Frontier Airlines has once again issued a formal proposal to acquire Spirit Airlines… I can’t say that I’m surprised, and I think this is probably the best bet for the two airlines.

In this post:

Frontier looks to buy Spirit, take on the “big four”

In November 2024, we saw Spirit file for Chapter 11 bankruptcy protection, as the airline hadn’t turned a profit since before the pandemic. The carrier has been an attractive acquisition target over the past few years, though.

In February 2022, Frontier announced plans to acquire Spirit, to create a national ultra low cost carrier. However, following that, JetBlue also expressed interest in acquiring Spirit — not to maintain the company’s business model, but rather to be able to grow, and become a competitor to the “big four” US carriers (American, Delta, Southwest, and United).

In July 2022, JetBlue announced plans to acquire Spirit in a $3.8 billion deal, as the company outbid Frontier. However, the Department of Justice under the Biden administration decided to challenge this merger, arguing that it was bad for competition. A trial was held in late 2023, and in early 2024 it was announced that a judge ruled to block the merger.

This left Spirit in an awful situation, with massive debt, as the airline continues to hemorrhage money, with billions in cumulative operating losses over recent years. Spirit simply doesn’t have an independent future.

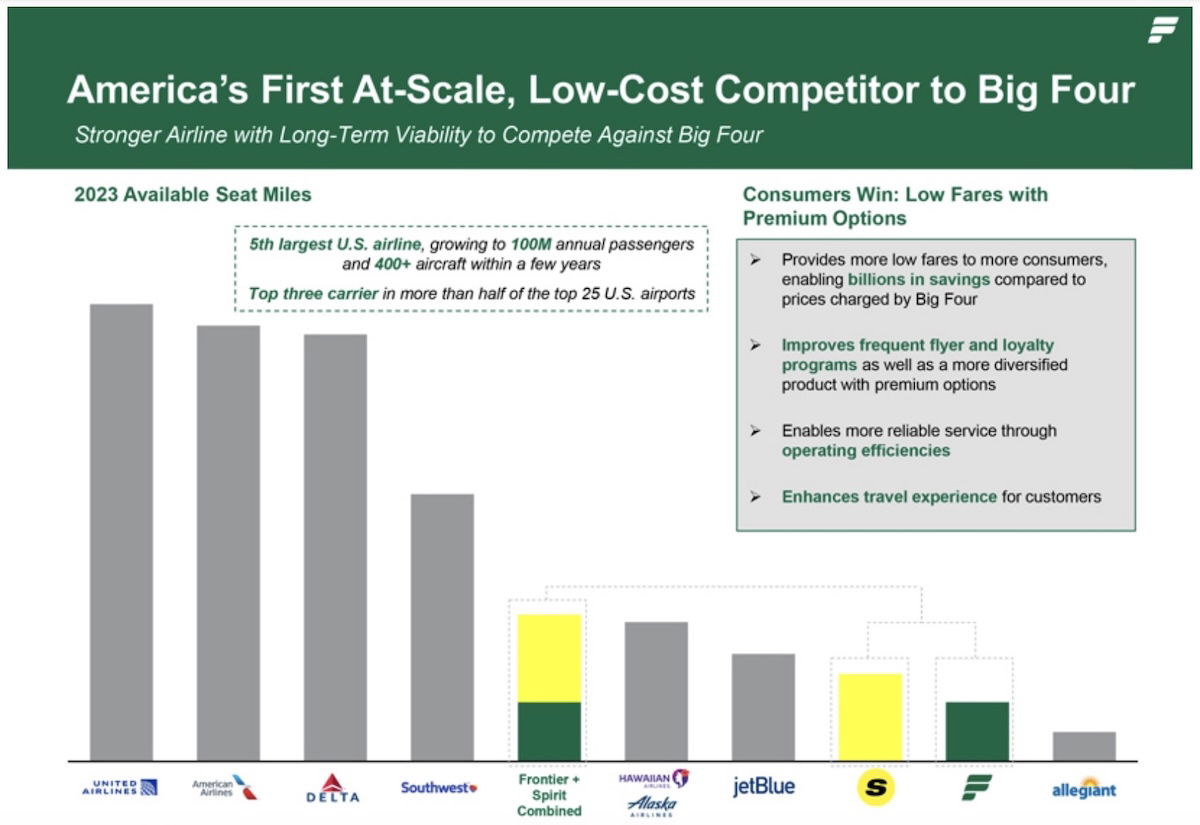

So there’s now an interesting update. In recent weeks, discussions have once again resumed about the possibility of Frontier acquiring Spirit. The goal is to create “America’s first at-scale, low-cost competitor” to the big four. Frontier notes that the materials in Spirit’s bankruptcy court filings “demonstrate that Spirit’s standalone plan will likely result in an unprofitable airline with a high debt load and limited likelihood of success.”

In a letter dated January 7, 2025, Frontier outlined its desire to acquire Spirit, with the following rationale:

We strongly believe that now is the time to form the country’s first, at-scale, low-fare carrier by combining our two businesses. A Frontier / Spirit combination will bring unmatched benefits:

Stronger competitive position due to much needed scale: the combined Frontier / Spirit will be better positioned for long-term viability as a more effective competitor in our existing and new markets. The combined company will be the fifth largest airline in the U.S., growing to 100 million passengers and over 400 aircraft within a few years.

Value proposition: by combining our operations, we will be able to improve our loyalty and frequent flyer programs and offer a diversified product — including premium options — and thereby create a stronger platform for accelerated, long-term growth. Additionally, the combination will allow more reliable service through operational efficiencies, including airport infrastructure optimization, further enhancing the travel experience for our customers.

Offering more low fares to more consumers: the combined business will greatly increase our presence in numerous major markets in the U.S. and offer significant network connections, creating thousands of new markets and enabling consumers to save billions compared to the prices charged by the Big Four.

Here’s how Bill Franke, Chair of Frontier’s Board of Directors, describes this proposal:

“This proposal reflects a compelling opportunity that will result in more value than Spirit’s standalone plan by creating a stronger low fare airline with the long-term viability to compete more effectively and enter new markets at scale. We stand ready to continue discussions with Spirit and its financial stakeholders and believe that we can promptly reach agreement on a transaction. We are hopeful we can achieve a resolution that delivers significant value for consumers, team members, communities, partners, creditors and shareholders.”

Meanwhile here’s how Barry Biffle, Frontier’s CEO, describes this proposal:

“While we are pleased with the strong results Frontier has been able to deliver through the execution of our business strategy, we have long believed a combination with Spirit would allow us to unlock additional value creation opportunities. As a combined airline, we would be positioned to offer more options and deeper savings, as well as an enhanced travel experience with more reliable service.”

This deal seems like the best bet for both airlines

I think this merger has huge upside for both the airlines, and for consumers. There would be synergies to a deal like this, and the airlines have highly complementary fleets and route networks.

Let me be blunt — this is likely Spirit’s only “real” path forward, short of just chunks of the company being sold off (aircraft, gate space, etc.). Spirit is losing money at an unsustainable rate, and even if the company emerges from bankruptcy, it wont have long before it’s in trouble again.

While Frontier has also struggled with profitability, the situation hasn’t been as bad as at Spirit, and Frontier has also been much faster to make updates to its business model. I think there’s power to scale, and I think the combined airline could be a lot more competitive than a smaller, independent Frontier.

Ultra low cost carriers in the United States have an uphill battle. They still have a cost advantage, but not as much as in the past, given labor costs and other considerations. Furthermore, even the most profitable legacy carriers are barely making money actually transporting passengers, but rather they’re making their money from other things, like their loyalty programs. It’s much harder for smaller and less premium airlines to tap into that.

Bottom line

Frontier Airlines has once again issued a formal proposal to acquire Spirit Airlines, as Spirit goes through Chapter 11 bankruptcy proceedings. Spirit doesn’t have a viable, independent future, given the rate at which the company is losing money, with no signs of that changing.

This deal is no doubt the best path forward for Spirit. Meanwhile for Frontier, I also think there’s merit to being a national competitor to the “big four,” as there’s power to scale. It’s still going to be an uphill battle, given how the industry has evolved, but I think it could work.

What do you make of the prospect of Frontier acquiring Spirit?

Part of Spirit's problem is their clientele...Not many people are looking to get on a plane with those type of people, much less pay for it. On the flip side, Spirit offered free, jerry Springer type entertainment. Knock em out fights, baby mama drama, and dude where does my bag go type of comedy...

Hopefully if the merger happens the airline goes a bit more "mainstream" in its customer base. Air Asia's "Now everyone...

Part of Spirit's problem is their clientele...Not many people are looking to get on a plane with those type of people, much less pay for it. On the flip side, Spirit offered free, jerry Springer type entertainment. Knock em out fights, baby mama drama, and dude where does my bag go type of comedy...

Hopefully if the merger happens the airline goes a bit more "mainstream" in its customer base. Air Asia's "Now everyone can fly model" isn't such a great idea in the US...

Regardless of Frontier vs JetBlue being the acquirer, this really makes the DOJ look stupid for blocking the earlier merger.

That’s why Judge’s go to law school (and you didn’t) and make those decisions.

It is being reported that NK has rejected the offer for the second time.

The bigger question if a merger happens is how will Frontier absorb Spirit's pilot and flight attendant contracts? I'm not sure Frontier can afford it.

seems they operate mainly out the same routes. Not sure the effort or cost to merge the two, assuming large cost, they will surely pass the cost to customers. I think frontier could do without merger to spirit and spirit can be absorbed by another airline to offer more flights to price conscience customers.

Lots of stupidity floating around here, F9 for making the offer and NK for rejecting it. The negotiations are going to be like a slap fight on the short bus. Entertaining in its own way, but yet still a little embarrassing to look at. The best option is that both die. As for the "consumers" affected, my feelings are summarized quite well by the great Jello Biafra: "Kill kill kill kill kill the poor".

It is now being reported on sites like Reuters, and Business Insider that Spirit just rejected Frontiers proposal again.

Spirit is jockeying for position..Never Accept the First Offer...and Frontier has already calculated this in their deal making. It's the creditors of Spirit who hold the cards at the moment. Not if they want to take a haircut, but how big a haircut they are willing to absorb.

Frontier is offering economy of scale which is needed in a shifting airline environment where:

- customers are requesting better service which ULLC airlines fail...

Spirit is jockeying for position..Never Accept the First Offer...and Frontier has already calculated this in their deal making. It's the creditors of Spirit who hold the cards at the moment. Not if they want to take a haircut, but how big a haircut they are willing to absorb.

Frontier is offering economy of scale which is needed in a shifting airline environment where:

- customers are requesting better service which ULLC airlines fail to provide in their current business model

- the current ULLC formula (rock bottom fares) isn't generate enough revenue to cover greater employee labor costs

- the Big Three can duplicate most of the ULLC with a mouse and a few lines of code sucking off revenue

- Southwest is moving from LLC to legacy format with assigned seating, amenities, etc.

- Should Frontier & Spirit consolidate; expect JetBlue to look for a dance partner (looking at you Alaska/Hawaii)

Spirit will ultimately have no choice. There's no evidence that the airline will ever turn a profit again and possibly can't be cash flow positive. Management may huff and puff (basically to try to save their own jobs) but they will need to make a deal. Now the question is how is Frontier then going to deal with the disaster of Spirit.

I'm wondering if e.g. B6 doesn't come back into the picture.

Of course, given the whole situation I also legitimately wonder if it doesn't transpire that NK is simply worth more dead than alive.

I have been told by a restructuring expert who has seen Spirit’s turnaround plan that they have no realistic chance of recovery.

A merger with Frontier is the only thing that makes sense for their survival.

And Spirit has some really great people working for them so I hope it works out.

As of this hour, NK has rejected F9's proposal which just means the negotiating is taking place.

NK likely does not have a viable standalone future - but then perhaps neither does B6.

NK is in chapter 11 which means someone is going to get a haircut. F9 is likely the only airline that can buy NK which means they do have a considerable amount of strength as they push for a deal.

Your phraseology, "NK **likely** does not have a viable standalone future" makes far more sense than the author's apparent assertion that Spirit absolutely has no future as a stand-alone carrier. None of us knows for certain if Spirit can survive alone. Things certainly don't look good at this point, but anything is possible - even if it looks very unlikely.

It made sense 3 years ago too!

Front-Spirit could easily compete with the Big 4 post-merger if they offer First Checked Bag free on all their fares. This would attract pax from other airlines and reduce the passenger fights onboard their own metal by 95%.

yes , this is the next-best scenario for F9 and NK. Growing larger and cutting costs makes sense to become a larger competitor.

The best scenario would be for one or both of the two carriers to have viable, profitable business plans before they merged. Neither do which is why this will be a merger that will cost money and still might not achieve a competitively stronger position.

The ULCC sector doesn't work as a...

yes , this is the next-best scenario for F9 and NK. Growing larger and cutting costs makes sense to become a larger competitor.

The best scenario would be for one or both of the two carriers to have viable, profitable business plans before they merged. Neither do which is why this will be a merger that will cost money and still might not achieve a competitively stronger position.

The ULCC sector doesn't work as a business strategy in the US because the legacy carriers match everything the ULCCs can do as a subset of the service they provide which includes higher fares and more premium services delivered more reliably.

F9 needed NK to shed debt in bankruptcy and that will happen. F9 will have to figure out how to carve out a future for the ULCC sector in the US but NK should make it out of bankruptcy and to a future as part of a larger company.

and that merger will probably be the only one the US airline industry sees in the next 4 years.

the most negative impact will be to WN and AA which is trying desperately to fix its ULCC culture but operates more like a ULCC for most of its customers than a premium legacy carrier.

This is not a surprise that they want to try again and this time I think it will happen. Both airlines together need to upgrade the passenger experience in the process, an area that both have faltered with.

Well Ben, I think they should merge and then Jetblue should merge with the Frontier/Spirit. Then they could really challenge the "big four"

Or after Frontier acquires Spirit, Alaska follows its earlier acquisition of Hawaiian with an acquisition of JetBlue to create an airline that’s relevant beyond WA, OR, CA, and HI…

The graph of airlines size makes me like the idea of an Alaska-JetBlue linkup as well.

At the time of the VX merger battle, I remember musing that a four-way tie-up between AS, B6, HA, and VX being ultimately probable in the long run - they all occupy/occupied non-overlapping niches (with the partial exception of AS/VX) and while AS/B6 were the biggest of the group, they all only added up to a single "major" carrier.

I would image JetBlue will be looking for a dance partner soon. If the NEA was to return, it isn't enough for long term survivability.

What JetBlue would provide in an Alaska/Hawaii merger:

- greater access to NYC & BOS & DCA

- greater coverage at LAX

- east coast coverage to complement the west coast & Pacific coverage of AS/HA

- leverage to fill in the midwest gap via Chicago...

I would image JetBlue will be looking for a dance partner soon. If the NEA was to return, it isn't enough for long term survivability.

What JetBlue would provide in an Alaska/Hawaii merger:

- greater access to NYC & BOS & DCA

- greater coverage at LAX

- east coast coverage to complement the west coast & Pacific coverage of AS/HA

- leverage to fill in the midwest gap via Chicago or St Louis or Kanas City

- existing European footprint proving more inter-continental leverage

- Better utilization of the AS/HA wide bodies via Europe & Caribbean

- extensive coverage of the Caribbean

- ability to compete with the Big Four and the ULLC Two