The Amex Offers program often has promotions that can save you money on hotel stays, especially with co-branded credit card partners Hilton and Marriott.

Historically, we’ve pretty regularly seen Amex Offers deals for Hilton-family properties, given the close partnership between American Express and Hilton. However, we haven’t seen so many offers in recent times. Fortunately, a new promotion has just been rolled out.

Best of all, these offers can be combined with any promotions being offered by Hilton Honors, including the current global promotion. Let’s go over the details of what’s available.

In this post:

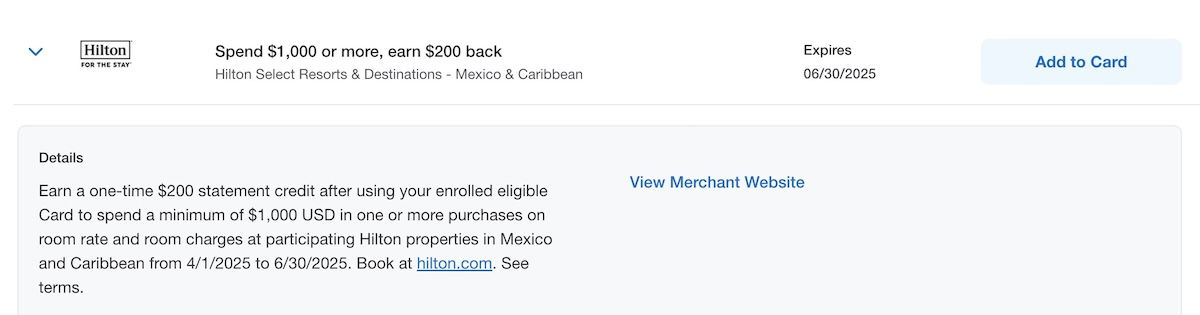

Spend $1,000+ at Hilton in Caribbean & Mexico, save $200

There’s a new targeted Amex Offers deal for stays at select Hilton properties over the coming months:

- Save $200 when you spend $1,000+ across one or more transactions (up to 20% back)

- This is valid when you pay for your stay between April 1 and June 30, 2025

- This is only valid for stays at select properties in the Caribbean and Mexico, and you can find participating properties here

- The terms state that you need to book directly with Hilton to take advantage of this

- Registration is required

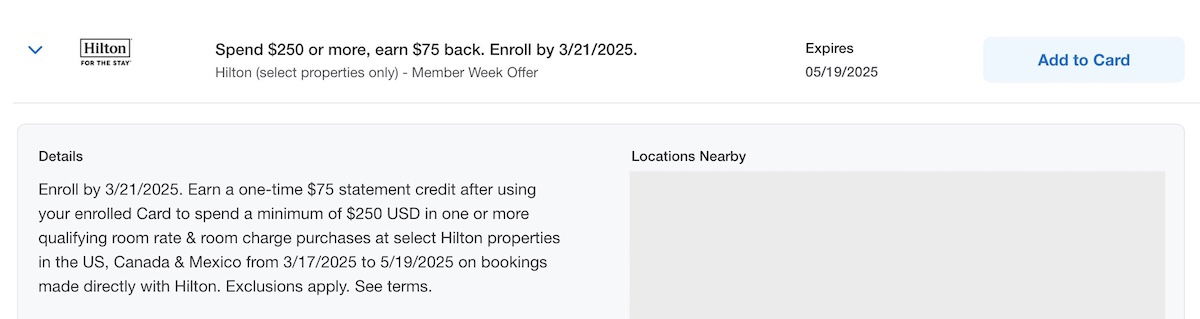

Spend $250+ at select Hilton brands, save $75

This is no longer open for registration, but as a reminder, there’s another Amex Offers deal that’s still active for upcoming stays:

- This is an Amex “Member Week Offer,” so enrollment was required by March 21, 2025 (closed now)

- Save $75 when you spend $250+ across one or more transactions (up to 30% back)

- This is valid when you pay for your stay between March 17 and May 19, 2025

- This is only valid for stays in the United States, Canada, and Mexico

- This offer is restricted to select brands, including Curio Collection by Hilton, Canopy by Hilton, Tapestry Collection by Hilton, Motto by Hilton, Tempo by Hilton, and Graduate by Hilton, and other brands are excluded

- The terms state that you need to book directly with Hilton to take advantage of this

- Registration is required

Look for this offer on Hilton Amex cards

When there are Amex Offers deals for Hilton Honors properties, they could be available on a variety of cards. However, ideally you’ll see them on a co-branded Hilton Honors credit card, so that you can earn bonus points for your hotel stay, while also qualifying for the statement credit offer.

Keep in mind that you can typically split payment methods at check-out at hotels, should you want to use multiple cards to maximize offers.

If you only see this offer on a card earning Membership Rewards points, try to register a card that earns bonus points on travel, so you can get as much value as possible.

Bottom line

There’s a new targeted Amex Offers deal, which could save you $200 when you spend $1,000+ at an eligible Hilton property in the Caribbean or Mexico. This has the potential to be a good deal, since there are lots of properties in the region that are popular with Hilton Honors members. We haven’t seen many Amex Offers deals for Hilton hotel stays lately, so I’m happy to see such an offer return.

Was your account targeted for this Hilton Amex Offers deal, and do you plan on taking advantage of it?

Is anyone seeing this for the AMEX Hilton Aspire card?