There are many reasons it can make sense to hold onto a lot of credit cards. I’d argue that American Express cards are among the most compelling to hold onto, and that’s thanks largely to the Amex Offers program, which can save you money and earn you bonus points for purchases with all kinds of retailers.

In this post I wanted to take a closer look at how exactly the Amex Offers program works. I should state upfront that Chase has a similar program named Chase Offers, though it’s not quite as compelling.

In this post:

What is the Amex Offers program?

With the Amex Offers program, those with US-issued American Express cards can receive statement credits or bonus Membership Rewards points for making purchases with select retailers. The types of retailers cover most industries, from shopping, to restaurants, to travel.

The list of participating retailers is constantly changing, and if you really take advantage of this program, it can potentially save you hundreds of dollars per year.

Presumably Amex runs this program as a way of engaging cardmembers, both by encouraging them to use Amex cards more, and by encouraging them to frequently check the Amex website. Furthermore, in most cases the retailers are also chipping in, as a way of generating incremental business from cardholders.

Which American Express cards have Amex Offers?

Virtually all US-issued American Express cards have access to the Amex Offers program. This includes:

- Personal and business Amex cards

- Credit cards and charge cards

- Amex cards that earn Amex Membership Rewards points

- Co-branded Amex cards, like those issued in partnership with Delta, Hilton, Marriott, etc.

Note that different Amex cards will have access to different Amex Offers. In my experience cards earning Membership Rewards points often have the most generous offers, while co-brand cards often have lucrative Amex Offers specific to that brand.

Tutorial: how to use Amex Offers

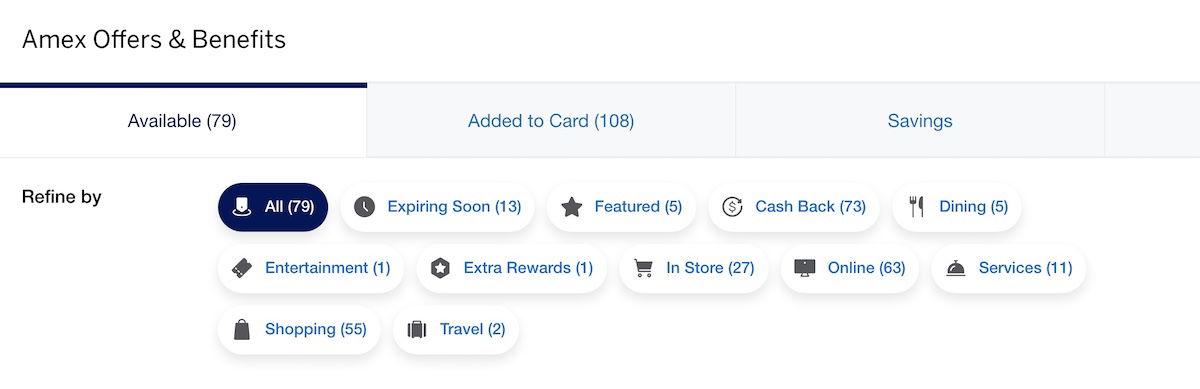

To access Amex Offers, log into your American Express account (either through the website or mobile app), and then scroll to the bottom. There you’ll see a section labeled “Amex Offers & Benefits,” which will show all the offers available on your account.

You can view Amex Offers in the order in which American Express chooses to display them, or you can choose to filter them based on a variety of categories, including:

- Expiring Soon

- Featured

- Cash Back

- Dining

- Entertainment

- Extra Rewards

- In Store

- Online

- Services

- Shopping

- Travel

Generally speaking there are three kinds of Amex Offers deals:

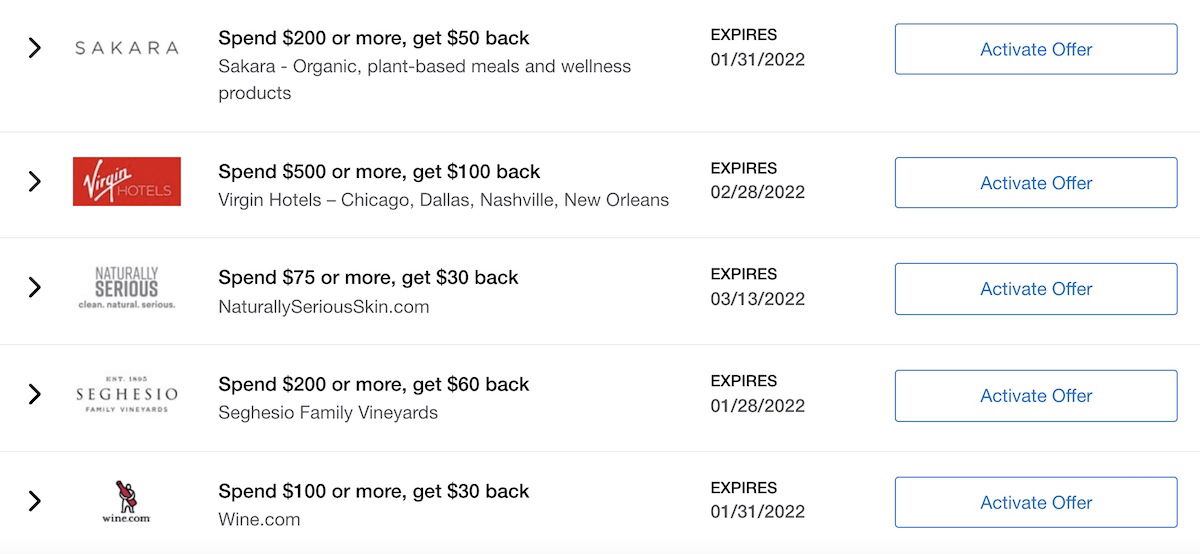

- Some Amex Offers are for a fixed value statement credit after making a purchase of a certain amount (for example, spend $100 and get $25 back)

- Some Amex Offers are for a certain number of bonus Membership Rewards points after making a purchase of a certain amount (for example, spend $100 and get 2,500 bonus Amex points)

- Some Amex Offers are for a certain number of bonus points per dollar spent, up to a certain limit (for example, earn 5x bonus points on the first $1,000 spent)

In all cases you’ll need to register for Amex Offers in order to be eligible for them, so you’ll want to click the “Activate Offer” button for the offers that interest you (though I suggest reading the section below about maximizing Amex Offers before doing so).

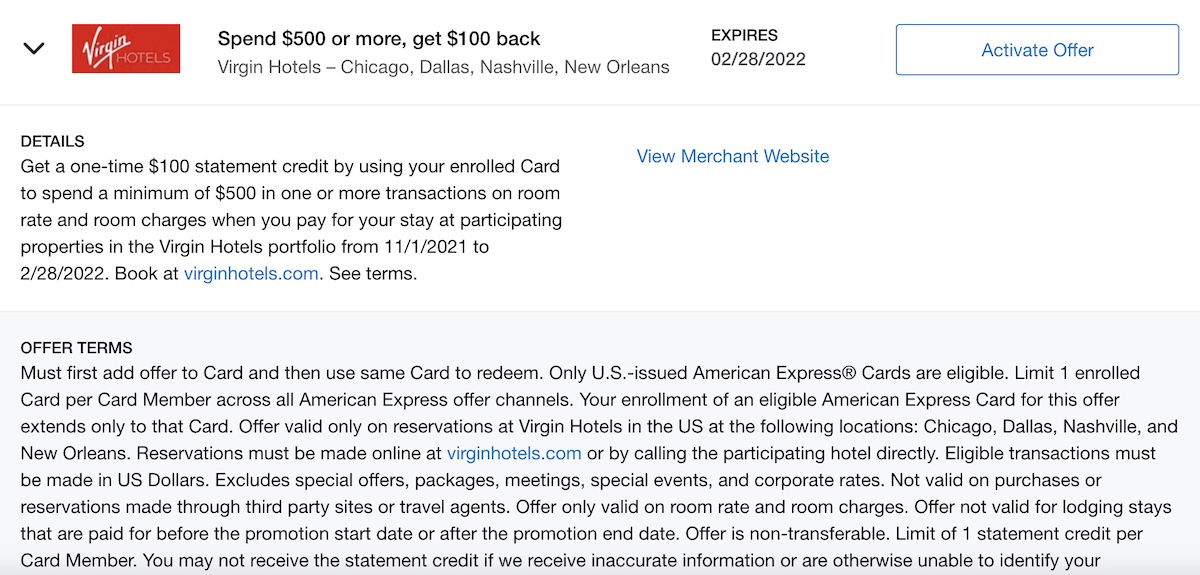

You can also push the arrow at the left of each offer to get more details about how exactly the offers work. There are quite a few terms associated with each offer, so you’ll want to read through them:

- Some retailers have geographic restrictions on where purchases can be made

- Some retailers have restrictions on what kind of purchases qualify, excluding gift cards and partner products

- Some retailers allow you to reach spending thresholds across multiple transactions, while some require purchases to be made in a single transaction

- Some retailers allow you to make in-store purchases, while others require online purchases

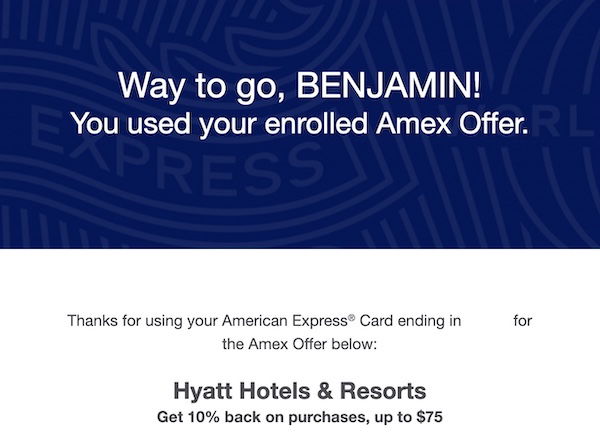

Once you’re registered you’ll want to make a purchase directly with a retailer, following the terms laid out with the offer. Shortly after making an eligible purchase you should receive an email confirming that the offer has been used.

If the offer is for a statement credit, you’ll often find that the credit posts within days, even if the terms indicate it will take longer.

Tips: maximize value with Amex Offers

While the above is a rundown of how the Amex Offers program works, I wanted to provide some general tips for really maximizing the value of Amex Offers, since there is a bit of nuance to doing so.

In no particular order, here are some further recommendations:

Register for Amex Offers promotions early

If you see an Amex Offers deal that you think you might be able to take advantage of, register right away. While all offers have end dates, in some cases there’s a cap on how many people can register. Register as soon as you can, because once registered you’re guaranteed to have the offer, even if you don’t make a purchase for a while. Otherwise you may see the offer disappear from your account before the expiration date.

Keep your Amex Offers total below 100

Any given American Express account will show at most 100 Amex Offers. Absolutely add as many Amex Offers to your cards as you can, even if you don’t think you’ll use them. By keeping the number of new deals below 100, you’re most likely to see new offers.

For example, if you’re at 100 Amex Offers and register for 10, there’s a good chance that 10 more offers will appear once you log out and then log back in again. This is the easiest way to get access to the best offers possible.

Choose the card on which you add Amex Offers carefully

You can only add an Amex Offers promotion to a single card in your profile. Once the offer is added to one card, it will disappear on other cards. Therefore you’ll want to pick the card on which you register very carefully.

In particular, use the card that maximizes your rewards beyond the Amex Offers deal as such. For example, say there’s an Amex Offers deal for a hotel stay, and that you see the offer on the following two cards:

- The Amex Platinum Card offers 1x Membership Rewards points per dollar spent on hotels, which I value at a return of 1.7%

- The Amex Green Card offers 3x Membership Rewards points per dollar spent on hotels, which I value at a return of 5.1%

Since the Amex Green Card offers a much better return on hotel spending, you should register for the offer on that card, so that you can maximize the offer and maximize your rewards. If you see an offer available on multiple cards, always choose the card offering the best rewards for spending with that retailer.

The information and associated card details on this page for the American Express Green Card has been collected independently by OMAAT and has not been reviewed or provided by the card issuer.

Stack Amex Offers with shopping portal bonuses

Using online shopping portals is one of the best ways to maximize your spending online. Just for going through a portal like Rakuten, you can earn bonus points or bonus cash back. This is essentially a way to double dip, and it’s perfectly legit:

- First register for the Amex Offers promotion you want

- Then go to the online shopping portal offering the biggest bonus with the retailer you’re considering

- Then pay for your purchase with the card on which your Amex Offers promotion is registered

- Then you’ll earn both the Amex Offers reward and the shopping portal reward

Think creatively with Amex Offers retailers

Often it pays to be creative with Amex Offers retailers. For example, sometimes you may see Amex Offers for department stores that you may not otherwise make purchases from. However, keep in mind that many department stores sell third party products at the same prices you’d find elsewhere. This includes things like skincare, cologne, candles, shoes, etc.

Even if you’d usually purchase a product with another retailer, it could be worth changing the retailer to maximize your rewards.

Choose Membership Rewards points over cash

In some cases you’ll see two versions of Amex Offers on different cards. When you see this, one version will offer a statement credit, and one will offer Membership Rewards points. For example, you might see the following two options:

- Spend $250 or more, get $50 back

- Spend $250 or more, get 5,000 Membership Rewards points

You’ll consistently see that with this option, one Membership Rewards point is valued at one cent. In the above example, you can choose you earn a $50 statement credit or 5,000 bonus Membership Rewards points.

Personally I’d highly recommend earning Amex points, assuming you’re looking to maximize travel long-term. I value Membership Rewards points at 1.7 cents each, so to me the offer for points is 70% more valuable.

Have as many Amex cards as possible

Amex Offers is one reason to have as many American Express cards as possible. The more cards you have, the more of a variety of Amex Offers you’ll have access to. This is a reason I think there’s big value in picking up no annual fee Amex cards, like the Amex Blue Business Plus (Rates & Fees).

It costs nothing to hang onto them, having credit cards long-term can help your credit score, and you can even make money on them with Amex Offers.

Get more Amex Offers by adding authorized users

While you can only add a given Amex Offers deal to one of your cards, authorized users on credit cards can register as well. In other words, you and your authorized users can potentially register for the same deal.

This is a reason that it could pay to have multiple authorized users on your credit cards, especially if there’s no annual fee for adding them.

Split payments across multiple cards when possible

Let me explain this in the form of an example. Say you and your spouse both see the above offer for $100 back when spending $500+ at Virgin Hotels. Say you book an eligible hotel and the bill is over $1,000. At check-out you could each pay $500 with your respective card, and then you’d both earn a $100 statement credit (assuming you both registered, etc.).

While not all online retailers will let you split purchases, in-person retailers usually will, and that may allow you to maximize rewards.

Bottom line

When many people think of the core benefits of Amex cards, the Amex Offers program probably isn’t the first thing that comes to mind. However, it’s often overlooked, and it saves me hundreds of dollars per year, and also earns me lots of bonus Membership Rewards points.

With a bit of creativity and effort, this is an awesome program that’s worth taking advantage of. These offers more than cover the annual fees on some of my Amex cards, and even allow me to “earn” money on some no annual fee cards.

What has your experience been with the Amex Offers program?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Blue Business® Plus Credit Card from American Express (Rates & Fees).

Member since 88? Yeah right.

I don't spend a lot, and I only have the plain Hilton Honors card - but even I am able to take advantage of an offer here and there!

I've had mixed success with these. Some are super easy to do to the point that I've registered for them thinking maybe I'd shop there, forgetting about it, and then being pleasantly surprised when I get a credit later.

Other times, the T&C and hoops to jump through are a pain. One example of this was with Wine Insiders. Signed up. Clicked the Amex link. Was offered another offer like free shipping or a discount,...

I've had mixed success with these. Some are super easy to do to the point that I've registered for them thinking maybe I'd shop there, forgetting about it, and then being pleasantly surprised when I get a credit later.

Other times, the T&C and hoops to jump through are a pain. One example of this was with Wine Insiders. Signed up. Clicked the Amex link. Was offered another offer like free shipping or a discount, but when that applied the domain changed slightly preventing the amex offer from processing. Amex wouldn't budge on it. I know you can't usually stack offers, but they then shouldn't offer you a separate promotion when visiting the /amex link. The value was a wash for me so I wasn't out anything in this case, but it really turns the online shopping experience into one of working to making sure you don't run afoul of rules and a gamble as to what will ultimately count and what will not (see also: Amex airline fee credits).

After spending 10 hours waiting for amex travel call back for a flight change then 3 hours with customer service to end up having to cancel my flight completely then only getting a credit that I can only use through amex travel the value of miles has decreased markedly in my mind.

My Amex Plat card has become too cumbersome to stay on top of with the shift to shopping offers. I just find myself constantly resenting the way this card works now. It is just a bunch of incentives to shift my spending patterns and even tempt me to buy from merchants I don't value very much.

While I agree that these deals can present excellent opportunity to save money or earn bonus points, it's worth noting that the businesses that sponsor/pay for these promotions also sponsor/pay for shopping portal points. In some cases vendors will reject your shopping portal points if you are "stacking" with an AmEx offer. I've had this happen multiple times over the past 12-18 months as merchants have gotten savvier about stacking. My advice is to calculate...

While I agree that these deals can present excellent opportunity to save money or earn bonus points, it's worth noting that the businesses that sponsor/pay for these promotions also sponsor/pay for shopping portal points. In some cases vendors will reject your shopping portal points if you are "stacking" with an AmEx offer. I've had this happen multiple times over the past 12-18 months as merchants have gotten savvier about stacking. My advice is to calculate the value of the shopping portal deal and the AmEx deal. If in a rare circumstance the portal is BETTER than the AmEx you may not want to stack.

Examples?

Sources?

Never had it happen to me. Would be interesting to know who any why. AFAIK, stacking doesn't violate any T&C of either.

Yup, agree that I've never had any issues stacking. In fact, I've recently quintuple stacked several promos/offers at Saks Fifth Ave and it worked beautifully:

1. promo code for 15% off purchase at check out

2. Standard 1x MR points with Amex platinum

3. Amex Offers for 4x bonus MR points at Saks

4. Rakuten portal for 15x MR points

5. Semi-annual $50 Saks statement credit for Amex Platinum

...

Yup, agree that I've never had any issues stacking. In fact, I've recently quintuple stacked several promos/offers at Saks Fifth Ave and it worked beautifully:

1. promo code for 15% off purchase at check out

2. Standard 1x MR points with Amex platinum

3. Amex Offers for 4x bonus MR points at Saks

4. Rakuten portal for 15x MR points

5. Semi-annual $50 Saks statement credit for Amex Platinum

Basically paid about $1.50 out of pocket for $55 worth of beauty products that I would have bought anyway and it's the same price as other retailers, plus almost 1000 MR points. It's great that the timing for all of these promos and offers worked out and it was fun to pull off.