Link: Apply now for the Instacart Mastercard®

Chase recently launched the Instacart Mastercard®, which is an intriguing no annual fee card from the grocery delivery service. While I don’t think it’s for everyone, it’s at least worth being aware of. Let’s cover some of the important details of the card.

In this post:

Instacart Mastercard no annual fee

Let’s start with a huge positive of the Instacart Mastercard, which is that it has no annual fee. That’ll be a big draw for many, since you can’t beat picking up a no annual fee card, assuming the card adds value to your portfolio.

Instacart Mastercard welcome bonus

The Instacart Mastercard has a decent welcome bonus when you consider that there’s no spending requirement to earn it, but rather it’s awarded upon approval. You can receive:

- A $100 Instacart credit

- A free year of Instacart+ membership, which will auto-renew into an annual membership of $99 per year after the first year (though you can cancel at anytime)

With Instacart+, you get waived delivery fees on most orders of over $35, and you also get lower service fees. If you order groceries through Instacart frequently, then getting a membership is a no-brainer. Note that select other Chase cards are also offering an Instacart+ membership.

That’s a decent bonus for a no annual fee card. However, keep in mind that this is a Chase card, and standard application rules apply, including the 5/24 rule. There are other Chase cards with much more generous bonuses.

Instacart Mastercard rewards structure

The Instacart Mastercard is a cash back credit card, with the following rewards structure:

- Earn 5% cash back on Instacart.com and Instacart app purchases

- Earn 5% cash back on travel purchased through the Chase Travel Portal, including flights, hotels, and more

- Earn 2% cash back on restaurants, gas stations, and select streaming services

- Earn 1% cash back on all other purchases

The card also has no foreign transaction fees, making it a great card for purchases abroad. Note that this is a “true” cash back card, which is to say that you can redeem your rewards for a direct deposit or statement credit with no minimum to redeem.

The way I view the rewards structure:

- 5% cash back on Instacart purchases is the primary reason you’d want to consider this card, if you’re a frequent Instacart customer

- The 5% cash back on travel purchased through the Chase Travel Portal is pretty restrictive, and for that matter the Chase Freedom Unlimited® (review) offers the same rewards on those purchases, also has no annual fee, and is a more well-rounded card

- While it’s nice that there are bonus categories on restaurants and gas stations, there are other cards that are more rewarding in both of these categories

- 1% cash back on everyday spending isn’t competitive, as there are much better cards for everyday spending

Is the Instacart Mastercard worth it?

It’s always cool to see new co-branded credit cards launch, though personally I have a hard time getting excited about the Instacart Mastercard. On the plus side, the card has no annual fee and no foreign transaction fees, has a pretty decent welcome bonus (with no spending requirement), and could be rewarding for those who spend a lot with Instacart, given the 5% cash back.

At the same time, I feel like there are some missed opportunities there in terms of making this a well-rounded card that people will want to spend a lot on. How about throwing in an Instacart+ membership on an ongoing basis if you spend a certain amount every year? How about offering elevated rewards if you redeem for Instacart?

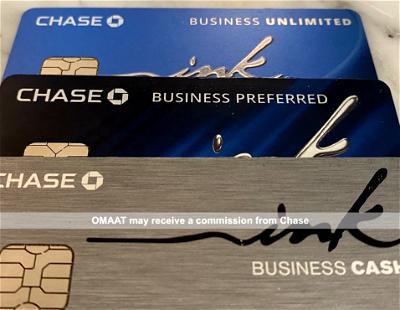

I think the other major consideration is that this is a Chase card, and Chase has so many incredible cards that I’d rather apply for, in terms of the perks, welcome bonuses, return on spending, etc. For personal cards that could range from the no annual fee Chase Freedom FlexSM Credit Card (review) to the $95 annual fee Chase Sapphire Preferred® Card (review). For business cards that could range from the no annual fee Ink Business Unlimited® Credit Card (review) to the $95 annual fee Ink Business Preferred® Credit Card (review).

Bottom line

The Instacart Mastercard has been launched. The no annual fee card offers a welcome bonus upon approval, and offers 5% cash back with Instacart. Furthermore, the card has no foreign transaction fees.

I could see this card making sense for some consumers, but I think there are more well-rounded cards out there, and I wouldn’t use up a valuable Chase credit card “slot” for this.

What’s your take on the new Instacart Mastercard?

Never heard of Instacart

Having dealt with instacart and their shenanigans I would not trust one word they write. On my first order they somehow charged me for a case of bounty that was not delivered. Their internal policy is to be suspicious of the most costly item missing claims. It took too many phone calls and video review till I got my credit.

Credit is where they take advantage. After one botched order they gave me one...

Having dealt with instacart and their shenanigans I would not trust one word they write. On my first order they somehow charged me for a case of bounty that was not delivered. Their internal policy is to be suspicious of the most costly item missing claims. It took too many phone calls and video review till I got my credit.

Credit is where they take advantage. After one botched order they gave me one free shipping, good for 3 months. This was patently useless on my Instacart+ account that included free shipping, lol.

How on earth did they miss the easy layup with calling it Instacar(d)?

Ironically people who wishes to get 5% back probably don't care about 2% on restaurants or gas stations.

If you have time or mobility to eat out or drive, most likely you shouldn't be using Instacart.

“ If you have time or mobility to eat out or drive, most likely you shouldn't be using Instacart.”

What?

Instacart is for people who don’t want to waste their time in grocery (and other) local stores.

I use Instacart about once a week, usually for a medium-sized order, but I also have restaurant meals at least 4 or 5 times a week--sometimes in person (usually weekends), sometimes takeout, sometimes delivery. It's not a matter of mobility but a time saver. It would take around 1.5 to 2 hrs to drive to my preferred grocery store, shop for all the items I want, check out, load car, and drive back. That same...

I use Instacart about once a week, usually for a medium-sized order, but I also have restaurant meals at least 4 or 5 times a week--sometimes in person (usually weekends), sometimes takeout, sometimes delivery. It's not a matter of mobility but a time saver. It would take around 1.5 to 2 hrs to drive to my preferred grocery store, shop for all the items I want, check out, load car, and drive back. That same grocery has same as in-store pricing on Instacart, so I'm paying around $20 in tip and small delivery fee to save close to 2 hours per week. That's completely worth it. Moreover, if I had to go to the grocery in person, my only available times are in relatively busy periods (e.g., weekend afternoons or weekday early evening), when grocery stores are most crowded, but with Instacart I can arrange for delivery at a time I could not otherwise go in person.

Nevertheless, I would not consider this card, especially as it takes up at 5/24 slot. There are plenty of other ways to get 5% on groceries or close to it, and since this card doesn't even include an Instacart+ subscription--which they practically give away on occasions--I don't find it a compelling card.

Also, for people who have had surgery or are disabled and cannot get out.

The link to apply for the card doesnt work. I wonder why.

Link doesn't go anywhere after login....

https://www.instacart.com/cobrand/chase/complete?status=empty_url

It seems like if you use Instacart, and otherwise pay for an instacart plus membership, this card is a non brainer assuming you don't have plans to open up 5 other cards within 24 months.

Exactly.

It’s effectively the same card as the Amazon Prime Rewards VISA for Amazon purchases (of course with more limited uses) which we have just for Amazon purchases.

If you’re a big Instacart user, it’s a no brainer.