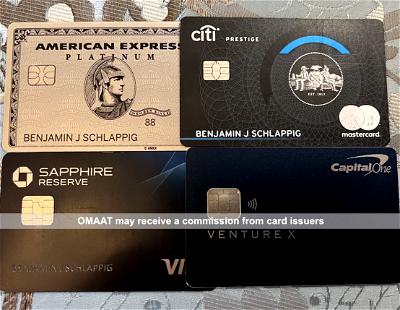

Many of us in the miles & points world have many credit cards in order to maximize our return on spending and card perks. One question I sometimes get asked is if it’s possible to apply for multiple credit cards in a day. In this post I wanted to address that, and talk about the pros and cons to doing so.

In this post:

Yes, you can apply for multiple cards the same day

In general, there’s absolutely no issue with applying for multiple credit cards the same day. I’m not just talking two cards, but if you wanted to, you could even apply for five credit cards the same day. Keep in mind that card issuers don’t really “talk” to one another, aside from what shows on your credit report, and even that sometimes posts with a delay.

The major restriction to be aware of is that each issuer has rules regarding how you need to space out applications. Very broadly speaking, most card issuers will only approve you for one card in a day, so if you’re going to apply for multiple cards, make sure they’re with different issuers. For example, Citi will approve you for up to one card every eight days, and two cards every 65 days (I know, that seems random).

In other words, it could be possible to apply for the Citi Strata Premier℠ Card (review), Chase Sapphire Preferred® Card (review), and the Capital One Venture Rewards Credit Card (review) the same day. However, don’t expect you’d be able to get approved for two cards from Citi, two cards from Capital One, or two cards from Chase, in a single day. You can read about the major restrictions from each card issuer here.

Now, some people think that applying for multiple cards in a day will lead to credit inquiries being consolidated, meaning that you’d only get one inquiry on your credit report even if you apply for four cards. That’s not generally the case (and definitely not the case if the cards are from multiple issuers), so that shouldn’t be a motivating factor here one way or another.

The pros to applying for multiple cards the same day

Why should you consider applying for multiple credit cards the same day? On the most basic level, some of us are just in the mood to apply for credit cards some days, and if there are multiple cards you’re eying, you might as well do it all at once.

Practically speaking, there’s one more significant implication. When you apply for a credit card, your score is dinged slightly for the inquiry (though there are other positive long term impacts from having more cards). Usually that inquiry is reflected on your report with a delay, anywhere from several days later, to several weeks later.

In other words, if you apply for multiple cards in a day, then odds are decent that your credit won’t reflect what other cards you’ve applied for that day. That shouldn’t be a big deal at all, unless your credit score is just at the very cusp of being good.

The cons to applying for multiple cards the same day

Why shouldn’t you apply for multiple credit cards in a day? There are a couple of considerations.

First of all, there are some amazing credit card welcome offers out there, but typically the bonuses require some amount of spending. Those spending requirements can be significant, so you might want to space out your applications so you can complete all those spending requirements.

In other words, if you usually spend $1,000 per month on a credit card, you don’t want to get five cards that require you to each spend $3,000 within the first three months.

There’s one other consideration, though it’s fairly minor. Say you apply for 10 credit cards in a day. While there’s a chance you may be approved, if a human ever reviews your credit report in the future, that might look suspicious. The logical conclusion most analysts would draw from such behavior is that you were in a bind and needed to max out a bunch of credit cards, and that’s not a good look.

Bottom line

It’s absolutely possible to apply for multiple credit cards the same day and get approved. In general your odds are best if the cards you apply for are all from different issuers, though.

There are some minor pros and cons to applying for multiple cards the same day rather than spacing them out. Personally when I do apply for cards, I usually try to pick up a couple the same day, but not more than that.

What’s your strategy with applying for multiple cards the same day vs. spacing out applications?

How long should you wait between applying for multiple cards from the same issue? I know amex has a 5 day or so requirement between cards and two ever 90 days.

I recently got the Amex Marriott Bevy mostly for the bonus and want to also get the Amex Marriott Brilliant for a longer term care.