It’s pretty common for credit card companies to send out targeted spend bonuses every so often to encourage people to use their cards more often. I’m not talking about credit card sign-up bonuses, but rather bonuses that encourage incremental spend for existing cardmembers.

I get these offers all the time by email, and am frequently conflicted as to whether or not they’re worth taking advantage of. I figured I’d share the latest targeted spend offer I got, along with my thought process in deciding whether or not to take advantage of it.

My targeted JetBlue Plus Card spend offer

I’ve had the JetBlue Plus Card for a bit over a year now, and find it to be a great card. It offers a great welcome bonus, 5,000 points on the account anniversary each year, and a 10% refund on redeemed points. To me that more than justifies the card’s $99 annual fee. However, it’s not a card I put much everyday spend on, given how many other great cards there are, with more compelling category bonuses.

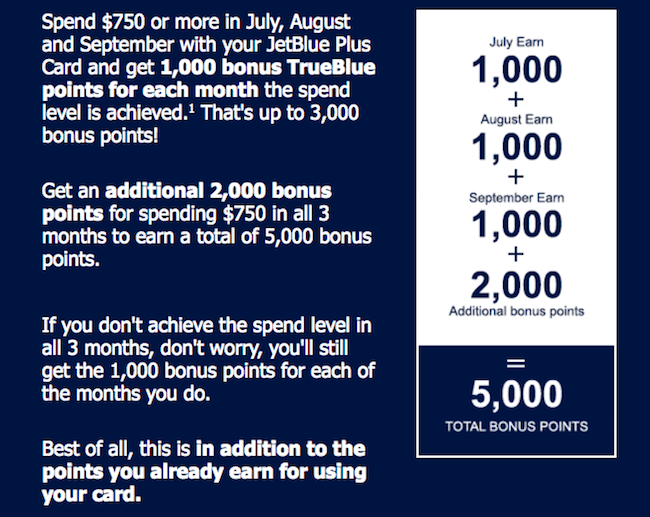

However, I just received a targeted spend bonus on the JetBlue Plus Card, which can earn me up to 5,000 bonus points. As I always do when I receive these offers, I decided to crunch the numbers.

With this offer I can earn 1,000 bonus TrueBlue points for each month (July, August, or September) in which I spend at least $750 on the card. On top of that, I can earn a further 2,000 bonus points if I complete the spend requirement for all three months. That means if I spend $2,250 over the course of three months I’d earn 5,000 bonus TrueBlue points, in addition to the points I’d usually earn for spend.

So, is this offer worth it?

Assuming I spend $2,250 in non-bonused categories distributed evenly over the three months, I’d earn a total of 7,250 TrueBlue points, which is 3.2 TrueBlue points per dollar spent. I value TrueBlue points at ~1.5 cents each, so to me that’s a return of just under 5%. Pretty good, right?

To look at this in terms of the opportunity cost of spend:

- I could be earning 2x Membership Rewards points with The Blue Business® Plus Credit Card from American Express (though that’s capped at $50,000 of spend per calendar year / 1x after that)

- I could earn 1.5x Ultimate Rewards points with the Chase Freedom Unlimited®, since I have the card in conjunction with a card accruing Ultimate Rewards points

I value those points currencies at 1.7 cents each, so to me that’s a return of ~2.5-3.5%. For my personal situation, the JetBlue Plus Card offers an incremental return of 1.5-2.5% on $2,250 of spend.

On the surface that seems worth it, but it doesn’t factor in the effort required to take advantage of this offer. For three months I have to make sure I track my spend closely to get as close to $750 as possible, and it’s something that will often be in the back of my mind. Is it worth doing that for an incremental return of ~$30?

My credit card strategy is complicated enough as is, so that’s why I often avoid these offers. To me it’s just not worth the hassle of complicating my strategy even further just for a (relatively) small incremental gain. Yet at the same time, I’m still tempted, because I hate leaving points on the “table.”

Would you take advantage of this offer? Am I crazy for usually skipping these offers, since I don’t want to complicate my strategy even further?

I generally do take advantage of offers for points I find attractive. For example, I have earned 20,000 bonus AAdvantage miles in the last two years on these type of bonuses with my Barclaycard Aviator Red card. I don't do it for lower-values currencies but some are worth the tracking. I already keep a big spreadsheet to track my cards so a few additional cells is no big deal.

These offers are typical from Barclaycard. I've received a few on the Aviator card. There's one now where if I spend $1000 in Jul/Aug/Sep, I receive 5,000 bonus points. Not worth it in my opinion.

I'm also becoming increasingly annoyed with these offers. They're frequent, but not consistent, and managing the spend is time-consuming. Not to mention the requirement per month is kind of restrictive. And AA miles are becoming less and less attractive.

way to pretend like you're not going to have your mom buy exactly 750 bucks of gift cards.

Have the Aviator 3x$750 offer for 10K. I put the 750 of non bonus spend on here the last 2 months, July to go. It's worth it to me for very little hassle. I'm getting 12,250 points for $2,250 spend which could of been 4500 max with Amex Blue biz.

I also got an Amex bonus offer for 5000 points for any purchases I make over $5,000. I never make purchases that large so doubt I'll take advantage.

I've found that if I take up an offer like this, and complete it, they'll often offer something higher next time. For example, if I completed the same targeted spend you've been offered, I might be offered something like spend $1000 in November, December and January and get 2000 bonus points per month, plus 5000 points if I spend the minimum in each of the three months.

Same deal with the Barclays AA card - $750 a month for three months, 10,000 miles. I wouldn't otherwise be using this or my Citi AA card (too many others with better earning), so this is an incentive for me to top up the AA account. I think there's value in diversification of points, on top of their redemption value, that should be considered.

@Lucky for the average joe .... I think of myself as such ... who has, perhaps 4 or 5 credit cards, this is fairly different. Using myself as an example ... I have 4 Amex cards - Platinum, Delta Platinum, Delta Gold, Blue Biz Plus and I have a Chase Sapphire Reserve.

First, I don't have the tracking complexity that you have. Second, since I am really only putting a couple thousand in spend...

@Lucky for the average joe .... I think of myself as such ... who has, perhaps 4 or 5 credit cards, this is fairly different. Using myself as an example ... I have 4 Amex cards - Platinum, Delta Platinum, Delta Gold, Blue Biz Plus and I have a Chase Sapphire Reserve.

First, I don't have the tracking complexity that you have. Second, since I am really only putting a couple thousand in spend on credit cards every month (except the Blue Biz Plus, where all my business spend goes) ... it's pretty easy to manage that incremental value. I just shift all my spend to that card for 3 months.

It would be more interesting if you evaluated the offer in a way that makes sense to average joe :-)

I enter my transactions manually into Quicken. It's easy to add a running balance in the memo section of each transaction so that you always know exactly how much more spend you need to make.

Nope -- too much work to keep track of the EACH month part. If it were spend $X total, get Y points, it is an offer I would at least consider.

I was traveling overseas a fair bit, and am taking advantage of the AAdvantage Aviator targeted bonus ($750 in May, June, July, 10,000 bonus miles). This card gives me the advantage of no FTF, whereas I've the blue for business which gives me 2.3 points/$ but has 2.7% FTF. So in my case it's worthwhile I guess.

Have a similar issue/offer via AA Platinum Select MasterCard. 3 miles per $1 up to 2,500 miles. Worth it, or stick with CSR?