In March 2022, we learned that South American mega-airline LATAM would be launching co-branded credit cards in the United States, and it’s with a new issuer to the airline credit card space. Well, we’ve now learned the details of these cards, and they’re also open for applications, so let’s take a look at the details.

In this post:

Details of the Cardless LATAM credit cards

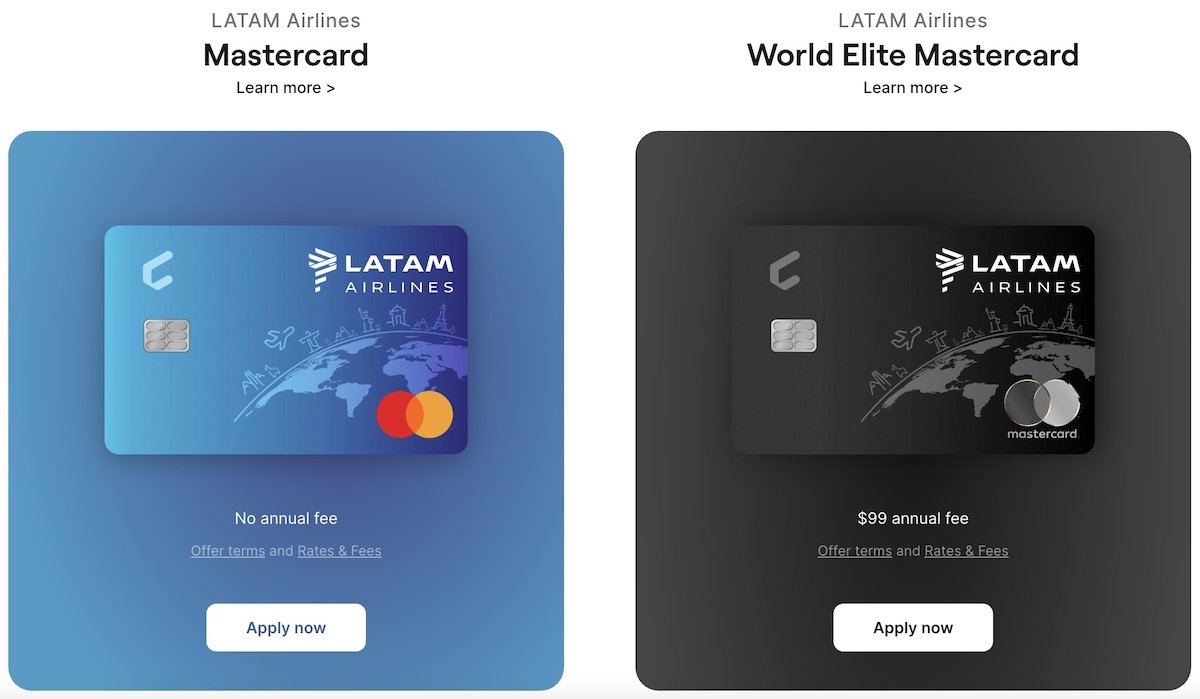

San Francisco-based financial technology firm, Cardless, has partnered with LATAM to create, distribute, and market new credit cards in the United States. Specifically, we’re seeing the introduction of two co-branded credit cards, including a no annual fee card and a premium card.

The LATAM Airlines Mastercard:

- Has no annual fee

- Has no foreign transaction fees

- Offers a sign-up bonus of 15,000 miles after spending $1,000 within the first three months

- Offers 3x miles on LATAM purchases, 2x miles on restaurants and ground transportation, and 1x miles on everything else

- Offers qualifying points toward LATAM elite status at the rate of 10% of the miles earned from card purchases (which doesn’t include miles from sign-up bonuses or promotional miles)

The LATAM Airlines World Elite Mastercard:

- Has a $99 annual fee

- Has no foreign transaction fees

- Offers a sign-up bonus of 40,000 miles after spending $2,500 within the first three months

- Offers 4x miles on LATAM purchases, 3x miles on restaurants and ground transportation, and 1x miles on everything else

- Offers qualifying points toward LATAM elite status at the rate of 20% of the miles earned from card purchases (which doesn’t include miles from sign-up bonuses or promotional miles)

- Offers two LATAM lounge passes per year

- Offers two upgrade coupons per year (though those with elite status won’t receive these coupons)

I’ve written in the past about Cardless, which is trying to revolutionize the co-brand credit card industry in the United States. The people behind Cardless are huge miles & points geeks. What makes Cardless unique is that the company can launch a co-brand credit card in a month (compared to over a year in many cases with the larger issuers), and can also make these agreements economically viable even if the portfolio doesn’t see billions of dollars of spending annually.

Up until now, Cardless has primarily partnered with sports teams, so LATAM is Cardless’ first airline partner.

My take on LATAM’s new credit cards

It’s always cool to see new co-branded credit cards, and it’s particularly great to see Cardless get into this space.

Prior to learning the details of the card portfolio, I was skeptical of how much general appeal there could be for these cards:

- LATAM has left the oneworld alliance, and instead now just partners with Delta (without belonging to SkyTeam); this means there are limited opportunities for redeeming rewards on partners

- LATAM’s frequent flyer program, LATAM Pass, isn’t particularly lucrative, though it’s probably still the best option for booking award flights on LATAM

- This could be useful for those specifically loyal to LATAM or who fly to the region regularly

Now that we’ve learned the details of the cards, what’s my take? These cards are roughly what I would have expected, with a couple of pleasant surprises:

- It’s cool that spending money on the cards can help you qualify for elite status, meaning that 10-20% of the miles you earn from spending will help you earn status; this follows the trend of airlines making it increasingly easy to earn status with credit card spending (like what American is doing with Loyalty Points)

- It’s cool that the premium card offers two lounge passes plus two upgrade coupons, which could be a reason to pick up the card

I’m impressed overall, though for my own spending profile and rewards preferences, these likely aren’t cards that I’ll be prioritizing applying for.

Bottom line

Cardless has launched its first airline credit cards, in partnership with LATAM. We’re seeing two new cards issued, including one no annual fee card, and one $99 annual fee card. The cards both have some unique benefits and are pretty competitive, and I’m impressed by the overall value proposition for those who are LATAM loyalists.

What do you make of Cardless’ new LATAM credit cards?

I have the MC World Elite.

My experience 1y+ is poor.

The card got blocked without any reasonable explanation for 1 month or more.

The card does not provide the two qualifying segments promised. It is a false promise.

The card just ships the miles to Latam pass account, but it is hard to rescue

The card does not work to purchase Latam tickets at the same time, Amex works just fine.

I have the LATAM Cardless world elite. Worst credit card I have had. They freeze your account any time you are traveling (multiple times even after calling). They have no 24 hour customer service. Their excuse was "well we are a small company at Cardless". In case of fraud you have no way of communicating with them on a weekend or after hours. Their limit is ridiculous. I also have had Chase Sapphire Reserve for...

I have the LATAM Cardless world elite. Worst credit card I have had. They freeze your account any time you are traveling (multiple times even after calling). They have no 24 hour customer service. Their excuse was "well we are a small company at Cardless". In case of fraud you have no way of communicating with them on a weekend or after hours. Their limit is ridiculous. I also have had Chase Sapphire Reserve for years and only did this because I fly Latam. Chase Sapphire is a real credit card.

Was a previous LATAM credit card holder until it folded. Have had nothing but trouble applying with Cardless; don't know what algorithm they are using but " i can't be found." was reason I couldn't be given new card. That's a new one!

US BANK TENIA LATAM VISA ERA MUCHO MEJOR, POR Q POR PRIMERA VEZ TE REGALABAN 40,000 MILLAS AQUI CON ESTA TARJETA ES CUANDO TENGAS EL IMPORTE DE 2,500 DOLARES , Y ESTA TARJETA LA Q SE PAGA 99 ANUAL FEE NO DICE Q PUNTOS TE DA CUANDO COMPRES POR EJEMPLO LA LATAM VISA US BANK TE DABA SIEMPRE LOS PUENTOS CUANDO COMPRAS EN TRADER JOE EN TIENDAS Q PAGUES TU ASEGUARANZA DE SALUD ETC ETC ESTA TARJETA NO ESPECIFICA NADA SEA MAS EXOPLICITOS

I go to Peru and Columbia every year. Eventually, I end up flying LATAM at least once. A big flaw with this is that on their websites in Peru and Columbia they will not let you use a Visa or Mastercard that was issued outside of that particular country. I have been able to use my US-issued American Express card though. If you use the United States website for latam, domestic tickets within Peru or Columbia always cost more.

That’s not true , you could use US issued MC .

The Latam Pass program is utter garbage. It's not uncommon to find business class award tickets to Brazil, Chile, etc for over 1 million points.

And a few months ago they even removed partner award availability (DL, QR, etc) from their website. Now you need to call and wait for hours to speak to a reservations agent who wasn't even trained on how to book such tickets.

Truth!

I can’t imagine who would find this card useful

I have the Cardless Manchester United card. A few weeks after I mailed my arbitration opt-out letter, a US-based agent called to thank me for having the card and to confirm my arbitration opt-out. No other company has ever given me a live call to confirm arbitration opt-outs! I see this as a good sign that their operations are in relatively good order.

They also back stab their first batch of applicants.

And the reason you got a live call isn't because operations are in relatively good order. On the contrary, they were a mess (hopefully better now) and have to do it manually because they have no clue how to deal with it.

I can't say this how far this card issuer has come, but they are still new in the industry and expect lengthy turn around...

They also back stab their first batch of applicants.

And the reason you got a live call isn't because operations are in relatively good order. On the contrary, they were a mess (hopefully better now) and have to do it manually because they have no clue how to deal with it.

I can't say this how far this card issuer has come, but they are still new in the industry and expect lengthy turn around time to get problem solved.

Their customer service used to be M-F, even now is not 24/7.

Take the hint.