Well this wasn’t exactly what I was expecting.

Amex’s new welcome bonus eligibility tool

Last week I wrote about how Amex added a new welcome bonus eligibility tool. Most American Express credit cards have a “once in a lifetime” policy, where you can’t earn the welcome bonus on a card if you’ve had the card before. For example, The Business Platinum Card® from American Express ($695 annual fee (Rates & Fees)) has the following terms on the application page:

Welcome offer not available to applicants who have or have had this Card. We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.

Essentially if you apply for a card and won’t be eligible for the welcome bonus, Amex will tell you in the form of a pop-up at the time you apply for a card. In theory this should account for those who aren’t eligible because they’ve had the card in the past, and those who aren’t eligible because of “other factors” (which is language that was also recently added to applications).

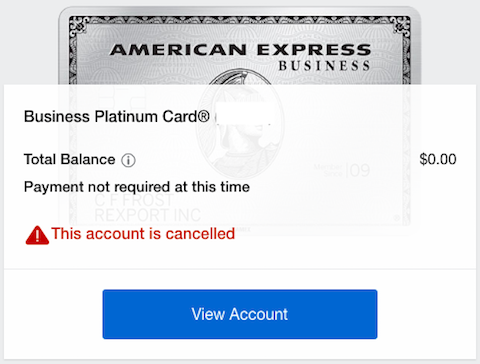

My experience applying for an Amex card

I decided to submit an application for The Business Platinum Card® from American Express. Based on looking at my online Amex profile, this is a card I’ve had before.

I don’t know exactly when I had the card in the past, though I think it goes back several years. And the other interesting wrinkle is that I think I didn’t apply for the card directly. Rather if I recall correctly, I had applied for The Business Gold Rewards Card from American Express, and then accepted an upgrade offer to this card. At least that’s what I recall, though I could be mistaken.

I’ve had the card before, but I’m not 100% sure if eligibility is generally based on having had the card before, or having received a welcome bonus on the card before (and I certainly did receive some points when I upgraded to the card).

I submitted my application, and was expecting a pop-up saying that I wasn’t eligible because I had the card before. To my surprise, the application was submitted, and I got a “pending review” message. I phoned up the number they asked me to call, and they said a decision would be made within a couple of days. I’m not sure why that is, but I suspect it’s unrelated to anything regarding the welcome bonus eligibility.

This makes me wonder if I am in fact eligible for the bonus, and if so, whether it’s because:

- I initially signed up for the Business Gold Rewards Card more than seven years ago (at least I think that’s the case)

- I never received the full welcome bonus on the Business Platinum Card, but rather only received an upgrade offer

- There’s just a glitch with this new feature, and it should be showing a message but isn’t

Why the Amex Business Platinum Card is compelling

The card comes with all kinds of great perks (Enrollment is required for select benefits), including:

- A $200 annual airline fee credit

- Access to Amex Centurion Lounges

- Access to Delta SkyClubs when flying Delta same day

- A Priority Pass membership

- Free Hilton Honors and Starwood Preferred Guest Gold status

- Access to American Express Fine Hotels & Resorts

- Access to the Amex International Airline Program, which can save you a ton on premium airfare

- A TSA PreCheck or Global Entry free credit, once every four years

- up to $199 back on your CLEAR Plus membership every year

I also have The Platinum Card® from American Express, so some of those benefits are redundant, what I really want from this card is the ability to get a 35% refund on select Pay With Points transactions. With the 35% Airline Bonus benefit, you can get up to 1,000,000 points back per calendar year.

For someone who doesn’t have either version of the Platinum Card, this is especially lucrative though.

Bottom line

I’m not really sure what to make of this. I’ve had the Amex Business Platinum Card before, and if I recall correctly I got it as part of an upgrade offer from the Business Gold Rewards Card. I was expecting that I’d apply and receive a message saying that I’m not eligible, but that’s not what happened.

Anyone have a guess of what’s going on? Have you applied for a card since Amex added these “alerts” to their applications, and if so, what was your experience like?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees).

@Dave

Yes. My flights did originate in the U.S.

@Matt, I agree that your comments were very informative and helpful. It would be great if Lucky were to invite you to do a column providing an insider's view of the credit card application process. Lucky?

Thanks for the clarifications.

You can't use AA gift cards for international flights originating outside the USA.

This is odd. I had the business platinum card back in 2014 and applied and got approved and got no notification. When I tried to add the card to my current account I was prompted to create a new login though. This is very odd...

I’ve used aa gift cards for both domestic and international tickets. In fact, I’m writing this from an international location that I used my aa gift cards for the tickets. There was one time where the online system did not allow me to use multiple gift cards. So I just called and agent was able to do it. I don’t remember if that was an international or domestic ticket though.

@Robert Hanson - you can use them for domestic AA tickets, but not international.

AFAIK, AA gift cards are only good for the same sort of 'incidental charges' that the statement credit is good for. You can use them for baggage fees, food purchases in-flight, etc. I've been told you cannot use them to purchase tickets, or for award ticket fees and taxes, etc. If that's incorrect, someone please let me know.

@Matt - You get the award for most informative, helpful commenter of the month as far as I'm concerned, thanks for sharing the knowledge!

@AdamR

I just do a “year to date” view of my charges, then sort by amount. The negative amount charges (refunds, credits, etc) are at the top or bottom of the list. You’re looking for “airline fee credit” or something along those lines.

@Matt:

That's a fantastic idea about airline gift cards! Do you know if there's any way to check how much of that $200 airline credit has been utilized other than just seeing some sort of refund on your monthly statement?

Seven years is the "magic horizon" for AmEx. I've reapplied, been approved for, and received bonuses for cards I've held more than 7 years ago. Things roll off their records at that point, it seems!

@Grant - You can use the $200 airline credit to purchase airline gift cards with most airlines. Most people break it up into two or more transactions. I used mine last year and this year to purchase AA gift cards (each time, 2x $100 gift cards).

Lucky, are you aware that the T Mobile One PLUS plan ($10/month over the standard One) gives you unlimited Gogo? I don't know if I'd value the Gogo passes at face value in that case.

@ Matt : did you guys over at new app use leverage ECM behavior scores like Prob-A, Prob-T or that "total structural risk" score (forgot the exact name of it) on top of Q-Scr ?

I used to work for Amex (CCSG, which is the consumer card side of the business, so OSBN, Open, might have their own additional criteria). and it seems highly, highly unlikely that they're going to deny you the bonus.

99% of these pending applications are due to flags in your Q-Score (Quality score, a risk criteria built during the recession). Often this is related to number of open accounts, preexisting accessible lines of credit,...

I used to work for Amex (CCSG, which is the consumer card side of the business, so OSBN, Open, might have their own additional criteria). and it seems highly, highly unlikely that they're going to deny you the bonus.

99% of these pending applications are due to flags in your Q-Score (Quality score, a risk criteria built during the recession). Often this is related to number of open accounts, preexisting accessible lines of credit, or other flags on your credit report that might not be captured by your FICO score for consumers, not sure what they use on the OSBN side if you're applying from a true EIN rather than SSN. Most of these pends are approved, they just have a human double check things to ensure that this isn't a fraudulent account. Pends are set by risk criteria and are never related to bonus fulfillment, which lives in its own distinct system not tied to approving apps.

I should also point out that "lifetime" in the world of Amex can mean different things. Often it's 10 years, due to the 10 solid years of credit history someone can have. Other times, it's related to when a policy was put in place. For example, if the bonus policy was put in place in 2015, but you had the card in 2014, you are exempt from the policy. Lastly, often times when products go through even remote re-brands, they are technically different products. For example, there are two cards "Premier Rewards Gold" -- internally just called PRG -- and "Rewards Premium Gold" -- internally called RPG -- which are essentially rebrands of the same product. However, they are treated as distinct products within the Amex system. You can actually hold both cards if you want. Because of that, often times what will appear to be the same product is actually different from the product you've had before.

@Lucky - I’d be curious to know how you/Ford use the $200 airline credit. I can’t imagine you needing to pay for checked bags since you don’t check them.

And since you don’t fly coach much you’re probably not buying any food aboard, either.

I know there are some ‘creative’ ways of using he credit; just curious what you do.

Very steep spending requirements!

Earn 50,000 Membership Rewards® points after you spend $10,000 and an extra 50,000 points after you spend an additional $15,000 all on qualifying purchases on the Business Platinum Card within your first 3 months of card Membership. Offer expires 08/08/18.†