I can’t help but point out how in 2022, American seems to have radically changed its approach to selling miles directly to consumers. I’m not sure I can make sense of it?

In this post:

American used to aggressively sell miles

Historically American Airlines has been the most aggressive of the “big three” US carriers when it comes to selling airline miles directly to consumers. Virtually all US airlines will directly sell members miles, but in most cases it’s not actually a good deal.

The exception has historically been American, as it has been possible to buy AAdvantage miles with big bonuses or discounts. This is a practice that goes back to way before the current American AAdvantage program, as this is something that US Airways Dividend Miles did more aggressively than any other airline back in the day (and keep in mind it’s still US Airways management in charge at American).

Ultimately selling miles to consumers is a fantastic business model, especially with the global alliances (partner redemptions are generally pretty low cost), and with airlines increasingly switching to dynamic award pricing. This is big and profitable business for airlines.

This suddenly stopped this year

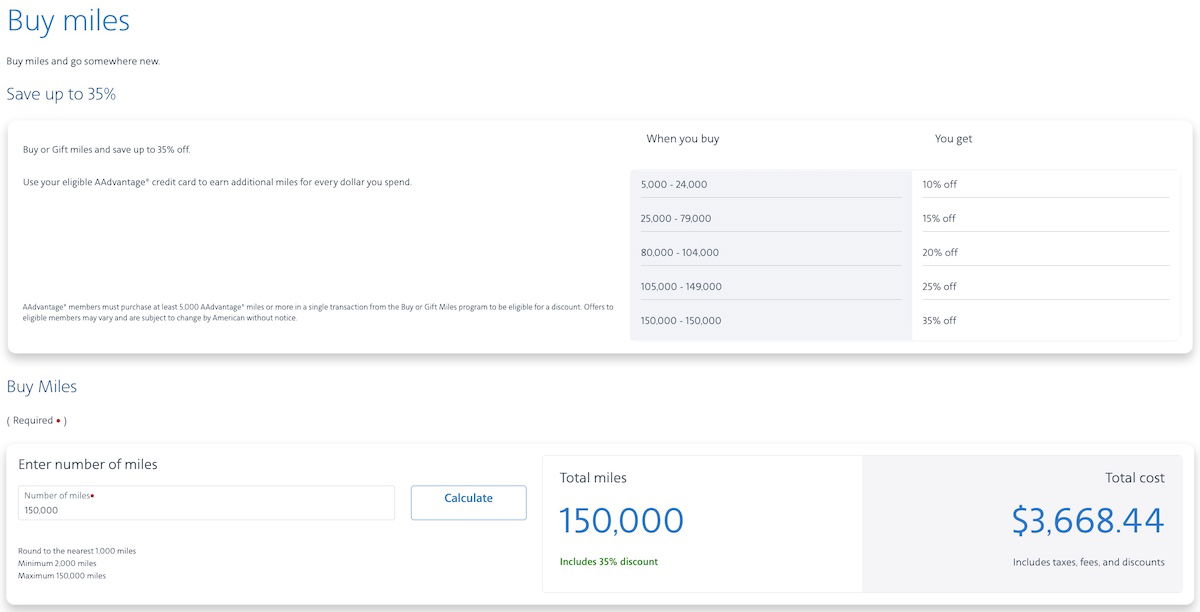

Rather oddly, earlier this year American AAdvantage seemed to radically change its approach to selling miles. In January 2022, American increased the cost to purchase miles by 19%, from 2.95 cents to 3.5 cents per mile (pre-tax), before any promotion discounts or bonuses.

My assumption at the time was that this was a marketing strategy, so that American could market offering bigger discounts and bonuses. In other words, I figured the program might go from offering a 75% bonus on purchased miles, to instead offering a 100% bonus on purchased miles (with each mile being more expensive). It’s kind of like how airlines never buy planes at the actual sticker price.

But that’s not what has happened. While American has historically had a different promotion on purchased miles every month, for all of 2022, American has had the same offer — you can save 35% off the purchase of AAdvantage miles, and this makes the cost per purchased mile 2.45 cents.

For context, American AAdvantage has historically sold miles for well under 2.0 cents (and in some cases around 1.7 cents) during promotion periods. For what it’s worth, I value AAdvantage miles at 1.5 cents each

If you can acquire AAdvantage miles for under two cents each, I’d say there are all kinds of amazing uses for miles where you can get outsized value. However, at 2.45 cents per mile, I’d say it’s a different story.

Why doesn’t American want to sell miles anymore?

American is very much countering the trend by not aggressively selling miles anymore, and I can’t help but wonder why. I guess there are two potential explanations.

One potential explanation is that American hasn’t actually given up, but rather has found that selling miles at a higher cost is more profitable. I would have assumed the airline has seen a massive dip in the number of people buying miles this year, as buying AAdvantage miles for nearly 2.5 cents each isn’t worth it in a vast majority of cases.

But perhaps the numbers don’t reflect that, and the mileage selling business remains robust. Obviously the margins on selling miles for 2.45 cents are better than when selling miles at 1.7 cents. But how much of a drop in business has American seen? I suppose if it’s “only” 50%, then the airline might be better off. I would think the drop would be more significant than that, though, especially as American’s promotions on purchased miles haven’t gotten as much press as in the past, given that the offer has been the same, and isn’t very good.

The other explanation is that selling miles simply isn’t as profitable as it used to be for AAdvantage, and/or the program has reprioritized:

- This year we’ve seen the introduction of Loyalty Points, which has greatly changed how status is earned, and even credit card spending counts toward status; however, buying miles doesn’t count toward status

- Credit card companies buy miles from airlines in bulk, and aren’t paying anywhere close to 2.45 cents per mile, so selling miles to consumers is significantly higher margin (though also significantly lower volume)

- Has AAdvantage already met all of its performance goals with the new Loyalty Points system, and management wants to temporarily throttle back selling miles, so that it has another lever to pull when growth is needed?

- Did American somehow do some math and decide that it wasn’t making as much money as it thought on selling miles to consumers?

I don’t have the answer, but I’m sure someone has some insights, and I’m curious what OMAAT readers think.

Bottom line

Selling miles can be big business for airlines, and historically American AAdvantage (and before that, US Airways Dividend Miles) has been one of the most aggressive about selling miles.

That has changed this year, though — AAdvantage not only increased the base cost to purchase miles (before any promotions), but has also stopped offering lucrative promotions on buying miles. This most definitely counters the industry trend, and I can’t help but wonder what the explanation is.

Why do you think American AAdvantage has seemingly given up on having lucrative promos for buying miles?

As a reminder, AA Miles are a virtual currency per IRS definition.

This will remain true until they stop selling miles, and stop allowing them to be transferred to other people.

Selling the miles at a discount decreases the value and buying miles may be only useful for an immediate reward.

Another unwelcome trend with regard to partner awards is AAdvantage giving preference to undesirable 2nd or 3rd tier airlines (like AirIndia) in constucting long-haul awards rather than offering say, 2 sector awards with great connectivity with a popular premium airline (Qatar with its QSuites) which no doubt come at an extra cost to AA.

This is something United's plan has been doing for some time, causing a drop in interest in their offerings. (Aeroplan...

Another unwelcome trend with regard to partner awards is AAdvantage giving preference to undesirable 2nd or 3rd tier airlines (like AirIndia) in constucting long-haul awards rather than offering say, 2 sector awards with great connectivity with a popular premium airline (Qatar with its QSuites) which no doubt come at an extra cost to AA.

This is something United's plan has been doing for some time, causing a drop in interest in their offerings. (Aeroplan is also a serial offerder too.)

Also AAdvantage has pretty much ceased single awards for long-hauls on some routings (i.e. Australia to Europe) forcing one to buy 2 connecting sectors at a substantially increased overall cost.

With recession looming in the US, I wonder if AAdvantage is creating a situation of short term gain for long term pain. Airlines are notorious for not thinking more than one day out.

I suspect that the explanation is far less complicated than your various hypotheses: we're in a travel bubble brought on by pent up demand, which has temporarily distorted market dynamics.

Those of us who are road warriors and/or avgeeks have a pretty good idea of the value of miles. But the average person probably doesn't. So "35% off" may simply look like a deal to those who have never considered purchasing miles before. If...

I suspect that the explanation is far less complicated than your various hypotheses: we're in a travel bubble brought on by pent up demand, which has temporarily distorted market dynamics.

Those of us who are road warriors and/or avgeeks have a pretty good idea of the value of miles. But the average person probably doesn't. So "35% off" may simply look like a deal to those who have never considered purchasing miles before. If that's the case, AA is just charging what the market will bear.

The same can be said for the swelled elite ranks, which you wrote about recently. With millions of people suddenly obsessed with going somewhere, it logically follows that awareness of available perks would increase as well. Hence the dramatic increase in credit card sign-ups and desire to accumulate points. But how much of that is going to continue when people return to their normal patterns and the annual fees (which are waived for the first year) finally kick in?

It might actually be (partially) your fault? Fallout for the millions of miles purchased at that earlier extraordinarily lower rate?

@ Willem -- So American doesn't want to sell miles at a profitable rate because the airline sold miles at a potentially unprofitable rate? Please help me understand that logic, because it's not my understanding of how business usually works?

@Lucky

It's all about controlling the currency.

Same reason America keeps printing money but still can't keep printing unlimited money.

@Lucky....AA is still selling miles at 2.4cpp, but your article is asking why AA is not offering any promos or discounts on buying miles and it could be because they lost so much money on the SimplyMiles deal in December that they are taking the year to recoup the costs and dont have any incentive to offer frequent discounts/promos anymore? Also perhaps a reason why they raised the price of miles right after that promo? I dunno, just a theory.

@Ben....Wonder if this is due to the SimplyMiles fiasco last December? How many miles were sold at a rate that was WAY below market price? Tens and tens of millions? You and Gary alone bought over 10 million combined and thats only two people. Since it was open to everyone for so many days, I wonder how many more people got in on this and bought millions.

I think this is a reasonable hypothesis. If AAdvantage has targets for annual mile sales they may be have blown threw them via that one SimpliMiles promotion.

The key thing in assessing a points/miles sale (viz. from the perspective of the issuer) is how much time passes between getting the cash for the points/miles and a redemption (and what is the likely cost of that redemption) and what is the issuer's cost of capital (in AAL's case, it's a double-digit percentage: the balance sheet is an absolute shambles thanks mostly to Doug).

For credit card miles, that period is almost certainly multiple...

The key thing in assessing a points/miles sale (viz. from the perspective of the issuer) is how much time passes between getting the cash for the points/miles and a redemption (and what is the likely cost of that redemption) and what is the issuer's cost of capital (in AAL's case, it's a double-digit percentage: the balance sheet is an absolute shambles thanks mostly to Doug).

For credit card miles, that period is almost certainly multiple years: the typical card accumulates less than 25k miles per year, and arguably there's basically always more new miles being issued to credit cards than credit card miles being redeemed (so you can make a reasonable case that the period is closer to infinite).

For mile purchases, there are a few situations:

* probably accounting for a majority of the point purchase transactions is the "I'm 5-10-20k miles short for the redemption I want, so I'll buy miles" case. Delta, United, and other airlines have introduced "miles + cash" awards that essentially bundle a mile sale with a redemption to cover this situation as they deemphasize direct sale of miles.

* then you have the "I see a sweet-spot redemption and will buy the miles now" crowd.

* and then there's the speculative purchase (probably only a good idea if trying to hit a card spending target, generally)

All three of those are typically a shorter time horizon than credit card miles, and the former two may be exceptionally short (e.g. if there's a partner which mostly opens up award inventory when fairly close-in). The latter two may be somewhat price sensitive (the first is rather price insensitive), but are also not that indicative of a long stream of cash-flow (the buyer in the first has been accumulating miles, presumably).

A 12% annualized cost of capital and means that with a 6 year mile holding period, selling a mile to Citi/Barclays for 0.9 cents is better than selling a mile for 1.8 cents that gets immediately redeemed, and that credit card mile is probably more likely to be redeemed for a domestic economy award (where the direct cash cost is basically just the fuel) vs. a partner premium cabin award (which will have a real cash outflow).

Delta miles could be acquired at 1.1 cent per mile with some effort. United miles could be acquired at 1.9 cent per miles with zero effort. AA miles not so much so. The best option as of late for AA mile was via Marriott; but alas, the end of the 5K bonus.

The AA web site worked well for international redemptions at one point; but not so much so now. Qatar and Japan Airlines...

Delta miles could be acquired at 1.1 cent per mile with some effort. United miles could be acquired at 1.9 cent per miles with zero effort. AA miles not so much so. The best option as of late for AA mile was via Marriott; but alas, the end of the 5K bonus.

The AA web site worked well for international redemptions at one point; but not so much so now. Qatar and Japan Airlines in particular are few and far between. A search of sorts highlighted issues with checked baggage and now Qatar is no not be found on the AA web site. Searches for Japan Airlines to / from SE Asia results in First on the long hop and economy on the short hop; though options exist for business on the short hop. The short hop is 6 hours so not so short.

For US domestic AA flights BA is the better option. I don't find good value in domestic flights unless the award travel is at the lowest rate. BA miles are certainly easier to acquire

Perhaps AA is working to fix some of the issue before selling more miles. A working web site isn't a factor for other loyalty programs, though.

Maybe their auditors have told them the liability on their balance sheet for unredeemed miles is huge and can’t go on like that. If people aren’t redeeming their miles then the liability gets bigger and is a risk to the financial stability of the company.

As an aside, as a non US citizen doing travel points hacking I’m now seeking out programs like AS and SQ where the printing of miles currency, basically by US...

Maybe their auditors have told them the liability on their balance sheet for unredeemed miles is huge and can’t go on like that. If people aren’t redeeming their miles then the liability gets bigger and is a risk to the financial stability of the company.

As an aside, as a non US citizen doing travel points hacking I’m now seeking out programs like AS and SQ where the printing of miles currency, basically by US credit card companies is avoided by not being affiliated with these companies. It’s basically just money printing. I’m not wanting to go up against someone with $1m miles when I want to redeem my miles. I’m sure the partner airlines of these devalued currencies realise that too and are releasing less award space to the US airlines like United and AA which have huge amounts of unredeemd miles on their balance sheets. It’s not in their interests of the partner airlines to have rabid points hacking travellers in their premium cabins.

With regard to the supposed problem of unredeemed miles on the balance sheet, Qantas had the same, if not worse, problem with FF points stacking up during the pandemic lockdowns when flying anywhere was inpossible.

One solution to relieve the pressure was to offer a number of 'points-only' flights in all classes (at a fairly inflated rate I might add) from Australian ports to selected international destinations. This created great excitement and sold out...

With regard to the supposed problem of unredeemed miles on the balance sheet, Qantas had the same, if not worse, problem with FF points stacking up during the pandemic lockdowns when flying anywhere was inpossible.

One solution to relieve the pressure was to offer a number of 'points-only' flights in all classes (at a fairly inflated rate I might add) from Australian ports to selected international destinations. This created great excitement and sold out in no time.

Millions and millions of points were wiped off the books at a time when many people were still hesitant about resuming flying, and planes were nowhere near full.

Even now this type of thing could still be an idea for US airlines awash with bloated mileage accounts. Something to please the members rather than alienate them as they are doing now.

Why have transfer bonuses to some airline and hotel loyalty programs been weaker recently? Might the reasons be related? As business has roared back, might the companies not need the cash as much, and therefore don't need to offer discounts or bonuses?

I never liked the comment, mainly from Gary Leff, but also from this post, that American Airlines "loses money flying planes" and only "makes money via AAdvantage." Most customers transacting via AAdvantage ultimately are trying to redeem for flights. And while this blog and many focus on partner redemptions, I think over and over again it has been said that the vast majority of redemptions are on the airline's own metal, mostly in economy, and...

I never liked the comment, mainly from Gary Leff, but also from this post, that American Airlines "loses money flying planes" and only "makes money via AAdvantage." Most customers transacting via AAdvantage ultimately are trying to redeem for flights. And while this blog and many focus on partner redemptions, I think over and over again it has been said that the vast majority of redemptions are on the airline's own metal, mostly in economy, and mostly domestic. So without the actual planes, AAdvantage wouldn't be worth much as a standalone entity.

To answer the question posed by the article, it seems like American is heavily emphasizing its preferred partners as way to earn American Airlines miles. Even within partners, it trailed, then ended, the ability to transfer Thank You points to AAdvantage. There are no signs of that coming back. And the Marriott/AAdvantage link has also been devalued. Bottom line - if you want American miles, the best way is to fly the airline (even here, they devalued flying for lower level elites or non-elites), spend on the card, or spend on preferred partners. Shortcuts like buying miles (and immediately redeeming them for partner redemptions, not doing anything to reinforce the profitability of flying or partnerships) or transferring from Marriott/Thank You Points have been discouraged.

Post-COVID, AA has net income from operations.

There's a measure of accounting fiction in the "loses money flying planes/makes money from the FF program": a lot (not all) of the FF profit is an artifact of the fictional price the airline sells award tickets to its FF program. The FF program is still the cheapest capital source for the airline, though.

I think it's simply neglect. Staff is focused on higher priority matters.

Say you don’t understand how big businesses operate without saying you don’t understand how big businesses operate.

Buddy, it’s not like American has 12 employees at corporate and they said ‘oh no we have higher priorities, let’s all go focus on something else..eeeeeek’

The company has clearly changed their strategy and this observation is pointing out the downstream impact of that change in strategy.

I think you greatly overestimate the number of people who are as analytical as you/we are about the pricing of airline miles purchases.

Why sell miles when flights are full. Just returned from 5 weeks vacation and each flight on each carrier was full, Iceland air, Qatar, Malta, Lufthansa, BA, Salam Airways. Finnair. Domestic on AA, each flight taken overbooked.

@ Alex -- Because American Airlines sells miles, not selling tickets. American's Q3 cost per air seat mile was higher than the carrier's revenue per air seat mile. Meanwhile the airline continues to make billions of dollars on the AAdvantage program.

Get it but was not one of the points that the cost per mile was to high to buy them from AA. So yes they sell miles but is there a buyer for them, so when flts are full no incentive to increase bonus. Also if u sell miles and the flights are full u give back some money for overbooking. Isn’t liability on purchased miles limited since a transaction is finished, Aa gets money,...

Get it but was not one of the points that the cost per mile was to high to buy them from AA. So yes they sell miles but is there a buyer for them, so when flts are full no incentive to increase bonus. Also if u sell miles and the flights are full u give back some money for overbooking. Isn’t liability on purchased miles limited since a transaction is finished, Aa gets money, one gets miles, different from getting miles off a ticket, u actually fly and get what u paid for , the miles given is then a liability which could get cancelled by devaluation. U fortunately I know cargo better than PAX business.

That's absolutely the BEST time for them to sell miles -- they get the revenue from the sale, and the chance that the miles will actually be redeemed is lower. Best of all for them is if they sell the miles and the purchaser allows them to expire. That's free money for the company.

Yeah, roll on the Recession! lol

Buying miles was a fool's errand anyway.

The answer is the Loyalty Points program. AA IS selling massive amounts of miles through the LP program. Just not direct to consumers. It wants to direct you through it's volume partners.

@ Bob -- Why, though? Why would American rather sell miles for (probably around) one cent each and have those qualify as Loyalty Points, rather than 70-100% more, and not have those qualify as Loyalty Points?

1) There is more to credit card agreements than selling points - I think AA gets a percentage of spend, percentage of signups, etc, in addition to sold points

2) People with Loyalty Points are more likely to buy American Airlines tickets

I’m personally sitting on over a half million AA miles with no practical way to use them as redemptions are massively inflated over past years. Not willing to spend 360,000 miles on a J trip to Europe. I’m breaking my rule and holding miles hoping for a better luck this next year. In the meantime, buying AA miles seems like a fool’s errand.

I'm in a similar boat - have just over 1 million, and that after justing spending 160,000 to fly to Tokyo in F on JAL. No longer worth it to fly AA metal to Europe - plus, AA tries to put you on BA metal with the surcharges. I'm trying to plan more trips to Asia just to put a dent in my pile of miles.

I don’t know where you’re looking. There is widespread availability from JFK - LHR for 78k miles in J on American thru at least February 2023. I just booked Flagship first from JFK- GRU for 66,000 miles leaving early January and found a return in J for 45,000 miles! There was a return in flagship first for 55,000 but I opted for J since the ground experience in GRU is not worth the extra 10k miles in my opinion.

Yes, trying to get back from Stockholm to NYC last week the best (only good) business class redemptions were on AA. Some were on BA and therefore not so great, but there were also AA metal redemptions available with about an $80 co-pay.

@Jeff - if I were wanting to travel to LHR or GRU from JFK between now and February, clearly not an issue. Unfortunately, JFK is pretty much a dead AA hub for me, given my location in SAN. Like everything else with redemptions YMMV.

AA historically sells miles aggressively when they're desperate for cash (Financial Crisis, Covid). The logic being that they would get cash from the sale immediately, and deal with the financial liability later - it's effectively a loan.

When they're on good financial footing, they have no reason to sell miles for less than the liability they carry.

@ Pat -- But the cost at which American sells miles during promotions isn't less than the liability they carry. Keep in mind American is selling miles to credit card companies for way, way less than consumers are being charged.

I believe American isn't selling its miles as cheaply to its credit card issuers as its main domestic competitors to theirs. Citi, for example, hasn't allowed conversion of its points to AA miles (other than for a very brief period last year) because of the cost of conversion.

Correct, Ben, but exchanging the future liability of redemptions for cash today can smooth financial operations that require cash on hand. Combined with plans to depreciate those obligations (by raising award prices or otherwise making it hard for holders the cash them in) makes selling a net positive.

Do you know that American is currently selling miles to Citi? Last I heard, Citi was sitting on a glut of miles they bought from AA a long time ago.

It's entirely possible I'm operating on outdated information.