I don’t talk much about Hungarian ultra low cost carrier Wizz Air, which has expanded massively in recent years, and for a long time, seemed unstoppable. Several years back, the airline launched a Wizz Air Abu Dhabi subsidiary, marking its first base in the Middle East.

There’s now an interesting update, as the company will be fully shutting down this subsidiary, for some interesting reasons…

In this post:

Wizz Air Abu Dhabi ceasing operations very soon

Wizz Air Abu Dhabi will be ceasing operations as of September 2025. For context, Wizz Air has 12 Airbus A321s based at Abu Dhabi’s Zayed International Airport (AUH), which have served roughly 30 destinations in the region, including in the Middle East, Africa, Central Asia, Europe, etc. This currently makes up around 5% of Wizz Air’s overall network.

Wizz CEO József Váradi claims the company will instead be focusing on its “bread and butter” of central and eastern Europe, claiming “we have been underinvesting in this market over the last few years,” and that “now we can go back to the full spirit of continuously exploiting the market.”

The Abu Dhabi subsidiary was launched in partnership with the Abu Dhabi Developmental Holding Company, meaning it was essentially a joint venture between the government and the airline. What made little sense to me about this is that Wizz Air Abu Dhabi launched shortly after Air Arabia Abu Dhabi, operating with a similar model, as a joint venture between Air Arabia and Etihad.

Abu Dhabi isn’t that big of an origin and destination market, so it seemed odd to suddenly launch two ultra low cost carriers at the airport, especially if the goal isn’t simply to transport foreign workers to and from the city.

So, why is Wizz Air Abu Dhabi ceasing operations? The operation reportedly wasn’t profitable from the beginning, and three reasons are being cited for this decision:

- The carrier’s ultra low cost carrier business model was struggling to work in Abu Dhabi, because engines were degrading faster due to the hot, harsh environment, making operations less efficient

- Wizz Air had not been granted the market access it had been promised to India and Pakistan, when it first decided to open Abu Dhabi, limiting the growth potential

- Recent tensions and airspace closures in the region have made the prospect of profitability even worse, making Wizz Air cut its losses and move on

Wizz Air has been losing steam in recent years

Going back a few years, Wizz Air was one of the most promising and profitable ultra low cost carriers, and it seemed to increasingly be getting into Ryanair’s league.

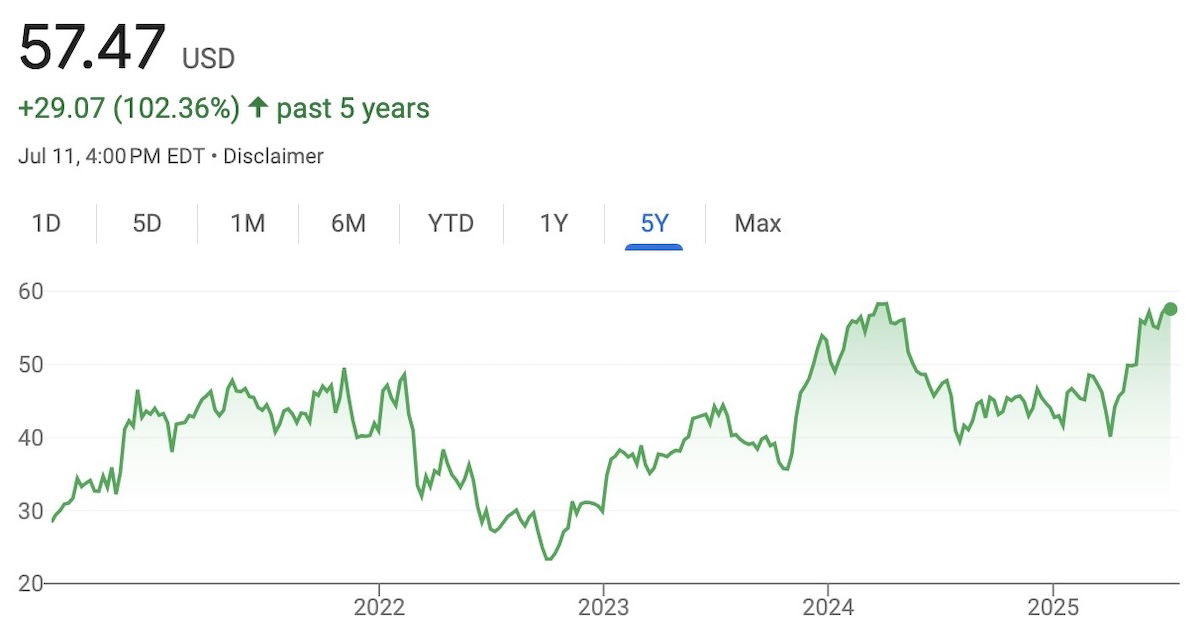

However, in recent times, the company’s prospects seem a little less bright. For example, just compare Ryanair stock, which is up over 100% in the past five years…

…to Wizz Air’s stock, which is down over 60%.

Wizz Air has partly blamed its poor performance on having planes grounded due to issues with Pratt & Whitney GTF engines, given the carrier’s Airbus A320-family focus. However, Wizz Air is still carrying more passengers than ever before, and I don’t know to what extent you can blame lagging performance on lack of aircraft, when there are obviously profitability struggles in some markets.

The US ultra low cost carrier business model has basically become impossible, between higher labor costs, the legacy carriers competing more fiercely with basic economy, and so much of industry profits coming from loyalty programs.

Europe doesn’t quite have the same issue. Workforces aren’t unionized in the same way (especially with these multi-AOC operations), credit card revenue doesn’t factor into economics as much, and the legacy carriers all have one or two hubs (limiting their competitiveness in point-to-point markets).

Still, success of the ultra low cost carrier business model relies on continued growth, to keep labor costs down, to keep fleets modern, etc. What’s incredible to me is how Ryanair has been able to continue to grow at the pace that it has, all while continuing to so heavily focus on its core geographies. I think Wizz Air is realizing that losing focus on a region probably wasn’t the best strategy, and the airline should go back to what it does best.

If there’s one thing Ryanair is good at, it’s staying very focused. Just listen to how Ryanair executives talk about why the airline doesn’t sell vacation packages. Ryanair boss Michael O’Leary acknowledges there would be money to be made there, but it’s just not worth Ryanair’s time, when the company could instead focus on continuing to grow its operation, with unrivaled margins.

I’m curious if Wizz Air can get back to the point where it looks as promising as it did a few years ago, or if the company will face more structural challenges, now that it has lost some steam.

Bottom line

Wizz Air Abu Dhabi will be ceasing operations as of September 2025. At one point, Wizz Air viewed the Middle East as its next major market, in order to fuel growth. However, that hasn’t worked out as planned, due to a variety of factors.

This includes the heat in the Middle East causing engines to degrade at an accelerated pace, lack of access to India and Pakistan, and the general airspace closures and other stability issues in recent times. I can’t say I’m terribly surprised to see this, and I’m curious how exactly Wizz Air redeploys this capacity.

What do you make of Wizz Air Abu Dhabi shutting down?

Wizz is strong in East Europe where structural hurdles persiste, notably the Russia/Belarus/Ukraine airspace and markets are closed to them. There would be demand however considering the proportion of russophones in East Europe.

The diversification to middle east was probably subsidized as a way to give an edge to Etihad in accessing secondary or tertiary indian cities. To Wizz, it was oversold based on wishful thinking on behalf of UAE authorities re Indian market...

Wizz is strong in East Europe where structural hurdles persiste, notably the Russia/Belarus/Ukraine airspace and markets are closed to them. There would be demand however considering the proportion of russophones in East Europe.

The diversification to middle east was probably subsidized as a way to give an edge to Etihad in accessing secondary or tertiary indian cities. To Wizz, it was oversold based on wishful thinking on behalf of UAE authorities re Indian market access. The hot harsh environment is just an excuse to save face. Sure the HD 321s carry a little less pax per engine than an Emirates A380 and at lower yields. But that's not the point of the operation.

Abu Dhabi would have had a better chance of success if they had partnered with IndiGo. Indigo as well: Turkey is too far away.

Now what for Wizz? Even if they refocus on their traditional market they will stay hampered down by the Russo-Ukrainian war which limits their routings and market access, let alone access to cheap kerosene. I also assume the yields are lower in Eastern Europe as the mix is more heavily focused on VFR than Ryanair's western clientèle which is probably heavier on leisure and business.

Operationnally, Wizz are maxed out on efficiency with the 240 pax 321s while Ryanair still has the Max10s in the pocket. So they can't gain anymore on the fleet. Maybe they have some network optimizations beyond the ME pull out ? Not a big opportunity.

Honestly I don't see them recovering in any significant manner until they gain access to the currently closed airspace and markets in East Europe.

Sounds like the heat reason may be a polite way of not having to say they became frustrated with their JV partners, particularly re access to India.

Too bad. Although I’ve never flown with them at AUH, their route to MLE kept Etihads prices down as they had competition to the Maldives. You could fly Etihad for around $150 ow from AUH to MLE. With Wizz exiting the ME, I fully expect Etihad to now raise those prices to the same level as Emirates out of DXB now.

They stopped flying to MLE a few months ago. Etihad's prices have skyrocketed and are now around $600-800 for a round trip in economy class to MLE.

UAE carriers have fully utilised the bilateral rights with India and the latter has consistently refused to raise that number. So unless another airline was willing to give up some capacity for Wizz Air (unlikely given the demand), there was zero probability of tapping into the India market

"...now we can go back to the full spirit of continuously exploiting the market."

Credit to this lad for having the stones to say what Ed Bastian of Delta means but won't say himself.

Honestly Lucky,

Ryanair isn’t actually very low cost these days on many routes, often even having a direct route and speed premium price over legacy carriers in basic economy with a stopover in their hub. As the provincial airports in European cities of half a million people tend to be much smaller this their American equivalents.

To what extent, do you think, is the lower importance of credit card deals outside the US attributable to regulations limiting swipe fees? Presumably that would limit the amount of revenue that an EU airline would generate, no?

The interesting part of this is that Wizz plans on opening an Israeli subsidiary, so I’d have to imagine their concerns regarding regional instability are not entirely true.

Perhaps they are reassigning those planes.

Real reason of shutting down: unable to save fifty pounds *puh person*, or 200 pounds for a family of 4

That's a disgusting discrimination.