For the third time in recent months, Emirates has drastically increased fuel surcharges on tickets. This is especially bad news for those looking to redeem Skywards miles.

In this post:

Emirates award flights just got more expensive

Airlines typically have carrier imposed surcharges on tickets, which are often referred to as fuel surcharges. Essentially this is a component of the ticket cost that’s theoretically supposed to go toward paying for fuel.

Back in the day these surcharges were introduced as a temporary measure when fuel costs increased, but go figure they’ve stuck around for most airlines permanently.

For those booking tickets with cash, these surcharges typically don’t matter, since they make up part of the overall fare. If fuel surcharges were to increase by $200 per ticket, generally the base fare would decrease by $200 per ticket.

The major implication here is for award tickets, as some airlines pass on fuel surcharges when redeeming miles. Emirates Skywards is one of those programs, unfortunately, and Emirates has significantly hiked fuel surcharges for the third time in recent months, reflecting the extent to which the cost of oil has skyrocketed.

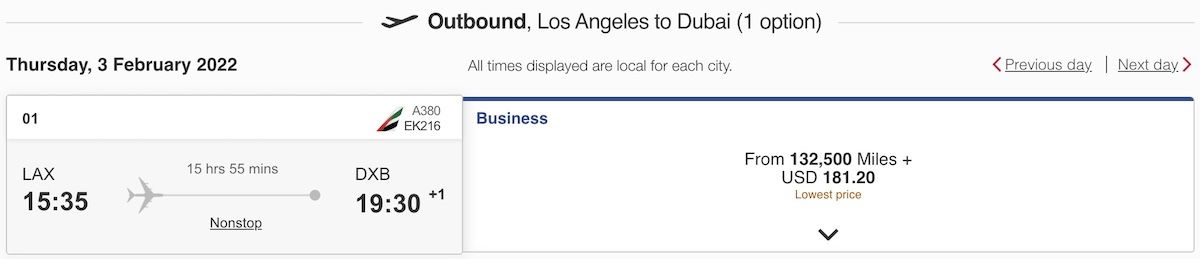

For example, at the beginning of the year, a one-way Emirates Skywards business class award ticket from Los Angeles to Dubai had $181.20 in taxes, fees, and carrier imposed surcharges.

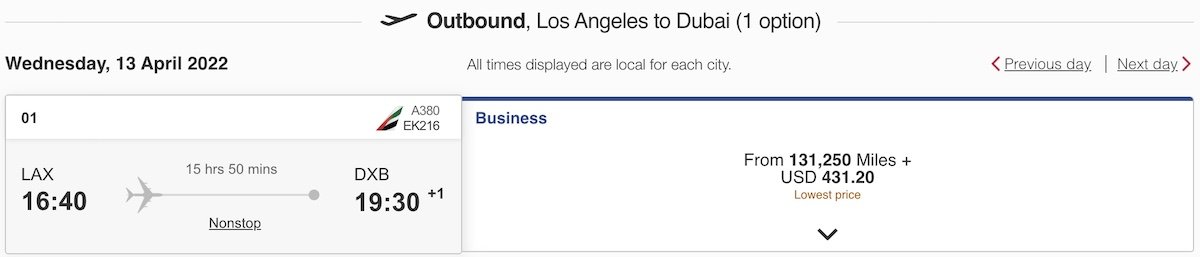

Then as of early March 2022, that same ticket would cost you $431.20 in taxes, fees, and carrier imposed surcharges, reflecting a further $250 in fees. Before someone asks, I’m not sure why the mileage requirements decreased by 1,000 miles… that’s odd.

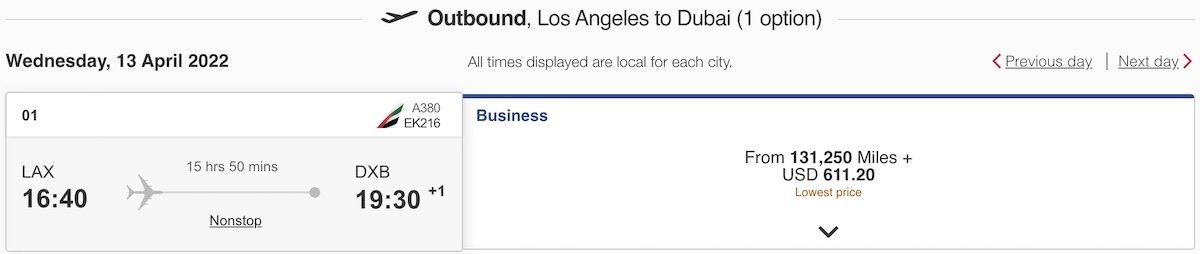

Then a couple of weeks after that, the same ticket would cost you $611.20 in taxes, fees, and carrier imposed surcharges, reflecting a further $180 in fees.

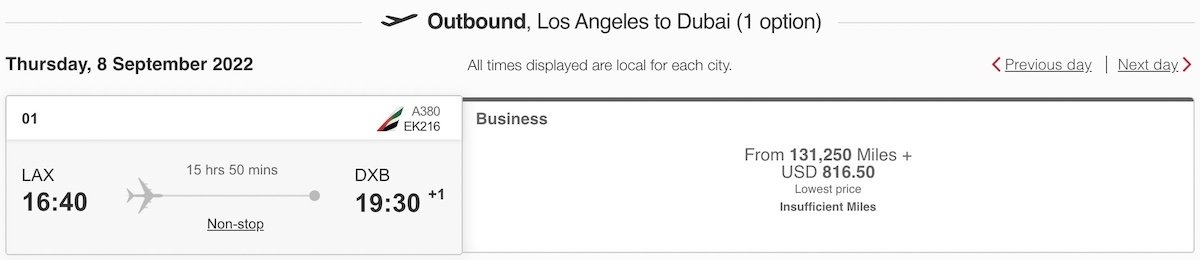

Now as of June 2022, the same ticket will cost you $816.50 in taxes, fees, and carrier imposed surcharges, reflecting a further $205 in fees.

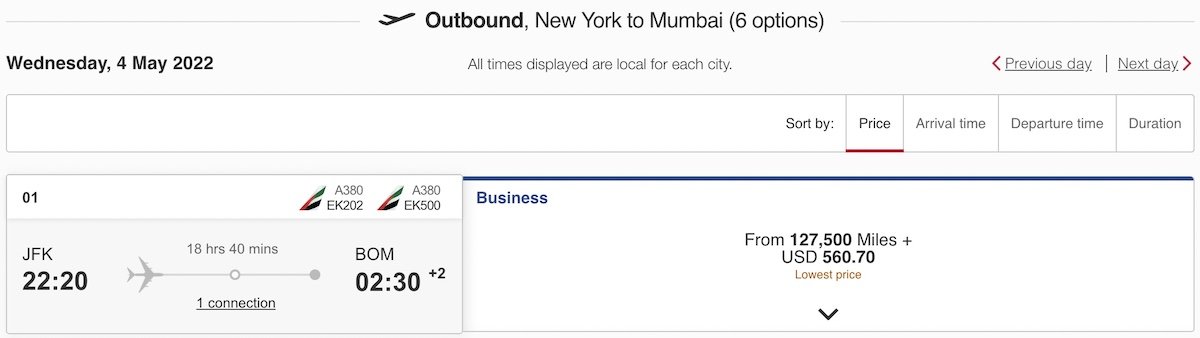

Unfortunately all awards between the United States and Dubai (and beyond) seem to have these much higher fees. For example, as of early March 2022, a one-way New York to Mumbai business class itinerary would cost you $560.70 in taxes, fees, and surcharges.

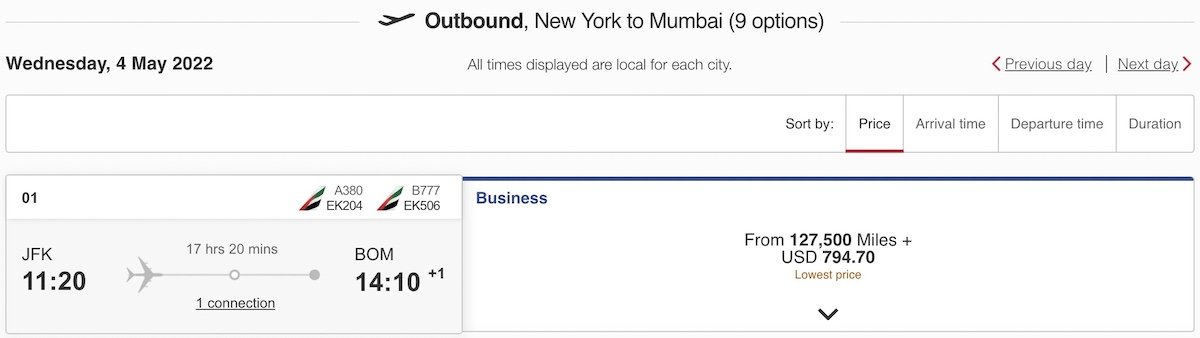

Then a couple of weeks after that, the same ticket would cost you $794.70 in taxes, fees, and carrier imposed surcharges, reflecting a further $234 in fees.

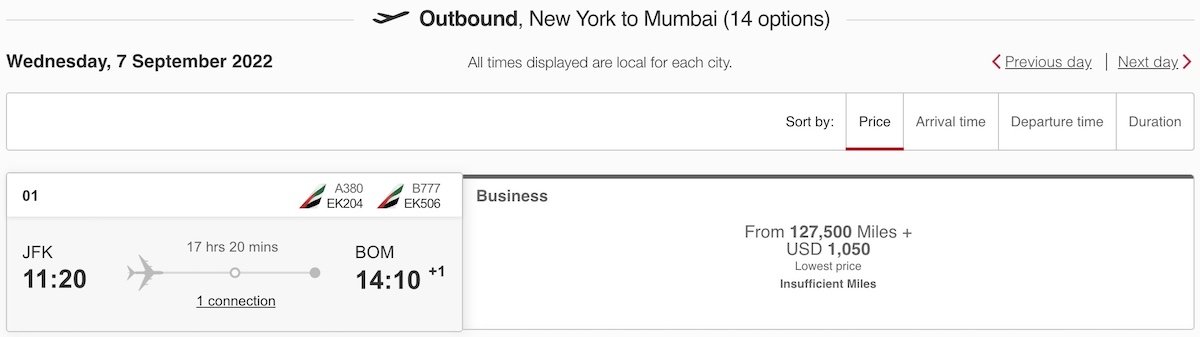

Now that same ticket will cost you $1,050 in taxes, fees, and carrier imposed surcharges, reflecting a further $255 in fees.

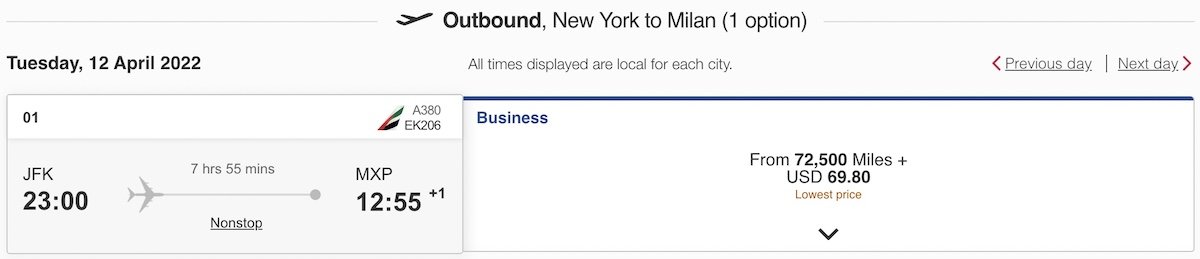

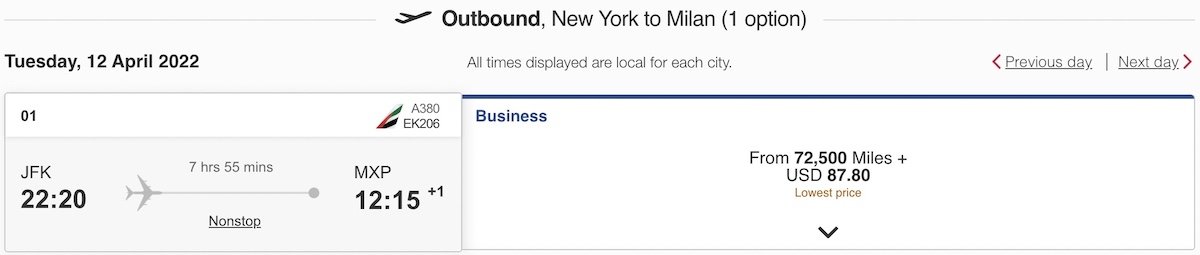

The only good news is that Emirates’ fifth freedom flights from the United States (from Newark to Athens and New York to Milan) haven’t seen fees increase by nearly as much. For example, as of early March 2022, a one-way New York to Milan flight in business class would cost you $69.80 in taxes, fees, and carrier imposed surcharges, compared to around $40 before.

Then a couple of weeks after that, the same ticket would cost $87.70 in taxes, fees, and carrier imposed surcharges, reflecting a further $18 in fees. We haven’t seen any increases beyond that, so that’s good.

This is only the latest Emirates Skywards devaluation

Skywards is a useful frequent flyer program, because it has full access to Emirates first & business class award tickets, which are blocked through many partner programs.

For a while the program was even getting more compelling. In May 2020, Emirates significantly lowered fuel surcharges, which was great for awards. Now we’re seeing that trend reversed, which is bad news for redemptions.

It’s one thing if this were the only negative Emirates Skywards change, but earlier this year Emirates increased the cost of one-way business class award tickets. When you couple that with much higher fees on award tickets, redeeming Skywards miles is looking less attractive than before.

Let me of course acknowledge that oil prices have increased drastically, and I recognize that this is costing airlines a lot of money. However, many other airlines don’t pass on fuel surcharges on award tickets, so the fact that these are passed on when redeeming Skywards miles disproportionately impacts award passengers.

Bottom line

Emirates has significantly increased fuel surcharges for the third time in recent months. While this doesn’t have huge implications for flights paid with cash (since this is factored into the overall fare), this is major for those redeeming miles. For flights between the United States and Dubai (and beyond), you can expect to pay a minimum of $800+ for a premium cabin one-way award ticket.

Here’s to hoping that oil prices go down again, and that these increased fees don’t stick around in the long run.

What do you make of Emirates’ increased fuel surcharges?

Rip off

Rip off fuel price has reduced over the last month

My flight from Manchester UK

To Bangkok is normally £500 now Emirates

Thieves want £1,200 cash customer no miles

LAX-DXB-MEL in J is now $1630 in taxes per person. Unreal.

it is ridiculous the surcharge fee imposed by Emirates Airlines. Besides the tax, Emirates add a very high fee. As an example a trip from DXB to YUL is AED 23,460 + AED 5,920 charges + AED 385 taxes and fees.

I never understood the charge of AED 5,920 (which is equivalent to $1,440)

Not paying $800 in fuel surcharges. I've flown Emirates in F before. It was alright but I don't feel a strong need to repeat if I can't get a good award on it.

In January 2022, I had booked a Business Class award ticket on Emirates. I went to book the same route now. Fuel surcharges have increased by 320% since January for an award ticket on the very same route.

Agree with Eskimo - It's interesting how they don't lower the price when oil goes down but are quick to raise it when oil prices go up

Just like fuel sellers

That's right people. Sign up for all those credit cards with their "amazing" offers and free miles. Just booked a RT DCA to Milwaukee on UA for almost 60K miles economy. Suddenly the 80K credit card offer doesn't look so attractive.

@David

Yeah but you used miles instead of paying $400-$550 for an economy air fare. Not as bad of a deal as you think.

@Ben - Any idea about awards out of places that restrict YQ like Brazil? Maybe a post about places that limit these odious fees would be helpful to your readers.

Just redeemed in May for two one ways from DFW to IST via DBX. Business class fuel surcharge was $850 per ticket. Still cheaper than paying cash and I had a bunch of expiring skywards miles from Covid cancellations, so I had to just grin and bear it. Oh well.

Are those award prices for real? 130k in J to Dubai? Plus $800 in YQ? Are they out of their mind? I'll take Qsuites to Maldives for half of that, with no YQ.

“ Here’s to hoping that oil prices go down again, and that these increased fees don’t stick around in the long run.”

An airline decreasing fees? Ha! That’s a good one.

Outside of JetBlue flights the program is about useless. Good luck booking JFK-MXP IN F unless close in. EWR-ATH is almost as bad. Unfortunately I myself have too many miles tied up in this program due to a cancelled flight.

I checked today LAX-ATH for two in J and it was over $3k in taxes and fuel surcharges. Makes BA look almost affordable. I simply refuse to participate in that fukery.

A Europe-Australia reward ticket in business now costs 285k Miles + €2300 in 'Fuel surcharges'. And for that you'll be seating in a 2-3-2 configuration!

There's no point in giving Emirates business anymore. Their paid rates are higher than competitors and the hardware on the B777 which they use on most routes just isn't good either.

Sad to see the direction EK is going.

When Emirates starts making Lufthansa’s fuel surcharges and fees for award tickets look cheap in comparison :)

I have noticed that paid-for fares from London to Asia over the coming weeks have skyrocketed - e.g. LHR-SIN on Singapore £8k in business, LHR-BKK on Qatar £5k in business (Qatar used to be a great value proposition). Clearly demand is off the scale so no surprise airlines are "giving" less and less away. May be a feature for a while?

Fuel surcharges seem to only go one way.

Wooohooooo. I paid like $23 for my first class ticket on Emirates this month.

Dem planes hungry.

Unfortunate precedent, though.

Anyone else seeing increased fuel surcharges on other airlines? I was about to book an ANA award and seeing YQ around $350 for roundtrip between US and SE Asia. I believe it was much lower before.

IIRC, Japanese airlines increase and decrease fuel surcharges periodically based on actual fuel prices.

British ORDLHR next week. 60,000 and $725 in fees.

BA has always been next level with this. I don't understand why anyone would commit themselves to that program.

It's hilarious that people actually think airlines are seriously effected by fuel prices like they say. Most airlines not only have massive reserves, but they saw this fuel increase coming. It wasn't like this war was a great secret.

It's also hilarious that people actually think no airlines are seriously effected by fuel prices like they say.

Most airlines actually do NOT have massive reserves. Storage isn't free.

Many airlines don't even hedge fuel. i.e. AA DL UA

Those that do, will already see the effects of war on future contracts.

Yes because this war isn't a great secret, prices have already reflected war the moment Putin moved next to the...

It's also hilarious that people actually think no airlines are seriously effected by fuel prices like they say.

Most airlines actually do NOT have massive reserves. Storage isn't free.

Many airlines don't even hedge fuel. i.e. AA DL UA

Those that do, will already see the effects of war on future contracts.

Yes because this war isn't a great secret, prices have already reflected war the moment Putin moved next to the border.

However, Emirates is also owned by an oil cartel. So at least EK could have deal with it easier than other airlines.

Hah, I forgot about who owned them. They should be the last to raise them.

@Eskimo

When fuel prices dropped 10 somewhat years ago the airlines were rolling in dough. They bought back complementary pretzels.

How about we return the biscoff biscuits and pretzels instead of fare increases ?

Simply taking advantage of a situation that has nothing to do with their airline to rake in some extra bucks. Just before Covid hit I flew a RTW in F on Korean and Emirates, for a price of 46K per leg, plus $750 taxes pp. So glad I did that then!! That will never happen again. EK is just joining the ranks of LH, OZ, LX , VS, all who take Americans over the coals for taxes, especially on the outbound. Inbound is around half of outbound for LH, OZ, or LX.

Saudia award flight also has huge surcharge i.e. LAX-JED $850! not sure if that's recent or always the case

5 days ago, I checked the Skywards Classic Rewards price for a London-Lusaka Business class return. At that time the price was 150,000 miles plus £528 sterling. To get one now Emirates is asking 150,000 miles plus £854!!!!! Serious?! Yesterday, I checked and almost booked BHX (Birmingham) - Accra return in this March 2022 month in economy and was quoted 75,000 miles plus £281. Every day in the month was available at this price. Today...

5 days ago, I checked the Skywards Classic Rewards price for a London-Lusaka Business class return. At that time the price was 150,000 miles plus £528 sterling. To get one now Emirates is asking 150,000 miles plus £854!!!!! Serious?! Yesterday, I checked and almost booked BHX (Birmingham) - Accra return in this March 2022 month in economy and was quoted 75,000 miles plus £281. Every day in the month was available at this price. Today there are no 75,000 mile tickets in March and the price has shot up to £356. This really is the end of the road for me with Emirates. Trouble is I still have just less than 400,000 miles wih them but no way will I ever aceed to these exorbitant increases which are a cynical ploy to make back money lost during Covid and with war-related oil price increases. So we, the customers, are expected to help emirates out of hole, with all the support they get from UAE government? Forget!!!

A wise man once said 'never underestimate how much someone will pay for a free flight'. I see this nonsense as the end of the road for many FFP propositions. The ticket price is the ticket price is the ticket price, so don't tell me I can have a free flight that costs hundreds of dollars.

Jump over to hotel frequent guest programs and a free room. No one asks me to pay extra because the price of the electricity to heat the room went up. :(

That’s not _completely_ true. Hotels in Reno, NV implemented a $2 “energy” surcharge on rooms due to an energy cost spike. It gets better. This was implemented more than 20 years ago and has never gone away. Never.

Interesting compare. $2?????

Emirates stopped being of interest to me when they suddenly and drastically raised they’re award ticket redemption rates on AS. I did book my wife and daughter on J class from Cebu-LAX with a 24 hr stopover in Dubai so she could visit her best friend. 105k mikes each. Ok but not a bargain. That was two years ago. We haven’t flown on them since. Prefer JAL with 65k J or 75 K F to Manila.

I'm hoping this increases my chance of being able to upgrade to first in a few months when I go to dxb

Emirates like every other business that depends upon the public to succeed (restaurants, banks, credit cards, airlines) employ a highly unusual model of trying to discourage people from using their services or purchasing their products. Not what I learned in business school 50 years ago.

Because they know discerning customers are a thing of the past. In an instant gratification culture, you can get away with murder. The same reason people will accept wild fluctuations in groceries and household goods at the moment without questioning the details. As long as they can have it when they want it, most won't even think of balking at the price.

They need profit. Least bothered about even regular customers. I have never redeemed my reward points because of covid delay in travel the skyward miles reduced from 21 thousand miles to 9 thousand

BOM-DXB-SFO total tax on award ticket used to be $450 few days back, now its $820!

That's an increase of $370, almost 82% increase!!!

For once it's nice to be on the "before" side of a negative change instead of the "after". I just booked a return trip in EK F at the 'old' rate.

Now, assuming Covid doesn't f*** up the trip for the 4th time...

I’ve flown first class with this airline. They don’t live up to the hype.

Probably because Russian and Ukraine airspace is now closed to EK flying to the west coast of the US so they're talking of an extra stop in Europe to refuel as the journey will be considerably longer.

Likely fake news. Today's flights are already over Russian Airspace. Yesterday's DXB-SFO and DOH-SFO landed on time and took a route over Russian Airspace.

Jumeirah Frankfurt is closing.

It is rebranded to JW Marriott

Saudia award flight also has huge surcharge i.e. LAX-JED $850! not sure if that's recent or always the case

I'm guessing your dissatisfaction with them raising fuel surcharges comes without much consideration of the reality that oil prices had already doubled before the western world went to economic war with the 3rd largest oil producing country?

@Rob Yes but no.

It's funny how fuel surcharge works. When oil prices goes down, these surcharges hardly goes down. When oil prices goes up, it jumps right away.

It's funnier that cash prices for tickets doesn't jump proportionally to these surcharges.

Not to mention, airlines also hedge fuel.

Not to mention, UAE is also an oil cartel.

It's a resort fee. You get scammed by it regardless of you using their wifi or pool.

@Eskimo, I'm sorry, but I don't think you understand how hedging works. It does not lock in a lower fuel price for the rest of time. They are all just contracts with short expirations to help smooth the earnings impact of sudden price moves.

@Rob

I'm sorry but I don't think you understand how airlines actually hedge their fuels.

Take Southwest as the aggressive example. At one point they hedge almost 70% of their fuel for 24-48 months. Even today IAG partially hedge all the way to 2024.

So much for short term. And unless Ukraine timeframe turns into Afghanistan. 4 years is a long time for war, but if Russia drags it to 20 years, then we...

@Rob

I'm sorry but I don't think you understand how airlines actually hedge their fuels.

Take Southwest as the aggressive example. At one point they hedge almost 70% of their fuel for 24-48 months. Even today IAG partially hedge all the way to 2024.

So much for short term. And unless Ukraine timeframe turns into Afghanistan. 4 years is a long time for war, but if Russia drags it to 20 years, then we probably have to invade Iraq for oil again.

And by the way, you can lock fuel price for the rest of time (even if it's not the best strategy) It's called owning an oil field.