Links:

- Get $25 for signing up for a SoFi Money account and depositing at least $100

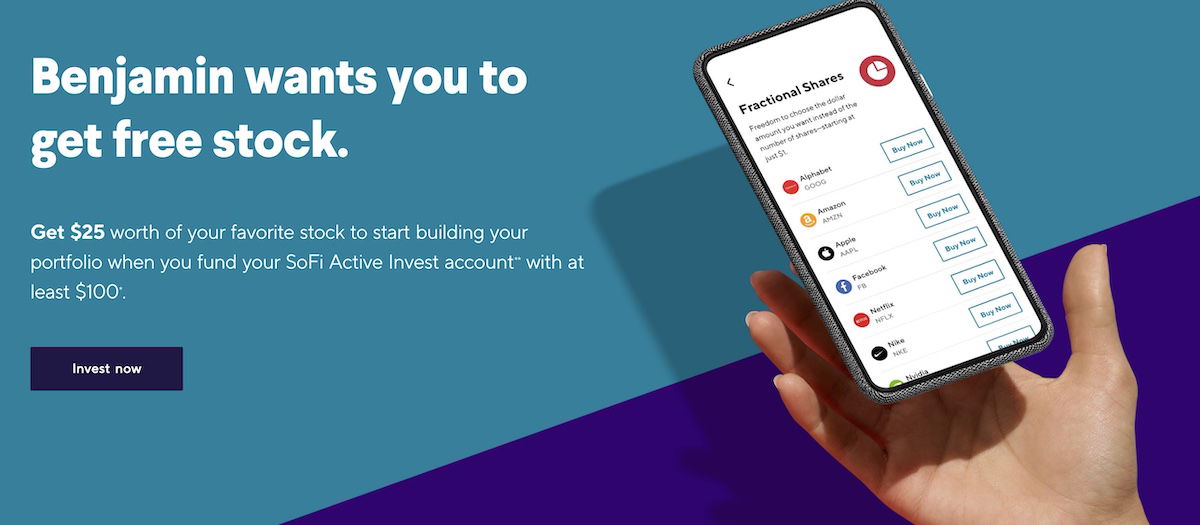

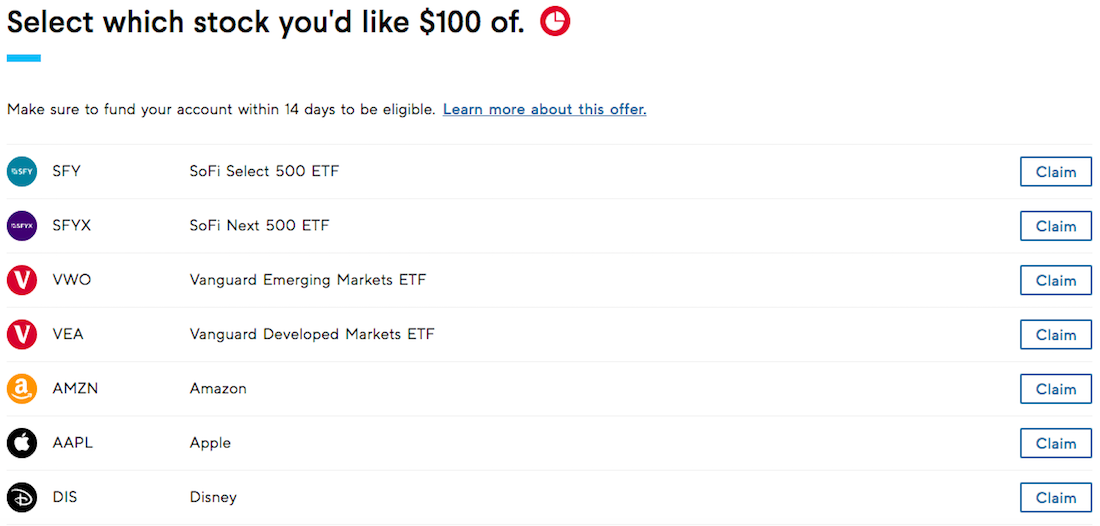

- Get $25 in stocks for signing up for a SoFi Invest account and funding an Active Investing account with $100 or more

I’ve written a few times in the past about SoFi’s generous referral program. Over time the bank has made some changes to the program, including the perks and the bonuses for new members, so I wanted to provide an update for both SoFi Money and SoFi Invest.

The good news is that SoFi Money is offering one of the best account bonuses we’ve seen for new members, so this is something that many people could benefit from. It’s not unusual to see some sort of a bonus when signing up for a checking or savings accounts and completing some activity. However, SoFi has been especially generous.

For those of you not familiar with SoFi, it’s essentially an online personal finance company offering savings accounts, investment opportunities, and more. Here’s what you need to know about how these two SoFi referral bonus opportunities work:

In this post:

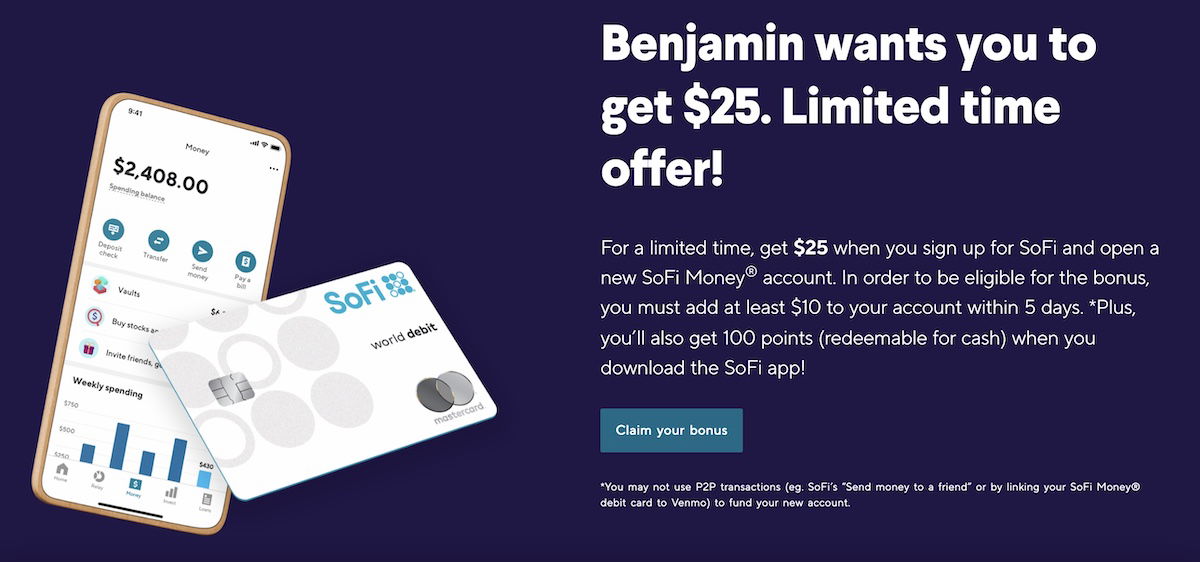

Get $25 with new SoFi Money account

You can earn $25 when you sign up for a SoFi Money account and deposit at least $100 within five days. Once you’re a member, you can also earn a $50 bonus for every friend or family member you refer, who does the same.

As far as the bonuses go:

- Your bonus should post within ten business days of when eligible activity is completed

- To be eligible the person you refer needs to open the account and fund it with $10 within five days

- You can earn up to $10,000 per year for referring people

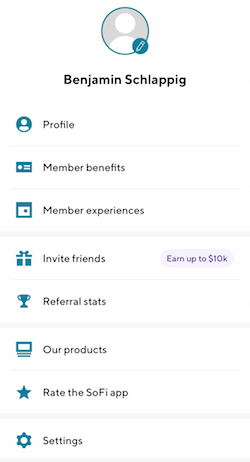

- To find your referral code you’ll need to download SoFi’s app and click on the top left of the page, where you’ll see a link to “Invite friends”

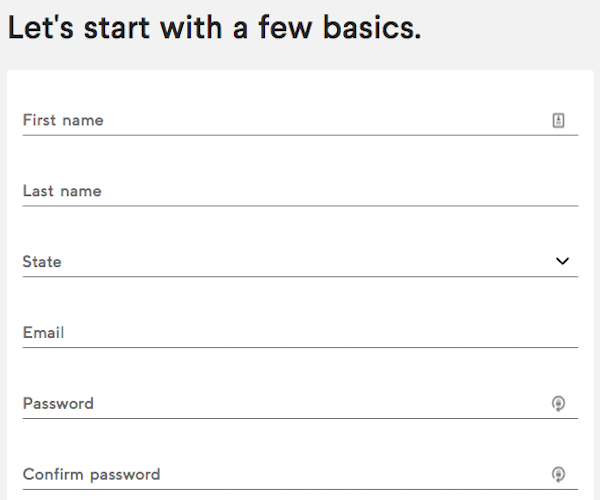

Signing up for a SoFi account is easy

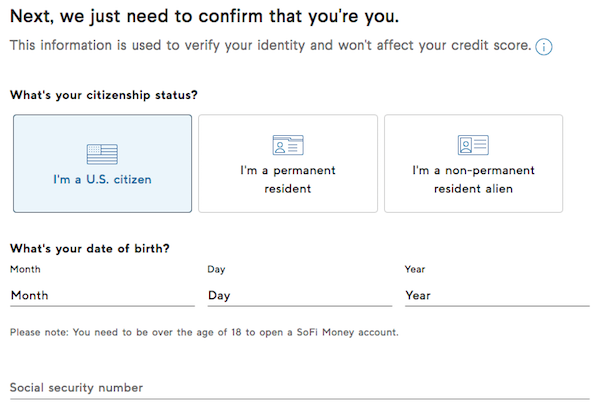

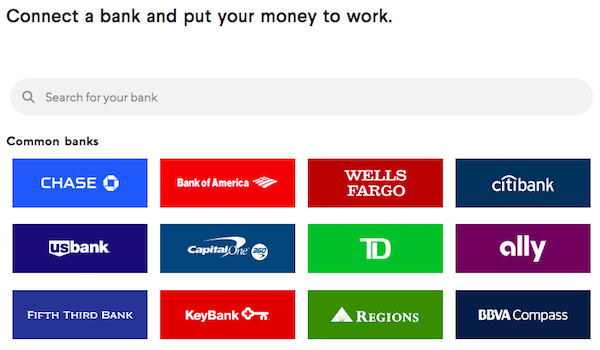

Signing up for a SoFi account couldn’t be easier. It literally took me three minutes. You just have to enter some personal details across a few pages, including your name, SSN, address, and more.

Then you’ll have the option of easily linking your SoFi account to a bank account, so that you can fund the account (or you can do that at a later point if you want).

Benefits of a SoFi Money account

Why would you want to keep a SoFi Money account long term?

- There are no account fees

- You pay no ATM fees at 55,000 locations around the world, so this is great for international travelers

- SoFi consistently has cash back promotions for certain spending categories, which can save you money

For many a SoFi Money account will be well worth leaving open. Getting a no fee account with no ATM fees at so many locations is awesome. On top of that, the SoFi Money debit card is issued as a Mastercard, and that comes with a bunch of additional benefits, including:

- Mastercard Airport Concierge: Available 24/7/365 at over 450 destinations worldwide, cardholders get 15% off personal Meet and Greet agents to escort them through the airport on departure, arrival and/or any connecting flights and expedite them through the security and/or the immigration process (at participating airports).

- Cell phone protection: When you pay your cell phone bill with SoFi Mastercard, receive up to $200 per claim, $25 deductible, up to 2 claims per year. Unlimited lines associated with the cell phone bill.

- Mastercard golf: Provides discounted access to golf courses, complimentary grounds passes for PGA Tournaments, access to domestic and international golf travel packages, and more.

- Additional SoFi member experiences: On top of SoFi member experiences, SoFi Money Mastercard cardholders will have the opportunity to engage in bonus exclusive, once-in-a-lifetime experiences with the people they love in the cities where they live and travel.

- Enhanced security with credit monitoring, alerts for suspicious activity, and white-glove service to help you resolve issues with Mastercard ID Theft Protection

- Purchase Assurance: Provides coverage for most new items purchased with your SoFi Money card that are damaged or stolen within 90 days of the date of purchase, up to $1,000 per claim.

- Extended Warranty: Doubles the original manufacturer’s (or store brand) warranty. Coverage is for eligible items purchased with your Mastercard.

Get $25 with new SoFi Invest account

In addition to the standard SoFi Money account, there’s also SoFi Invest, which is SoFi’s stock trading platform. With this, the person being referred can receive $25 in free stocks when they fund an Active Invest account with at least $100. On top of that, the person being referred can get up to $50 in free stocks, so you can start referring people as soon as you have an account.

The process of signing up for an account is easy, especially if you’ve already set up a SoFi Money account, as most of the information transfers over.

Here you’re not getting cash, but rather you’re getting $25 in stocks both for referring and for being referred. You can choose from a wide array of popular stocks.

Keep in mind that you can always liquidate the stocks after opening your account, if you’d like.

Bottom line

Back in December 2019 it took me about five minutes to set up both a SoFi Money and SoFi Invest account, and to earn the awesome bonuses. While the bonuses have changed over time, they continue to be compelling for many.

The $25 new member bonus for SoFi Money is particularly compelling, given how little you have to put into an account to activate that. Not only that, but there’s long-term value in a SoFi Money account, especially when you look at the benefit of getting a no fee ATM card that you can use globally.

Get $50 signing up for sofi

https://www.sofi.com/invite/money?gcp=f1d53033-98f1-4224-a531-531d2c3a432d

Hey! I'm using SoFi Invest to buy and sell stocks (and pieces of stocks) with zero fees. Open an Active Investing account with $100 or more, and you'll get $25 in stock. I'll get $25 in stock, too! Use my link: https://www.sofi.com/invite/invest?gcp=d5312973-a43b-4967-8f49-275a5192e6b4

Hi! Join me on the SoFi mobile app! You can save, spend, trade and borrow — all in one app. Use my link to sign up and you’ll get $15 cash rewards. https://sofi.app.link/SvyLD8tfFjb

Use my link to sign up and you’ll get 1,000 rewards points ($10)

https://sofi.app.link/rsR3DUQhpib

Feel free to use my link to sign up for SoFi Money and you’ll get a $50 bonus.

https://www.sofi.com/invite/money?gcp=f36d0b72-a2f1-4b28-96f3-2fe56cadce74

Feel free to use my referral link:

https://www.sofi.com/invite/money?gcp=b8ed31f4-2a1c-408b-8962-1423f65d4b22

Hello. Here are my referral links for SoFi Money and SoFi Invest for anyone who is interested. Thank you.

SoFi Money: https://www.sofi.com/invite/money?gcp=a18272e3-4986-4d56-b12c-091673a733a6

SoFi Invest: https://www.sofi.com/share/invest/3165008

Hello, Amber.

SOFI is asking me for full name and email address of person referring.

So far, I have been out of luck.

Referral link

SoFi Money:

https://www.sofi.com/invite/money?gcp=13a8491e-1eff-4aa9-8b70-38a40a0ce7aa

Hello, Nate.

I need your name and email address for SOFI Money referral.

Thanks, Nessie

Feel free to use my links. Thanks in advance!

Also, they sometimes ask for name and email verification before they post the bonus. Reply to this comment with an email address and I’ll get back to you.

Sofi Money: https://www.sofi.com/invite/money?gcp=52168b3b-dbc4-4fcd-a8e7-dc68c3d91aca

Sofi Invest: https://www.sofi.com/share/invest/2938347

Horrible customer service for chargebacks, still haven’t received my money back from my april trips. Sent all documents that flights were cancelled in europe, chase and BoA refunded me my full amount on my cards. SoFi denied them all within a week of filing and I send proof of all my emails and texts from those companies. No refunds or vouchers will be closing my account with them soon.

For accounts opened after June 9th 2020 the benefits aren't as generous. Read the terms and conditions so you won't be disappointed

@lucky this is no longer true. SoFi explicitly states new members DO NOT receive ATM fee waivers internationally or in the USA. It is only AllPoint ATMs now.

I signed up with a referral link last year, and I haven't seen the referral bonus yet. I don't recommend this at all.

To everyone who is saying Ben is being shifty by not publishing all the details etc you do realize it’s, you know, your responsibility to research the details and make sure it works for you.

Fresh referral links

SoFi Money

https://www.sofi.com/invite/money?gcp=154050aa-5a78-4980-9ce5-44191271951e

SoFi Invest

https://www.sofi.com/share/invest/2941820

Hello!

If anyone’s referrals are maxed out, here are some new links!

SoFi Money: https://www.sofi.com/invite/money?gcp=2be2bffc-9846-48fc-90ec-1c1cd2bfd970

SoFi Invest: https://www.sofi.com/share/invest/2881784

Here's my two SoFi referral links!

receive $75 with my SoFi Money referral:

https://www.sofi.com/invite/money?gcp=bc5009cc-e4c6-4b98-a99a-951b08c96aeb

receive $100 with my SoFi Invest referral:

https://www.sofi.com/share/invest/2089890

I think that Ben probably maxed out on his referral link already. As a shameless plug, here is my referral link. Please use it if you are interested in a SoFi Invest account. Thanks! :)

https://www.sofi.com/share/invest/2848510

Hi everyone,

Much of the above links for SoFi Money are either for the old bonus or expired. Here is my link, I would really appreciate it if you could help a low-income student out :)

Sofi Money (you get $75 on making two direct deposits of $500+, I get $25 hah)

https://www.sofi.com/invite/money?gcp=c535d01f-7e8d-4aae-ad9c-d7794e712b87

Thank you very much!

Hello, here are my referrals for Sofi:

Sofi Invest: https://www.sofi.com/share/invest/2679123

Sofi Money: https://www.sofi.com/share/money/2679123

Thank you for using my links!

@nanikore

https://www.sofi.com/invite/money?gcp=b1815f61-c06e-4266-b985-836a41cfdf3a

https://www.sofi.com/share/invest/2810956

Lots of accounts just like SoFi. Nothing new there.

e.g., Scwab, Ally, E-Trade etc. Schwab and Ally both good. Ally has linked savings account with same 1.6% APR interest as SoFi, so if you're concerned about SoFi FDIC protection, use Ally.

Schwab better if you want to do wires - you can do them online; never need to visit a branch. Only time you'd visit a branch is for extremely large checks, but if you...

Lots of accounts just like SoFi. Nothing new there.

e.g., Scwab, Ally, E-Trade etc. Schwab and Ally both good. Ally has linked savings account with same 1.6% APR interest as SoFi, so if you're concerned about SoFi FDIC protection, use Ally.

Schwab better if you want to do wires - you can do them online; never need to visit a branch. Only time you'd visit a branch is for extremely large checks, but if you open an investor account you can deposit in an investment branch (investor account is easy, no monthly fees, no mins etc)

Ally easy all around, with a better interest rate than Schwab.

Both offer no FX fee withdrawls, no ATM fees, free checks, no monthly fees etc.

@nanikore

try this: Thanks!

https://www.sofi.com/invite/money?gcp=1f1080e0-a592-4251-88fc-379838746841

I wanted to sign up for sofi money and it seemed like all the referral link have expired. If any of you have a new referral link, please post it here and I will use it. Win - win :)

I signed up for SoFi money about a month ago and I’m super happy with my experience so far. For someone who travels a lot, the ATM feee reimbursements are really nice. There’s also other products that SoFi offers that are really good such as personal loans and investments.

If you want to sign up and get $25 after funding your money account with $100, feel free to use my referral link: Hi! Get SoFi...

I signed up for SoFi money about a month ago and I’m super happy with my experience so far. For someone who travels a lot, the ATM feee reimbursements are really nice. There’s also other products that SoFi offers that are really good such as personal loans and investments.

If you want to sign up and get $25 after funding your money account with $100, feel free to use my referral link: Hi! Get SoFi Money today. As long as you fund your account with at least $100, you’ll get an extra $25. Then start saving, spending, and earning high interest—all in one product. Use my link: https://www.sofi.com/share/money/1878414/

Just signed up. I was planning to get a Charles Schwab account for ATM withdraw while traveling abroad, but this seems much simpler than needing a 2nd account and and the hard pull from Charles Schwab. Plus, this has a better interest rate too. Though I looked online and it seems there are some horror stories of accounts being frozen for suspicious activity for weeks. So I'm just going to use this as savings account to withdraw money while traveling.

Based on my personal experience with SoFi, don't trust them to pay the bonus they advertise. I signed up and was really liking the interface and what they had to offer, until they wouldn't pay the bonus I signed up under. I can't give them my money if I can't trust them. My recommendation is that you explore some of the other options out there--there are a lot of other online banking and investing options...

Based on my personal experience with SoFi, don't trust them to pay the bonus they advertise. I signed up and was really liking the interface and what they had to offer, until they wouldn't pay the bonus I signed up under. I can't give them my money if I can't trust them. My recommendation is that you explore some of the other options out there--there are a lot of other online banking and investing options available now. SoFi was not a good experience.

***Have come across numerous other people who haven't gotten the bonus either--beware!!!

I would assume that the referral bonus is taxable, which would make this somewhat less rewarding

Ben looks like he just wanted to make a quick buck. He definitely should have disclosed the fine print before making this post.

So I digged a bit deeper. It clearly states only us passport holders or perminant residents qualify. That means people without green card is out??

Also it doesn't say sofi is a bank, so is it really protected by insurance?? It would be great if you write a responsible post since you are making a lot of money out of this...

Some fine print: "we don’t offer multiple bonuses for the same referred friend, even if they sign up for multiple products." So, I think the chances are slim that someone would sign up for the investment account without signing up for the money account. Therefore, you're unlikely going to get the $100 bonus, just the $25 one. So ask your friends to sign up for the investment account first if they want one.

Also: There...

Some fine print: "we don’t offer multiple bonuses for the same referred friend, even if they sign up for multiple products." So, I think the chances are slim that someone would sign up for the investment account without signing up for the money account. Therefore, you're unlikely going to get the $100 bonus, just the $25 one. So ask your friends to sign up for the investment account first if they want one.

Also: There are restrictions on bonuses for "referrer or the referred friend live in Ohio, Michigan, or Vermont."

If more people understood the relative difficulty (and, in many cases, near impossibility) for non-US residents to open an online bank account with a US bank, there would probably have been far fewer comments on this particular post.

I don't bank anywhere I can't pronounce.

How long do you have to leave the money in the accounts?

@ Eskimo -- huh?

Umm, do you all know that all of you are violating their referral t&c.

SoFi isn't cracking down that hard as the other major one yet, but there could be a mass clawback coming.

@ Ken -- duh

why is it posted again about this sofi thing? Is it because Ben makes tons of money for posting this again and again? I thought they had a better offer in the past, so is it not better to wait for a better offer? how about non-us citizens? Previous comments indicate that it excludes non-us citizens? Also, how safe is it this company? Suppose a million people give them their 1000usd for their referrals, what...

why is it posted again about this sofi thing? Is it because Ben makes tons of money for posting this again and again? I thought they had a better offer in the past, so is it not better to wait for a better offer? how about non-us citizens? Previous comments indicate that it excludes non-us citizens? Also, how safe is it this company? Suppose a million people give them their 1000usd for their referrals, what if SOFi bankrupts? Is it under federal protection? Also how good is the service? Everyone is getting lured by the referrals and bloggers keep referring because they can get 25usd from each signup but I don't hear much about their customer service quality etc.

@ Ben -- I'll wait for the bonus to increase again. If not, oh well. I have better things to do with my time.

DO NOT WASTE YOUR TIME TRYING TO OPEN AN ACCOUNT IF YOU HAVE AN OVERSEAS IP ADDRESS. I used Ben's links and opened both accounts using a Mexican IP address. Within minutes I received an email saying the account had been closed because I was not in the US. I called SOFI and explained that this was a stupid policy given that I could have just used a VPN to mask my location and there...

DO NOT WASTE YOUR TIME TRYING TO OPEN AN ACCOUNT IF YOU HAVE AN OVERSEAS IP ADDRESS. I used Ben's links and opened both accounts using a Mexican IP address. Within minutes I received an email saying the account had been closed because I was not in the US. I called SOFI and explained that this was a stupid policy given that I could have just used a VPN to mask my location and there only response was that I was on a recorded line. Thus if you really want this account, use a VPN if you are outside the US; otherwise just avoid. I will just avoid.

Sorry Ben.

Hi everybody, if you use my links I’ll put the bonus money towards great travel experiences in 2020. I’ve been a SoFi Money and Invest me,her for several months now and only have good things to say about it. Although Ben describes their interest rate as not industry leading, that’s not completely true - others that are higher are savings accounts with transaction limits, while this is a full checking account with paper checks, billpay,...

Hi everybody, if you use my links I’ll put the bonus money towards great travel experiences in 2020. I’ve been a SoFi Money and Invest me,her for several months now and only have good things to say about it. Although Ben describes their interest rate as not industry leading, that’s not completely true - others that are higher are savings accounts with transaction limits, while this is a full checking account with paper checks, billpay, atm card, and person to person payments as well. This is the highest interest rate you’ll find for such an account and their fee structure and atm reimbursement are also industry leading.

They also offer personal loans and refinances, including of student loans.

SoFi Money (checking account): https://www.sofi.com/share/money/2650725/

SoFi Invest (stock investing including fractional shares): https://www.sofi.com/share/invest/2650725

SoFi Loan: https://www.sofi.com/share/2650725

@Lucky:

See the "I am a non-permanent resident alien option"?

Select that and, even though SoFi collect v your PII, they tell you to go away as they discriminate against such people and refuse to offer those product to them and refuse to give a reason for doing so.

Please update this article to include this fact.

How easy is it to liquidate the $100 in stocks - in particular what are the fees associated with selling the stock?

Hey everyone - here are my referral links if you'd like to use them. It would be much appreciated!

SoFi Money ($25): https://www.sofi.com/share/money/2798891/

SoFi Invest ($100): https://www.sofi.com/share/invest/2798891

Thanks!

Sorry, this still seems sketchy to me. And I don't want to be hustling friends/family so I can make a few bucks. I'm giving it a hard pass.

It’s a checking account, not a credit card with associated pull.

That being said, the bonus was better earlier on- I got $175 investing considerably less (checking bonus, stock bonus, crypto bonus), I bet a blog with high readership will rake it on referrals, though. Ch-Ching!

Hard pull?

Hi Folks! If Ben ends up maxing out his referrals feel free to use mine! Thank you!

SoFi Money: https://www.sofi.com/share/money/2727194/

SoFi Invest: https://www.sofi.com/share/invest/2727194

So where can I get referrals?

Hi Ben,

I used your link. Somebody use my link please? https://www.sofi.com/share/money/2798587/