loss secondary to the airline.

I would be curious also...

CSR still seems better overall as it has a coverage for emergency or detnal care while traveling. It would easily say pay a $100-$300 ER copay. Also, I am not sure what type of baggage insurance for both delay and loss that the Amex Plat offers, but I think CSR readily covers both baggage delay (an amount per day for incidentals) as well as baggage loss secondary to the airline.

I would be curious also if it will be easier to file and have claims paid by CSR or Amex?

The claims process is tedious. I would get a policy that has a much simpler "claims" process similar to:

http://getfreebird.com

I'm not interested in sending dozens or hundreds of pages of documentation.

"'roundtrip travel may consist of roundtrip, one-way, or combinations of roundtrip or one-way tickets'”

So how does this work if you are booking awards with different partners? Sometimes you have to mix and match awards because it can be tough to find availability both directions. Honestly most of my travel is booked to one destination and then coming back from another destination so if my start airport and end airport is the same will that...

"'roundtrip travel may consist of roundtrip, one-way, or combinations of roundtrip or one-way tickets'”

So how does this work if you are booking awards with different partners? Sometimes you have to mix and match awards because it can be tough to find availability both directions. Honestly most of my travel is booked to one destination and then coming back from another destination so if my start airport and end airport is the same will that work? What about returning to different airports but still in the same city (ie fly out of LGA and return to JFK)?

@Mac C Based on the terms it seems like you can use vouchers/miles to pay rest. Just you can't use other cards to pay one part and use Plat to pay a different part.

"tickets paid for entirely" is problematic, even with paid award tickets. My CSR just paid for a Southwest paid flight where I used mostly a LUV voucher, and small remaining on CSR ($194.12 LUV + $51.86 CSR) + Companion tax of $11.20. So for other tickets, they paid out $545 for a delay of 6.5 hours - just got confirmation email that it was just approved.

@CF Frost Platinum has Medical Evacuation as I remember.

Chase still seems to have an advantage by also including Medical Evacuation coverage which is really awesome.

Does this coverage apply for flights booked this year for travel next year???

hello. does anyone know if this covers trips taken in 2020 but purchased in 2019? i have an upcoming trip in april/may but i purchased it in september so hopefully this is covered.

@Lucky, I'm curious what your views are on travel insurance. Do you ever pay for it, or do you pretty much rely on your credit card coverage when you travel abroad?

@mjonis

If you want a "comprehensive" policy, then you should buy one. There's a reason none of the major cards cover "work reasons" because it creates a moral hazard issue.

Does the Schwab Platinum also get all these same benefits changes?

Thanks.

Seems both Chase and Amex have very (IMO) limited covered reasons, compared to a "comprehensive" policy.

Neither one includes "work reasons" (ie: employer says you can't have the time off, you lose your job, etc.)

Citi used to cover work reasons.

Sounds like a lot of confusion on what is being cut. I’ve (foolishly I guess) had AAA but was going to get around to discontinuing. But maybe if there there really are four instances available that would be more than enough for me.

Also, is the travel accident insurance 100 percent gone?

With no airline incidental charges, I think that 200 credit is close to worthless to me now, although maybe there are...

Sounds like a lot of confusion on what is being cut. I’ve (foolishly I guess) had AAA but was going to get around to discontinuing. But maybe if there there really are four instances available that would be more than enough for me.

Also, is the travel accident insurance 100 percent gone?

With no airline incidental charges, I think that 200 credit is close to worthless to me now, although maybe there are ways to use it that I am missing.

Also, have heard the Sak’s credit is being disallowed for gift card purchases.

The Uber I use some months, but miss it quite a few also.

Would love separate articles on all of above! Except the Uber perhaps.

There’s a reduction in the fee for Schwab platinum card owners, but I’m thinking of transferring to ameritrade for a nice cash bonus. I don’t even know if I can keep the schwab platinum without an account? Guess I could leave a bit in it.

If you could get more clarification from Amex would be great!

Yes. My recent AMEX Gold card statement also confirmed that Premium Roadside Assistance will be discontinued in January 2020. This means that I will now have to spend $80 per year for an AAA membership for me and my AU spouse. This plus the loss of the airline gift card reimbursement means that I will cancel my Gold card. Getting tired of increased annual fees and devaluations.

My statement today for Platinum does say that premium roadside is being cut contrary to some of the posts here.

AlexS the card might not be for you, that's fair. For me, I saved $600 on paid business class tickets with the Amex IAP which covers more than the AF. On months I don't need Uber I use Uber Eats for $15 in 'free' food so that $200 is used fully. The $100 to Saks', not really worth the face value but I can find a few things to buy in the bath/body category twice a year.

Even with these "improvements" I still can't justify getting an Amex card over a CSR.

Just a quick comparison:

Amex Plat vs. CSR:

Annual Fee - $550 vs $450

Travel Credit $220 (only for incidentals on ONE airline) vs. $300 for just about anything remotely travel-related

Lounges: Centurion / SkyClub (cardholder only) / Priority Pass vs. Priority Pass

Rental Car Coverage: None vs. $75k coverage included with each rental

...

Even with these "improvements" I still can't justify getting an Amex card over a CSR.

Just a quick comparison:

Amex Plat vs. CSR:

Annual Fee - $550 vs $450

Travel Credit $220 (only for incidentals on ONE airline) vs. $300 for just about anything remotely travel-related

Lounges: Centurion / SkyClub (cardholder only) / Priority Pass vs. Priority Pass

Rental Car Coverage: None vs. $75k coverage included with each rental

Trip Interruption: $10k per trip / $20k per year vs. $10k per person / $20k per trip

Trip Delay: 6 hours / $500 coverage per event vs. 6 hours / $500 per airline ticket

The only thing I think Amex really has an advantage on is the lounge situation domestically. BUT, let's be honest -- the lounge situation domestically sucks. Almost all of them are overcrowded and most of them are underwhelming. It's amazing how much better the ones abroad are, even in the smallest of airports/countries.

Roundtrip requirements make this useless. All of my domestic travel is one way tickets. All of my award travel is one way. Reducing extended warranty and purchase protection would move purchased to another card. I will use an Amex card for items i want the protection coverage for.

As a Type 1 diabetic, it is extremely hard to get life insurance. I have always been grateful for the insurance coverage on trips paid for on my Reserve card. Poof! Now that's gone. Not that I'm looking to be killed in a plane crash, but my wife and family receiving 500K would still be great for them.

@Jordan Let's forget about common sense which can help people who have it understand why the BTS and VIE is different from SJC and SFO.

Do you understand that all major airlines consider SJC and SFO co-terminals? (For example look at here for list of airports which AA considers co-terminals: https://www.aa.com/i18n/fragments/agency/agency-dom-coterm.jsp ) And do you understand that considering two or several airports as co-terminals, by definition, means that those airports are considered the "same...

@Jordan Let's forget about common sense which can help people who have it understand why the BTS and VIE is different from SJC and SFO.

Do you understand that all major airlines consider SJC and SFO co-terminals? (For example look at here for list of airports which AA considers co-terminals: https://www.aa.com/i18n/fragments/agency/agency-dom-coterm.jsp ) And do you understand that considering two or several airports as co-terminals, by definition, means that those airports are considered the "same point" for ticketing contractual purposes?

@Kevin: I just searched and got the following option (among many others) on aa.com as a roundtrip NYC-LAX-NYC:

Depart New York, NY to Los Angeles, CA

Friday, September 27, 2019

8:00 AM11:07 AM

6h 7m

Nonstop

AA 1 32B-Airbus A321 (Sharklets) Wi-Fi on-boardPower on-board

Main Cabin

Details, for JFK to LAX, departing at 8:00 AM Nonstop Changefor JFK to LAX, departing at 8:00 AM Nonstop

Return Los...

@Kevin: I just searched and got the following option (among many others) on aa.com as a roundtrip NYC-LAX-NYC:

Depart New York, NY to Los Angeles, CA

Friday, September 27, 2019

8:00 AM11:07 AM

6h 7m

Nonstop

AA 1 32B-Airbus A321 (Sharklets) Wi-Fi on-boardPower on-board

Main Cabin

Details, for JFK to LAX, departing at 8:00 AM Nonstop Changefor JFK to LAX, departing at 8:00 AM Nonstop

Return Los Angeles, CA to New York, NY

Wednesday, October 2, 2019

6:35 AM4:40 PM

7h 5m

1 stopOpens 1 stop pop-up for LAX to LGA, departing at 6:35 AM

LAX - ORD AA 2452 321-Airbus A321 Wi-Fi on-boardPower on-board

ORD - LGA AA 2302 738-Boeing 737 Wi-Fi on-boardPower on-board

Main Cabin

Details, for LAX to LGA, departing at 6:35 AM 1 stop Change

EWR-JFK-LGA, SFO-SJC-OAK, ORD-MDW are reasonable alternatives and most booking engines allow them to be booked as a single origin or destination.

Any word on Return Protection? Since that has been eliminated from so many other banks, I am thinking this could be removed as well, but no mention here. Called the number on back of the card and they have no idea about any benefit changes.

@Miz

Not at all. A round trip flight (from a quick google search) is defined as a trip departing from and returning to the same point. That doesn’t mean ‘same metropolitan area’. That means same airport. Searching for flights on the same ticket does not a round trip make. How bout this: Ryanair/other airlines have in the past marketed Vienna airport as serving Bratislava. While in reality many people do choose that option, does flying...

@Miz

Not at all. A round trip flight (from a quick google search) is defined as a trip departing from and returning to the same point. That doesn’t mean ‘same metropolitan area’. That means same airport. Searching for flights on the same ticket does not a round trip make. How bout this: Ryanair/other airlines have in the past marketed Vienna airport as serving Bratislava. While in reality many people do choose that option, does flying out of Bratislava and arriving back to Vienna count as a round trip by your definition, since both can technically serve Bratislava despite being in different countries? Where are the limits to your definition of roundtrip? Roundtrip is clearly Point A to Point B to Point A. None of your BS

@staradmiral

Wrong again. I did a dummy booking using your example (10-16 to 10-23) and if you type in JFK-LAX on the round trip option on the home page (www.aa.com), the only paired flights are JFK-LAX and vice versa.

Good try though!

@Kevin

I just tried it right now and I can on the american airlines website. Round trip selected, JFK -> LAX -> EWR

Does anybody know if these changes will also apply for UK and European cardholders?

@Jordan, I am not sure in which alternative world or in which part of current world "no one would ever consider SFO-anywhere-SJC a round trip". of What I know is that people in the Bay Area conceivably consider and use SFO, SJC, and OAK airports as alternative airports for the same metropolitan area. Some OTA and airlines also group them under the Bay Area Airports and let you search for flight to/from them at once.

@Staradmiral

Your example is terrible. Same city does not mean round trip when it involves different airports.

You can't believe book a JFK--anywhere-EWR trip without clicking the multi-city function on all search engines.

AMEX Assurance sucks anyway, the ONE time I had to use it, my claim was denied. They should do away with it altogether and lower their annual card fees.

@Jordan,

I think many would consider JFK-anywhere-EWR a round trip. Meanwhile EWR is not in the same city or even the same state. SFO to SJC seems the same situation to me.

@Ron

You claim when your kids break things? That's OK, Johnny, just throw it against the wall. Doesn't matter, I'll get you a new one for free.

@Miz

No one would ever consider SFO-anywhere-SJC a round trip. Not sure why you would think it is.

So many stupid people in the comments who either can’t read or won’t read.

If roadside coverage goes with the AMEX Plat that would seriously suck. I haven't used AAA in over 10 years. That $85 savings was one was yi justify the ridiculous cost and increases. First they drop the private restaurants from Priority Plus, now this.

Those new Centurion lounges are still a long time away...

Premium roadside assistance is not cut--please update your article

Eliminating travel accident and dismemberment insurance coverage and lacking emergency travel medical coverage makes it incomplete as a premium travel card. So though there are some positive changes, I'm still sticking with my CSR for travel. Been a moneymaker for me the last several years.

This is a good post because I often forget or don't know what benefits I have with the Amex Plat. I keep it for the lounge access and 5x for flights.

I’ve used road side assistant before, would be a bummer if they removed it. Also the 120 days of purchase protection to 90 is also not good in my book. I’ve taken advantage of purchase protection since there are young kids in my house and newly purchased items get broken. Purchase protection saved me a few times over the year.

I hope we are not losing the AMEX Platinum roadside assistance - the 4 tows per year .

It has saved me twice the past year , the phone agents are incredibly helpful , they send you a link to track where the tow truck is and then follow up to check on the service .

I have not joined AAA because of this service so losing this benefit would be another ding against the card and loss of value , especially after losing the Delta gift card benefit

Aren't we all Gary, when you get down to it?

Has anyone seen the T&Cs? If I buy a ticket today for travel after January 1, would Amex cover me? Or is it only for purchases after Jan 1?

This was the main thing missing from Platinum for me. (Remaining is to allow Delta SkyClub access for companions.) Will likely move all my airfare spend to Amex Platinum now.

This latest round of changes underscores my belief that, at least for areas where it can be obtained relatively cheaply, explicitly *paying* for coverage is less likely to be devalued or loaded with procedural hurdles. In other words, pay for a standalone annual AAA membership. AAA knows that if they screw around with basic towing/lockout/dead battery coverage, people will simply not renew memberships. Similarly, Amex offfers paid "Premium Rental Protection" coverage for cars rented with...

This latest round of changes underscores my belief that, at least for areas where it can be obtained relatively cheaply, explicitly *paying* for coverage is less likely to be devalued or loaded with procedural hurdles. In other words, pay for a standalone annual AAA membership. AAA knows that if they screw around with basic towing/lockout/dead battery coverage, people will simply not renew memberships. Similarly, Amex offfers paid "Premium Rental Protection" coverage for cars rented with Amex cards that are subscribed to "PRP for less than $25 per *rental* (not per *day*). Again, since that's a *paid* product, Amex doesn't randomly mess with it without warning.

As some people are stating, I would be VERY happy if the Premium Roadside Assistance stays. I've used it before, and it works really well. But if they're getting rid of the pay-per-use Roadside Hotline, what's the point in that?

The American Express Platinum card already has baggage insurance.

Who is Gary

@Ben (Lucky)

Small thing I'd like to point out, but based on an article by The Points Guy (https://thepointsguy.com/news/amex-trip-delay-purchase-benefits/), AmEx's Roadside Assistance HOTLINE (the roadside assistance coverage provided on the Green Card, some Delta cards, etc) is being discontinued. However, nothing is mentioned about cancellation of PREMIUM Roadside Assistance (coverage on the Platinum Card, Gold Card, Delta Reserve Card, etc). So I don't think roadside assistance is being cut entirely.

The other thing is...

@Ben (Lucky)

Small thing I'd like to point out, but based on an article by The Points Guy (https://thepointsguy.com/news/amex-trip-delay-purchase-benefits/), AmEx's Roadside Assistance HOTLINE (the roadside assistance coverage provided on the Green Card, some Delta cards, etc) is being discontinued. However, nothing is mentioned about cancellation of PREMIUM Roadside Assistance (coverage on the Platinum Card, Gold Card, Delta Reserve Card, etc). So I don't think roadside assistance is being cut entirely.

The other thing is that according to TPG, "a round-trip is defined as travel to one or more destinations that begins and ends in the original city of departure. So one itinerary bringing a covered traveler from New York to London, then back from Paris to New York would qualify as a round-trip for the purposes of Amex’s insurance coverage." This sounds like multiple one-way tickets will count as a round-trip, as long as you come back to the original city of departure.

We value the travel accident insurance as we were with friends in Alaska (2 cars, both being paid for with the Platinum card) and our friend had a very bad auto accident. Totaled the car and all 3 occupants went to the hospital in Homer and EVERYTHING was covered and paid for.

Only regular roadside assistance (the pay per use coverage) is being eliminated.

PREMIUM roadside assistance (4 uses per year with no cost to cardholder) which is offered on the high annual fee cards such as Platinum, Gold, etc. will be retained.

@Jetiquette

Worry not for AMEX

AMEX can be very sophisticated in protecting their interests. I actually took out an AMEX policy for travel and I was forced to abandon the claim after they demanded what might have been hundreds of pages of documents pertaining to all unrelated medical care in the 5 years prior. The claim was for documented food poisoning resulting in dehydration and IV and metabolites administered. Somehow, total costs were...

@Jetiquette

Worry not for AMEX

AMEX can be very sophisticated in protecting their interests. I actually took out an AMEX policy for travel and I was forced to abandon the claim after they demanded what might have been hundreds of pages of documents pertaining to all unrelated medical care in the 5 years prior. The claim was for documented food poisoning resulting in dehydration and IV and metabolites administered. Somehow, total costs were only about USD500 so I learned my lesson. Years later, I still get annual notices regarding how they can and will share confidential medical information that should be HIPPA qualified.

This does nothing to persuade me to put another premium AMEX card in my wallet...AMEX has a very long way to go to earn back my business.

This is certainly a game changer. I have the Platinum as well as the Prestige and after losing all the benefits on the Prestige, i had been debating my longer term strategy. I had planned to keep using Prestige since I also have the Rewards+ and that made the airfare bonus 5.5x instead of 5x. But now i'm going "full Platinum" with airfare (and just may "full Gold" with dining) and start my wind down...

This is certainly a game changer. I have the Platinum as well as the Prestige and after losing all the benefits on the Prestige, i had been debating my longer term strategy. I had planned to keep using Prestige since I also have the Rewards+ and that made the airfare bonus 5.5x instead of 5x. But now i'm going "full Platinum" with airfare (and just may "full Gold" with dining) and start my wind down plan from the TYP ecosystem.

Between the (Prestige+DC+Rewards+) trifecta and (Platinum+Gold+BBP) trifecta, now the Amex trifecta is more useful simply because of the travel coverage benefits.

Unless Citi introduces some other meaningful benefit to the Prestige, its on my "winding it down" list.

I echo others. Recently convinced my

father to get roadside assistance as he could drop AAA. He will not be happy. Nor will I.

Not only Amex does not cover one-way tickets, it does not even cover all types of round trips. For example if I depart SFO and return to SJC, I am not covered, because I am not returning to the original city of departure!!! Their T&C for their coverage doesn't make sense. In my book I won't consider that Amex has added these benefits until after (if ever) they cover one-way trips. If they ever do...

Not only Amex does not cover one-way tickets, it does not even cover all types of round trips. For example if I depart SFO and return to SJC, I am not covered, because I am not returning to the original city of departure!!! Their T&C for their coverage doesn't make sense. In my book I won't consider that Amex has added these benefits until after (if ever) they cover one-way trips. If they ever do that, almost all possibilities that are currently ridiculously excluded from the coverage will be sensibly covered.

I think it’s the gold and green card that are eligible for insurance of trip delay of more than 12hrs rather than the Gold Delta personal/business cards as per the report by TPG.

Citi: We're canning most of the popular benefits of holding our premium cards.

Card holders: Damn, may cancel my (insert Citi card name).

*Amex has enters the chat*

Very, very happy to see the travel protection added. This means my Amex Platinum will be my go-to choice for virtually all my flights I book going forward. (And makes me start questioning if it's worth keeping the Chase Sapphire Reserve, or downgrading it to the preferred.)

The reduced extended warranty is definitely a loss for me. I've had to use benefit this across various different card issuers, and I can say unequivocally that Amex...

Very, very happy to see the travel protection added. This means my Amex Platinum will be my go-to choice for virtually all my flights I book going forward. (And makes me start questioning if it's worth keeping the Chase Sapphire Reserve, or downgrading it to the preferred.)

The reduced extended warranty is definitely a loss for me. I've had to use benefit this across various different card issuers, and I can say unequivocally that Amex was by far and away the best with this. Far less questions and efforts to dodge coverage when it was needed than with my other card issuers. It's saved my butt on purchases big and small, so much so that I have gotten in the habit of always charging any sort of higher end items (electronics and luggage are two categories that come to my mind) to my Amex for the extended warranty coverage, even to the detriment of getting better rewards with a different card.

I just booked hotels and airfare for 2 different trips, about $5,000 total, and put it all on my CSR because of the travel insurance they offered. Amex majorly lost out and is finally catching on, so that's good, because it's a joke that they were a premium card without offering these already.

What do they define as "Round trip" ? Would a multi-city and stopover ticket work?

Real bummer with road assistance being axed...used it in the past for lockouts. One of the benefits I valued so def need to reassess keeping the Plat.

Would like to understand how Amex is classifying "round trip" — I routinely book two one-way tickets and it would be a bummer if this was not covered.

I have a feeling they will regret covering illness and inclement weather. Those will be used and abused VERY frequently.

Losing roadside coverage is a bummer. Have used it in a pinch a few times for dead batteries, flat tires, etc.. Guess I'll have to join AAA next year. :(

Just to add to the chorus, I've seen several sources now report language indicating award trips are covered.

My apologies, folks. Updated.

Gary has a different read on awards being covered

Gary notes that award tickets would qualify, FYI