In January 2022 we learned about changes coming to the Citi Double Cash® Card as of this spring. For most people the implications here shouldn’t be huge, but I’d still say these are positive developments overall.

This is a heads up that these Citi Double Cash Card changes are live as of today (March 28, 2022). Cardmembers should notice changes to how their Citi online account looks, so let’s go over the details.

In this post:

Why the Citi Double Cash Card is awesome

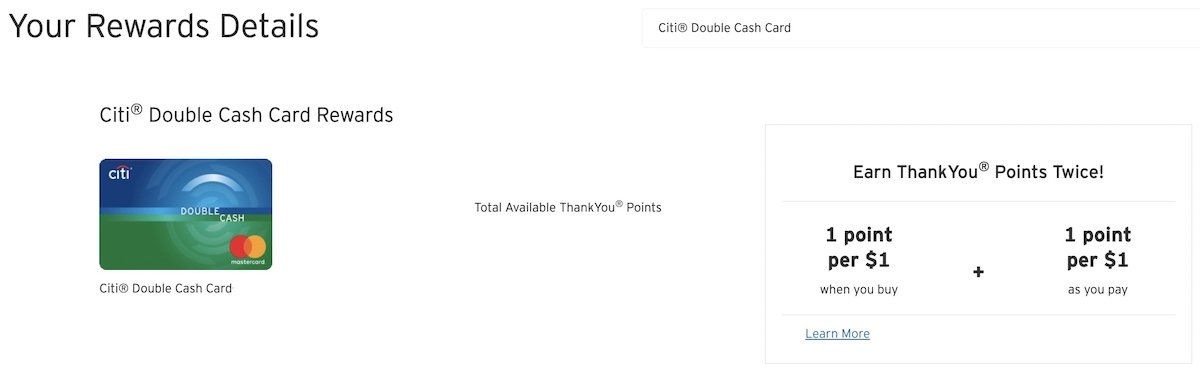

For those not familiar with the Citi Double Cash Card (review), this is a no annual fee card that has historically offered 1% cash back when you make a purchase, and 1% cash back when you pay for that purchase.

What made this card so great is that in conjunction with a card earning ThankYou points, like the Citi Strata Premier® Card (review), the cash back rewards could be converted into ThankYou points. This conversion happened at the rate of one cent per point, meaning you could earn 2x Citi ThankYou points per dollar spent. I value that at a 3.4% return, making it one of the best cards for everyday spending.

As I’ll explain below, this card now directly earns ThankYou points. This is noteworthy, but doesn’t have quite as many implications as you may assume.

What changed about the Citi Double Cash Card

With the changes that have been made to the Citi Double Cash Card as of March 28, 2022:

- There’s no longer a minimum cash back balance required to redeem rewards, while previously there was a $25 minimum; this is good for those who have the card but don’t spend all that much

- The card now earns ThankYou points rather than cash back; that means you earn one ThankYou point when you make a purchase, and one ThankYou point when you pay for that purchase

- You continue to have the option to redeem rewards as cash back at the same rate, but you also have access to other Citi ThankYou redemption options, including for gift cards, for booking flights and hotels, and more

For those maximizing rewards, the implications here are fairly limited:

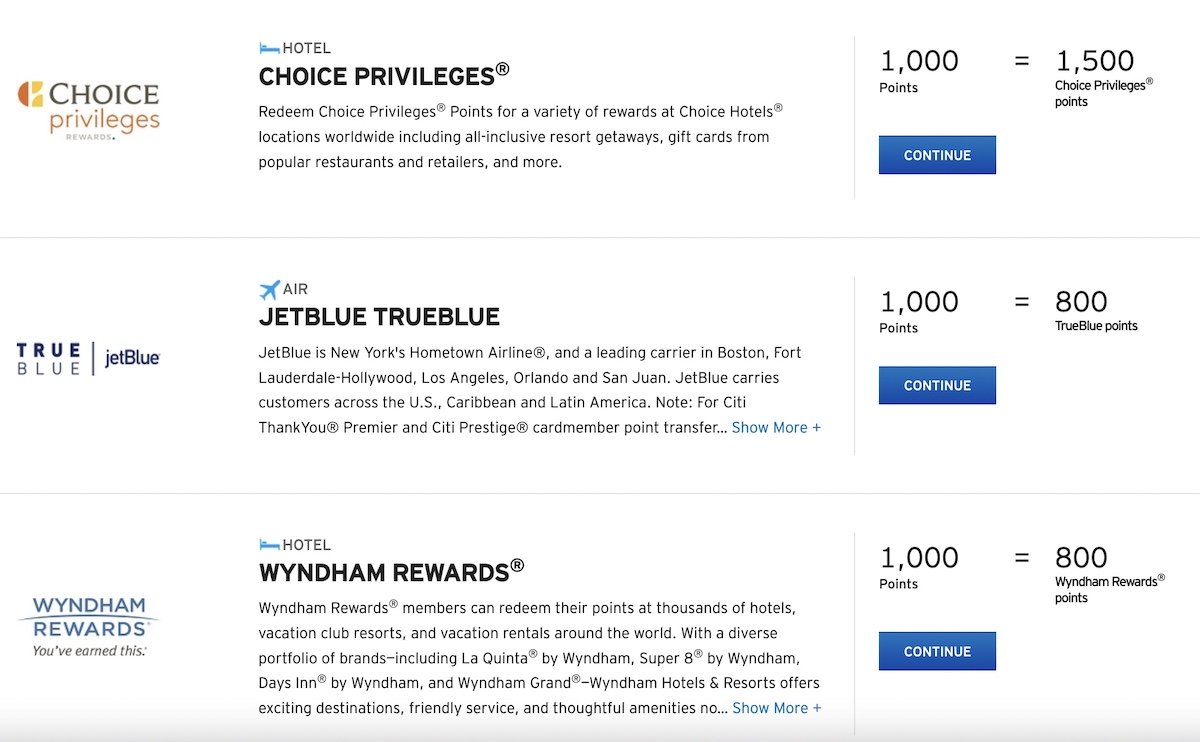

- While the Citi Double Cash Card now earns ThankYou points, those points can’t be converted into airline miles or hotel points with most partners unless you have a “premium” card earning ThankYou points in conjunction with it; the exceptions are that you are able to transfer points directly to JetBlue TrueBlue, Choice Privileges, and Wyndham Rewards (more details on that below)

- Aside from being able to transfer points to airline & hotel partners, most other Citi ThankYou redemptions offer at most one cent of value per point, in which case you’re better off just getting cash that you can spend however you’d like

- In theory this could be useful if you wanted to downgrade another card earning Citi ThankYou points, as this would allow you to maintain your points, though the points still expire 60 days after you close an account, and there’s not really any benefit to keeping those points rather than cashing them out

- One important thing to keep in mind is that Citi ThankYou points issued through various cards have different redemption options, and the ThankYou points issued through the Citi Double Cash continue to be redeemable for one cent cash back each

Are the Citi Double Cash Card changes as expected?

When I first posted about the changes to the Citi Double Cash Card earlier this year, many were skeptical about whether there was some massive devaluation coming, or something. For example, one reader had commented the following:

I have now read FOUR articles on this change, and I believe every single one of them is an unadvertised-as-such paid-for promotion. Because let’s look at what they’re really doing. They are TAKING AWAY the actual U.S. dollar money you got back in exchange for … NOTHING. Nothing you couldn’t already CHOOSE to do IF YOU WANTED TO. They are TAKING AWAY an option in exchange for NOTHING.

With these changes now live, hopefully people can believe once and for all that this wasn’t a devaluation. Nothing is being taken away here, and you can still cash out rewards as before. So, what has actually changed?

When I log into my card account, I now see my total available ThankYou points, rather than the total available cash back. The marketing is also updated to reflect that you “Earn ThankYou Points Twice” rather than “Earn Cash Back Twice.”

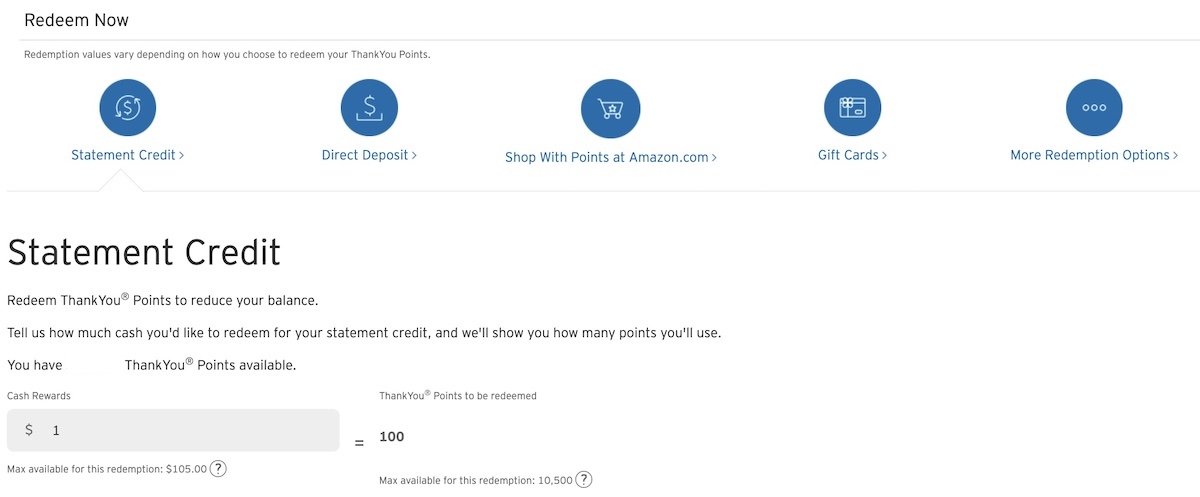

But when it comes time to redeem, you’re in a better spot than you were before. You can still convert your ThankYou points into cash back (either in the form of a statement credit or direct deposit) at the rate of one cent per point. For example, you could convert 100 ThankYou points into $1 cash back.

It’s also now possible to convert ThankYou points earned directly with the Citi Double Cash into three airline & hotel currencies:

- Convert ThankYou points into Choice Privileges points at a 1,000:1,500 ratio

- Convert ThankYou points into JetBlue TrueBlue points at a 1,000:800 ratio

- Convert ThankYou points into Wyndham Rewards points at a 1,000:800 ratio

In all cases you’ll get a better transfer ratio, plus have access to lots more partners, if you have the card in conjunction with the Citi Strata Premier Card.

Bottom line

Changes to the Citi Double Cash Card have now gone live, and they’re exactly as expected. Ultimately I’d say these adjustments are more about marketing than anything else. The card now earns ThankYou points rather than cash rewards, though those ThankYou points can be redeemed at the same rate as before toward statement credits, cash back, etc.

I suppose the goal is to market this as a more versatile card that can earn travel and other rewards, rather than just a cash back card. This seem to be about better integrating the Citi Double Cash into the ThankYou ecosystem, though you still aren’t able to transfer points to ThankYou partners unless you also have another premium card earning ThankYou points.

Importantly let me emphasize that if you’re looking to earn cash back, these changes aren’t negative. Nothing has changed for the worse. You can still accrue cash back at the same rate, and you can even cash out without the $25 minimum (which is a good thing).

What do you make of these Citi Double Cash Card changes?

I use double cash a lot because I want flexibility to use the cash how I want on airlines etc... Forcing me to use their thank you points on their page simply means I'm likely spending more by not being able to shop around. From what I see I now earn only 1.6% cash back from this card now. Spin it how you want, for cash and flexibility, this is a major loss.

Cash is KING for a reason; and make no mistake, points are not cash.

If I wanted a points credit card, I would have signed up for one. I wanted a cash back card and that is why I Signed up for Double Cash when it was introduced. Citi talks about how you can use the point to buy most anything; but the fact is, I can use cash to buy everything from anyone. Citi...

Cash is KING for a reason; and make no mistake, points are not cash.

If I wanted a points credit card, I would have signed up for one. I wanted a cash back card and that is why I Signed up for Double Cash when it was introduced. Citi talks about how you can use the point to buy most anything; but the fact is, I can use cash to buy everything from anyone. Citi already had a points card so why the need for the change? Well consider, Last month they owed me cash, now they only owe me points.

For those angry at Citi, like me; Wells Fargo now has an actual 2% cash back card.

SO. The new system sucks. I tried to get $64 in rewards as a check. The confirmation button didn't work. After 2 days on Chat, on hold, after being told it would be sent by check with a confirmatory email - which never arrived, Citi actually DELETED my rewards. Over 2 hours on HOLD they have agreed to a 'gift' of the money - which is MINE. My Citicard has worked well for ~16 years. Their "improvements" mean I'll be changing my card.

Its too bad and its only going to be worse from here, always follow the money when it comes to these things.

Can you transfer points to another TYP holder if the DC is your sole TYP earning card? (So no pairing with Premier/Prestige)

In reading the comments, it seems that reading comprehension is at an all time low or people have just become so set in their ideas they don't want to understand what is read.

While earning 2x on everyday spending seems appealing, I find myself spending on other cards to meet minimum spend thresholds nowadays versus spending on Double Cash, CFU. For example I get thousands of dollars of benefit by spending $30K on Delta Reserve to get Delta Platinum, so I prioritize that. Other options include spending on a Hyatt card to get another free night, spending on AA cards for status, etc. Double Cash isn’t getting used as much as it used to.

Thank you points are too unnecessarily complex as the rules seem to follow the card, and not the user. They could learn a lot from following Ultimate Reward points.

The next step is devaluation - by changing the cash redemption option to 1.1 points to 1c and then downwards

We just knew SOMEone would continue arguing that :).

Surely it's possible, but I don't consider it likely. Should the day come however, we can all decide to stop using the card at that time...

You really are not that bright if you think its unlikely it would happen, it has already happened to a lot of other credit cards. What you fail to realize is these credit companies are businesses and they will do whatever they can to increase profits. Its a scummy thing because now they can adjust the values of the points as they see fit.

You note at the outset that you value TY points at 3.4 cents apiece. Unless I'm overlooking something, that heightened value is due to the availability of conversion to other rewards programs. But, as you note, the points coming from Double Cash are not convertible in this manner. So, it seems a bit unfair to couch your analysis in terms of a 3.4 valuation for TY points, when that valuation wouldn't apply to these points,

Does the card has foreign transaction fees??

Yes, "3% of the U.S. dollar amount of each purchase" (from Citi web site).

The Citi Doubtful Cash Card...

You’ll continue to have the option to redeem rewards as cash bk at the same rate. This is very unclear in their email.

This is NOT the same. I do not want points to redeem for a gift card. I want the cash as a credit on my balance. I cash out every month, since I easily meet the 25. requirements. I am furious about this. It changed the whole thing.

You are furious, why? Because you'll still be able to cash out every month for a credit on your statement? The only thing that changed is, no more $25 requirement... (you might have a slow month here and there)

WHy would you take cash as a balance credit. You are missing out on 1% reward for paying your balance. Best to take the cash back, and use the cash back to pay your balance or buy a chill pill.

The issue with this change is not necessarily that people don’t understand what’s happening. This is the main issue: a vast majority of citi double cash customers choose this card over many other options in order to not have to worry about confusing credit card reward programs. We simply wanted 2% cash back. If Citi cared about their customers and the user experience they would allow you to automatically claim your 2% cash back reward...

The issue with this change is not necessarily that people don’t understand what’s happening. This is the main issue: a vast majority of citi double cash customers choose this card over many other options in order to not have to worry about confusing credit card reward programs. We simply wanted 2% cash back. If Citi cared about their customers and the user experience they would allow you to automatically claim your 2% cash back reward with no time commitment from their customer. But the bottom line is when companies make the experience more complicated or they partner with other companies to offer special ‘rewards’ less rewards are claimed and ultimately the expense for the credit card company is reduced. This change is simply a way for Citi to slightly reduce their expenses and casually screw over their customers while trying to rebrand it as a positive change. I challenge any Citi executive or partner to explain how this change is helpful for the vast majority of credit card customers who pay off their full balance each month and simply want 2% cash back without worrying about confusing reward redemptions?

Hey, randoo5! You should have just copied and pasted :).

So, right now you click on the redemption button and put in how much money you want to redeem. In the future, you go to thankyou.com and click on the redemption button and put in how much money you want to redeem.

I don't understand how that is confusing? The process doesn't really change, and people get this card for a reason, so I don't see why fewer rewards would be claimed?

Hello OPR. You hit the nail on the head of why this is bad. As you stated, "right now you click on" and"in the future". Yeah, I can tell you that "the future" will be short-lived, and soon "points" will not be able to be used for cash, only for some Citi picked overpriced goods we don't want.

I am waiting for the fine print, but I am concerned. I have used Thank You points and find them very limiting. You pay a premium to convert points to gift cards. Add the limited redemption of gift cards in intervals of 1000 points, I find the argument that this is better than redeeming at 25$ disingenuous. This “change” has definitely made me consider changing to another CC.

I agree, gift cards are not appealing.

So why don't you just redeem for cash, just like before?

I got the email and tried to login to the THANKYOU awards site given in the email. Logged in, only to be told that I am ineligible to use the site since I am not the primary cardholder. I may not be the primary cardholder...but I am the SOLE cardholder...no one else can use the card exccept me, so I assume I am the primary cardholder. This means what? Going to try to get what...

I got the email and tried to login to the THANKYOU awards site given in the email. Logged in, only to be told that I am ineligible to use the site since I am not the primary cardholder. I may not be the primary cardholder...but I am the SOLE cardholder...no one else can use the card exccept me, so I assume I am the primary cardholder. This means what? Going to try to get what little money I have in rewards out now, while the getting may be good. Actually, it has always been complicated to get my cash back from this card. If I used the money to apply to the balance on the card, that money did NOT earn 1% as a payment, so you have to have a check sent and then pay from other money in order to get the 1% for paying. What a mess.

You're right, nobody wants to mess with checks. Now I'm not sure if this was always the case, I haven't had the card that long, but right now you can redeem as a direct deposit, so straight to your bank account. Have you looked into that?

I acquired a Citi Double Cash (DC) Card about a year ago -- my interest was not the cash back but the ability to convert cash-back to TY points and add them to my stash of Citi Premium TY points. I have to admit that I found the process to do that confusing and non-intuitive (unlike at Chase).

My concern with the upcoming changes is will the DC TY points continue to be able...

I acquired a Citi Double Cash (DC) Card about a year ago -- my interest was not the cash back but the ability to convert cash-back to TY points and add them to my stash of Citi Premium TY points. I have to admit that I found the process to do that confusing and non-intuitive (unlike at Chase).

My concern with the upcoming changes is will the DC TY points continue to be able to combined with Premium TY points. For instance TY points earned on Citi banking accounts cannot be combined with credit card TY points. Will that happen here?????

Ben, why didn't you say that the card will still have the cash-back option but also have the flexibility of transferring points to airlines? And, why didn't you say that the card will still earn 1 point on purchase and 1 point on payment? Oh, you did? Four times? I guess I should have READ your article.

Didn’t know about the Choice option. I have so many more miles than hotel points so am thinking of using the bonus from my recent Citi premier to transfer to choice. Also have the double cash back card. So I guess from what you are saying, I don’t need to keep the premier and pay annual fee and I can still essentially get 4 choice points per dollar by using the double cash back, then...

Didn’t know about the Choice option. I have so many more miles than hotel points so am thinking of using the bonus from my recent Citi premier to transfer to choice. Also have the double cash back card. So I guess from what you are saying, I don’t need to keep the premier and pay annual fee and I can still essentially get 4 choice points per dollar by using the double cash back, then getting 2 choice points per thank you point, regardless of needing to have a premium card?

Yes, you can use the Double Cash to earn double the Choice points, but not if you cancel the Premier. You can’t transfer points to partners like Choice at all if you don’t keep a premium card. If you just have a Double Cash, you could only redeem TY points for cash at a 1:1 value, or for gift cards and such. Hope this helps.

That is not correct. If you only have the DC, you can still transfer to Choice, JetBlue and Wyndham.

Is the goal here to point out idiotic and stupid and illiterate the (American) audience is?

Because if so Lucky could not write fast enough to publish a sufficient amount of articles.

I think the post and the comments indicate that a large majority of people with cards like Double Cash (and probably Freedom Unlimited and Freedom Flex and such) just use the cards as cash back and don't bother with transferrable points. Therefore any change to that appears threatening.

I'm still happy with my Fidelity cash back card. Just automatically get 2% cash back every month. No gimmicks

It's great that you have a card you're happy with, in the end that's what matters.

But I'm wondering what 'gimmicks' you're referring to? The DoubleCash will earn 2 points per dollar - just like the Fidelity Rewards Visa. Then you can redeem those points at 1c/point - just like the Fidelity Rewards Visa.

After reading that collection of comments, I weep for the critical reasoning capabilities of OMAAT readers.

Also, this card carries a 3% intl fee, so it’s trash outside the US.

You haven't seen the reddit discussion :P.

I have now read FOUR articles on this change, and I believe every single one of them is an unadvertised-as-such paid-for promotion. Because let's look at what they're really doing. They are TAKING AWAY the actual U.S. dollar money you got back in exchange for ... NOTHING. Nothing you couldn't already CHOOSE to do IF YOU WANTED TO. They are TAKING AWAY an option in exchange for NOTHING.

This is a CLASSIC gimmick: the...

I have now read FOUR articles on this change, and I believe every single one of them is an unadvertised-as-such paid-for promotion. Because let's look at what they're really doing. They are TAKING AWAY the actual U.S. dollar money you got back in exchange for ... NOTHING. Nothing you couldn't already CHOOSE to do IF YOU WANTED TO. They are TAKING AWAY an option in exchange for NOTHING.

This is a CLASSIC gimmick: the CASH they gave you was CASH. You could leave it there and eventually do whatever you wanted with it, it was a REAL DOLLAR. Now, they know that many people will NEVER find anything worth using points on and thus they will NEVER have to pay these "benefits" out! I have NEVER found one single thing worth getting with Thank You points, other than occasionally using at Amazon. I don't fly; I don't buy gift cards as most of them are for chains that are already overpriced and sell junk and using points for my Choice Hotels will cost me THEIR rewards. Even this article tries to confuse you: if you actually "continue[d] to have the option to redeem rewards as cash back at the same rate" as This Article says ... then they could just GIVE YOU CASH. NO they are TAKING AWAY your ability to EARN CASH. Here is the REAL language on THEIR email to me: "Beginning 03/28/2022, cash back will be earned in the form of ThankYou® Points instead of cash rewards." Note that: INSTEAD OF CASH REWARDS.

So me, unless you really see an ADVANTAGE in Thank you points, I suggest you REDEEM your cash rewards sooner rather than later. I just redeemed all of mine to get rid of a balance on the card. Just remember this redemption is NOT your monthly payment you MUST still make that IN ADDITION.

I also suspect that after a little more research I will DUMP this card for one that gives REAL CASH BACK unless they find ONE WAY I USE CONSISTENTLY to prove it's BETTER than just cash: e.g. make each point I get for that dollar spend worth hmm an extra tenth of a point so that if I can't use it for a while or find something worth it and am forced to use it not where I really want, it will balance out to my 2%. This is really shifting what WAS a straightforward card into the same chicanery and BS others use. I hope that eventually the HONEST cash back rewards writers will come out with HONEST articles saying this. I hope sooner rather than later.

"I have NEVER found one single thing worth getting with Thank You points"

Ehm, how about... 1:1 CASH? :)

I shouldn't be surprised if this is the first step on the road to reducing the cash back rate on the Double Cash card. It's easier and more subtle for Citi to change the Thank You cash redemption rate in the future than it is to change the "Double Cash" branding on the credit card. My prediction is that they will continue to give "Double" TY points (so $100 charged yields 100+100 = 200 TY...

I shouldn't be surprised if this is the first step on the road to reducing the cash back rate on the Double Cash card. It's easier and more subtle for Citi to change the Thank You cash redemption rate in the future than it is to change the "Double Cash" branding on the credit card. My prediction is that they will continue to give "Double" TY points (so $100 charged yields 100+100 = 200 TY points), but they will eventually reduce the cash redemption rate for TY points (so perhaps 200 TY points will be redeemed for only $1.50 or $1.00, instead of the initial $2.00). Under that scenario, Citi might still offer gift cards at the rate of 200 TY points = $2.00 in gift cards) so they'll still be able to make the "2% back" claim.

Nothing's ever free, and no changes in credit card benefits are ever in the card holder's favor. Remember what Citi did to the price-match program, the rental-car-insurance program, the double-warranty program on this card just a couple of years ago.

I think you'd be supposed by how many folks don't pay their balance in full every month. Citi is still getting the upper hand, trust me. The interest that people pay, supports them paying 2%. It's literally nothing for them.

This exactly. Add a barrier and change cash to points.

I have a Thank You account from my Citibank bank accounts. The price for $1 cash back is currently 2 Thank You points. So how will that work now? Are they changing the "price" of cash back so $1 cash back costs 1 TY point? Or will there be two separate TY buckets with different redemption rates?

Citibank will find a way to make it complicated, fail at execution and the fallout will work against you. That's their main thing.

The main thing to realize is that not all ThankYou points are created equal. I also have a ThankYou account where I can only redeem for 2 TYP/$.

However, when I first converted some Double Cash rewards, a *new* ThankYou account was created, *where I can redeem for 1 TYP/$*.

I can transfer points from the lousy account to the good one and redeem for 1 TYP/$. It's also possible to have them combine...

The main thing to realize is that not all ThankYou points are created equal. I also have a ThankYou account where I can only redeem for 2 TYP/$.

However, when I first converted some Double Cash rewards, a *new* ThankYou account was created, *where I can redeem for 1 TYP/$*.

I can transfer points from the lousy account to the good one and redeem for 1 TYP/$. It's also possible to have them combine your TY accounts, at which point, purportedly, all your TYP will be redeemable at the good rate. I haven't tried that yet :).

Based on wording, this is a complete destruction of the card. It says that current cash rewards convert at 1 point per CENT ($10 would be 1000 points). But we will only earn 1 point per DOLLAR. That's A BIG difference.

You're confusing the EARN with the SPEND. You EARN 1 point per dollar spent or paid, i.e., if you spend $1.00, you currently get $0.01 and will instead get 1 point. When you cash them in, that same conversion rate applies. One point = 1 cent. It's confusing because of how they worded the email, and I read it that way at first also, but the math checks out. The real problem for me is...

You're confusing the EARN with the SPEND. You EARN 1 point per dollar spent or paid, i.e., if you spend $1.00, you currently get $0.01 and will instead get 1 point. When you cash them in, that same conversion rate applies. One point = 1 cent. It's confusing because of how they worded the email, and I read it that way at first also, but the math checks out. The real problem for me is what if I spend $1.99? Do I get 1.99 points? Do I get 2 points? I suspect I get only 1 point. That isn't a lot, since it's only the change on each purchase, but it makes this card worse than any other 2% cash back card if that's right, and the difference is disproportionately large if you use it as your daily driver and put everything on it like I do. I have many, many small purchases on this card every month. I think I'll take a hit over the course of the year on it.

Yeah, Citi is turning Double cash (2%) back into a 1% cash back card. The point system is a gimmick!

And how are they doing that exactly? 2 ThankYou points for every dollar spent (and paid off) and points redeem for 1c/point. Where do you get the 1% from?

I think this is bad. Citibank is actually reducing the Double Cash Card benefits. Im going to look at Capitol One Quick Silver Card. Yes, it is 1.5% instead of 2%. points earned. However, the Quicksilver is pure cash earned.

How are they reducing the benefits? The card will still pay the same. You're giving up rewards over... no practical change?

It seems a bit silly for Citi to say "No More $25 Minimums", when that applied to cash balance redemptions and they will simply no longer exist.

And we can already convert our cash balance to ThankYou points and cash those out without minimums... So it seems nothing really changes and Citi is just streamlining their operations?

They probably had this in mind when they first enabled the conversion to ThankYou points. After all, people...

It seems a bit silly for Citi to say "No More $25 Minimums", when that applied to cash balance redemptions and they will simply no longer exist.

And we can already convert our cash balance to ThankYou points and cash those out without minimums... So it seems nothing really changes and Citi is just streamlining their operations?

They probably had this in mind when they first enabled the conversion to ThankYou points. After all, people don't handle too much change all at once too well :).

I originally acquired the DoubleCash card because of its support for Virtual Card Numbers. I really wish Citi would make those features available using only a Browser rather than requiring a Windows-specific App installation.

The windows only app is gone. I am use the virtual card feature with only a browser.

Ok, I’ll have to poke around Citi’s website again and see. Thanks.

Try the mobile app - there is the virtual card feature there as well - works great for me.

It's a win-win. You value a Thank You point at 1.7 cents but we both know Citi is paying less than 1 cent per point to the transfer partners.

And they still can't figure out what to do with the Prestige.

Seriously

They don't need to figure it out, I did it for them. Cancelled it.

The elimination of the $25 minimum is great news.

If you just want cash back, there are better 2% fee free cards.

PayPal MC, has no intl fee (Citi is 3%!)

If you combine points with Citi Reward+, you get 10% points back on redemption (up to 10K rebate per year), making it a 2.22% cash back/miles card. Overall Citi has improved their products lately. The 1:2 transfer to Choice can be a great option for aspirational (Preferred hotels) or budget travel. So finally we have another transferable pts with good hotel partners besides Chase.