Link: Apply now for The Business Platinum Card® from American Express

The Business Platinum Card® from American Express (review) is a popular business card. While the card has a steep $695 annual fee (Rates & Fees), that’s potentially pretty easy to justify, thanks to the huge numbers of credits and benefits, the airport lounge access perks, and the added value when redeeming points.

Another huge incentive to apply for the card is that it consistently features a huge welcome offer, which makes the card especially compelling for the first year (there’s a terrific offer right now).

In this post, I want to talk about why the Amex Business Platinum Card might just be one of the easiest cards with a huge welcome offer that you can be approved for, as I think there are quite a few misconceptions. When I applied for the card, I was instantly approved!

In this post:

Basic Amex Business Platinum application restrictions

On the surface, there are just a few consistent restrictions when it comes to getting approved for the Amex Business Platinum Card:

- The welcome offer is “once in a lifetime,” so you’re not eligible for the offer if you currently have the card, or have had the card in the past; however, as I’ll discuss below, there are some exceptions

- You are eligible for the welcome offer on this card if you’ve had any other Amex card, so you can apply for this card even if you have cards like The Platinum Card® from American Express (review) or American Express® Business Gold Card (review)

- While Amex typically has a limit of letting someone have at most five Amex credit cards (including personal and business cards), that doesn’t include this product, since it’s not a traditional credit card

- Amex will sometimes decide that people aren’t eligible for welcome offers on cards despite otherwise following the rules, and in those cases, you should get a pop-up during the application process

- If you’re worried about the Chase 5/24 limit, getting approved for the Amex Business Platinum shouldn’t count as a further card toward that limit

Why the Amex Business Platinum is easy to get approved for

Historically, there has been the belief that in order to get approved for the Amex Business Platinum Card (or the personal version of the card), you need to have really high income, a near perfect credit score, a ton of credit history, etc. However, that doesn’t actually reflect reality.

Of course we can only go on anecdotal data, since it’s not like these details are officially published. Based on data points, I find Amex business cards to probably be among the easiest to get approved for. As long as you have a decent credit score and income, you’ll find that a lot of people report instant approvals on this card.

Keep in mind that even a sole proprietorship makes you eligible for this card (you can use your social security number as your tax ID, your name as your business name, etc.).

The fact that Amex business cards like this are generally easy to be approved for is no coincidence. For one, a lot of card issuers are focusing heavily on business cards, since they have higher interchange fees, so they’re more lucrative. Furthermore, this is a hybrid card rather than a traditional credit card, meaning that in theory, the balance has to be paid off in full each billing cycle. That makes the product lower risk for the card issuer.

Applying for the Amex Business Platinum is low risk

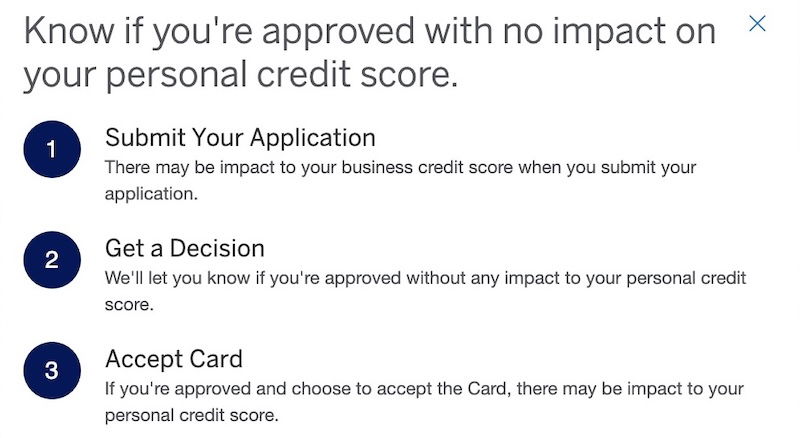

Sometimes people are hesitant to apply for a card, because they’re worried they might be rejected. Now, getting denied for a card isn’t a big deal, but it’s even less big of a deal with Amex. When you go to the application page for the Amex Business Platinum Card, you’ll see a note stating “Know if you’re approved with no personal credit score impact.”

As you’ll see explained there, you’ll get a decision about your approval without any impact on your personal credit score. So in the event you’re not approved for the card, it has absolutely no impact on your personal credit score. This is as risk-free as card applications come.

Also keep in mind that if you’re not sure if you’re eligible for the welcome offer, Amex will let you know before you submit your application that you’re not eligible. So as long as there’s not a message like that during your application, you’d be eligible for the offer.

Earning the Amex Business Platinum welcome offer again

People often wonder if they can earn the welcome offer on the Amex Business Platinum Card more than once. When you go to the standard application page, you’ll see the following verbiage:

You may not be eligible to receive a welcome offer if you have or have had this Card or previous versions of this Card.

Indeed, that’s pretty standard language for Amex cards, in line with the issuer’s “once in a lifetime” rule. The catch is that Amex also often targets people for cards with “no lifetime language,” as it’s called. If you’re eligible for these offers, you’ll often find them when logging into your Amex account, even with pop-ups (or you may receive them via email, snail mail, etc.).

To see if the offer you’re applying for has no lifetime language, just click on “Offer & Benefit Terms,” and see if the above language about not being eligible for the welcome offer shows up. If it doesn’t, you should be good to go.

Let me give an example. I had the Amex Business Platinum Card several years back, but canceled it. Last year, I received a pop-up in my account, inviting me to apply for the card again, with no lifetime language. I took advantage of that, and was instantly approved.

Then for the past several weeks, I’ve had the same pop-up for the exact same card, despite already having the card. Literally every time I logged into my Amex account, the pop-up would show up. Amex was literally begging me to apply.

Their wish is my command, so I applied and was approved yet again, despite the fact that I have that exact card already.

It’s very strange, because obviously this is deliberate targeting on Amex’s part. After all, this shows up while logged into my existing account, where the exact same card is linked. So it’s just worth keeping this in mind. I know some people might be hesitant to apply for the card because they know they’ll only be able to earn the offer once. However, that’s not consistently the case in practice.

Bottom line

The Amex Business Platinum Card consistently has a huge welcome offer, making it a pretty lucrative card to pick up. Best of all, I find the card to be extremely easy to be approved for, assuming you have decent income and credit. While the offer on the card is “once in a lifetime,” keep an eye out for targeted offers with “no lifetime language,” as I’ve now been targeted for these a couple of times.

If you’ve applied for the Amex Business Platinum Card, what was your experience like?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees).

Just got a mailer with the 250k offer plus $500 flight credit for $20K in 3 months. The spend is a bit of a stretch but seems like a solid offer.

That's a ripper of an offer. The spend is steep but if you can time it to tax voucher payments, HOA/maintenance dues or some such, it's not too crazy. I'm sure it's game-able, someone smarter than me should chime in on a strategy.

Ben, any comment on Delta starting to charge more for single passenger bookings vs multiple?

Really?

Did OMAAT just repost and deleted all the comments?

Checked my eligibility out of curiosity. Currently hold only the US Amex green and UK Plat and have never held another US Amex. Received the popup that I was ineligible on the 250k offer. Is there any workaround or do I have to wait for another couple months?