If you register your email address through this link or using code EARLY16250 you can immediately get Zero Graphite status when the card launches next year. See below for all the details.

There’s a new startup in the credit card space, called Zero, that many people should be excited about. To cut to the chase, in early 2017 we’ll see a credit card that acts like a debit card, and offers up to 3% cashback on all purchases. Let me explain.

Debit cards vs. credit cards

Many debit cards used to offer decent rewards structures, though unfortunately that changed a couple of years back when new regulations were introduced, which capped debit card transaction fees. Since debit card merchant fees are just a few cents on most transactions, we don’t really see debit card rewards anymore.

While credit cards can charge merchant fees of over 2%, debit cards can’t. That’s why there’s such a big discrepancy between debit card and credit card rewards.

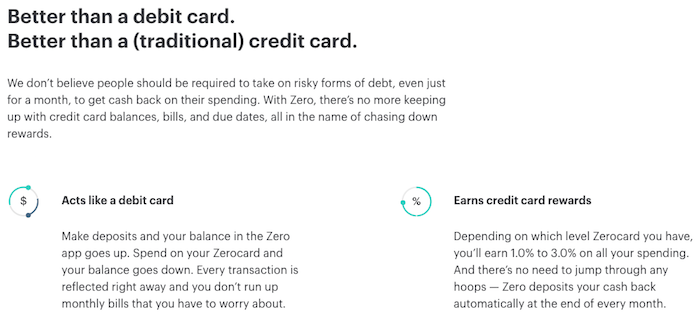

Still, a lot of consumers prefer debit cards. Many people have trouble staying on top of their finances, and psychologically prefer using a debit card, where money is deducted from their account, rather than “borrowing” money and then paying it off at the end of the cycle.

So while I’d like to think there’s no downside to a credit card for a responsible consumer with self control, I realize that doesn’t apply to everyone.

Zero is a credit card that acts like a debit card

When it launches in early 2017, Zerocard will be a Visa credit card that acts like a debit card. You’ll load your account with cash and then can make purchases as you would with any other debit card. The difference is that you’ll earn cashback rewards, ranging from 1% to 3%. The reason they’re able to do this is by technically categorizing the card as a credit card rather than debit card, so they can charge merchant fees and offer rewards.

On the surface this product is ideal for anyone who prefers using a debit card but still wants rewards (lots of people use debit cards, and presumably would love to earn rewards). However, this card could potentially be really valuable even for those of us who love credit cards.

What rewards does Zero offer?

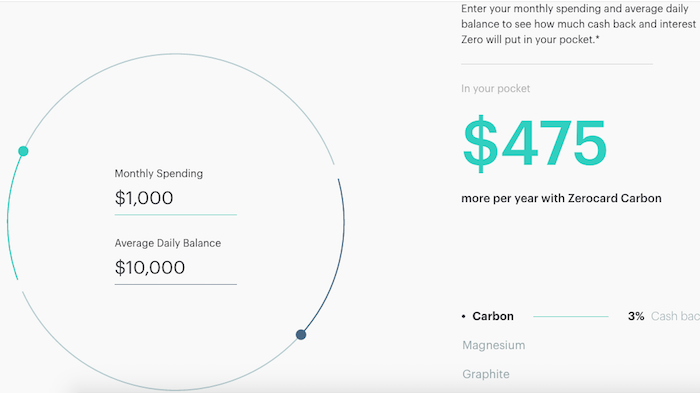

The structure of Zerocard’s rewards is sort of similar to elite status with an airline or hotel. The rewards you earn with Zero depend on how much money you spend on your Zerocard per year. The thresholds are as follows:

- Quartz members (no spend requirement) earn 1% cashback

- Graphite members ($25,000+ spending annually) earn 1.5% cashback

- Magnesium members ($50,000+ spending annually) earn 2% cashback

- Carbon members ($100,000+ spending annually) earn 3% cashback

The level you’re eligible for is based on your annual spend, and once you achieve a level it’s valid through the end of the following year. In the following year you’ll have to spend enough for the required threshold to “requalify.”

On top of that, you earn interest for the balance in your account “at a higher rate than lending savings accounts,” or so they say. They have a tool on their site that lets you estimate how much cashback you’ll earn, and based on that it seems to suggest you’ll earn roughly 1.25% interest on your balance.

Does Zero make sense for you?

In my opinion the area where this is really a game-changer is for those who refuse to get a credit card and prefer a debit card. They’ll earn 1% cashback on all purchases, while right now they’re probably not earning any rewards.

That being said, this is also revolutionary for big spenders, as there’s no card out there offering 3% cashback. Of course there’s a big spend requirement, but for the right person this could be huge. For example, say you’re someone who has big tax obligations. You can pay your taxes with a credit card for a fee of under 1.9%, so you could basically make a 1.1% profit on paying your taxes.

This would also be the best card out there for everyday spend, though in many cases you can do better on other cards with bonus categories. Of course $100,000+ is a lot of everyday purchases to make. 😉

How can Zero afford to offer 3% cashback?

Now, I haven’t spoken to anyone at the company (and have no relationship with them, other than having just signed up and using their publicly available referral program), so I can only speculate here. Like many businesses, I suspect they’ll make money on some consumers and some transactions, and lose money on others:

- They’ll make money on you as you spend your way to the first $100,000, in order to earn Carbon status

- Lots of people will go for Carbon status but not end up making it, so will fall in a lower category

- In reality they can afford to lose money on some customers in order to create something that seems aspirational, since they’ll have big margins on a vast majority of their cardmembers, where they’ll only be offering 1% in rewards

- Who knows, over time they may adjust the rewards structure, in case this becomes too lucrative

Register now and get fast tracked “status”

Zerocard is only launching in early 2017, though you can already sign-up for early access by entering your email address. However, if you sign-up through someone else’s referral link you’ll automatically start with Zero Graphite status rather than Zero Quartz status (getting you 1.5% cashback rather than 1% cashback).

Here’s my link, if you’d like to sign-up through it (or enter code EARLY16250), which will automatically get you Zero Graphite status at a minimum once they launch (and of course there’s no obligation, you’re just adding your name to an email list at this point).

On top of that, if you refer enough people you can immediately get higher status, all the way up to Carbon. However, their terms aren’t very clear on how many referrals are required to get a higher tier, so I suspect they’re still working that out. Here’s what the terms say:

Register to join the waitlist for early access and take advantage of the early access referral program. The early access referral program allows users to level up faster if they successfully invite friends to also sign up. Please note that this referral program is being offered for a limited time, and will not be available once we launch the Zero experience and products to the general public (“Official Launch Date”). Registrations must be received at or before 11:59 p.m. PST on the calendar day immediately preceding Zero’s Official Launch Date. People who level up via waiting list referrals unlock the ability to initially receive a higher level card (i.e. Zerocard Carbon) and will maintain it for the remainder of the calendar year in which they become a customer, plus all of the following calendar year.

So you might as well get on the list and invite friends as well if you think you’ll be interested (feel free to leave your code below).

Bottom line

I commend Zero for doing something really unique here, and think they’ll be successful when they launch next year. I don’t think the card is right for everyone, but if nothing else, this card is revolutionary for those who use debit cards on principle, as it will once again be possible to earn rewards.

On the high end this also has the potential to be lucrative. If you’re a huge spender and many of your purchases don’t fall into other categories, this has the potential to be the best card ever.

What they’re doing here is actually pretty simple, and I’m surprised we haven’t seen any banks come out with a similar concept.

What do you make of Zero? Do you plan on signing up?

(Tip of the hat to Hans Mast)

Instant Graphite 2% awaits the clicker of the link...

https://zerofinancial.com/CASH23662

Type in DOLLAR21200 to get instant GRAPHITE

Sign up and refer a friend. Click here: https://zerofinancial.com/DOLLAR18512

I'm glad I happened upon this article. This card sounds and looks to be very interesting and useful. I prefer to use my debit card over credit cards. I like to spend my own money that I know I have so to get rewarded for that along with having a unique but simple looking card is great. Hope I get approved!

Please sign up with my link code

https://zerofinancial.com/DOLLAR13718

Please sign up under my link so we can all level up!

https://zerofinancial.com/CARD5682

Zerocard Graphite:

https://zerofinancial.com/SECURE1553

Thanks!

Please use my link:

https://zerofinancial.com/CARD1536

You are brilliant for using my code!

https://zerofinancial.com/EARLY61173

Please use this link to start at 1.5%,

https://zerofinancial.com/EARLY3902

Share Link:

https://zerofinancial.com/EARLY35725

*insurance*

Do they offer car rental unsuranxe as a benefit?

3% with a $100k minimum spend requirement? Bahahahahahahahahaha.

Definitely NOT a good value considering what such a level of spend can get you with other cards. Factor in that you have to pre-pay and this "deal" looks worse than Blackberry stock.

Can someone answer Jamesy's question please?

Specifically, will applying for this card show up on my credit report? I am trying SO VERY HARD to not apply for any new cards anytime soon (except maybe non-Chase business cards) so I can maybe qualify for CSR in about a year (and keep up with all the dang bloggers who keep bragging about how they got the card and how they plan to spend their 10K UR....

Can someone answer Jamesy's question please?

Specifically, will applying for this card show up on my credit report? I am trying SO VERY HARD to not apply for any new cards anytime soon (except maybe non-Chase business cards) so I can maybe qualify for CSR in about a year (and keep up with all the dang bloggers who keep bragging about how they got the card and how they plan to spend their 10K UR. Sorry but this ongoing bragging really ticks me off).

If you can answer this question accurately, I'll consider using your link to apply.

Terri -

They don't clearly say. But one of the items in their FAQ mentions credit scores:

"Because Zero discourages overspending and encourages automatic payments in full of any Zerocard balances, Zero may increase your credit score."

This suggests that it would be included as a line of credit on your report.

I'm right there with you on frustratedly waiting to drop under 5/24. That Delta Platinum offer is hard to pass up,...

Terri -

They don't clearly say. But one of the items in their FAQ mentions credit scores:

"Because Zero discourages overspending and encourages automatic payments in full of any Zerocard balances, Zero may increase your credit score."

This suggests that it would be included as a line of credit on your report.

I'm right there with you on frustratedly waiting to drop under 5/24. That Delta Platinum offer is hard to pass up, and if the other rumors are good, it's going to make it harder. I'd say holding out for CSR is a good call, but there's also no harm in signing up for the Zero waitlist and making the decision once we learn more.

If you do, I'd appreciate it if you use my referral: https://zerofinancial.com/EARLY17445

Sign up under my link please, thanks :)

https://zerofinancial.com/EARLY19025

Excited to try this product out.

Here's my link:

https://zerofinancial.com/EARLY705

Perk Street tried this a number of years ago - I actually really liked them but sadly they shut down. I'd be surprised that a startup could offer higher rewards in a marketplace with now-mandated lower transaction fees and make a real go of it.

Understanding why they think they can do so would be helpful.

"Zerocard will be a Visa credit card that acts like a debit card. You’ll load your account with cash and then can make purchases as you would with any other debit card."

So... a prepaid debit card?

I would think that by calling it a credit card, you're implying that they will extend you, you know, credit. I may have skimmed their site a little too quickly, but I didn't see that on their...

"Zerocard will be a Visa credit card that acts like a debit card. You’ll load your account with cash and then can make purchases as you would with any other debit card."

So... a prepaid debit card?

I would think that by calling it a credit card, you're implying that they will extend you, you know, credit. I may have skimmed their site a little too quickly, but I didn't see that on their site.

In fact, Zero markets the card as "a Visa card that acts like a debit card and earns credit card rewards." But they provide interest on deposits.

So... an online bank that gives you cash back when you use their debit card.

Neat.

Thanks Ben. Signed up and here's my link.

https://zerofinancial.com/EARLY18404

Definitely could be good for non-bonus, though really would want that 2 or 3% (1.5 doesn't quite entice me given some of the other cards.) Good to sign up though and will be interesting to see how it works. Smart on them for getting the word out before launching.

HTTPS://ZEROFINANCIAL.COM/EARLY18337

Code: EARLY18337

Thanks for letting us share.

Multi-level marketing in credit cards now. What has America come to?!

JCB has a 3% cash back card that's essentially no annual fee - although only available on the West Coast.

https://www.jcbusa.com/for_consumers/marukai-premium-jcb-card/

Tim, you need to get laid.

Lucky, can you find out if they report to the ctedit bureau just like a regular credit card?

It appears to have Visa Infinite branding. Wonder if it will include the $100 flight credits that the CSR does not?

They do say no fees, but it's unclear if that includes foreign transaction or cash advance fees.

They offer ACH, so in theory you could pay taxes/mortgage/utilities with it. That almost certainly won't earn cashback or count as spend though.

Unless you get Carbon though, probably not worth using this over other cards.

Still,...

It appears to have Visa Infinite branding. Wonder if it will include the $100 flight credits that the CSR does not?

They do say no fees, but it's unclear if that includes foreign transaction or cash advance fees.

They offer ACH, so in theory you could pay taxes/mortgage/utilities with it. That almost certainly won't earn cashback or count as spend though.

Unless you get Carbon though, probably not worth using this over other cards.

Still, why not, here's my code: https://zerofinancial.com/EARLY17445

It sounds exactly like a pre-paid credit card to me? Something the rest of the world has had for years. Granted the interest on the balance is somewhat unique, but it's not as revolutionary as you're proclaiming it to be!

Seriously? I can't imagine any scenario where this card would make sense.

I'm gonna have to stop reading the blog if these redirects don't stop. It's OOC

Thanks Lucky! I just signed up using your referral link and I posted to Facebook so now I will be earning 2%. With 3 referrals of my own I will earn 3%. Here is my referral link:

https://zerofinancial.com/EARLY17336

Share on facebook for magnesium and only more 3 referrals for carbon.

Here’s my code – https://zerofinancial.com/EARLY17323

Thanks!

While the present this as a novel idea, isn't it simply an evolution of a secured credit card?

FYI, using Check Status you can see your progress towards attaining higher level due to referrals.

Nothing like having another chance to pimp some CC that isn't even attempting to publicize details.

"high interest on deposits" (except we don't tell you what interest rate).

no info on how to reach the 3% via referrals ("level-up" and you may or *may not* be rewarded).

Lucky's advice: "... so you might as well do it..." because, hell, otherwise how would he get his referrals?

Here is a thought Lucky: why not try...

Nothing like having another chance to pimp some CC that isn't even attempting to publicize details.

"high interest on deposits" (except we don't tell you what interest rate).

no info on how to reach the 3% via referrals ("level-up" and you may or *may not* be rewarded).

Lucky's advice: "... so you might as well do it..." because, hell, otherwise how would he get his referrals?

Here is a thought Lucky: why not try to contact them and give us some details as opposed to simply writing a free press release on their behalf and giving us your referral link and a(nother) click bait blog title. This blog has gone so far downhill over the past few years.

Quantity does not mean quality.

They will make money off the top level. They seem to be a bank so they will make money off the deposits.

The best ever cards were the gm card at 5% toward a vehicle and my favorite the recently now defunct Barclay's Travelocity at 4% back.

I would guess they would not care about business spend if you hold a large enough balance.

Everything in this article is accurate except the exclamation point at the end of the headline. Which one of your readers uses a debit card on principle?

I think it's a safe assumption that most of your readers earn 1.5%+ on most transactions, and may average closer to 3-4% given various category bonuses mentioned in your Chase quadfecta.

Please use my code

https://zerofinancial.com/EARLY17249

This is interesting, thanks. Would appreciate anyone who signs up through my link: https://zerofinancial.com/EARLY17181

Not clear if you earn 3% on the $100K you spend to earn the Graphite status too.

And to clarify, I do see on their site that they mention FDIC insured through a member partner bank. Remember, not everything you read on the internet is true. If it seems too good to be true, it just might be.

Main question everyone should be asking is if the deposits in your account are FDIC insured? Getting to 100k in spending means around 10k a month in your account. They go belly up, can you afford to lose 10k?

And mine. .. https://zerofinancial.com/EARLY17119

Thank you

Ok, I'll bite, here's a link to use

https://zerofinancial.com/EARLY17077

Graphite is Carbon, while Carbon doesn't have to be Graphite. I am twisted.

With that been said, this card is not for me. I want elite benefits and easy status.

Here's my code - https://zerofinancial.com/EARLY2084

Thanks

Er... Lol, that should have been 3... 2... 1...

Cue the reports of closed accounts and confiscated rewards in 1... 2... 3...

Otherwise, they'll get crushed by MSers.

Will this be a good card to use abroad? Any ideas what the foreign exchange rates/fees are? Will they charge to use foreign ATMs?

Share on social media to get to magnesium and 3 referrals for carbon.

Here's my code

zerofinancial.com/EARLY16947