Making Travel Less Taxing: Introduction

Your Tax Home (Away from Home)

Airfare and Transportation

Lodging and Meals

Entertaining Clients

Car Expenses

The Nitty Gritty: Required Receipts and Tax Forms

Ask Scott!

Hello, fellow travelers! The individual tax deadline is < 1 month from today; have you filed your tax return yet? Today, we continue our drive through business travel tax issues by considering car expenses. First, I will discuss how all taxpayers who itemize deductions, even employees with no unreimbursed business expenses, can reduce their tax liability for taxes paid to register or purchase personal vehicles. Then, I’ll explain the rules for deducting expenses related to the business use of vehicles. Please also note the disclaimer that follows this post.

Personal Property and Sales Taxes

Car Ownership Taxes

All taxpayers can deduct personal property taxes as an itemized deduction regardless of employment status. These taxes, colloquially known as “car taxes,” are assessed based on rates set by individual states (or individual counties within a state) and vary widely. The portion of a vehicle registration fee that is tied to the car’s value is deductible in the same way that property taxes assessed by a local government on real estate are deductible. But, a flat car registration fee is not deductible; so, if the car tax and flat fees are combined into one overall registration fee (as they are in California), you should determine the fee that is tied to on the car’s value and deduct that portion.

As an example, a humble Los Angeleno seeking to register a new $200,000 vehicle would pay Los Angeles County $1,401 for the right to sit in traffic drive down Santa Monica Boulevard (calculator here). Of that fee, the portion based on the car’s value, referred to as a “vehicle license fee,” is $1,301 and would be deductible as an itemized deduction. In other states, such as Texas, the car registration fee is the same for every vehicle type, so there is nothing to deduct as an itemized deduction because the fee is not based on the value of the vehicle.

Registering a $200,000 vehicle in Los Angeles would generate a vehicle license fee of $1,301 that would be deductible as an itemized deduction (remove a zero from those figures for a more pedestrian vehicle).

If you are self-employed and use the car in your business, you should allocate the property taxes paid based on the percentage of miles you drive for business versus personal and deduct the business portion first against business income since those deductions will lower both your income and self-employment tax liability. Then, deduct the portion allocable to your personal use of the vehicle as an itemized deduction.

Sales Taxes

For residents of states with no state income tax (AK, FL, NH, NV, SD, TN, TX, WA and WY), in lieu of deducting state income taxes, you may deduct actual sales taxes paid or elect to use the standard sales tax deduction amount the IRS designates based on your income and family size. And, sales taxes paid on a vehicle are considered “bonus” items that are added to your actual or standard sales tax amount. Consequently, if you live in one of those states, make sure you take a deduction for the sales taxes paid on your new (or new to you) vehicle.

Actual Expenses or Standard Mileage Rate

As with airfare, lodging and meals, the first question in determining what car expenses are deductible is the location of your tax home. So, if you believe you have deductible car expenses, I recommend reviewing that post first lest you begin counting miles in vain.

Often, a vehicle is used for both business and non-business purposes; in that case, you should allocate your expenses based on the number of miles you drive for business and personal reasons. Travel to any of the following generates business miles:

- Client or customer offices;

- Business meetings not at your primary work location;

- Secondary work locations; and

- Temporary work locations.

Importantly, miles that you drive to your principal place of business do not count since those trips are considered your daily commute. But, if you drive to your primary location and then drive to a secondary location, the miles beyond your normal commute do count.

For cars used solely for business-use, such as these two used for courtesy airport pick-ups and customer transport on the tarmac, respectively, no allocation between business and personal mileage is necessary.

For a business-use vehicle, you can calculate your expense based on either a standard mileage rate or your actual expenses. If you want to use the standard mileage rate, you must use it in the first year you use the vehicle for business purposes. In subsequent years, you may choose to use either the actual expense or standard mileage method; however, if you use the actual expense method the first year you use the vehicle, you cannot later switch to the standard mileage rate.

Actual Expenses and Depreciation

Gasoline, license fees, oil, tolls, lease payments, insurance premiums, parking garage rent, parking fees, registration fees, and repairs (including tires) are all deductible if you elect to use the actual expense method. Basically, everything you incur to maintain, operate, and store the vehicle is deductible. But, the largest “actual” expense is not an expense actually incurred—depreciation (maybe someone at the IRS has a sense of humor).

Traditional accounting rules dictate that an asset be expensed over its useful life so that an asset that cost $20,000 and was expected to last for 5 years would be expensed $4,000 per year over 5 years. However, to encourage businesses to purchase equipment and thereby spur economic growth, Congress has created an exception to the traditional rules of depreciation: taxpayers may deduct all (or a significant portion) of the cost of new assets in the year the asset is placed into service even though the asset may be used in subsequent years.

Business assets like an airplane are depreciated over several years based on the asset’s expected useful life. (Something tells me that AA’s Super 80s have exceeded their expected useful lives for tax purposes).

Thus, given that the actual expense deduction includes both special depreciation allowances and the actual costs of operation, the actual expense method will almost always generate a greater deduction in the first year than the standard mileage rate. So, why would anyone use the standard mileage rate? Well, if your business-use percentage of a vehicle falls below 50% in a later year or you dispose of a vehicle for which you earlier deducted bonus depreciation, you may have to recognize as ordinary income some of those previously taken special depreciation allowances. The mechanics of those calculations are beyond the scope of this post (unless you need help sleeping), but that journey from taking a large deduction to recognizing income due to depreciation recapture is perhaps akin to what a frequent flyer experiences upon booking a incorrectly priced award only to later receive a call from the airline asking for the true mielage cost.

Standard Mileage Rate

Like the per diem for lodging and meals, a standard mileage rate exists that eases the recordkeeping requirements of keeping actual receipts. However, the mileage rate is not adjusted based on where you live or are driving. Thus, for taxpayers in jurisdictions where the cost of gasoline is low, the tax deduction for the use of your personal vehicle will be higher than if the rate were location-based (and vice versa).

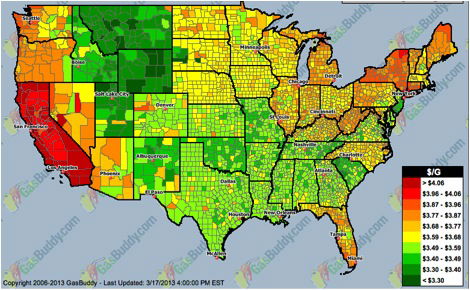

Gas prices vary widely as shown by this GasBuddy.com county map. Regardless of the price of gas where you are doing business, you can deduct 55.5 cents per mile for business miles driven in 2012.

The standard mileage rate was 55.5 cents per mile for all of 2012 and rose to 56.5 cents per mile for 2013. The IRS states that the rate is based on an annual study of the fixed and variable costs of operating a vehicle. In some years, the Service will adjust the rate in the middle of the year (creating additional recordkeeping requirements) based on changing gas prices.

Disposition of a Car

If you trade-in, sell or lose your car due to theft or an accident, you may have a taxable gain or deductible loss on the vehicle. Does realizing a gain on the sale of a car sound about as likely as finding low mileage Air France business class availability using Delta SkyMiles during peak summer season? Keep in mind that depreciation reduces your basis in the vehicle and that due to special depreciation allowances, you could easily have a lower basis in a vehicle than its trade-in or resale value, especially early in the car’s life when depreciation is largest. For most taxpayers, though, no tax will be due upon disposing of the vehicle because if you trade-in the car or use the proceeds from insurance to purchase another car, any gain you realize is not recognized but is considered a tax-free like-kind exchange.

Assuming you do not purchase another vehicle with the proceeds, then the portion of any gain due to special depreciation allowances is treated as ordinary income, also known as “depreciation recapture,” a particularly irksome tax provision when it applies since the “income” is the reversal of previously taken deductions. If you are using the actual expense method, then the depreciation previously taken is self-evident, and if you used the standard mileage rate, the IRS designates 22 of the 55.5 cents per miles as a depreciation expense (this allocation is adjusted annually).

The owner of this Acura NSX may have to recapture more than just the front end of the vehicle if bonus depreciation was deducted for its business use.

Conclusion and Next Time

All taxpayers may deduct personal property taxes based on a car’s value as an itemized deduction, and those who live in states with no income tax may deduct sales taxes paid on the purchase of any vehicle as a “bonus” sales tax deduction item. To deduct the cost of using a vehicle in business, taxpayers may use either the actual expense or standard mileage methods, and in most cases, the actual expense method will generate a higher deduction in the initial years of vehicle use. However, taxpayers should carefully consider how the vehicle will be used beyond the first year to avoid depreciation recapture income. I hope you enjoyed this cruise through tax law governing auto expenses! Next week, we’ll discuss what records you need to maintain and how long you need to maintain them to substantiate tax deductions.

Please leave questions in the comments or contact me on my law and CPA firm website or @ScottTaxLaw.

Disclaimer: While I hope the information I provide will be helpful (and hopefully even humorous at times), none of this information should be construed as offering legal advice or creating an attorney-client relationship between the reader and my law firm. You should not act or refrain from acting based on this advice and should consult your own attorney or CPA regarding your specific tax matters. IRS Circular 230 Notice: Nothing in these communication is intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law.

@Jeremy - Yes, I agree. I typically advise clients who anticipating keeping a vehicle for a long time to use the standard mileage rate; it's a far easier recordkeeping task to just count miles than actual expenses, as well.

No, in my experience, tax software does not handle these issues that well. Particularly in the case of a taxpayer who isn't as fastidious in their recordkeeping, tracking a vehicle's depreciation over time can be a large task.

"For a business-use vehicle, you can calculate your expense based on either a standard mileage rate or your actual expenses. If you want to use the standard mileage rate, you must use it in the first year you use the vehicle for business purposes. In subsequent years, you may choose to use either the actual expense or standard mileage method; however, if you use the actual expense method the first year you use the vehicle,...

"For a business-use vehicle, you can calculate your expense based on either a standard mileage rate or your actual expenses. If you want to use the standard mileage rate, you must use it in the first year you use the vehicle for business purposes. In subsequent years, you may choose to use either the actual expense or standard mileage method; however, if you use the actual expense method the first year you use the vehicle, you cannot later switch to the standard mileage rate."

I'm a CPA working for a company but doing tax work on the side and this just came up the other week. It's pretty important to realize this as one may be tempted to take actual expenses (and bonus depreciation) in the first year however by doing that it prevents the standard mileage rate in future years which could have a huge impact to a taxpayer that drives a significant number of miles!

Anyway it got me thinking, what happens to the standard mileage rate in the far out future. If you assume 22 cents of it is for depreciation, then driving 100K miles on a car that cost $22,000 new would make it fully depreciated. After that point in time, are you allowed to only take the 33 cents for standard mileage rate (or actual expenses not including depreciation)? Does tax software typically handle this stuff fairly well?

Agree re the complexity, Scott - although if you can work the system then it's a pretty good effective tax rate you end up with!! OTOH the threshold for our 40% tax rate keeps heading lower and lower with only a relatively small personal allowance and really very little by way of deductions available (perhaps $1500 or so at most for work-related costs). On top of 20% VAT/sales tax too... ;)

@Zhong Liang Ong - excellent observation! I took that picture outside the Marina Bay Sands hotel in Singapore last December.

@Alan, yes there are a lot of potential deductions, but the other side of the coin is how complex complying with our tax system is compared to other countries. Our system is heavily influenced by various interest groups that have been able to lobby Congress successfully to include deductions for their interests. And, Congress has chosen to incentivize certain behaviors through the tax code (e.g. granting a deduction for charitable giving...but only in certain cases),...

@Alan, yes there are a lot of potential deductions, but the other side of the coin is how complex complying with our tax system is compared to other countries. Our system is heavily influenced by various interest groups that have been able to lobby Congress successfully to include deductions for their interests. And, Congress has chosen to incentivize certain behaviors through the tax code (e.g. granting a deduction for charitable giving...but only in certain cases), adding to its complexity.

Hi Lucky, is it just me or does the picture with the Lamboghinis have a very Singaporean-esque background?

Wow I still can't believe how much stuff you guys across the Pond are allowed to deduct from your taxes - very jealous, must massively reduce the effective rate you have to pay!

@Daninstl - thanks! Yes, the AMT is quite annoying especially since the current impact of the tax is far beyond what the original intent was. I see many of my clients getting hit by the AMT due to the amount of state and local income taxes they pay.

Very good info. I have been able to deduct my car expenses for many years and it is a nice deduction. Now if I could just get rid of the AMT I seem to owe every year it might help.