Link: Learn more about the Citi Strata Elite℠ Card

The Citi Strata Elite℠ Card (review) is Citi’s new premium card. While the card has a steep $595 annual fee, there are lots of reasons to consider picking up this card.

I applied for the card several weeks back in a Citi branch (back when there was a big incentive to do so), while Ford just applied for the card online, and was instantly approved. So I want to report back with the two experiences.

While this card isn’t some amazing slam dunk that’s too good to be true, I think the card is absolutely worth giving a shot, especially with the welcome offer available, plus the excellent first year value.

In this post:

Basic Citi Strata Elite application restrictions

As a reminder, there’s a portfolio of three personal Citi Strata products. In addition to the Citi Strata Elite, there’s also the $95 annual fee Citi Strata Premier® Card (review) and no annual fee Citi Strata℠ Card (review).

Eligibility for the three Citi Strata products is considered independently, including when it comes to the welcome bonuses, so that’s great for consumers. This means that having the Citi Strata Premier doesn’t preclude you from getting the Citi Strata Elite, and vice versa (you’re also eligible for this card if you have the Citi Prestige Card, which is no longer open to new applicants).

The most important thing to understand is Citi’s 48-month rule, which is that the welcome bonus on a particular card isn’t available to those who have received a new cardmember bonus on that exact card in the past 48 months. The 48 months is based on when you received the bonus on a card, rather than based on when you opened the card.

Also remember Citi’s general application restrictions, including that on a rolling basis, you can generally only be approved for at most one Citi card every eight days, and at most two Citi cards every 65 days.

Citi Strata Elite application & approval experience

You can apply for the card either directly online or at a Citi branch. When initially launched, the offer in the branch was superior to the offer online. However, now you can earn the same number of bonus points regardless of whether you apply online or at a branch, so I’d recommend applying online (and applying at a branch can be kind of annoying, as I’ll explain below).

With the current offer, you can earn 75,000 ThankYou bonus points after spending $6,000 within three months. Let me share my experience with the two application processes.

Citi Strata Elite online application experience

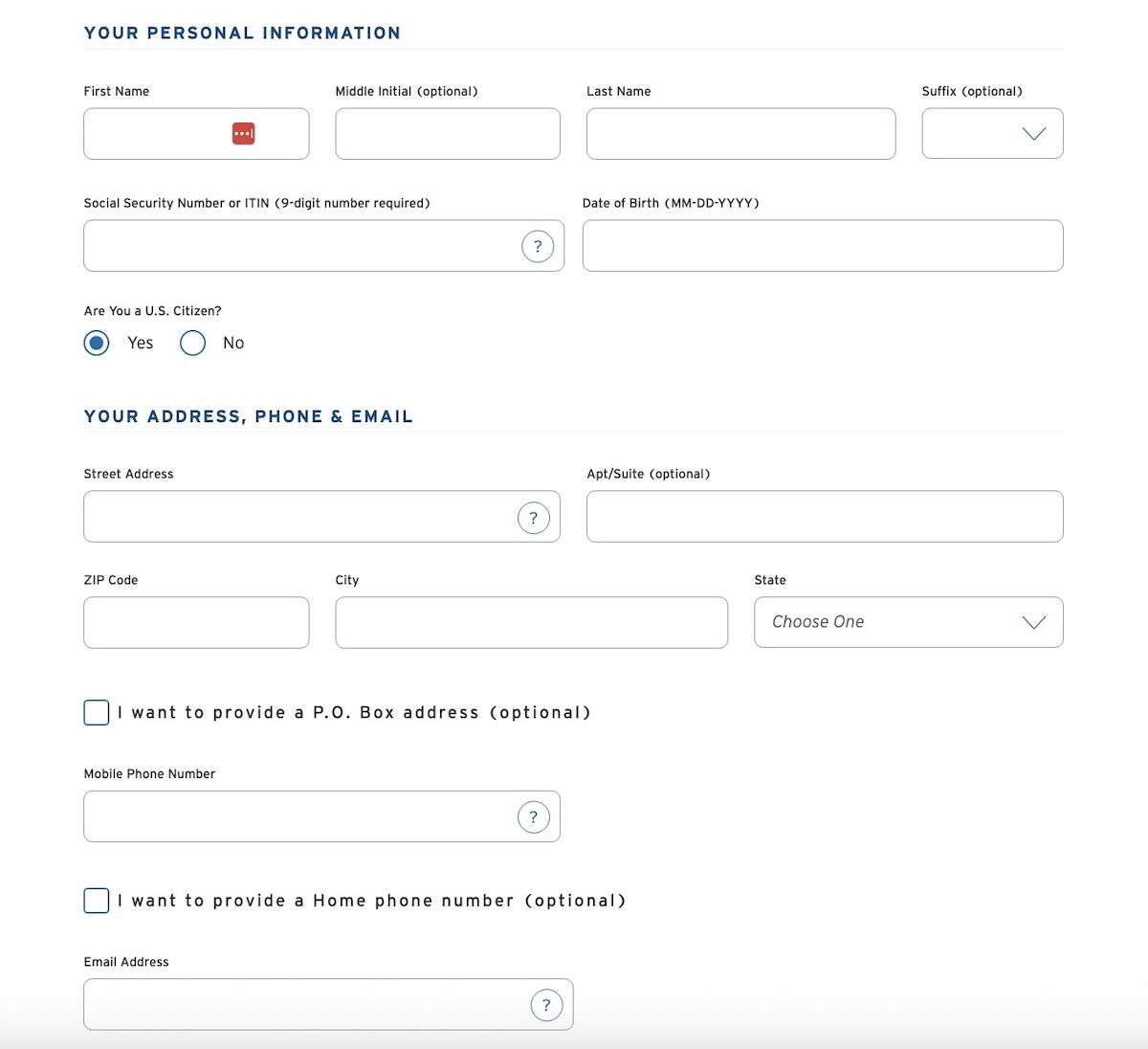

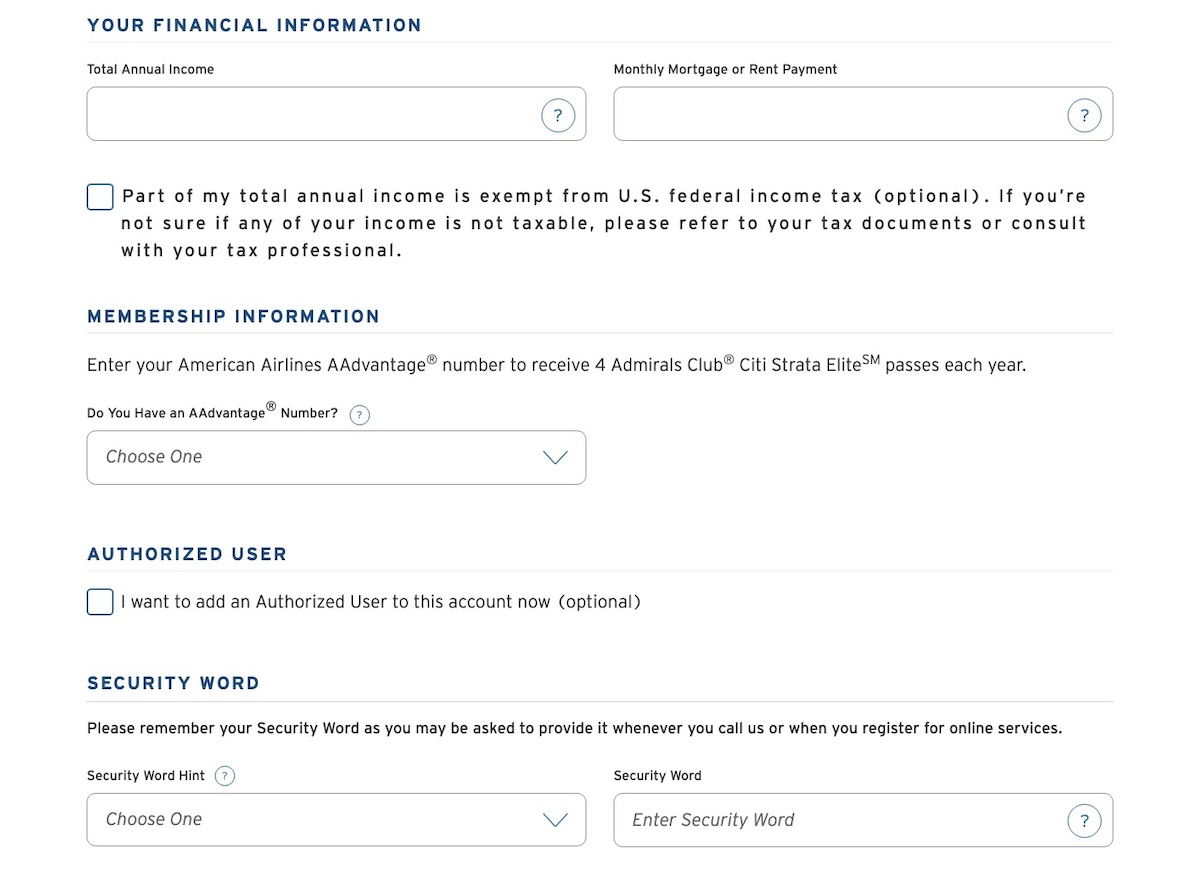

The Citi Strata Elite online application process is really straightforward, and consists of just one short page. It’s actually shorter than applications with most other card issuers. It just asks for personal details — name, date of birth, social security number, address, phone number, income, etc.

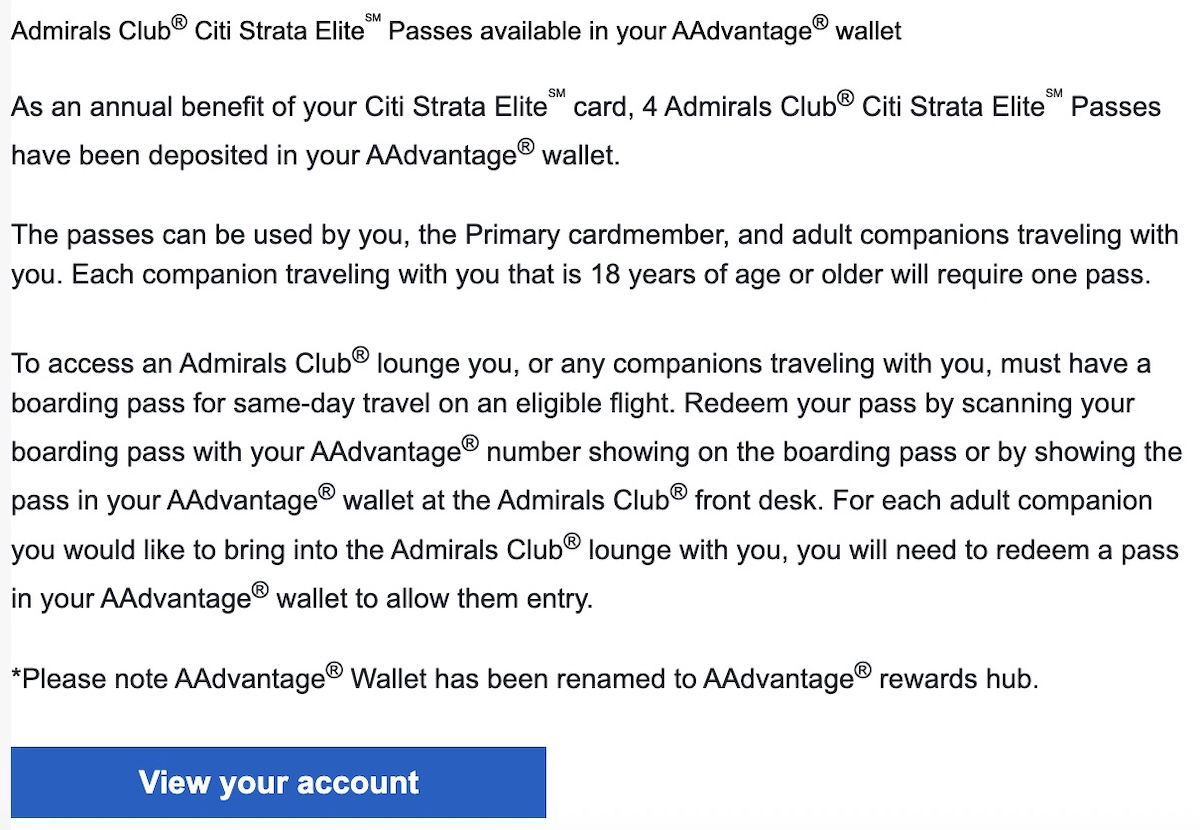

At the end of the application, you’ll be asked for your American AAdvantage number, if you have one. The reason you’ll want to include this is because this is where the Admirals Club day passes will be deposited, as those are an ongoing card perk.

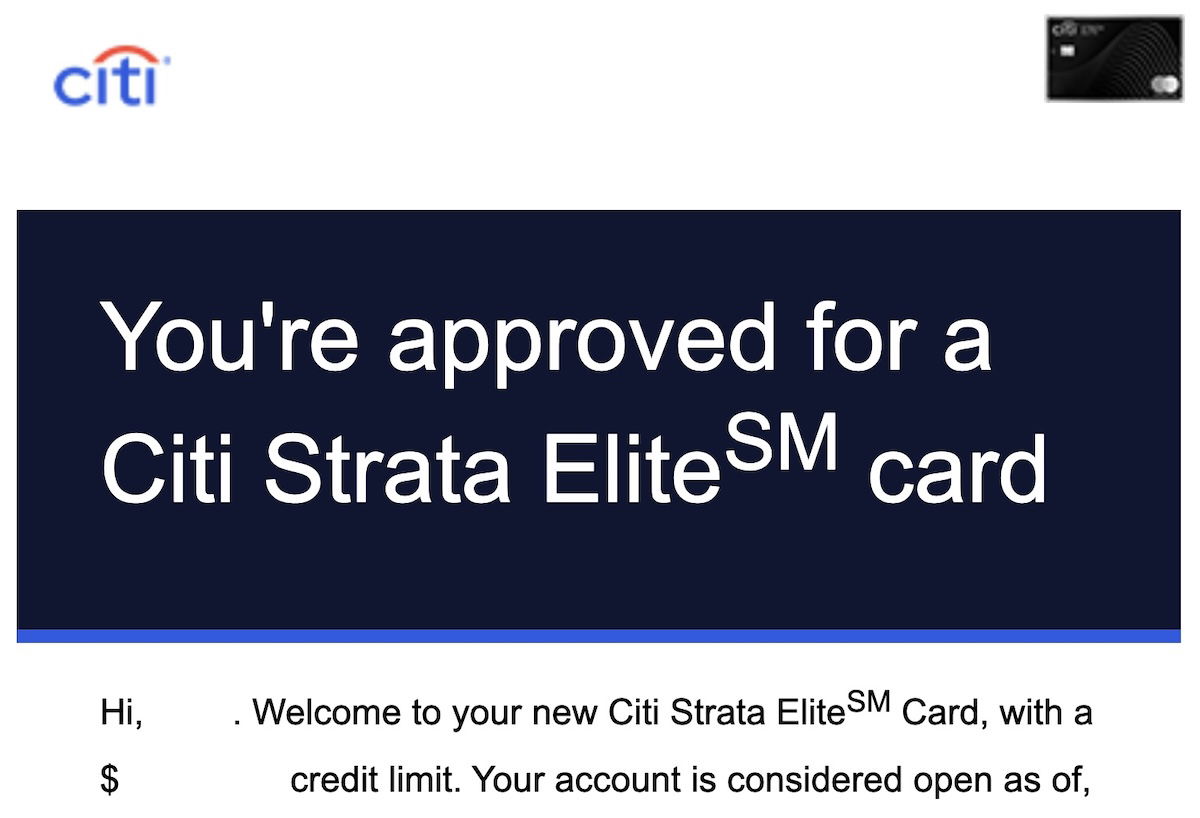

Ford received an instant approval on his application, with a huge credit line as well. Anecdotally, it seems a lot of people are reporting instant approvals on this card! For what it’s worth, he doesn’t currently have any other Citi cards on which he’s the primary cardmember.

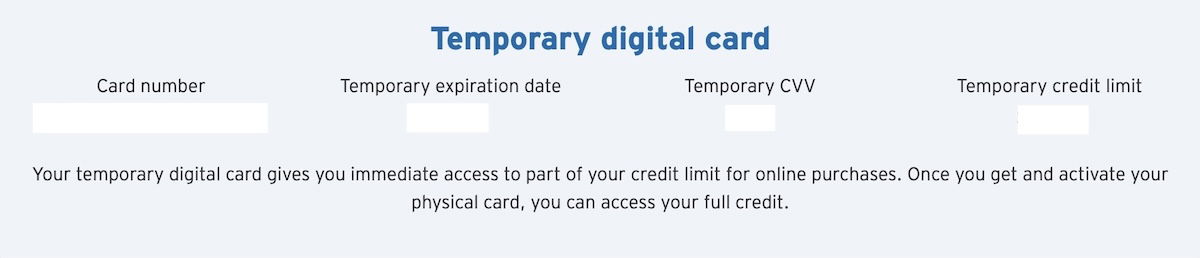

He could then immediately set up his online account, and that also gave him access to a temporary digital card, with access to 10% of his full credit line. It’s always nice when you can start spending right away upon approval, especially if you’re applying prior to a planned purchase.

Moments later, he also received an email confirming that he already had the four Admirals Club passes deposited in his AAdvantage account.

So yeah, application experiences don’t get much easier than that!

Citi Strata Elite in-branch application experience

Several weeks back, I applied for the Citi Strata Elite at a Citi branch, back when you could earn more bonus points in-branch rather than online (that’s no longer the case). I’ll still share my experience, though it’s a lot less relevant now.

In the past, I haven’t had great experiences with getting Citi in-branch appointments, let alone even getting individual Citi branches to pick up the phone. So I was delighted when a banker answered after only a few rings, and said he’d be available any time. I headed over to the branch, and the application took all of 10 minutes.

This was my first time in years visiting a bank branch for an appointment, and a few things stood out to me. For one, it was kind of odd how my social security number was said out loud for confirmation, and how I had to state my income, etc. Fortunately the branch was empty, but otherwise it seems like there should be a better way, like asking people to enter it on a keypad or something, no?

Next, admittedly I’m a huge introvert, but the small talk was sort of painful:

“Where is your last name from?”

“It’s German(ish).”

“Oh, are you German?”

“Yeah, my parents are both from Germany, and all my other relatives live there.”

“Oh, Germany is a beautiful country.”

“Yes it is, have you been?”

“No… but you are lucky, now you are living in the greatest country on earth.”

Erm, can we just proceed with the application, please? Anyway, my application was instantly approved, though with a very low credit line (probably because I have a few open Citi cards with high credit lines, and there’s only so much credit banks will extend to consumers).

The banker never asked me if I had an AAdvantage number. That’s kind of frustrating, because as soon as my card was approved, I received an email indicating I had a new AAdvantage account, and my Admirals Club passes were deposited there.

If this ends up happening to you, there’s actually a pretty easy solution, which I figured out after the fact. Log into the AAdvantage account you want to keep, go to the “Account summary” section, and then select the “Merge accounts” option, which will let you combine the two accounts.

My long term Citi Strata Elite strategy

Now that I have the Citi Strata Elite, what’s my strategy? I think this is a solid card, though it’s not necessarily a card where the math is that overwhelmingly exciting (then again, cards with that kind of math tend to get devalued pretty quickly). I do think there’s huge merit to picking up the card and taking it for a spin, given the welcome offer and very strong ongoing perks.

The card has a $595 annual fee, and because I’m a Citigold member, I get a $145 reduction on that annually, meaning the card will cost me $450 on an ongoing basis.

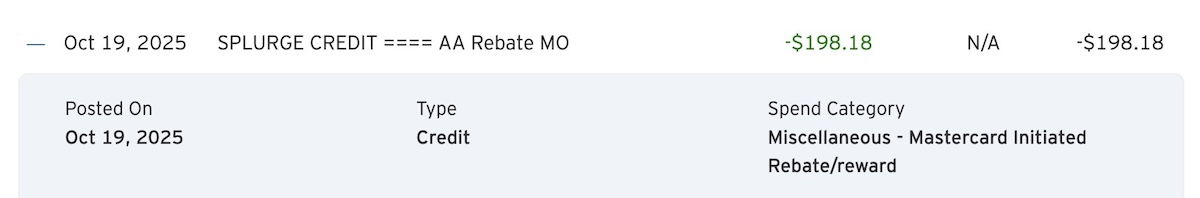

The way I view it, the card’s $200 annual “Splurge Credit” is basically good as cash, since that can be used to purchase American Airlines tickets, or even to purchase retailer gift cards with Best Buy. It’s even offered every calendar year, so that’s particularly rewarding with your card’s first annual fee (you can receive $400 in credits before your first account anniversary).

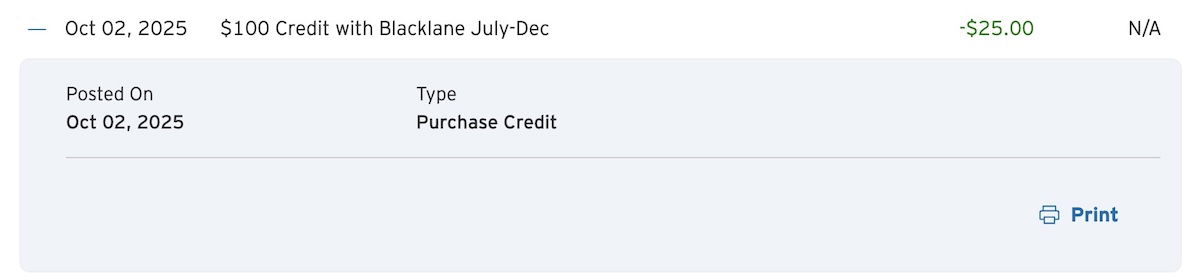

While not quite good as cash, I do also value the up to $200 annual Blacklane credit, in the form of a $100 credit semi-annually. While Blacklane is generally a lot more expensive than Uber, I’ve found value with Blacklane’s on-demand rides available in select cities, including in Miami. So with reasonable pricing and nice cars, I’m getting good value there.

There’s also an up to $300 annual hotel credit, valid for hotel bookings of at least two nights through Citi Travel. If you can stay for two nights at a hotel costing just over $150 per night, that’s easy enough to take advantage of, though I wouldn’t consider it to be worth face value.

Then there’s the Priority Pass membership and four annual American Admirals Club passes. While those perks will be nice for some, I already have several cards that offer Priority Pass, and I also have an Admirals Club membership with the Citi® / AAdvantage® Executive World Elite Mastercard® (review). So for me, the incremental value there is limited.

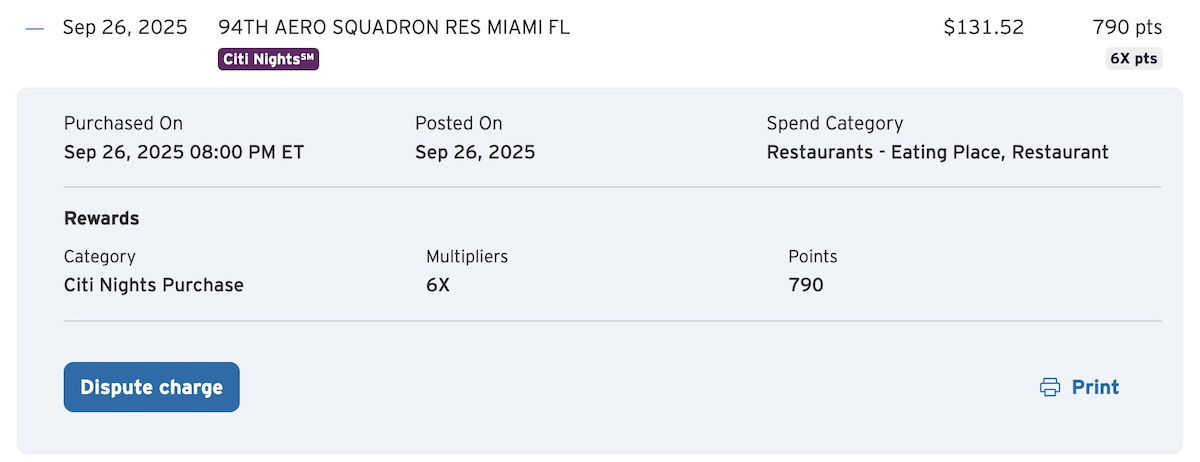

I do also appreciate the card’s “Citi Nights” concept, whereby you can earn 6x points when dining on Friday and Saturday nights over select hours. Given that those are the nights where we usually go out to eat (if we do), it’s nice to maximize points on those purchases, with the industry’s best return on dining spending.

Bottom line

The Citi Strata Elite is Citi’s new premium credit card. The card is offering a huge welcome bonus, and has some solid perks that may interest many. With Citi ThankYou points now being transferable to American AAdvantage, perhaps the most exciting detail is being able to use this card to rack up American miles, including with the welcome bonus.

If you’re interested in applying for the card, the good news is that eligibility is unrelated to having any other Citi card, so lots of people should qualify. There are lots of reports of instant card approvals, and I can’t imagine the offer will get better than it is right now.

If you’ve applied for the Citi Strata Elite, what was your experience like?

Citi denied me for "too many recent accounts" i've only applied for one card in the last year, about 2 months ago. called reconsideration, no use. there is some other rule in play here other than the ones mentioned

What is the value if you have a prestige already..,

I applied in a Citi branch and after going through the steps twice (don't ask) was denied. The banker couldn't give me a reason, just said I would get a letter within a couple of weeks with the reason that I was denied.

Then a couple of days later, I got a message that 4 Admiral's Club passes had been deposited to my account. I checked and sure enough, there they were in my AA...

I applied in a Citi branch and after going through the steps twice (don't ask) was denied. The banker couldn't give me a reason, just said I would get a letter within a couple of weeks with the reason that I was denied.

Then a couple of days later, I got a message that 4 Admiral's Club passes had been deposited to my account. I checked and sure enough, there they were in my AA account. Hmmm...maybe some kind of glitch?

A few days later I got a call from one of the bankers at the branch telling me that I was approved after all. Meanwhile, there was a package for me in the package room that turned out to be the card, in a nice presentation box.

So the communications around the card approval process sucked but the end result was favorable!

Just applied, denied (over 800 credit score), and called the reconsideration line. She wouldn't tell me why, just that my letter would come in 7-10 days. First time applying for a Citi product, so not sure the issue.

No offense, but it's pretty 430 behavior to go to a bank to apply. You couldn't afford a computer?

Jeanne Moss, oh miss richy rich with the PC over here... you do realize that before Citi had the negative press in the WSJ, there were just two ways to get the 100K offer... a sketchy link on a Chinese blog... or going in-branch. Otherwise, it was just 80K. Now, thankfully, everything is 100K.

That's a TPG-style headline; even Gary's been pumpin' those out lately. Listen, I'm a fan of churning, so 'approvals' are always preferred to 'denials.' Yet, c'mon, with online applications, yeah, most of the time it's 'instant.' That said, I got my Strata Elite in the mail yesterday; it is a beautiful, mostly black, metal 'beast' of a card. Looking forward to earning my 6x points this Friday after 6PM...

Where are you going to dine? I may join you.

Your mom.

(Sorry, I couldn't resist; also, I still value my relative anonymity. Use it as an opportunity to treat your friends, or make some new friends, buy a girl a drink, for those 6x points!)

I no longer drink alcohol, and I steer clear of mocktails as they are often just as expensive and they are really just sugary beverages which are deeply unhealthy. I prefer tap and sparkling water. If you see me at a restaurant with both a carafe of tap and a bottle of Pellegrino on the table, that's definitely me. Please come and say hi.

Enjoy your "anonymity" but realize it cannot be sustained. I have...

I no longer drink alcohol, and I steer clear of mocktails as they are often just as expensive and they are really just sugary beverages which are deeply unhealthy. I prefer tap and sparkling water. If you see me at a restaurant with both a carafe of tap and a bottle of Pellegrino on the table, that's definitely me. Please come and say hi.

Enjoy your "anonymity" but realize it cannot be sustained. I have uncovered the identities of numerous individuals on discussion forums- not just travel blogs. Think of me as a white hat, though. I'm just about to send a message to a Paul, Weiss counsel urging him to delete the portions of his reddit comment history that describe lascivious group sex. (He most recently posted on r/biglaw asking why he isn't being considered for equity partner.. well, my friend, the firm cannot have equity partners who are publicly revealed to be "bb" fetishists.)

I'll admit, I rarely do these days (unless it's 'included' with the lounge or in 'first' or 'business' class on-board). Makes me sleepy, and have to pee a lot. Ahh, aging. However, for those who are inclined, you can be their 'best friend' if you want to pay their tab, I suppose. You are onto to something with sparking water (yes, by the carafe!) Just ask for a lime to be added, and it'll appear...

I'll admit, I rarely do these days (unless it's 'included' with the lounge or in 'first' or 'business' class on-board). Makes me sleepy, and have to pee a lot. Ahh, aging. However, for those who are inclined, you can be their 'best friend' if you want to pay their tab, I suppose. You are onto to something with sparking water (yes, by the carafe!) Just ask for a lime to be added, and it'll appear as though you're downing 'gin and tonics' with precision!

As for your talents as a private investigator, how 'delightfully absurd,' as the Hedonismbot would say. Such is the problem with 'groups'... there's always a leaker, and in that case, perhaps, both figuratively and literally. *snort*

I don't pay other people's tabs, at least not on purpose. One restaurant in Tribeca asked me to pay on the Bilt app, which I did, and then when I walked out the door, they grabbed me back inside because they said I paid the wrong tab. (They screwed up.) Silver lining: I earned Bilt points from both the incorrect and the correct tabs!

Peeing a lot is good assuming that means you are well...

I don't pay other people's tabs, at least not on purpose. One restaurant in Tribeca asked me to pay on the Bilt app, which I did, and then when I walked out the door, they grabbed me back inside because they said I paid the wrong tab. (They screwed up.) Silver lining: I earned Bilt points from both the incorrect and the correct tabs!

Peeing a lot is good assuming that means you are well hydrated. I generally pee once an hour and ensure it is a very light, pale yellow color. I've reviewed my peeing with the top urologist in Manhattan. I can send you his name if you like.

I already see Dr. Richard Handler at the Pecker Checker Stream Team downtown.

LOL. Now if the Stream Team could combine their services with the Dream Team, you'd be all set for those overnight flights...

If you are Citigold Private Client the bank credits you the entire first year annual fee so the card is free.

As the bank does if it suspended your account for a month, asking for an IRS form!

I feel like you're doing your readers a bit of a disservice in not mentioning the whole 4506 debacle related to this card (there's a WSJ article about it).

I applied, was approved, received a letter two weeks later saying they'd close my account in two weeks if i didn't provide address verification, with no method of how to provide it.

I was actually on vacation at the time, so when i got...

I feel like you're doing your readers a bit of a disservice in not mentioning the whole 4506 debacle related to this card (there's a WSJ article about it).

I applied, was approved, received a letter two weeks later saying they'd close my account in two weeks if i didn't provide address verification, with no method of how to provide it.

I was actually on vacation at the time, so when i got back the account was closed. It's now been 3 weeks of purgatory where I've been shuffled to different departments to try and reopen it, never reaching anyone that has information.

@ breathesrain -- That whole situations sounds like a mess, though I believe Citi is now making good, and even refunding the annual fees for those people?

The one reason I didn't cover it is that I was under the impression that most people who had their accounts suspended may have applied through a link from a banker in a way they weren't supposed to? Or did you apply via a standard link or directly...

@ breathesrain -- That whole situations sounds like a mess, though I believe Citi is now making good, and even refunding the annual fees for those people?

The one reason I didn't cover it is that I was under the impression that most people who had their accounts suspended may have applied through a link from a banker in a way they weren't supposed to? Or did you apply via a standard link or directly with a Citi banker? Do we know if it was truly just random whether people got that treatment, or...?

It doesn’t matter. The PR nightmare for Citi is horrific. A page 1 WSJ article that was pushed to all WSJ readers as a news alert. If you are after HNWI individuals, they all just scoffed and moved on with thinking about this card at all.

Ironically the Globe card is basically an Elite-lite with the same 4 club passes for $350, and you can double dip the credits as well. So anyone who cares...

It doesn’t matter. The PR nightmare for Citi is horrific. A page 1 WSJ article that was pushed to all WSJ readers as a news alert. If you are after HNWI individuals, they all just scoffed and moved on with thinking about this card at all.

Ironically the Globe card is basically an Elite-lite with the same 4 club passes for $350, and you can double dip the credits as well. So anyone who cares about AA admirals club access can now get the Globe card and a very similar value in SUB (90k v 100k and AA vs TY points but still). I’m sure the timing of that launch was the last thing Citi wanted to do as it tried to clean up the mess with the Elite, but when you win a contract with AA over Barclays, I’m sure AA dictated that timing and did not budge on it.

@ Peter -- Oh I agree it's a massive PR disaster no doubt. But I do think the way that people applied does matter. We've seen other card issuers similarly create issues when people use links that weren't intended to be used.

Regarding the Elite vs. the Globe, I really think it comes down to how much you value the relative Splurge credits. I consider the Elite credit to basically be worth close to face value, while I'll struggle to get value with the Globe credit.

Sure, but as soon as Citi was given a chance by the WSJ to comment on the article, it didn’t matter anymore. The adults in the room at Citi are supposed to provide a comment saying something like “We are gratified by the number of applications for our new premium Strata Elite credit card which is already delivering our customers outsized value compared to our competitors. Because we vigilantly work to protect our customers from...

Sure, but as soon as Citi was given a chance by the WSJ to comment on the article, it didn’t matter anymore. The adults in the room at Citi are supposed to provide a comment saying something like “We are gratified by the number of applications for our new premium Strata Elite credit card which is already delivering our customers outsized value compared to our competitors. Because we vigilantly work to protect our customers from fraud, we are working to verify certain information from less than 1% of our applicants. We look forward to completing that verification process shortly so that all of our customers can enjoy using their new premium Strata Elite card.” If you can’t do that in the middle of a launch window for a credit card targeting HNWIs, that’s pretty amazing.

Putting aside the calendar year double-dip extra value, I think off of a $450 fee (Citigold price) it’s a somewhat low stakes keeper - can use the $200 splurge/AA credit and the $200 blacklane credit and call it a day. But at $595 you need to use the $300 hotel credit as well, and that’s a 2 night minimum stay. When there are already better cards out there that provide access to bank branded lounges (Amex, Chase, C1) that all have hotel credits, and this card is the #4 premium card in your wallet, it’s really hard to value that $300 at anything close to face value especially with a 2 night stay.

So for many, I think you can value the $200 splurge at $200, the blacklane at say $150, the $300 at… $100 maybe? So that covers the Citigold $450 I guess, but otherwise for $595, you have to value the AA passes at something as well to come close to getting back to even. If this is the only premium credit card you have - sure, but it’s clearly not the only premium credit card that most people getting this card have. I’m sure that makes it very hard for Citi to actually attract HWNIs, and the massive PR bungling that just happened puts a nail in a coffin.

The Globe is $350 and if you are an occasional AA flier with the family, you can value the $100 in splurge by buying a Ticketmaster.com ticket, the $100 in food onboard as… food, and the remaining $150 as lounge passes for the family of 4 for one roundtrip. That doesn’t work for those of us who have the AA Executive Card already, but I could see how it appeals to more people generally than the Elite would.

Thanks to that WSJ, it seems Citi has tried to 'save face' by refunding their AF ($595 savings) and giving those affected the 100,000 bonus points without the MSR. I still suspect many of those affected used that sketch Chinese blog link...

Just want to say I applied through the OMAAT link, and the same thing happened to me. After the card was delivered, it was immediately suspended. Customer service at citi was useless, they couldn't even really explain what was happening. Then two days ago a vaguely apologetic letter offering no first year fee and 100,000 points with no minimum spend.

That's a helpful data point, Daniel. Glad they are "making it right" but I'll wager that you'll be thinking twice about your continuing relationship with Citi. Lots of cards that folks can put spend on. Enjoy the 2025 and 2026 coupons.

Did you ever get your AA miles from the DoorDash promo? I never did and its been over a month...

@ Jordan -- I had to reach out to AAdvantage eShopping customer service. They just needed me Dasher ID, and then the points were posted within days. So I'd recommend reaching out.

It seems that it's posting automatically for those who made multiple deliveries, while it's not typically posting for those who made a single delivery. At least that's the best pattern I've been able to observe.

When Gary had posted about that... it was quite the laugh, as if he was gonna drive around Austin delivering someone's Chiptole. Wait, did you actually do it, Ben?! *gasp*

@ 1990 -- Of course I did! I delivered a bagel and some lemonade!

Niccce. (I could go for an everything-bagel...)

That’s the kind of dedication that really puts the Pro in Platinum Pro! Way to battle the eshopping Cartera gremlins for your miles/LP!

Uh... isn't every credit card approval an instant approval? I can't remember ever applying for an Amex or Chase card and receiving anything other than a confirmation that my card is in the mail.

Also lol at the "small talk" conversation. The United States is indeed the best country in the world, but not for any MAGA related reason. The United States is home to the world's best universities, hospitals, law firms, and travel blogs...

Uh... isn't every credit card approval an instant approval? I can't remember ever applying for an Amex or Chase card and receiving anything other than a confirmation that my card is in the mail.

Also lol at the "small talk" conversation. The United States is indeed the best country in the world, but not for any MAGA related reason. The United States is home to the world's best universities, hospitals, law firms, and travel blogs such as OMAAT! That's all the important stuff.

I admit I - with a limitless budget because of the high income I make in the USA - buy my clothes in London, my cosmetics in New Zealand, and the best food in the world is in France or Japan, the most beautiful women are in China and Taiwan (same country, really).

@ Gen Yinjing Youguan -- If you're only getting instant approvals, then you're lucky! Lots of cases out there of people not getting instant card approvals.

I thought you were Lucky, Ben...