While Priority Pass mostly consists of airport lounges, the company also has dozens of restaurants that are part of the network. Over the years we’ve seen many restaurants added and removed, so I wanted to provide a consolidated, updated look at which restaurants participate in Priority Pass, as well as how this whole concept works.

In this post:

What is Priority Pass?

Priority Pass is the world’s largest network of independent airport lounges, with over 1,300 lounges around the world. Priority Pass isn’t directly affiliated with any airline, and a majority of the company’s member lounges are independent, and not run by airlines (though there are exceptions).

In general, there are two ways to get a Priority Pass membership. You can either buy a membership directly, or you can often get a membership through a premium credit card. In the United States, a vast majority of people get a membership through the latter method. As I’ll explain below, how you attain your membership could impact the benefits associated with it.

Which credit cards offer a Priority Pass membership?

In the United States, the following are some of the most popular credit cards to come with Priority Pass memberships, along with their guesting privileges:

Capital One Venture X Rewards Credit Card

Capital One Venture X Rewards Credit Card

The Platinum Card® from American Express

The Platinum Card® from American Express

The Business Platinum Card® from American Express

The Business Platinum Card® from American Express

Note that while all of those cards offer Priority Pass memberships, all Priority Pass cards issued through American Express, as well as Priority Pass memberships issued through personal Capital One cards, don’t offer credits for restaurants or other non-lounge Priority Pass experiences.

Why would these card issuers be excluded? My guess is that they want to control costs associated with this benefit, and eliminating restaurant privileges is an easy way to do that.

For Priority Pass restaurant credits, the Chase Sapphire Reserve® (review) and Capital One Venture X Business (review) (Rates & Fees) are be the all-around best options.

What are Priority Pass restaurants?

A vast majority of Priority Pass locations are actual airport lounges, which feature plenty of seating, complimentary snacks and drinks, and sometimes showers.

However, in some cases Priority Pass has a hard time striking deals with airport lounges. This is especially true in terminals that are largely occupied by one of the “big three” US airlines.

American, Delta, and United all don’t allow any of their lounges to participate in Priority Pass (since they view Priority Pass as competition to their own lounge memberships).

In these cases, Priority Pass has gotten creative, and the company has partnered with some restaurants. The intention is that Priority Pass ordinarily pays lounges a certain amount for every guest who visits, so instead, Priority Pass pays restaurants a certain amount for every guest who visits, and then guests receive credit for some amount that they can spend at that restaurant.

As a general rule of thumb, restaurants are reimbursed about ~80-90% of the credit amount, so if you get a $28 credit you can expect the restaurant is getting about $23 of that (the restaurants are giving the discount due to the volume of business they’re getting from this).

Which US airport restaurants participate in Priority Pass?

As of now, there are well over two dozen airport restaurants in the United States that participate in Priority Pass. Here’s a chart showing the current restaurants, sorted by airport code:

Restaurant | Airport | Terminal / Location |

|---|---|---|

ATL – Atlanta, GA | Concourse B – food court area | |

BOS – Boston, MA | Terminal C – Airside – near Gate C25 | |

BOS – Boston, MA | Terminal B – Airside – opposite Gate B24 | |

BOS – Boston, MA | Terminal E – Airside – opposite Gate E7 | |

BNA – Nashville, TN | Concourse C – between Gates C15 and C17 | |

BWI – Baltimore, MD | Concourse C – between Gates C6 and C8 | |

CLE – Cleveland, OH | Concourse C – Airside – between Gates C4 and C6 | |

DCA – Washington, DC | Terminal C – Airside – near Gates 35-45 | |

DCA – Washington, DC | Terminal B – Airside – opposite Gate 12 | |

DEN – Denver, CO | Terminal A – Airside – near Gate 39 | |

DEN – Denver, CO | Concourse B Airside – after Gate 79 on Level 2B, next to Starbucks | |

DFW – Dallas, TX | Terminal E Airside – near Gate 5 | |

DTW – Detroit, MI | Evans Terminal Airside – near Gate D23 | |

FLL – Fort Lauderdale, FL | Concourse G – Airside – near Gate G6 | |

IAD – Dulles, VA | Concourse C – Airside – near Gate C14 | |

IAH – Houston, TX | Terminal A – Airside – near Gate A17 | |

IAH – Houston, TX | Terminal C – Airside – near Gate C42 | |

IND – Indianapolis, IN | Concourse B – Airside – near Gate B17 | |

JFK – New York, NY | Terminal 8 – Airside – opposite Gate 14 | |

LIT – Little Rock, AR | Airside – near Gate 6 | |

MIA – Miami, FL | Concourse D – Airside – between Gates D23 and D24 | |

MSP – Minneapolis, MN | Terminal 1 – Airside – between Concourses D & E | |

PDX – Portland, OR | Airside – Concourse C immediately after Security on the left-hand side | |

PDX – Portland, OR | Airside – Concourse D immediately after Security | |

PDX – Portland, OR | Airside – Concourse C near Gate C6 | |

PVD – Providence, RI | Airside | |

SEA – Seattle, WA | Airside – North Satellite | |

SEA – Seattle, WA | Airside – Central Terminal | |

SEA – Seattle, WA | Airside – Concourse C near gate C10 | |

SFO – San Francisco, CA | Terminal 2 – Airside – after Security | |

SFO – San Francisco, CA | Terminal 3 – Airside – Concourse F, near Gate F13 | |

SFO – San Francisco, CA | Terminal 3 – Airside – Concourse F, near Gate F4 | |

SFO – San Francisco, CA | International Terminal near Gate G3 | |

STL – St Louis, MO | Terminal 2 – Airside – Upper level, opposite Gate E6 | |

SYR – Syracuse, NY | North Concourse B – Airside – Airside Connector | |

TPA – Tampa, FL | Concourse F Airside – by Gate F85 | |

TUS – Tuscon, AZ | Landside – 2nd Floor, opposite the ‘Arroyo Trading Post’ |

What international airport restaurants participate in Priority Pass?

You can use your Priority Pass membership outside the United States as well, though I usually prefer a premium international lounge to a restaurant on those itineraries. Here’s the current list of airport restaurants outside the US that accept Priority Pass:

Restaurant | Airport | Terminal / Location |

|---|---|---|

BER – Berlin, Germany | Terminal 1 Airside – Level E1, near Gate 20. Schengen flights only | |

BNE – Brisbane, Australia | Domestic Terminal (Qantas Satellite) – Airside – Near Gates 16 and 21 | |

BNE – Brisbane, Australia | Domestic Terminal – Airside – Opposite Gate 40 (domestic flights only) | |

BNE – Brisbane, Australia | International Terminal – Landside – Food court | |

CBR – Canberra, Australia | Main Terminal – Airside – After security check | |

CBR – Canberra, Australia | Main Terminal – Airside – After security check | |

CJB – Coimbatore, India | Main Terminal – Airside of domestic departures – After security check | |

GRU – São Paulo, Brazil | Terminal 3 – Airside – Near Gates 301 to 304 (international flights only) | |

GRU – São Paulo, Brazil | Terminal 3 – Airside – After passport control in the transit area (international flights departing from Terminal 2 and 3 or in-transit passengers only) | |

HKG – Hong Kong | Terminal 1 – Airside – International Departures. East Hall, Level 7 in the Food Court Area | |

KIX – Osaka, Japan | Terminal 1 – Airside – Restaurant area | |

KIX – Osaka, Japan | Terminal 1 – Airside – Restaurant area | |

LGW – London, United Kingdom | South Terminal – Airside – One level up from shopping concourse | |

LHR – London, United Kingdom | Terminal 2 – Airside – after Passport Control, near Gates A20 – A21. | |

LHR – London, United Kingdom | Terminal 3 Landside – next to Pret, floor above Virgin Check-in | |

LHR – London, United Kingdom | Terminal 5 Landside – next to the South Security Checks | |

LTN – London, United Kingdom | Airside – after Duty Free on the right hand side | |

LIM – Lima, Peru | Airside – after Passport Control, near Gate 24 | |

LIM – Lima, Peru | Airside – after Passport Control, near Gate 24 | |

MEL – Melbourne, Australia | Terminal 2 – Airside – Opposite Gate 4 (international flights only) | |

MEL – Melbourne, Australia | Terminal 2 – Airside – Near luxury retail area | |

MEL – Melbourne, Australia | Terminal 2 – Airside – Opposite Gates 10 and 15 (international flights only) | |

NGO – Nagoya, Japan | Near Terminal 2 – Landside – In “Flight of Dreams” building | |

NGO – Nagoya, Japan | Terminal 1 – Airside – Near Gate 19 | |

OOL – Gold Coast, Australia | Main Terminal – Airside – Near Gate 38 | |

PNH – Phnom Penh, Cambodia | International Terminal – Airside – Near Gate 7 | |

PPT – Papeete, French Polynesia | International Terminal – Landside – Food court | |

SIN – Singapore | Terminal 2 – Landside – Level 3 | |

SIN – Singapore | Terminal 4 – Airside – Level 2 | |

SIN – Singapore | Terminal 1 – Airside – Past immigration | |

SIN – Singapore | Terminal 2 – Airside – Past immigration | |

SYD – Sydney, Australia | Terminal 1 – Airside – Near Gate 10 (international flights only) | |

SYD – Sydney, Australia | Terminal 1 – Landside – Food court | |

SYD – Sydney, Australia | Terminal 1 – Landside – Food court | |

SYD – Sydney, Australia | Terminal 1 – Airside – Near Gate 56 (international flights only) | |

SYD – Sydney, Australia | Terminal 2 – Airside – Food court (domestic flights only) | |

SYD – Sydney, Australia | Terminal 2 – Airside – Near Gate 32 (domestic flights only) | |

SYD – Sydney, Australia | Terminal 3 – Airside – Near Gate 3 (domestic flights only) | |

SYD – Sydney, Australia | Terminal 3 – Airside – Food court | |

TPE – Taipei, Taiwan | Terminal 1 – Airside – Near Gate A8 | |

TPE – Taipei, Taiwan | Terminal 1 – Airside – Near Gate B5 |

How much credit do you get at Priority Pass restaurants?

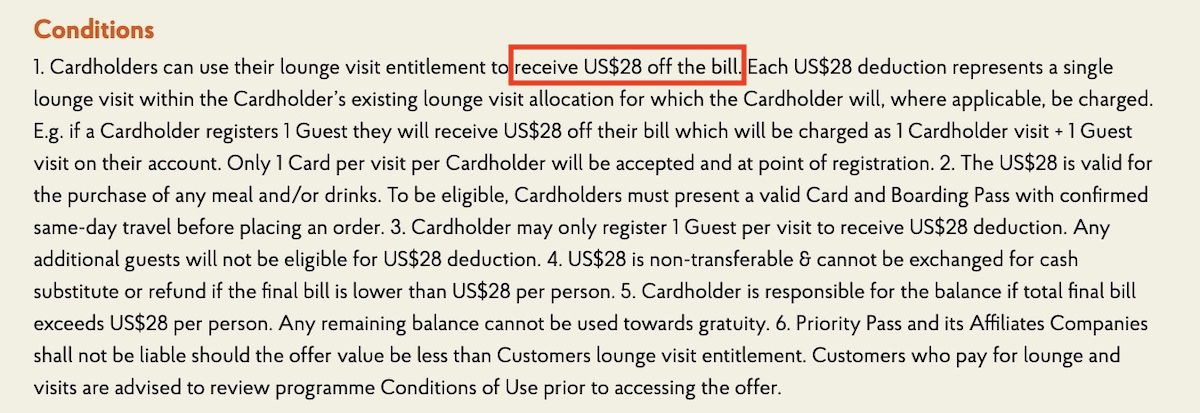

When you visit Priority Pass restaurants you get a certain dollar credit. A vast majority of Priority Pass restaurants offer you a $28 credit per person, while a couple of restaurants give you a $30 credit. You’ll want to check the restaurant you plan on visiting on the Priority Pass website to see the exact terms.

Note that the credit is per person, so if you have a Priority Pass membership that allows guesting privileges and offers credits at Priority Pass restaurants, you can multiply the credit by how many guests you have (just let the person swiping your card know how many guests you have).

If you’re traveling alone you’re limited to the credit for one person, so you can’t use multiple credits for yourself.

Priority Pass restaurant menus

Below you will find a list of the menus for each restaurant that participates in Priority Pass.

- Jerry Remy’s Sports Bar & Grill Menu

- Stephanie’s Menu

- Bar Symon Menu

- American Tap Room Menu

- Bracket Room Menu

- Chef Geoff’s Menu

- Cadillac Mexican Kitchen & Tequila Bar Menu

- Landry’s Seafood Menu

- The Fan Zone Menu

- Bobby Van’s Steakhouse Menu

- Point The Way Cafe Menu

- Rock & Brews Menu

- Kentucky Ale Taproom Menu

- Corona Beach House Menu

- Capers Cafe Le Bar Menu

- Westward Whiskey Menu

- Bambuza Menu

- Trail Head BBQ Bar Menu

- San Francisco Giant’s Clubhouse Menu

- Yankee Pier Menu

- The Pasta House Menu

- The Pasta House and Schlafly Beer Menu

- Johnny Rockets Menu

- The Café by Mise en Place Menu

- Noble Hops Menu

- Chili’s Menu

How many guests can you bring into Priority Pass restaurants?

There are two factors that determine for how many guests receive credit at a Priority Pass restaurant:

- Your specific membership only allows a certain number of complimentary guests (for most US issued credit cards, that number is two guests, not including the cardholder)

- Some Priority Pass restaurants have specific restrictions about how many guests you can bring in; for many US Priority Pass restaurants you’re limited to one or two guests

US Priority Pass restaurants are pretty evenly split when it comes to their rules for guests, so check the Priority Pass website for the specific location to see how many guests you can bring.

Can you use your Priority Pass restaurant on arrival or only on departure?

All US Priority Pass restaurants require you to show a boarding pass for confirmed same-day travel. Some restaurants require that you have an outbound boarding pass (meaning that you’re there before your flight), while other restaurants don’t have such a requirement.

You can visit many Priority Pass restaurants even upon arrival of your flight. Just check the terms on Priority Pass’ website for each restaurant.

Can you visit multiple Priority Pass restaurants at the same airport?

Generally speaking, yes. There are some airports that have multiple Priority Pass restaurants, and in those cases, you can also visit multiple lounges.

When should you present your card at Priority Pass restaurants?

The etiquette for this varies by restaurant. Some restaurants swipe your card upfront, while others only charge it upon the conclusion of the meal.

My strategy is to just ask the host when I’m seated if they need my card then or only want it later. I find that most locations just swipe your card at the end of the meal, though some swipe it at the beginning.

For those that swipe it at the end, when it comes time for the check, just let your server know that you’ll be paying with Priority Pass.

They should then bring over a machine where they’ll swipe your card, you’ll sign, and then you’ll be given a receipt (if you want it).

If you charge more than the Priority Pass credit amount then you’ll be brought a bill for the balance.

Should you tip when eating at a Priority Pass restaurant?

Priority Pass acts as a form of payment when dining at a Priority Pass restaurant, so it’s no different than a gift card, for example. Personally, I’d recommend tipping on the full amount just as you would if usually dining at an airport restaurant.

I’d note that the one exception to this is Corona Beach House at Miami Airport. That restaurant automatically builds in an 18% gratuity, so there’s no need to tip beyond that.

I’d love to see more restaurants adopt this policy, but I wouldn’t count on it happening. In the meantime, I certainly don’t want servers to lose out because of what’s a very generous benefit.

I always make sure I can tip in cash, because if I stay under the credit amount they sometimes can’t run credit card transactions just for tips (though if you go over your credit amount then you can just add your tip to the card you use to pay for the overage).

Are there other Priority Pass restaurant restrictions?

You’ll want to check the exact terms on each Priority Pass restaurant’s site, but as a general rule of thumb the credit isn’t valid for delivery orders, or orders through the “grab & go” feature, if a restaurant has it.

Some Priority Pass restaurants also prevent you from taking any leftovers with you.

Bottom line

Priority Pass restaurants are an awesome feature for terminals and airports that don’t otherwise have Priority Pass lounges (and heck, even those that do). And heck, they’re also an awesome feature for airports that do have traditional lounges, because you can “hop” between Priority Pass locations if you have time.

While the food served at Priority Pass restaurants isn’t typically gourmet, it does compare favorably to what you’ll usually otherwise be served on a plane.

So if you’re a Priority Pass member eligible for this perk, make sure you keep an eye out on for any restaurant locations the next time you’re passing through an airport.

If you’ve used Priority Pass restaurants, what was your experience like? Do you have any other questions?

The following links will direct you to the rates and fees for mentioned American Express Cards. These include: The Business Platinum® Card from American Express (Rates & Fees), and The Platinum Card® from American Express (Rates & Fees).

Automatically adding tips to bills is the absolute worst. Pay acceptable salaries rather than expecting customers to pay for it.

The list is misaligned thus the restaurants are associated with the wrong airport.

Looks to be a mobile browser compatibility since it's correct on desktop

How current is this list? seems some are incorrect; also lacking in lots of hot airports!

Outdated badly. Some bloggers use a system that automatically updates the publication date on old articles and presents them as new. It's a way to get people to click and view.

Can you please update to clarify that some Capital One cards still provide Priority Pass restaurants? I have the new "Venture X Business" card and this *does* come with the restaurant benefit. I confirmed this again today by logging into to my Venture X Business Priority Pass account and the restaurants and experiences show up; whereas if I log in to my consumer "Venture X" Priority Pass account the restaurants do not appear.

When...

Can you please update to clarify that some Capital One cards still provide Priority Pass restaurants? I have the new "Venture X Business" card and this *does* come with the restaurant benefit. I confirmed this again today by logging into to my Venture X Business Priority Pass account and the restaurants and experiences show up; whereas if I log in to my consumer "Venture X" Priority Pass account the restaurants do not appear.

When I received my new "Venture X Business" card last month, even Priority Pass itself thought that restaurant benefits would not apply to this. However, they were surprised when I created my account and this appeared. It confirmed the benefit recently at the Denver PP restaurants. Unfortunately, the "Venture X Business" PP benefits are very opaque.

I'm confused about Citi Prestige. They were a part of the restaurant access at one time. And several travel bloggers still have it as a benefit in their articles. But can't really find out anything about it with Citi itself.

It is really a nice resource to have all of these restaurants listed in one place! For one, it helps with deciding whether a card like the Chase Sapphire Reserve is worthwhile given it has access to these restaurants, but other Priority Pass granting credit cards (e.g. Amex Platinum, Capital One Venture X) do not.

That said, it seems to be missing some restaurants, e.g. this one in Canberra - https://www.prioritypass.com/lounges/australia/canberra/cbr2d-noodles-xo

(On that note,...

It is really a nice resource to have all of these restaurants listed in one place! For one, it helps with deciding whether a card like the Chase Sapphire Reserve is worthwhile given it has access to these restaurants, but other Priority Pass granting credit cards (e.g. Amex Platinum, Capital One Venture X) do not.

That said, it seems to be missing some restaurants, e.g. this one in Canberra - https://www.prioritypass.com/lounges/australia/canberra/cbr2d-noodles-xo

(On that note, given how small Canberra airport is, the three restaurants are all within 5 minutes walk of each other!)

Amex platinum business card has eliminated guest access.

Does anyone know if the restaurant benefit is still included in the Citi Prestige card? Citibank was unable to answer that question.

Yes, used my Priority Pass from my Prestige card at a few restaurants recently with no issues.

Time to update, from the PP website for both locations in EZE: PLEASE NOTE THE OUTBACK STEAKHOUSE WILL NO LONGER BE PART OF THE PROGRAMME EFFECTIVE 05AUG23.