Well this is a major disappointment.

Korean Air SkyPass has a great program for using miles for premium cabin awards. They often make 2-4 first class award seats available in advance, fly to more U.S. destinations than any other Asian carrier, and have an excellent first class product.

Korean Air SkyPass also has very reasonable first class redemption rates, generous hold policies, allows stopovers even on one-way tickets, etc. For a bit of context, here are some of their one-way redemption rates:

- North America to Japan, Korea, and China: 80,000 miles

- North America to Southeast Asia: 95,000 miles

- North America to Southwest Asia: 105,000 miles

- North America to Oceania: 120,000 miles

You can also redeem points for many SkyTeam carriers on the SkyPass website, though you can still only book awards for yourself and immediate family members.

Korean Air SkyPass is a Chase Ultimate Rewards transfer partner (meaning that Ultimate Rewards points can be converted to Korean Air at a 1:1 ratio), though there have been…relationship challenges…as of late. Transfers are no longer instant, instead taking several days, which has made things very inconvenient when combined with the changing hold policies at Korean.

Chase Sapphire Preferred® Card

Chase Sapphire Preferred® Card

Chase Sapphire Reserve®

Chase Sapphire Reserve®

Unfortunately, it gets worse.

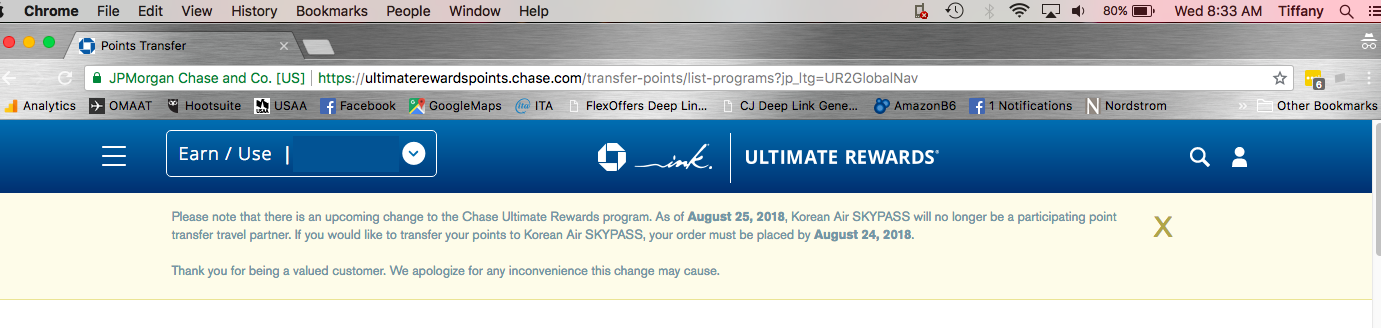

Eagle-eyed reader @ITSmartTours, who is in a future time-zone, alerted us to the fact that Ultimate Rewards transfers to Korean Air SkyPass may be ending entirely, and with very short notice.

Sure enough, if I log into my account, I see all the normal options and messaging (I’m in Arizona at present, and you can see the timestamp):

But once I changed my computer clock to Australia/tomorrow, the following appeared:

In the meantime, if you’ve been considering a Korean Air award, and want to use Ultimate Rewards points for that trip, I would accelerate your timeline.

Dramatically.

Thanks @AdamR and @Ian!

@Rob: The best way to get to Japan via UR is using Virgin Atlantic to fly ANA First Class for 120k R/T. @Lucky has had several posts recently about that use. Pretty simple to find space, go on the United site and search for nonstop first class for both directions then call Virgin. I believe they allow award holds as well.

@Rob:

I'd think the remaining options would be to transfer to and fly with SQ, though that can get costly depending on how you route and I've found SQ availability to be inconsistent and waitlisting causes me anxiety. Or he can transfer to UA and fly either UA, OZ, or NH. At the saver award level, the redemption costs in J aren't too bad and there are more options. I'd avoid UA because, well, they're...

@Rob:

I'd think the remaining options would be to transfer to and fly with SQ, though that can get costly depending on how you route and I've found SQ availability to be inconsistent and waitlisting causes me anxiety. Or he can transfer to UA and fly either UA, OZ, or NH. At the saver award level, the redemption costs in J aren't too bad and there are more options. I'd avoid UA because, well, they're UA and are just terrible comparatively. OZ and NH have much better products from the US. I'm sure others will chime in, too.

oof... I had finally convinced a buddy to stack up his chase points to got to Korea/Japan via Korean Air. I am not sure he will have enough before the transfer deadline. What would be the next best way to get there?

@Adam:

Yes! Seconded 100%. @Jules hit the nail on the head, too. I'm actually super okay with KE leaving because I found their F product to be "meh" compared to other redemptions out there at about the same cost. Subpar lounge/ground experience and hard product aloft was fine, but soft product was only okay. I know I'm pissing on some peoples' parades, but if Chase can make up for it with a partner that's more...

@Adam:

Yes! Seconded 100%. @Jules hit the nail on the head, too. I'm actually super okay with KE leaving because I found their F product to be "meh" compared to other redemptions out there at about the same cost. Subpar lounge/ground experience and hard product aloft was fine, but soft product was only okay. I know I'm pissing on some peoples' parades, but if Chase can make up for it with a partner that's more useful or has a better product, I'm all about it.

Also, great name, bud! :-)

@Adam yes! Chase should add Miles and More. The ability to book Lufthansa First more than two weeks out would be awesome.

If chase would add miles-and-more that would be amaZing

Uggggh....... I’ve been saving for a trip for Japan.

Noooooooooo

Glad I booked that trip to BKK in F a few weeks ago. I guess it was fun while it lasted. But this is a major bummer

@CS, but these blogs make $$$ from referral links from Chase! ;) I find what OMAAT team writes quite entertaining and it's rare to read Aman hotel reviews.

But back to the topic of this article, this is a huge devaluation for me as I used KE for first class skyteam redemptions to Asia. :/

Maybe you guys should stop pushing Chase cards 24/7. They have the least (interesting) range of partners anyway.

I use my chase points purely for KrisFlyer now and frankly, after their devaluation recently that’s kind of a waste too.

Ok I think everyone needs to calm down. Yes the redemption rates for Korean were great and the free stopover was great too but there are still great redemptions such as on Asiana, ANA and one of my favorite and underrated redemptions on EVA Airways. They only have business class but it's as good as a lot of first class on other airlines

Clearly KE got tired of dealing with a bunch of transient FF members transferring points and holding awards galore, despite not being profitable members otherwise. You know their customer service team loathed all the constant requests, even if it was job security. This wouldn't have ended if it was a wonderful, and largely profitable, experience for KE.

And yes, I was holding UR points for a first class KE redemption that was further complicated when...

Clearly KE got tired of dealing with a bunch of transient FF members transferring points and holding awards galore, despite not being profitable members otherwise. You know their customer service team loathed all the constant requests, even if it was job security. This wouldn't have ended if it was a wonderful, and largely profitable, experience for KE.

And yes, I was holding UR points for a first class KE redemption that was further complicated when availability vanished into thin air earlier this year.

I think they will pull SQ next. Chase is bleeding money right now because of these redemption partners.

This ruins the whole value proposition of the CSR for me. For UR it was always Korean and Hyatt awards.

I wish this was a glitch but glitches don’t produce detailed messages with cutoff dates

@Ian Asiana? Korean is my go to partner as well along with UA. But, Asiana would more than make up for it for me.

Since it’s been confirmed now, what are people going to do? Should I move 375k UR over to Korean for 3 biz class round trip tickets (that’s how many I need for N. America to Seoul, Japan, and Hong Kong?). My vacations plans are already set for this year so I won’t even use it until 2019 at the earliest.

@Jo who would be at the level of Korean though? Maybe, Etihad, or Emirates? This just stinks. They made a statement recently that intimated they would be adding a new transfer partner to make up for Ritz and Marriott merging into one. At this point though I’d be happier for bonus transfer offers like Citi or Amex than another partner I’d never use.

Wasn't it reported recently that Chase was looking to add transfer partners? It better be a good one to make up for this blow.

TPG confirmed KR partnership is ending.

Damn, I've got orphaned points there for a Japan trip I booked two years ago then had to cancel. I think rates have gone up slightly since then. I better make sure I have enough for a J redemption to Asia before the deadline.

Ouch, huge devaluation for Chase if true!

No! I don't want to speculatively transfer right now, but this was my go to transfer partner. It's actually the only thing I ever used Chase UR for. I may need to reconsider my CSR.

Now I’m hoping that Citi adds them (along with Aadvantage or JL mileage bank) as a transfer partner

What?!? This is very bad news if it’s permanent. I had planned on using UR for a couple of tickets on Korean First. I’m really hoping it’s just glitch.

Ah I really hope it’s just a glitch. Please let us know once KE confirms it. This would definitely devalue UR points for me.

I REALLY hope this isn't true.

Oh, man! I might have to move some points over quickly; hope this isn't a trend!

This website (and websites like it) probably bear part of the responsibility . . .